US eGrocery Sales Trends with Brick Meets Click – December 2024 Insights

Online Grocery Sales Reach $9.6 Billion in December—a 19% YOY Increase

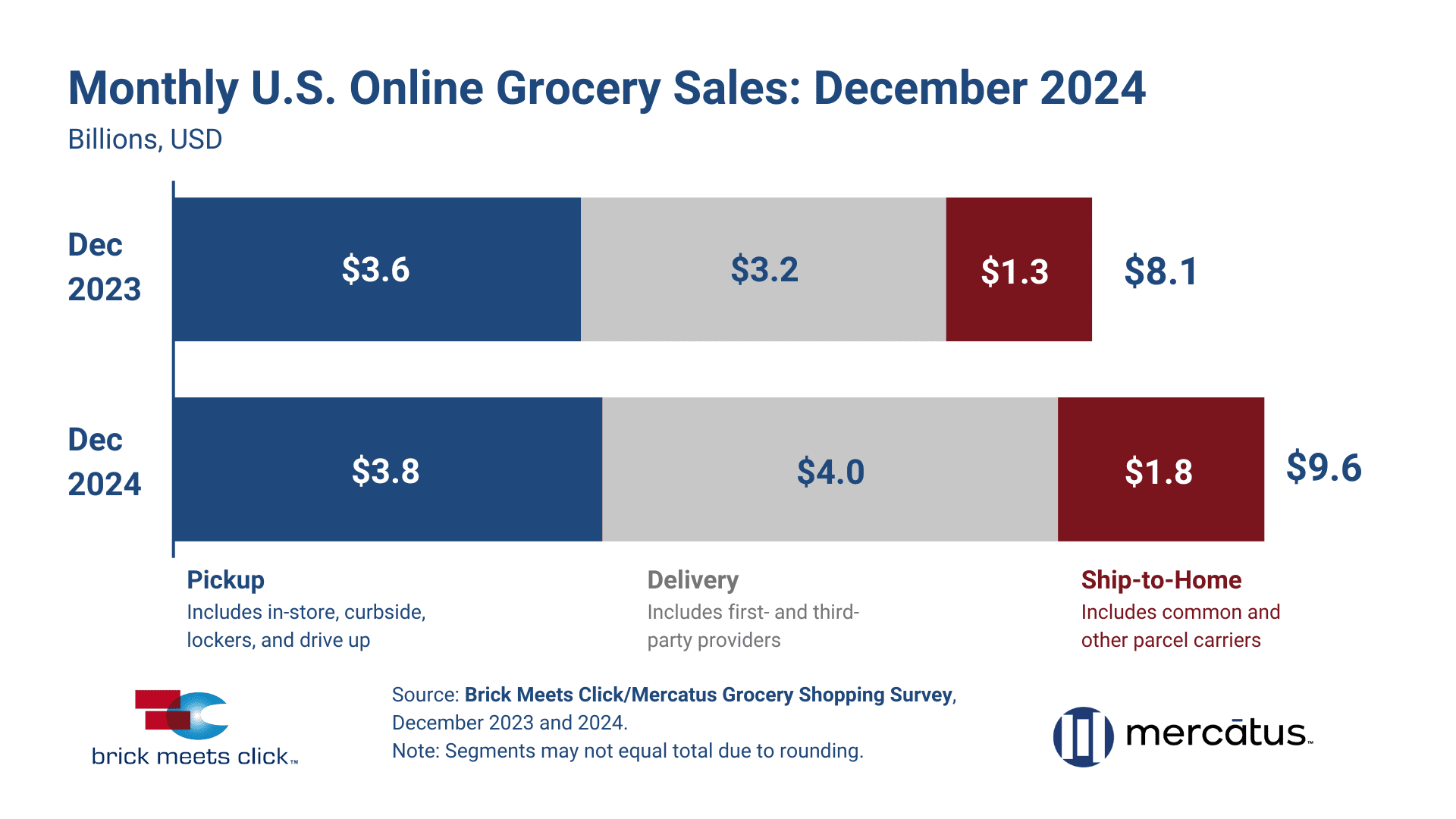

The U.S. eGrocery market ended 2024 on a strong note, with December sales climbing to $9.6 billion—an impressive 18.7% increase compared to one year ago.

