US eGrocery Market Share Report with Brick Meets Click – Insights From Q3-2024

How to Compete with the Delivery Discounts Reshaping the eGrocery Market

Delivery discounts are changing online grocery sales—and grocers are feeling the pressure.

As the industry’s biggest players continue to ramp up promotions on delivery subscriptions, grocery retailers face a new challenge: how to stay competitive and remain profitable when customers are increasingly drawn to the convenience and savings of “free” delivery.

The newly released Q3-2024 U.S. eGrocery Market Share Report from Brick Meets Click reveals how these discounts are accelerating online sales, with Walmart leading the charge.

The report highlights how the biggest retailer on the planet captured more than 35% of the eGrocery market in Q3, driven by the success of its Walmart+ subscription and aggressive delivery promotions.

This is a crucial trend for grocers to identify and understand, as it’s the basis for the growing divide between mass merchants and grocery retailers. With large retailers strengthening their grip on the market, grocers need cost-effective strategies to avoid losing more customers to the convenience and savings offered by these subscription services.

Discover how your grocery business can compete with these deep discounts—without risking profitability—by accessing the full Q3-2024 U.S. eGrocery Market Share Report.

To get your report, click the link below. Once validated, you’ll receive it free of charge.

➡️ Download the Q3-2024 eGrocery Market Share Report

The 5 Most Important Takeaways from the Report

1. Delivery is Driving Overall eGrocery Sales Growth

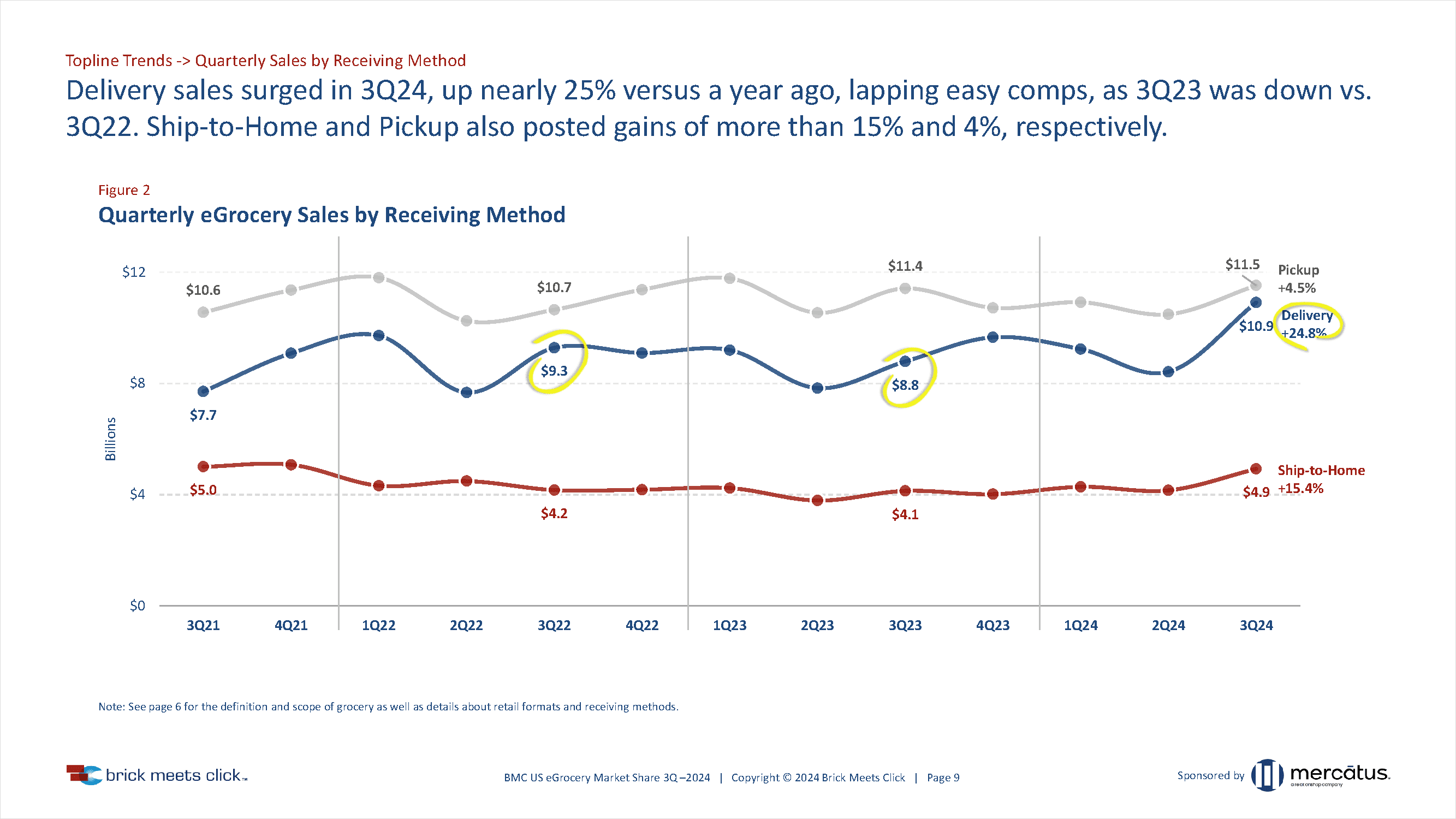

Total eGrocery sales in Q3-2024 increased by 14% year-over-year, primarily driven by the surge in delivery sales.

Aggressive promotions connected to subscription models, like Walmart+, Instacart+, and DashPass, are encouraging consumers to opt for delivery by offering free or heavily discounted service. These programs drive frequent orders as customers seek to maximize their membership benefits—making it the fastest-growing fulfillment method.

2. Walmart Extends Its Lead

Walmart continues to dominate the eGrocery landscape, capturing 35.1% of total online grocery sales in Q3-2024.

