US eGrocery Sales Trends with Brick Meets Click – May 2023 Insights

US eGrocery Sales Dip 3.4% YoY in May 2023 to $6.9 Billion

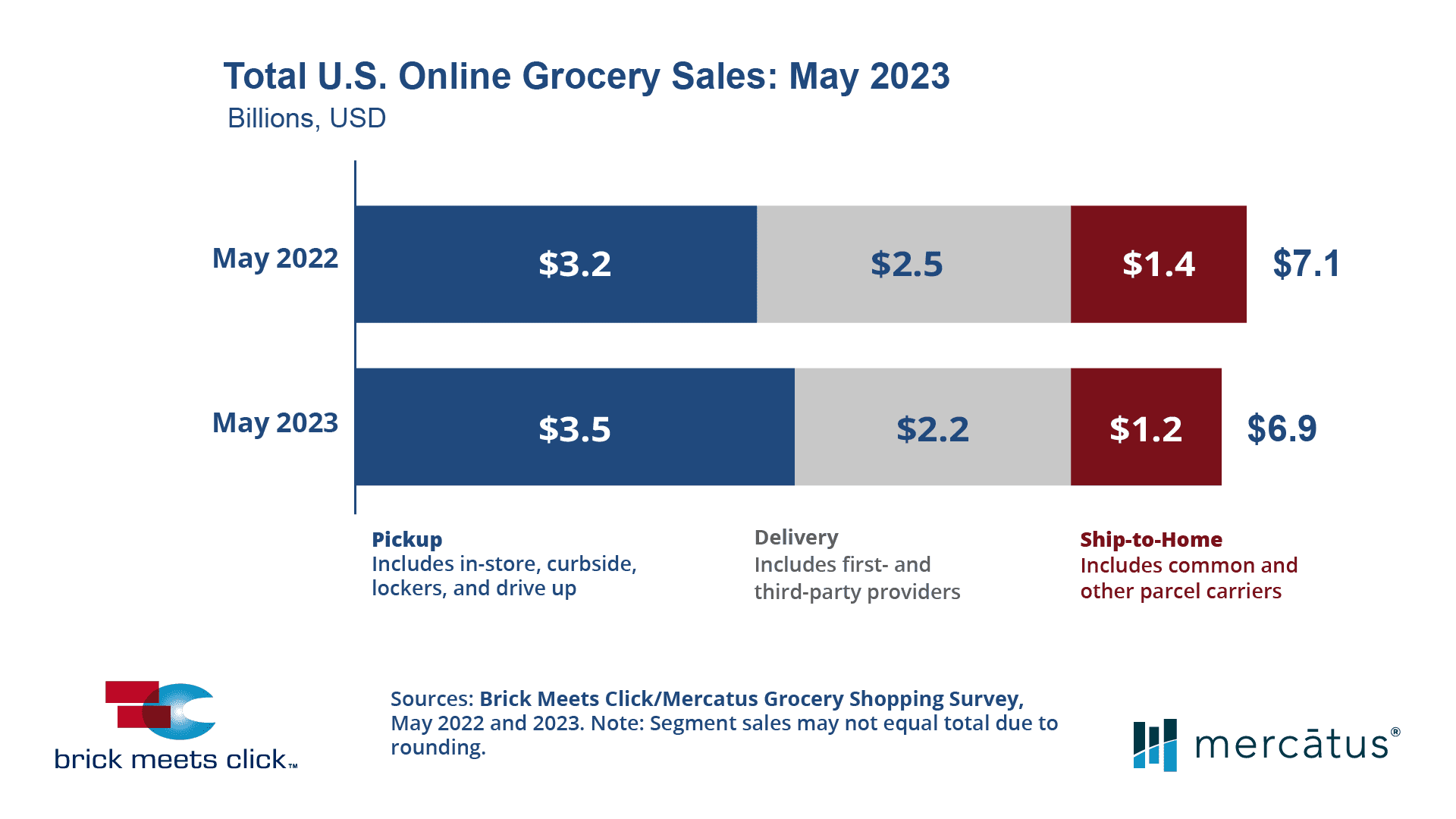

As per the Brick Meets Click/Mercatus Grocery Shopping Survey completed on May 30-31, 2023, US eGrocery sales reached $6.9 billion in May, indicating a 3.4% decrease year-over-year (YoY). This slump was underpinned by a combination of factors. Notably, there was a drop in households choosing to purchase groceries online in May 2023 compared to the previous year. This was compounded by a decrease in the average number of orders placed by active shoppers.

A Closer Look at May 2023 US Online Grocery Sales

In a reversal of the overall trend, Pickup emerged victorious with an impressive 9.1% YoY growth to $3.5 billion, contributing 50.7% to total eGrocery sales, its largest share to date. Conversely, Ship-to-Home and Delivery segments experienced dips of 17.0% and 11.7% YoY, accounting for 16.8% and 32.5% of eGrocery sales for the month respectively.

