How Grocers Can Use Membership Programs to Lift Sales and Boost Loyalty

The streak was finally broken.

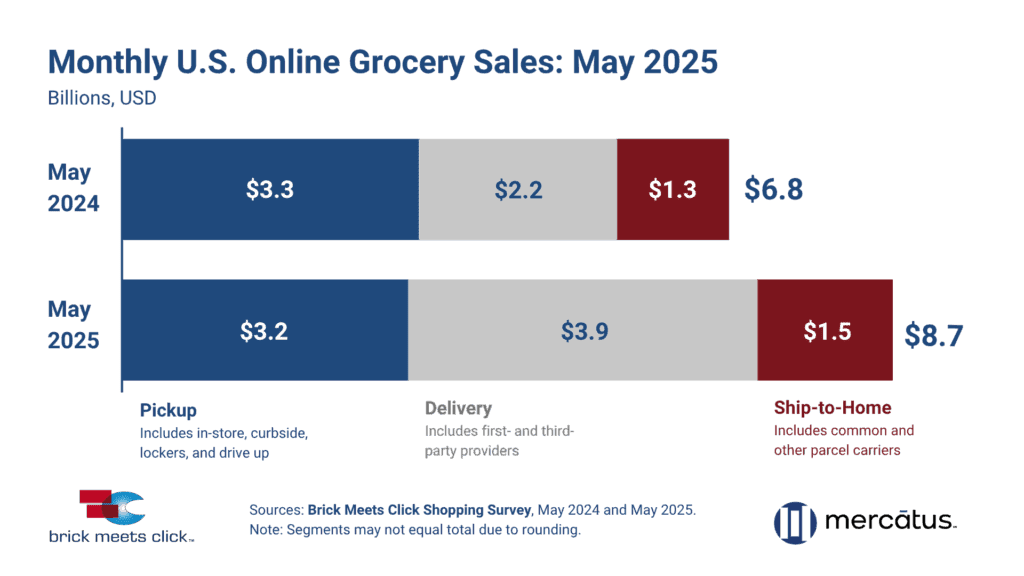

For the first time in 10 months, U.S. eGrocery sales failed to reach $9.5 billion.

But before anyone imagines May’s sales numbers to be a sign of slowdown, a quick look at the numbers tells a very different story.

The seasonal drop was much milder than expected due to delivery sales.

Jumping more than 70% year-over-year, delivery sales reached nearly $4 billion and captured 45.4% of the online grocery market.

The story should be familiar by now: Retailers like Walmart and marketplaces like Instacart are driving eGrocery growth by making delivery feel free. Their discounted membership programs cut or eliminate delivery fees so that customers pay a little up front, then order again and again because each transaction reinforces the value of the subscription.

This doesn’t just increase retention. It builds loyalty and shapes consumer expectations.

It also leaves grocers falling behind.

The traditional promo codes and trial offers used by regionals and independents might bring in new customers, but they rarely keep them. They’re built for short-term wins, not long-term engagement. Meanwhile, mass retailers and third-party marketplaces are offering a smoother, more rewarding experience that keeps customers coming back without having to be reminded.

But this is a gap that grocers can close.

With the right tools and the right approach, grocers can launch membership programs of their own and take control of their customer experience.

Grocers Can Compete with Their Own Membership Plans

The idea isn’t out of reach.

If customers are lapsing and traditional outreach isn’t working, it’s time to build new ways to bring shoppers back.

For grocers, that starts with reinforcing relationships through membership programs.

The surge in delivery sales and the retention it’s creating makes a clear case: Subscription models like Walmart+ are fueling habit-forming behavior. They’re driving loyalty through consistent value and repeat use.

But Walmart isn’t the only success story.

Lowes Foods offers a strong example of how regional grocers can build membership programs that deliver real results.

Lowes Foods Membership Success

The grocer introduced its eCommerce membership back in 2017, designed around value, frequency, and direct connection with its pickup customers.

The plan waived the standard $4.95 picking fee and offered unlimited online orders for a flat fee—$99 per year, or $49 during three annual promotions tied to key shopping moments: Black Friday, Valentine’s Day, and Back to School.

Each promotional push sold roughly 2,500 memberships, locking in 7,500 customers annually. Even better, the grocer generated almost $400,000 in annual revenue directly from membership sales alone.

But the impact went beyond direct revenue.

Members who enrolled averaged eight online orders and 38 in-store trips per year—46 total visits, combining digital convenience with in-store loyalty. Spend per customer increased, churn dropped, and the brand saw a clear lift in retention across both channels.

The program worked because it was rooted in customer behavior, designed to serve the full customer journey, and executed with precision:

Warm Leads

Store teams received lists of recent eGrocery customers who paid picking fees as part of their shopping experience. They targeted these customers and reached out with promotions.

