October U.S. Online Grocery Sales Total $8.1 Billion as KPIs Stabilize

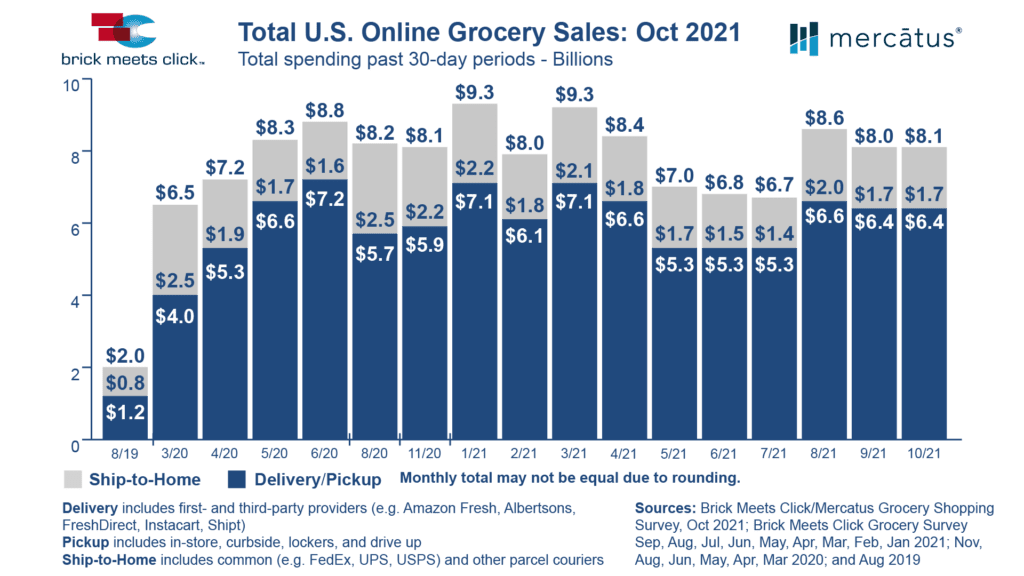

Barrington, Ill. – November 11, 2021 – The U.S. online grocery market generated $8.1 billion in sales during October, driven by $6.4 billion from the pickup/delivery segment and $1.7 billion from ship-to-home, reported the Brick Meets Click/Mercatus Grocery Shopping Survey fielded October 29-30, 2021.

“As the number of new COVID-19 cases in October continued to decline, key performance indicators (KPIs) for monthly active users, order frequency, and average order value are rebalancing from the record highs of 2020 and now provide a more stable and sizable base for building and forecasting the business in 2022 and beyond,” said David Bishop, Partner at Brick Meets Click.

During October, about 50% of U.S. households (63.8 million) bought groceries online, whether just a few items or a full basket of goods, according to the ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. To put this in perspective, the size of the current monthly active user (MAU) base remained larger than the total number of households in August 2019 who had placed at least one online grocery order during the past year.

Pickup continued to be the most popular way to receive online orders in October, with a monthly active user (MAU) base of 33.4 million households. Ship-to-home’s MAU base had 29.8 million households but has contracted each month since July 2021. Delivery served 26.2 million households in October but has experienced more volatility in month-over-month changes lately.

“While the vast majority of online grocery shoppers still prefer to use only one method – pickup, delivery, or ship-to-home – over 30% of MAUs chose to use multiple methods to get their online grocery needs met in October 2021,” explained Bishop. “And, the share of MAUs that received online orders via multiple methods has grown by over 16 percentage points since the start of the pandemic.”

The average number of orders placed by MAUs in October 2021 was 2.74, holding steady over the last few months. However, this order frequency is still 35% above pre-COVID levels and nearly 6% below the record high set in May 2020 when market conditions were significantly different. This illustrates how buying behavior is stabilizing versus last year at elevated levels compared to before the pandemic.

The mix of order share among the segments has shifted over the last several years, but not at an even rate. Pickup’s 37.9% share of orders for October 2021 was eight percentage points higher than November 2020 and ten points higher than pre-COVID, showing that most of pickup’s gains have occurred more recently. In contrast, delivery’s October share of 29.6% was just a two-point gain versus November 2020 and seven-point gain over pre-COVID, revealing that more of its gains happened earlier. Both of those gains came from ship-to-home’s share, which contracted to 32.5% in October 2021, with nearly two-thirds of the share loss occurring since last November.

The weighted average order value (AOV) across all three receiving methods totaled $70.65 in October 2021, which includes weighted averages of $85.13 for delivery, $80.88 for pickup, and $45.57 for ship-to-home. Although October AOVs were down across all the segments versus last year’s highs, pickup and delivery were 12% and 18% above pre-COVID AOVs respectively while ship-to-home has returned to pre-pandemic levels with just a 2% gain versus August 2019.

The share of Grocery’s monthly active users who also placed at least one online order with Mass during October 2021 was 25.6%, holding steady versus September 2021. For these households, nearly two times as many cross-shopped with Walmart compared to Target.

The likelihood that a monthly active user will order again from the same online grocery service in the next month landed at 57.2% for October 2021, down 4.2 percentage points from the prior month. This month-over-month decline likely was due to a change in the customer mix. There was a two-point uptick in the share of customers who used the most recent service for the first time, but only 30% of these first-time shoppers were very/extremely likely to make another order, compared to 80% of shoppers who had placed four or more orders within the past three months with the same provider.

When comparing repeat intent rates between retail formats for October 2021, Grocery’s repeat intent rates lagged those of Mass retailers like Walmart and Target by 2.1 percentage points, or almost 4%. This gap, while smaller than in September, signals that grocery retailers continue to have an opportunity to boost satisfaction by reducing sources of friction in their service.

“As we see online’s share of total weekly grocery shopping consistently hit the double-digits, it represents a new normal,” said Sylvain Perrier, president and CEO of Mercatus. “A sound strategy for grocers going forward is continued investment to improve and differentiate your online service. Incentivize customers to shop your first-party channel while offering them choices for receiving online orders. Leveraging a third-party last mile provider can make sense today for multiple reasons; however, it is essential that retailers take an integrated approach that promotes the benefit of ordering from the retailer’s owned experience.”

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on October 29-30, 2021, with 1,751 adults, 18 years and older, who participated in the household’s grocery shopping.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2021 – September 28-29 (n=1,728), August 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce® platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final, Stater Bros. Markets and others. Mercatus is headquartered in Toronto, Canada.

Media Contacts

Mark Fairhurst

416-603-3406

[email protected]

Newsroom

Newsroom