While many assume Walmart’s success is primarily due to its lower product prices, the reality is that its recent growth is driven by more sophisticated strategies that only a retailer of its scale can afford. Beyond offering delivery discounts through Walmart+ subscriptions, Walmart has implemented several powerful retention strategies, including the promotion of private-label products, as well as strengthening its omnichannel presence.

3. Supermarket Share Contracts

Supermarkets saw their market share shrink to 25.8% in Q3.

There’s a lot going on in this contraction because the deep discounts that are driving overall eGrocery growth aren’t just coming from big retailers, but also third-party delivery partners.

While some grocers may see short-term sales boosts driven by aggressive promotions, this reliance can undermine long-term sustainability. By depending too heavily on these external platforms, grocers risk losing direct control over customer relationships, data, and experiences—which are essential for growing market share instead of seeing it shrink.

4. The Rapid Rise of Delivery Over Pickup

Delivery has nearly doubled its share of the overall market in the past three years, rising from 22.1% in Q3-2021 to 39.6% in Q3-2024.

This surge is once again driven by promotions on delivery subscriptions, but we’re also seeing delivery has become the dominant fulfillment method for Supermarkets, representing between 50% and 57% of orders each quarter.

This is a concern for both of the reasons outlined in the takeaways above:

- Delivery has a higher cost-to-serve than pickup and doesn’t align with the value proposition of regional grocers; and

- Grocers often rely on third-party partners to fulfill delivery orders, which diminishes control over shopping data and customer experience.

5. Cross-sector Competition is Increasing

While Walmart’s position as the market leader puts a target on its back, the planet’s biggest retailer isn’t the only source of competition for grocery retailers.

Other big retailers like Target and Amazon, as well as club stores and discount formats are also vying for a piece of the eGrocery market. In the last quarter, Target had a sales share of 9.2% and Amazon had 9.0%, while club stores accounted for 5.7%, and hard discount made up 2.4%.

To learn more about these and other takeaways, download the full report.

5 Recommendations Based on Q3-2024 Market Share Data

1. Explore Subscription-based Models to Build Customer Loyalty

As delivery subscriptions continue to grow, regional grocers can leverage their own subscription models to drive customer loyalty and increase repeat business.