This surge caps off a year of contrasts: While the first half of 2024 saw extremely modest growth— just 0.3% YOY—second half sales grew by 17.7% YOY, driven by aggressive subscription and membership promotions tied to reduced delivery fees.

The impact of these strategies is once again evident in December’s numbers.

Even though all three fulfillment methods—pickup, delivery, and ship-to-home—reported YOY gains, delivery emerged as the preferred fulfillment method. Delivery sales surged 24.6% YOY, capturing 41.7% of total eGrocery sales, surpassing Pickup, which accounted for 39.4%.

This shift highlights how the previously mentioned discounts on delivery memberships and enhanced convenience are driving customer adoption and reshaping preferences. For regional grocers, these trends also highlight the urgency of adapting to this evolving market.

To discover the data behind these shifts and explore actionable strategies to compete effectively against the big players in 2025, keep reading.

December 2024 US Online Grocery Sales Analysis

All Fulfillment Methods See Gains

Even though delivery has emerged as the star performer over the last half of the year, December’s numbers show growth among all three receiving methods.

Delivery’s 24.6% YOY increase, reaching $4.0 billion in sales and capturing 41.7% of the market, will get a lot of attention, but let’s not ignore the performance of pickup and ship-to-home.

Even though it ceded share to Delivery, dropping to 39.4% of total eGrocery sales, pickup witnessed a 5.3% YOY increase, generating $3.8 billion in sales. Meanwhile, Ship-to-home made a remarkable comeback, surging nearly 40% YOY to contribute $1.8 billion, representing 18.9% of total sales, up from 15.9% from December 2023.

A Tale of Two Halves

As we mentioned in the opening, the annual numbers reveal a stark divide between the first and second halves of the year.

While the first six months of 2024 saw modest growth of just 0.3% YOY, the final six months delivered a dramatic 17.7% YOY increase, driving an overall 9.1% YOY gain for the year.

Each fulfillment method reflected this shift in performance:

- Delivery: Growth accelerated from less than 4% YOY in the first half to more than 25% YOY in the latter half, fueled by aggressive promotions on subscriptions and memberships.

- Ship-to-home: Growth soared from 5% YOY early in the year to nearly 20% YOY later, reclaiming lost share.

- Pickup: After a 4% YOY decline early in the year, pickup rebounded with a nearly 8% YOY gain in the final six months, demonstrating resilience despite ultimately losing share to delivery.

Mass Retailers Continue to Lead in Customer Loyalty

When it comes to customer loyalty, larger retailers are maintaining a clear advantage over grocers.

In December 2024, repeat intent rates—the likelihood that a customer will use the same service again within 30 days—remained higher for both Delivery and Pickup services among mass retailers compared to grocers.

While the gap in repeat intent rates has narrowed slightly from last year, the sustained loyalty to larger retailers like Walmart can be attributed to their ability to deliver seamless digital experiences, reliable fulfillment, and consistent value propositions. The subscription programs that we’ve mentioned throughout this analysis further incentivize repeat orders through perks such as discounted delivery fees and expedited service, creating a virtuous cycle of loyalty and retention.

10 Key Takeaways from December 2024 eGrocery Sales:

- The U.S. online grocery market reached $9.6 billion in sales in December 2024, an 18.7% YOY increase.

- This marks the fifth consecutive month of sales above $9.5 billion.

- Total 2024 eGrocery sales rose 9.1% YOY, driven by a 17.7% surge in the second half of the year, after flat growth of just 0.3% YOY in the first half.

- Delivery sales grew 24.6% YOY in December, reaching $4.0 billion and capturing 41.7% of total eGrocery sales, up from 39.8% last year.

