US Online Grocery: August KPIs Show Market Rebalancing After COVID Spike

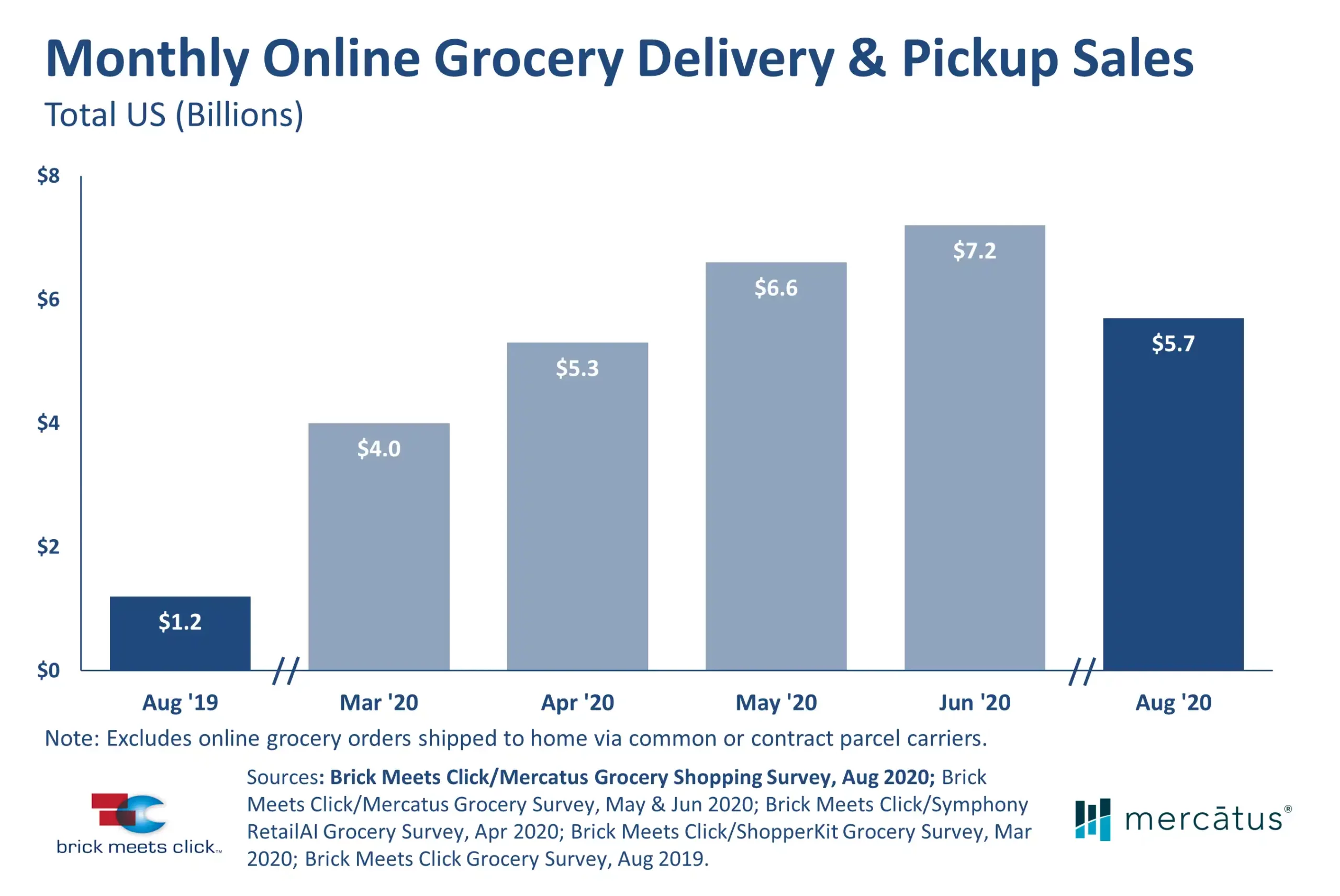

BARRINGTON, IL – September 10, 2020 — U.S. grocery delivery and pickup sales for August 2020 totaled $5.7 billion, down from June’s peak, but other key performance indicators showed strength. In particular, average order value increased to a record high of $95, and intent to make a repeat purchase in the next month reached 75% in a market that is nearly five times larger than it was just one year ago, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded August 24-26, 2020.

August sales levels represent about a 20% drop compared to June, and changing shopper attitudes toward COVID is likely one of the contributing factors. The ongoing research has documented a steady decline in the percentage of households that express a high level of concern about contracting the virus, dropping from a high of 47% in April to 38% in August.

“There is a common belief that the rapid and dramatic surge in sales caused by COVID-19, starting in mid-March, would recede at some point as stay-at-home orders and in-store shopping restrictions like occupancy limits, shortened hours and one-way aisles were relaxed,” said David Bishop, partner, Brick Meets Click. “While the August results reflect a retrenchment of sorts, the market appears positioned to begin a new growth cycle with a large base of committed shoppers.”

According to the survey results, approximately 37.5 million, or 29% of all U.S. households, are considered monthly active users of these online grocery services in August 2020 compared to 16.1 million one year ago. This gain of around 21.4 million represents a 133% increase in the number of active households placing at least one delivery or pickup order during the past month.

On a year-over-year basis, monthly active online grocery shoppers are spending more per order and placing more orders per month according to the research. Spending per order rose to a record $95 in August 2020 – 32% higher than a year ago – and active shoppers placed 1.6 orders per month compared to 1.0 orders in August 2019.

