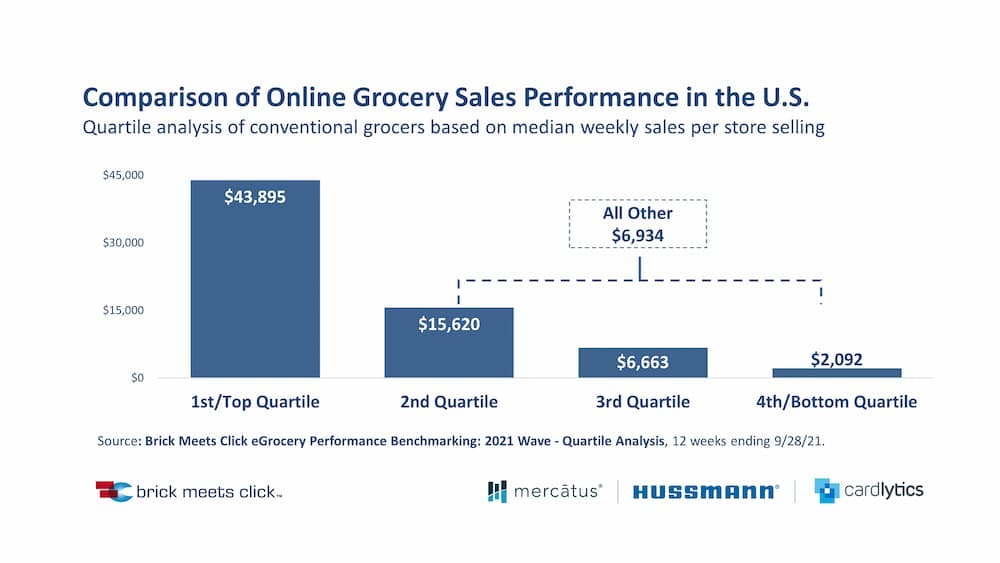

Top-Quartile Grocery Stores Generate Weekly Online Sales 6x Higher

Barrington, Ill. – May 25, 2022 – Conventional grocery stores in the top-performing quartile generated average weekly online grocery sales of $43,895, 6.3 times higher than the median sales of $6,934 for rest of the stores, according to the Brick Meets Click eGrocery Performance Benchmarking 2021 Wave.

A dramatically higher average order value (AOV) was one factor that influenced the strong performance of these top-quartile stores. The AOV at the top stores was 46% higher, as customers spent nearly $126 per order, compared to $86 at the lower-quartile stores. The availability of alcohol, whether beer only, beer and wine, or beer, wine, and liquor, likely played a role in the higher AOVs, as 90% of the top-quartile stores sold alcohol online while only 60% of the others did.

“Grocers are well aware that many variables affect performance across their base of stores, but they need to occasionally challenge or retest assumptions about growth drivers as selling online evolves and matures,” said David Bishop, Partner at Brick Meets Click. “This quartile analysis reinforced that excelling at selling online – like operating a physical store – requires both a sound strategy and effective execution.”

The 2021 eGrocery benchmarking wave, sponsored by Mercatus, Cardlytics and Hussmann. The benchmarks are based on online transactional data linked to non-personal identified households across nearly 950 stores from 45 U.S. banners. The study is the largest independently conducted online grocery benchmarking initiative completed to date.

The findings also revealed insights into how location, age, and range of services contribute to the significant performance gap between the top-performing stores and the others.

Store Location: Where a store is located is not as significant a factor as some may believe. While many assume the best places to operate are in the most populous areas, that assumption isn’t true for the top performing stores.

Analyzing per-store performance within the top quartile based on trade area population generally revealed an inverse relationship between population size and sales performance. In other words, top-quartile stores operating in zip codes with a population under 10,000 reported 31% higher weekly sales than stores in areas with a population over 40,000. In contrast, sales at stores in the lower quartiles increased as the size of the population did.

Age of Service: Top-quartile stores have matured much better than the rest. Top-quartile stores had operated online longer as 50% have done so for four or more years as compared to 34% of the others. Only 10% of the top-quartile stores had operated for less than one year versus 25% of all other stores. So, while top-quartile stores were operating longer online may help to explain differences in performance compared to the other quartile groups, the analysis revealed a surprising trend.

Clustering stores based on the age of their respective online service within each quartile showed that the top-quartile stores generally grew with age while the others typically contracted. In fact, top-quartile stores saw higher sales over time with those that operated online for 4 years or longer reporting over 50% higher sales compared to stores that had been online for less than one year. However, a comparative analysis of the remaining quartiles revealed a choppy sales trend that ultimately resulted in the oldest stores reporting weekly sales that were 23% lower than their youngest cohorts.

Range of Service: Offering multiple ways to receive an online order mattered the most. Top-quartile stores were 1.5 times more likely to offer both Pickup and Delivery services. In fact, 67% of the top-quartile group offered both services, while only 44% of the others did.

Top-quartile stores that offered both Pickup and Delivery generated weekly sales that were 39% higher than those that offered only one service. This wasn’t the case, however, with the other quartile groups. For all other stores, making both options available didn’t generate higher sales for some reason.

“It’s helpful for grocery executives to consider what factors may be preventing their online grocery business from performing at the same level as the top quartile,” said Sylvain Perrier, president and CEO, Mercatus. “The same factors that go to making one location successful in terms of online sales will not necessarily translate to all locations. The best performers likely have ironed out their operational wrinkles, resulting in the best possible fulfillment experience for customers. Meanwhile, the level of marketing investment directed to promoting online service options also will have an impact over time.”

For information about access to the research and related reports, go to brickmeetsclick.com.

About this research

The Brick Meets Click eGrocery Performance Benchmarking is an annual initiative based on ePOS data provided by participating retailers. It began in 2016 with 17 grocery store banners and has grown to 45 banners for 2021. The 2021 wave generated key insights based on an analysis of comparable 12-week periods during 2021 and 2020, examining performance across three 4-week periods (8, 9, and 10) ending with September 28, 2021. The study examines the critical business questions related to improving strategy and execution when operating a first-party ecommerce shopping service.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping from store to door. We enable retailers to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets and others.

About Cardlytics

Cardlytics (NASDAQ: CDLX) is a digital advertising platform. We partner with banks to run their rewards programs that promote customer loyalty and deepen relationships. In turn, we have a secure view into where and when consumers are spending their money. Using these insights, Cardlytics helps marketers identify, reach, and influence likely buyers at scale, as well as measure the true sales impact of marketing campaigns.

About Hussmann

Hussmann, a wholly owned subsidiary of Panasonic, promises to continuously provide the most customer-focused solutions in the food retailing industry. For more than 115 years we have been the innovation and technology leader delivering the broadest and most comprehensive solutions to our market including the cutting-edge e-commerce offering, eGrocery. We collaborate with customers to deliver better businesses, better partners, and a better world.

Newsroom

Newsroom