By offering perks like discounted or free pickup services, grocers incentivize customers to use their services more frequently, similar to how major players like Walmart have driven growth with delivery subscriptions.

In addition to core benefits—more value and convenience—regional grocers can bundle fresh produce, local products, or exclusive discounts with subscriptions to give customers a sense of extra value.

This not only drives order frequency but fosters long-term loyalty to a service that larger retailers will struggle to match.

2. Differentiate Through Pickup Services

While delivery is surging, pickup remains an underutilized opportunity for regional grocers to carve out their competitive edge.

Unlike larger players that are emphasizing delivery through promotions, grocers can compete by optimizing and promoting pickup services. Offering control and convenience without delivery fees, pickup appeals to cost-conscious customers who value the flexibility of online shopping but prefer avoiding added costs.

Regional grocers can further enhance pickup by bundling it with the subscription perks or special promotions mentioned above.

3. Leverage In-store Experiences and Local Expertise for Personalization

A local grocer’s place in the community is an underutilized asset for many regionals.

With lower prices being such an enormous advantage for Walmart, it can be easy for grocers to forget that they possess unique strengths larger retailers often struggle to replicate, particularly when it comes to in-store experiences and local expertise.

To differentiate themselves, regional grocers should leverage their deep knowledge of local customer preferences to offer personalized, tailored experiences. Whether through locally sourced products, personalized promotions based on shopping habits, or exclusive in-store events, grocers can create a more intimate shopping experience that resonates with their community.

Combining this personalized in-store service with online options—such as customized pickup or loyalty rewards—will help regional grocers strengthen customer relationships in ways that big-box retailers can’t easily match.

Pickup is great for grocers because it drives customers to the store, where they can capitalize on their traditional strengths like personalized service, convenient locations, and exclusive in-store offers aligned to the local community.

4. Shift Focus from Third-party Platforms to First-party Solutions

As we mentioned in our takeaways section, the subscription discounts offered by third-party platforms like Instacart and DoorDash may offer grocers a quick sales boost. However, long-term reliance on them poses significant risks.

That’s why regional grocers should aim to gradually shift more of their customers to first-party platforms, where they can control the customer experience, build direct relationships, and retain valuable data. By offering better deals for first-party services, exclusive loyalty perks, or tailored promotions, regional grocers can wean their customer base off third-party services.

This shift will not only reduce dependency on external platforms but also create a more sustainable business model where grocers have greater control over customer engagement and profitability.

5. Maximize the Psychological Power of Discounts and Promotions

The success of delivery subscriptions like Walmart+ and Target’s Circle highlights how “free” services and immediate savings are powerful motivators for customer engagement.

Once customers pay for a subscription, they often forget about the original fee and focus on maximizing its value, driving more frequent orders.

Regional grocers can make use of this psychology by offering limited-time promotions or discounts in more cost-effective ways than big retailers. The best way to leverage the power of promotions is to have the type of subscription or membership program we mentioned in our first recommendation.

By strategically timing offers for subscriptions, and memberships—and framing them as “ins

Don’t Just Level the Playing Field—Change It

The phrase “level the playing field” is often used to describe how underdogs can compete with favorites. But instead of trying to level the field, regional grocers should focus on playing the game in an entirely different arena—one where their unique strengths can shine.

The Q3-2024 U.S. eGrocery Market Share Report reveals how larger players are leveraging delivery promotions to capture more revenue. While smaller grocers may not be able to match the financial power of the industry’s largest players, they can focus on what makes them unique—personalized service, local expertise, and strong community ties—to create meaningful differentiation.

By leaning into these advantages and better communicating their value to customers, grocers can offer an experience that is difficult for larger retailers to replicate. This approach not only helps them compete in the short term but also builds a foundation for long-term success by developing deeper customer loyalty.

The insights provided in the Q3-2024 report are the first step in understanding where the market is headed and how to leverage your strengths to remain competitive in the grocery industry.

Newsroom

Newsroom