March U.S. eGrocery Sales Total $8.7 Billion, Down 6% Versus Prior Year

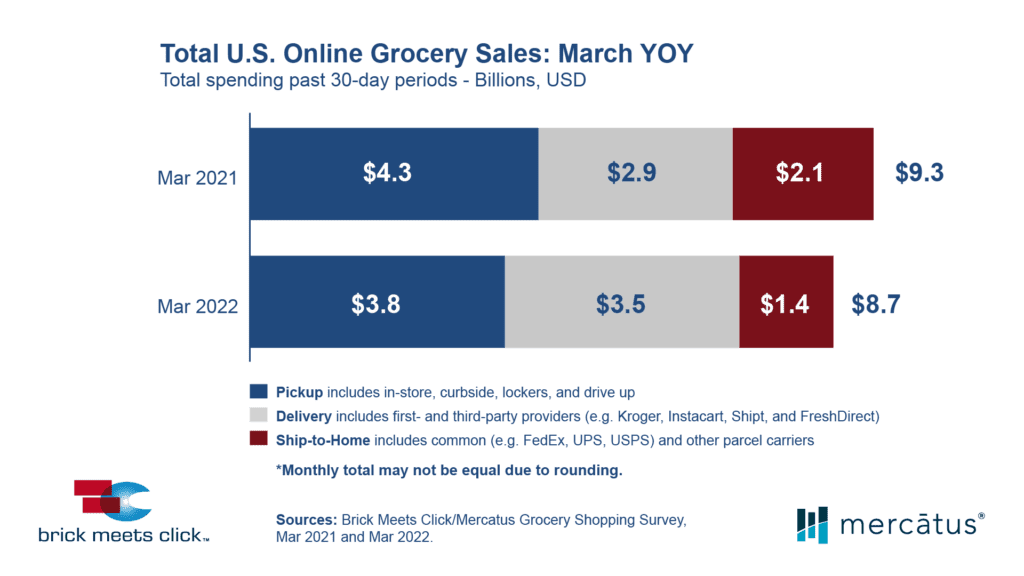

Barrington, Ill. – April 7, 2022 – In March, total U.S. online grocery sales pulled back 6% to $8.7 billion versus March 2021’s record high of $9.3 billion, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded March 28-29, 2022. Total sales for 1Q 2022 ($8.5B in January and $8.7B for both February and March) finished just 2.5% lower compared to a year ago.

March YOY performance across the three eGrocery segments varied as the online grocery market continues to evolve.

The Ship-to-Home segment experienced the largest sales contraction, plummeting over 30% in March compared to a year ago, from $2.1 billion to $1.4 billion. The decline was driven by a 13% reduction in the number of orders placed by Monthly Active Users (MAUs) combined with a 23% drop in the average order value (AOV).

Pickup sales declined almost 11% in March from $4.3 billion in 2021 to $3.8 billion in 2022, affected by similar factors but to different degrees. Order frequency for Pickup declined 8% while AOV dipped less than 4% versus the prior year.

In contrast, Delivery reported strong sales growth for March, surging over 20% on a year-over-year basis from $2.9 billion to $3.5 billion. The number of orders placed by MAUs climbed by 13% and AOV rose 7% versus 2021.

“Two factors continued to drive Delivery’s strong performance in March,” said David Bishop, partner at Brick Meets Click. “First, the aggressive expansion of third-party providers into grocery is enabling additional ways for people to shop online, and second, newer services focused on faster cycle times are appealing to a broader range of trip missions and usage occasions,” he added.

Cross-shopping between Grocery and Mass gained momentum as the share of Grocery’s MAU base that also shopped online with Mass during the month increased nearly 4 percentage points versus last year, finishing at 29% for March 2022.

The likelihood for an online grocery shopper to use the same service again within the next month also increased during March, climbing to almost 64%, up 1.4 percentage points on a year-over-year basis. Analyzing month-over-month results showed that March repeat intent rates at Mass providers improved 8 points while Grocery’s intent rates lost more than 5 percentage points versus February 2022.

On a quarterly basis, total eGrocery sales for Q1 2022 were just 2.5% lower versus Q1 2021, with Ship-to-Home down 29%, Pickup down 2%, and Delivery up 15%. Ship-to-Home ceded 6 points of market share to Delivery while Pickup, the dominant segment, held steady. During the first quarter of 2022, Ship-to-Home finished with 17% of eGrocery sales while Pickup’s share remained essentially unchanged at 46% and Delivery accounted for 38%.

“A key takeaway from March’s report is that online grocery sales have retained much of the gains from a year ago, proving the resilience of grocery eCommerce,” said Sylvain Perrier, president and CEO, Mercatus. “Even so, conventional grocers need to develop and strengthen their first-party web and mobile channels, leverage third-party solutions to fill in the gaps, and excel at executing the services they offer.”

In terms of share of wallet, total eGrocery finished the quarter at 13.1%, down from 13.7% last year. Excluding Ship-to-Home (since most conventional grocers don’t offer this service) reveals that the combined Delivery and Pickup share has grown around 40 basis points, accounting for 10.9% of total grocery spending during the first quarter.

For information about access to the research and monthly eShopper/eMarket reports, go to brickmeetsclick.com.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on March 28-29, 2022, with 1,681 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

- Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2022 – Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final, Stater Bros. Markets and others. Mercatus is headquartered in Toronto, Canada.

Newsroom

Newsroom