The total number of monthly active users (MAUs) for online grocery shrank by 5%, with each of the three segments – Ship-to-Home, Delivery, and Pickup – witnessing respective declines in their MAU bases. Notably, the percentage of MAUs who chose only one receiving method during May saw a significant increase of 6 percentage points to 72%, underscoring the impact of consumer loyalty in these challenging times.

Simultaneously, there was a drop in the average number of orders placed by MAUs, which fell 5% to 2.51 as compared to May 2022, perpetuating a downward trend that started from the peak of 2.91 in May 2020. However, not all metrics followed the downward trend. Interestingly, the overall spending per order demonstrated a significant increase of nearly 8% in May versus the previous year. This increase can largely be attributed to higher grocery product prices, reflecting the broader inflationary pressures in the economy. Pickup’s average order value (AOV) notably climbed almost 13% in May to $92, whereas Delivery saw a moderate uptick of 5% to $85.

Customer Loyalty and Market Share

Loyalty among customers, as measured by repeat intent rates, took a hit in May, declining 270 basis points YoY. This marks the third consecutive month in 2023 when customers signaled a lower likelihood of using the same Pickup or Delivery service again within the next 30 days as compared to the same periods in 2022. The decline in customer loyalty shines a light on the mounting challenges for online grocery services in retaining their user base and ensuring customer satisfaction amid a competitive environment.

Meanwhile, the online share of total grocery spending experienced a small decline, falling 2.7% points to 12.1% YoY. This decrease may signify a shift in customer preferences or changing market dynamics, potentially driven by a growing focus on cost-effectiveness or evolving shopping behaviors. When we factor out Ship-to-Home, the combined contribution from Pickup and Delivery declined to 10%, marking a decrease of 1.9% YoY, driven largely by Delivery’s weaker performance during May.

A segment-by-segment analysis shows diverging performances between different eGrocery formats. The Grocery sector witnessed a nearly 2% decline in its MAU base in May, while the Mass sector contracted by a more significant 5%. However, it’s important to note that despite the downturn, the Mass sector’s MAU base still towers over Grocery’s by more than 40%.

In contrast to the decline in order frequency and MAU base, the average order value (AOV) across all segments has grown. The combined AOV for Pickup and Delivery within the Grocery sector climbed by nearly 9%, while the Mass segment posted an even more substantial growth of nearly 14% YoY.

Key Findings for May 2023

- Total US online grocery sales for May 2023 declined by around 3.4% YoY, heavily influenced by a continued slump in Ship-to-Home and a slowdown in Delivery, despite a strong 9.1% YoY surge in Pickup sales.

- Weekly household spending on groceries saw an increase of 9% YoY, however, online’s share of grocery spending took a hit, falling by 270 basis points as households likely increased in-store purchases.

- The number of U.S. households purchasing groceries online in May 2023 declined by approximately 5% YoY. This was due to significant reductions in the user base for Ship-to-Home, Delivery, and a lesser extent for Pickup services.

- Overall order frequency per MAU fell by around 5.3% YoY. Yet, each of the three largest formats – Mass, Grocery, and Amazon’s pure play – registered growth, with increases of 9%, 10%, and 2% respectively.

- The weighted average AOV saw variable trends across all three delivery methods in May YoY. Pickup outperformed with a notable rise of around 13% while Delivery posted a modest gain of 5%. However, Ship-to-Home suffered a decline of more than 3%.

- Repeat intent rates for the Mass and Grocery format experienced the widest divergence to date (21%, driven by Mass’s 7.2% YoY growth, while the Grocery format fell sharply by 5.6% in comparison to the same period the previous year.

Key eGrocery Strategy Recommendations for May 2023:

- Capitalize on Pickup growth – with Pickup experiencing significant growth, retailers should focus on optimizing this service, making it more accessible and convenient for customers.

- Address the decline in repeat intent – Retailers should devise strategies to boost customer loyalty and improve repeat purchase rates.

- Prioritize customer experience – Amid the competitive market, providing a seamless and satisfying shopping experience can help retailers maintain and expand their customer base.

To summarize, the US eGrocery sector saw a slight contraction in May 2023, characterized by a decline in overall sales, a dip in order frequency, and a decrease in monthly active users. Yet, amidst this trend, Pickup remarkably defied the odds, capturing its largest share of the market to date. With shifting consumer dynamics, it’s crucial now more than ever for regional grocers to delve deeper into understanding their customers’ changing needs and make the necessary adjustments.

Make sure to watch the webinar from David Bishop and Mark Fairhurst and check out the full May 2023 US eGrocery Sales press release here.

P.S. If you are a Grocery Retailer looking for online grocery insights to help inform your strategy and evolve your approach, signup for our exclusive distribution list here.

Thanks for reading!

Newsroom

Newsroom