Research Reveals New Realities Facing the U.S. eGrocery Market

BARRINGTON, IL – Oct. 29, 2020 — COVID-19 was a catalyst for swift and significant changes in the U.S. grocery industry; however, it has also shaped a new set of realities that is becoming clearer in the August 2020 Brick Meets Click/Mercatus Grocery Shopping Survey.

A larger customer base, online’s greater share of grocery spending, and higher shopper expectations versus a year ago are the new realities facing grocers who want to grow their online business. As a result, how companies address three strategic questions will determine their ability to thrive in the coming months as competition intensifies.

How will grocers attract more online customers?

The number of monthly active users (MAU) of grocery delivery and pickup services in the U.S. stood at 37.5 million households at the end of August 2020, compared to 21.4 million in August 2019. Although this growth, which equates to a 133% gain, is impressive, much of it was driven by the coronavirus. This raises the question: where should companies focus to acquire new customers?

“If you want to catch more fish, you need to fish where the fish are, and winning back lapsed customers represents the strongest and nearest-term opportunity,” said David Bishop, partner, Brick Meets Click. “We estimate that the size of the lapsed customer segment includes 23.6 million households who received one or more grocery delivery or pickup orders since March 2020 but none during the month of August.”

The over-60 age segment also represents an opportunity for brick-and-mortar retailers to build their online businesses. The survey found that monthly active users over 60 years of age represented 30% of users who had groceries shipped to them via a parcel carrier, but only 20% and 18% of delivery and pickup users respectively.

How can grocers drive up spending per order?

The average order value increased by 32% versus a year ago, and the research clearly shows that a shift in the customer mix toward more frequent users is the main factor driving this gain.

The share of customers completing four or more online orders within the past three months with a specific grocery or mass service provider increased from 43% during August 2019 to 56% during August 2020, while the share of first-time customers declined slightly from 25% to 23%.