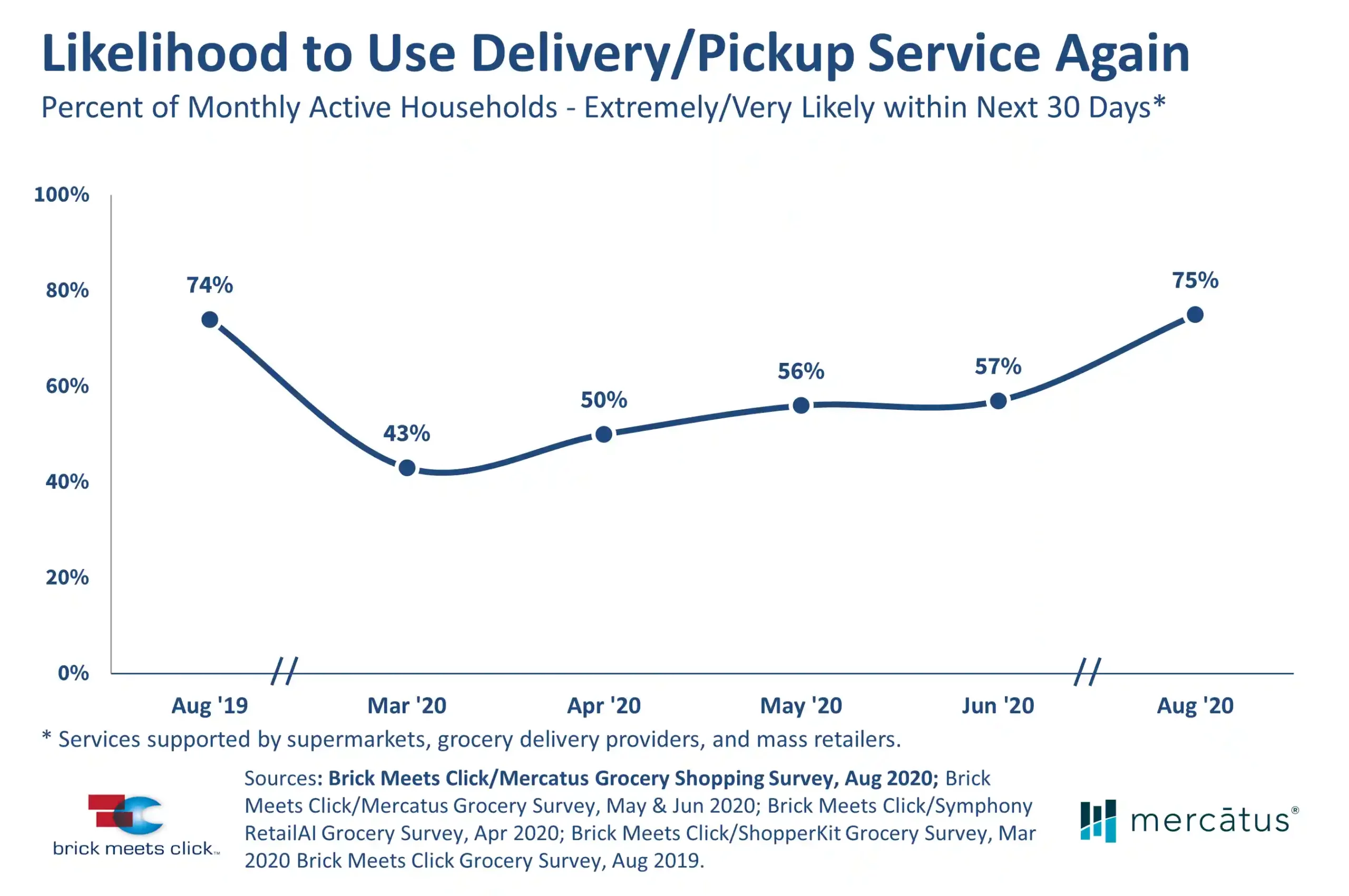

Also, during August, 75% of customers indicated that they are extremely or very likely to use their most recent online grocery service provider again within the next 30 days. This level of repeat intent is a significant improvement from June and slightly surpasses the rate reported during August 2019, which highlights how improved retail conditions are leading to stronger shopping experiences.

“The rise in repeat purchases and spending means grocers are successfully acquiring new online shoppers, and equally as important, converting existing digitally engaged customers,” said Sylvain Perrier, president and CEO, Mercatus. “Even with diminished concern about COVID-19, grocery shoppers are realizing the benefits of a streamlined and frictionless online shopping experience. Going forward, it’s critical that grocery executives focus their teams on rewarding online shoppers by delivering a differentiated eCommerce experience that caters to consumers’ high expectations.”

“These results reinforce that grocery delivery and pickup services will continue to play an important role for both shoppers and retailers going forward,” explains Bishop. “What’s also evident is that customers’ expectations will grow even higher, making it critical for retailers to continue improving the entire shopping experience.”

About This Consumer Research

Brick Meets Click conducted the survey on August 24-26, 2020 with 1,817 adults, 18 years and older, who participated in the household’s grocery shopping. Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses were weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology in terms of design, timing, and sampling for each of the surveys conducted throughout 2020: June 24-25 (n=1,781), May 20-22 (n=1,724), April 22-24 (n= 1,651), and March 23-25 (n=1,601).

The 2019 results are based on a similar survey conducted on August 21-23, 2019 with 2,485 adults, 18 years and older.

About Brick Meets Click

Brick Meets Click is a strategic advisory firm that focuses on how digital technology and new competitors are changing food marketing and sales. Founded in 2011, its guidance helps retailers, manufacturers, and suppliers adapt and find new sources of growth by better understanding the shifts in the marketplace and where opportunities exist to grow sales and profits.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce® platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final and others. Mercatus is headquartered in Toronto, Canada.

Media Contacts

David Bishop, Partner

Brick Meets Click

847-722-2732

[email protected]

Greg Earl

Ketner Group Communications (for Mercatus)

512-794-8876

[email protected]

Newsroom

Newsroom