Clear Communication

Associates used a simple script to explain the membership offer and communicate a compelling value proposition for each customer. Then, it was left to the customer to add to their cart.

Value-based Positioning

Benefits were positioned as added value, not just another discount.

Multiple Channels

Benefits and perks applied to both digital and in-store experiences, reinforcing brand preference across multiple channels.

And notably, this all happened before the pandemic. Before grocery became digital by default, before delivery was a primary driver of loyalty, and before shoppers expected seamless value at every touchpoint.

Today, this kind of model is even more powerful. Expectations are higher, but so is the opportunity.

With the right technology, what once required manual workarounds and siloed systems can now be launched and scaled with far greater speed, precision, and results.

DXPro Makes It Possible

Programs like this prove what’s possible.

But to scale a membership model like that today—without relying on manual processes or disjointed systems—grocers need modern infrastructure. That means technology built specifically for grocery and designed to reflect how consumers actually shop.

And that’s the biggest challenge.

The legacy platforms many grocers adopted when the pandemic began weren’t built for this. They’re designed to process orders, not foster loyalty. They support transactions, but not long-term engagement.

DXPro from Mercatus is different.

It gives grocers the ability to run smarter, more effective membership programs that are powered by unified data, personalized engagement, and seamless commerce.

If we look back at what made the Lowe’s Foods membership program successful, a few things stand out: smart targeting, personalized outreach, direct customer engagement, and a seamless experience across in-store and online channels.

DXPro is built to make each of those elements easier to execute and far more powerful at scale.

Here’s how it supports and extends what worked so well for Lowe’s:

Unified Data Intelligence

Lowe’s succeeded by identifying warm leads—pickup customers likely to convert. DXPro takes that further by using unified data to automatically surface your most promising prospects, predict engagement windows, and guide timing.

Predictive Personalization

Store associates at Lowe’s followed scripts to promote the membership during key events. With DXPro, that outreach becomes dynamic with membership offers being extended or promoted based on real shopping behavior, making each touchpoint feel relevant and well-timed.

Full Control of Brand and Customer Data

Lowe’s kept its customer relationship in-house, reaching out directly to shoppers. DXPro ensures you retain that ownership. Every transaction, interaction, and offer stays within your branded experience, helping you build loyalty for your store. No more building loyalty for third-party platforms. Every transaction strengthens your direct customer relationship.

Commerce Built for Grocery

Lowe’s designed a program that blended in-store and online behavior. DXPro is built to support the complexity of modern hybrid customers, not only in shopping across multiple channels, but also managing substitutions, promoting local assortments, and providing for multiple payment types.

Seamless Fulfillment

Membership only works if the experience delivers. DXPro helps grocers provide a seamless fulfillment experience by automating time slots, improving order accuracy, and making it easy to integrate your existing delivery solutions.

With DXPro, grocers don’t just replicate what worked at Lowe’s. You can take memberships further, with a platform built to deliver loyalty at scale, across every channel and every customer touchpoint.

Take Back Control, Get a Bigger Slice

If Lowes proves what’s possible with the right strategy, then DXPro shows what’s possible with the right platform.

Memberships are already shaping grocery loyalty, with the gains from this shift flowing to the companies that control the digital experience.

And that’s what has to be realized whenever the new monthly sales numbers come out: Mass retailers and third-party marketplaces aren’t just securing transactions with their discounted memberships, they’re capturing and controlling the customer relationship.

Whoever owns the checkout, the communication, and the rewards, will also own the customer’s loyalty.

And that’s not something you can solve with more coupons.

To compete and grow, grocers need ownership of the customer experience, data that turns insight into engagement, and a platform that powers long-term loyalty—not just single transactions

DXPro delivers all three.

It’s built for grocers who want to run smarter membership programs, deepen customer retention, and grow their share of a market that’s increasingly defined by digital behavior.

And it does it without the high cost or complexity of enterprise platforms built for someone else.

You don’t need Walmart’s budget. You don’t need to rent out your customer experience.

You need tech that helps you deliver a membership strategy on your own terms with your brand, your data, and your customers at the center.

How to Get Started

If your current loyalty efforts are focused on transactions instead of relationships, or if your customer data lives in someone else’s system, now is the time to rethink your approach.

Here’s what to do:

1. Audit your current membership and loyalty programs.

Where is it delivering value? Where is it falling short?

2. Look at your data.

Who controls it? Can you use it to drive smarter, more personalized engagement?

3. Reimagine what your program could be.

Think beyond points and promo codes. Think about how to consistently reward your best customers and keep them coming back.

Then talk to us.

Don’t wait for another month of missed opportunities.

Book a consultation with Mercatus to see how DXPro can help you build a membership program that drives loyalty, protects margin, and grows your revenue—online and in-store—starting today.

Newsroom

Newsroom