Total U.S. Online Grocery Sales for April 2021 Up 16% Versus Year Ago

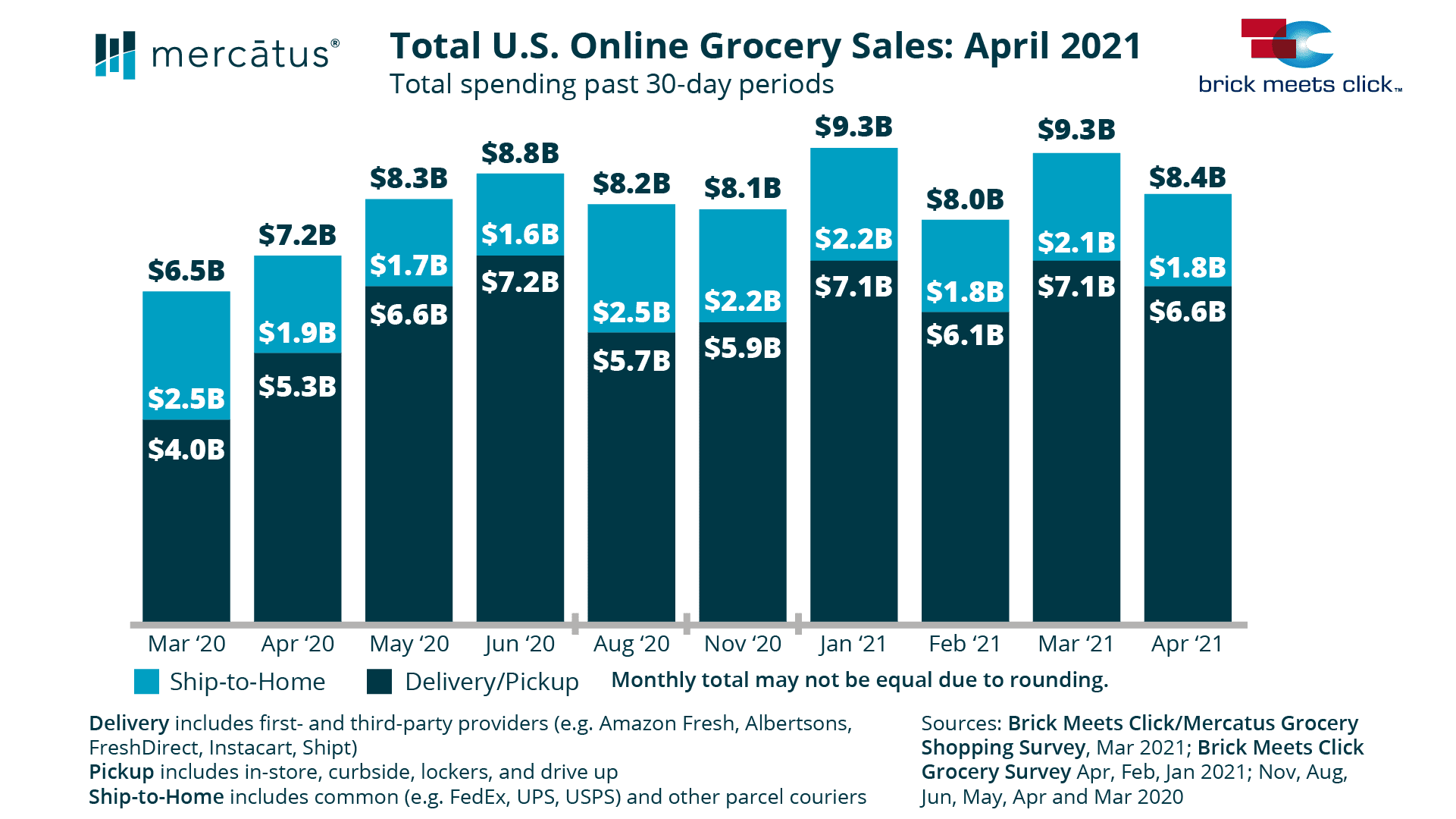

Barrington, Ill. – May 18, 2021 – The U.S. online grocery market finished April with $8.4 billion in sales, contracting by 10% compared to March’s $9.3 billion, but gaining 16% versus April 2020, according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded April 26-28, 2021. Despite this month-over-month decrease, total online grocery sales in April 2021 were more than four times higher than pre-pandemic levels.

“Online shopping has remained an attractive way to buy groceries for a sizable segment of the U.S.,” said David Bishop, partner, Brick Meets Click. “Last year, retailers were in a race to meet the dramatic surge in demand. This year, it’s about executing a sound and sustainable strategy, with the imperative squarely on improving integration and implementation.”

The ongoing independent research initiative, created and conducted by Brick Meets Click and sponsored by Mercatus, found that 67.8 million U.S. households bought groceries online in April, a 12% decline versus a year ago. However, this decline in shopper base was offset by more engagement as April’s monthly active users placed more delivery and pickup orders. These orders accounted for 78% of April 2021 total online grocery sales.

Monthly active users placed an average of 2.73 online orders during April 2021, up slightly from 2.68 orders one year ago. Year over year, the share of orders received via the ship-to-home segment dropped nearly nine percentage points, with pickup and delivery gaining six and three percentage points, respectively.

A growing share of the monthly active user base relied on two or more methods (pickup, delivery, and/or ship-to-home) to receive online grocery orders during April, continuing a trend that began at the onset of the pandemic in March 2020. Over 35% of monthly active users received orders via two or three different methods in April 2021, up almost three percentage points on a year-over-year basis and 20 points higher than pre-pandemic August 2019 levels.

April 2021’s average order value (AOV) of pickup, delivery, and ship-to-home orders dropped 6% versus the prior year on an order-weighted basis. This drop was driven largely by a 7% decline in ship-to-home AOV. Pickup and delivery AOVs dipped 1% and under 3% respectively but remained $8 (10%) above pre-COVID order values measured in August 2019.

The repeat intent rate, which measures the likelihood that a monthly active user will make another order within the next month with the same grocery service, jumped to 55% for April, up five percentage points versus a year ago, but continues to remain significantly below pre-pandemic intent. Among less satisfied users in April 2021, 11% are still searching for an acceptable alternative as they are extremely or very likely to use another service in the next month.

“As the country opens, we’re consistently seeing double the number of active online shoppers compared to pre-COVID,” said Sylvain Perrier, president and CEO, Mercatus. “At the same time, we know there’s increasing frustration with poor execution as evidenced by the widening repeat purchase gap between first- and fourth-time online customers. My message to grocery retail executives is blunt. There are no shortcuts. If you want to maximize the value of your digital investment, you also need a well-thought-out operations plan – one that can flex in response to shopper demand and help deliver a top-notch ordering and fulfillment experience.”

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on Apr. 26-28, 2021 with 1,941 adults, 18 years and older, who participated in the household’s grocery shopping.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted Mar. 26-28, 2021 (n=1,811), Feb. 26-28, 2021 (n= 1,812), Jan. 28-31, 2021 (n=1,776); throughout 2020, Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and Aug. 22-24, 2019 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce® platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final and others. Mercatus is headquartered in Toronto, Canada.

Related Content

May 2021 U.S. eGrocery Sales Report

Media Contacts

416-603-3406

[email protected]

Greg Earl

Ketner Group Communications

[email protected]

Newsroom

Newsroom