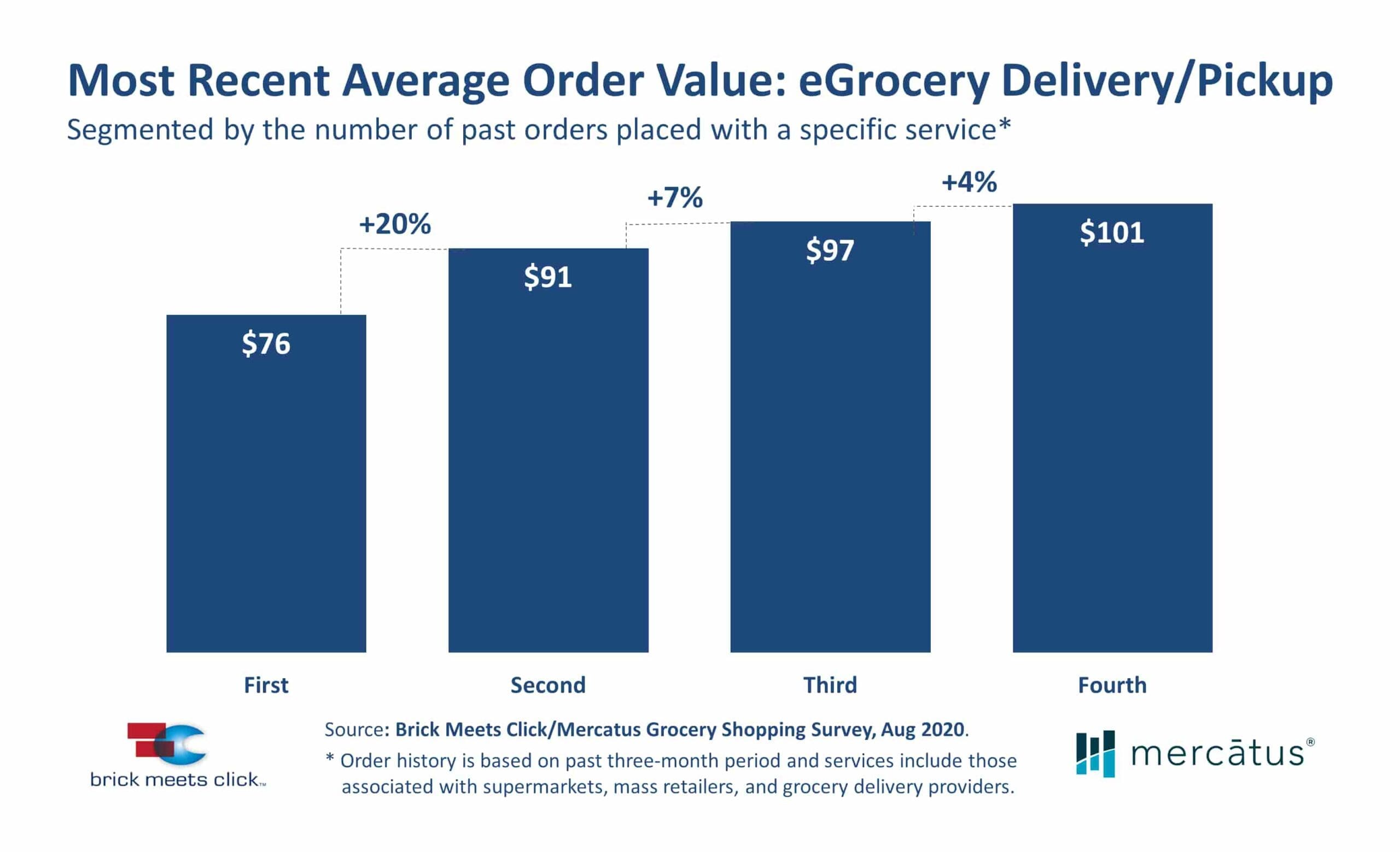

The research also documented how average order value climbed based on how many times a shopper used a specific service during the last three months. Customers who completed their first order with a specific grocery or mass provider spent $76 on average. Spending then grew 20% for those completing their second order, another 7% for those on their third, and 4% on their fourth, for an average order total of $101. After the fourth order, average spending leveled off.

“These insights suggest that as more customers become regular users of the service, retailers will need to improve their merchandising capabilities. That includes cross-, suggestive, and up-selling, in order to build larger rings,” according to Bishop. “And, while allowing customers to customize dietary and/or product preference is helpful, integrating past-purchase from in-store transactions will offer a more seamless way to support personalized recommendations.”

How can grocers improve our customer experience?

A larger number of households are receiving online grocery orders in more ways than just a year ago. The research found that 34% of all monthly active users received grocery orders via two or more methods (ship to home, home delivery, or store pickup) during the month, up from 15% from August 2019 based on a previous Brick Meets Click survey.

Also, the share of households shopping online across retail channels is growing. The August 2020 survey revealed that nearly one in five monthly active users of a grocery service used a mass service during the same time period as compared to one in seven during August 2019.

It will be important for grocery retailers to recognize that improvements to the ship-to-home experience and seamless and positive experiences with mass providers will frame expectations for those same customers when using a grocery service.

While it’s important to improve the customer experience for everyone, maintaining an intense focus on customers placing their first order is essential to boosting a customer’s lifetime value for a retailer. This represents a significant opportunity; the August 2020 survey found that a customer who placed an initial order with a service had a 52% chance of completing another order – those odds increased to 84% for someone who completed a third order.

“Despite the new realities of online grocery shopping, the customer experience remains a key driver of grocery retails’ success,” said Sylvain Perrier, president and CEO, Mercatus. “To sustain and grow online brand affinity, grocers must ensure that the digital channel complements retailers’ overall brand strategy and physical retail channels to create a consistent and seamless experience in line with what consumers want today.”

About This Consumer Research

Brick Meets Click conducted the survey on Aug. 24-26, 2020 with 1,817 adults, 18 years and older, who participated in the household’s grocery shopping. Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses were weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. The 2019 results are based on a similar survey conducted on Aug. 21-23, 2019 with 2,485 adults, 18 years and older.

About Brick Meets Click

Brick Meets Click is a strategic advisory firm that focuses on how digital technology and new competitors are changing food marketing and sales. Founded in 2011, its guidance helps retailers, manufacturers, and suppliers adapt and find new sources of growth by better understanding the shifts in the marketplace and where opportunities exist to grow sales and profits.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and profitability, and quickly adapt to changes in consumer behavior. The Mercatus Integrated Commerce® platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company brands, WinCo Foods, Smart & Final and others. Mercatus is headquartered in Toronto, Canada.

Media Contacts

David Bishop, Partner

Brick Meets Click

847-722-2732

[email protected]

Greg Earl

Ketner Group Communications (for Mercatus)

512-794-8876

[email protected]

Newsroom

Newsroom