- Pickup sales increased 5.3% YOY in December to $3.8 billion, but its share of total eGrocery sales declined to 39.4%, a loss of 500 basis points.

- Ship-to-home sales surged nearly 40% YOY in December, contributing $1.8 billion and increasing its share to 18.9%, up from 15.9% last year.

- More than 50% of monthly active users (MAUs) placed at least one order with a mass retailer in December.

- This contrasts to just a third of overall MAUs who ordered from a supermarket or hard discount store.

- A third of grocery’s MAU base also cross-shopped with a large retailer in the same month, an 800 basis point increase versus December 2023.

- Mass retailers posted higher repeat intent rates for both delivery and pickup services than Grocery operators, although the gap narrowed compared to last year.

Strategic Recommendations for Grocers

Enhance Customer Engagement

While the gap in repeat intent rates is narrowing, larger retailers continue to outperform grocers in retaining customers.

This success stems from a combination of lower costs and the effective use of tailored strategies that foster customer loyalty. For regional grocers to remain competitive, strengthening customer engagement must become a priority.

This involves leveraging tools and strategies to build stronger relationships with your customer base:

- Increase Personalization: Collecting and consolidating customer data allows grocers to craft personalized promotions, recommend products based on past purchases, and align offers with shopping habits.

- Reward Loyal Customers: With one-third of Grocery’s MAU base also shopping with Mass retailers, introducing member-only perks or bundling products can incentivize repeat orders and reduce cross-shopping.

- Improve Digital Experiences: Apps and online platforms should be intuitive and tailored to customer preferences. Simplified search functionality and faster order building can reduce friction, enhance satisfaction, and encourage repeat visits.

By adopting these strategies, regional grocers can close the loyalty gap and position themselves as strong competitors in a market increasingly dominated by larger retailers.

Highlight Fresh, Local, and Healthy Products

The rise of reduced delivery fees has driven more online orders, especially for center-aisle products like pantry staples—a category larger retailers already dominate.

However, regional grocers still hold a critical advantage in fresh food, prepared meals, and produce. These categories are the foundation of why many customers continue to shop with grocery stores, both in-store and online.

By leaning into these strengths through increased promotion and enhanced service offerings around perimeter departments, regional grocers can create a distinct value proposition that larger retailers will never be able to replicate. Freshness, quality, and local sourcing resonate strongly with shoppers and provide a competitive edge, particularly as health-conscious shopping trends continue to grow.

Building on these advantages is essential for retaining customers in the current market.

Look Ahead and Plan for Market Shifts

The 17.7% YOY growth in the second half of 2024 highlights how unexpected developments—such as aggressive mid-year membership promotions—can dramatically reshape the market.

Few analysts at mid-year could have predicted such a sharp turnaround from the flat growth seen in the first six months. Regional grocers must take a forward-thinking approach to prepare for future disruptions.

- Monitor potential economic pressures, such as tariffs on imported goods, which could significantly impact costs for both retailers and consumers.

- Anticipate shifts in consumer behavior, like the impact of GLP-1 weight-loss drugs like Ozempic, which may reduce demand for certain categories while increasing interest in others.

- Plan for the unexpected, such as technological advancements or aggressive pricing from competitors, by maintaining flexibility and building resilience into operations.

Closing Thoughts

This month’s sales numbers reflect a new standard for the U.S. eGrocery market that’s been established over the last six months.

December’s performance serves as a microcosm of the latter half of the year, showcasing the sustained impact of aggressive membership promotions and reduced delivery fees on customer behavior and overall sales growth.

While eGrocery leaders like Walmart and Instacart continue to reap the rewards of this growth, regional grocers have an opportunity to stand out by emphasizing fresh, local, and health-conscious offerings, alongside enhancing personalization and customer engagement.

Thank you for reading this month’s analysis. If you have any questions, please reach out.

For more insights from the Brick Meets Click/Mercatus December 2024 Grocery Shopper Survey, click here to access the full report.

Newsroom

Newsroom