Why Grocers Need to Prioritize First-Party Engagement Over Third-Party Reliance

There have been two major shifts in grocery retail over the last five years:

- The first occurred at the onset of the pandemic, when consumer behavior shifted dramatically toward online shopping.

- The second occurred this past November when Mass Retailers surpassed supermarkets as the format of choice for grocery shopping among households in the U.S. — both online and in-store.

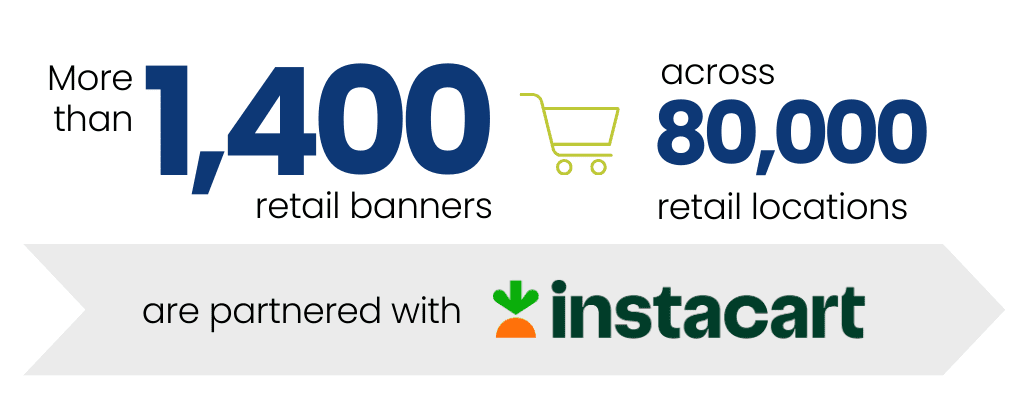

Many grocers turned to Instacart as a means of dealing with the first pandemic-related shift because the platform offered a rapid response to the sudden surge in demand for online grocery delivery. It enabled retailers to quickly cater to their customers’ immediate needs without the time and investment required to develop their own digital infrastructure.

As a new challenge emerges for supermarkets — the increasing market share being taken by Mass Merchants — the limitations of third-party partnerships are becoming more apparent. In a market that increasingly values differentiation, brand loyalty, and direct customer relationships, third-party dependence is stifling the direct connection with customers that grocers need to protect and win back their market share.

While the allure of an instant eCommerce solution with immediate access to a vast customer base is compelling, we need to ask if third-party reliance is meeting the most recently evolved needs of grocery retailers.

Do the benefits outweigh the drawbacks for grocers in today’s market?

How to Compete with Mass Merchants

Every month, when we analyze the data from the eGrocery sales reports, our key takeaways consistently highlight the importance of controlling the customer experience.

This control empowers grocers to:

- Directly and consistently connect with customers both online and in-store.

- Cultivate customer loyalty and reduce the tendency for cross-shopping.

- Collect and utilize data to personalize shopping experiences.

- Open avenues for additional revenue, such as retail media, and tap into the lucrative advertising market.

While there are nuances to each of the points above, this list represents the high-level playbook for regional grocers and independents looking to maintain a competitive edge in the current market.

Convenience at a Cost

It also represents the critical elements that third parties control through their mediation of the customer experience.

With this control, platforms like Instacart hold sway over the very strategies grocers need to compete with mass merchants effectively. While Instacart provides a convenient and expedited route to the online market, its primary aim is to continue growing its profitable, high-margin digital advertising business — not to altruistically support grocers or the broader industry.

That’s not a criticism of Instacart. It’s a publicly traded business like any other. And it’s been incredibly successful at leveraging the elements it controls to its own advantage:

- Direct Customer Connection: Instacart’s interface positions itself as the primary touchpoint for customers, not that of the individual grocers it serves. This direct line allows Instacart to prioritize competition on margins rather than service or quality.

- Customer Loyalty and Cross-Shopping: By centralizing various grocers on one platform, Instacart makes it convenient for customers to switch between retailers based on deals or availability. This practice dilutes brand loyalty to individual stores, and further fosters a loyalty to Instacart.

- Data Collection and Personalization: The data Instacart collects is used to refine its algorithms, personalize marketing efforts, and sell targeted advertising spaces to brands. All of this enhances its market position above that of individual grocers who can’t access and utilize the data from their own shoppers to the same effect.

- Revenue Opportunities: This data also allows Instacart to expand its advertising business and enhance its CPG relationships to secure a lucrative income stream that could otherwise benefit grocers directly.

This list of benefits is, in the end, what makes delivery subscriptions so appealing to a third-party provider. And that appeal is prompting other players, beyond Instacart, to try to capitalize on the market.

Amazon recently introduced its own grocery delivery subscription for Prime members across the United States, offering unlimited grocery delivery — at specific basket thresholds — from Amazon Fresh, Whole Foods Market, as well as other local grocery and specialty retailers.

Of course, the enormous customer base of Amazon is incredibly attractive to the non-Amazon retailers chosen to participate, but this new initiative also prompts a very serious question for all grocers: At what point do the benefits to third parties begin costing the grocers that have ceded control of the elements listed above?

How The Caper Cart Exemplifies Instacart’s Approach

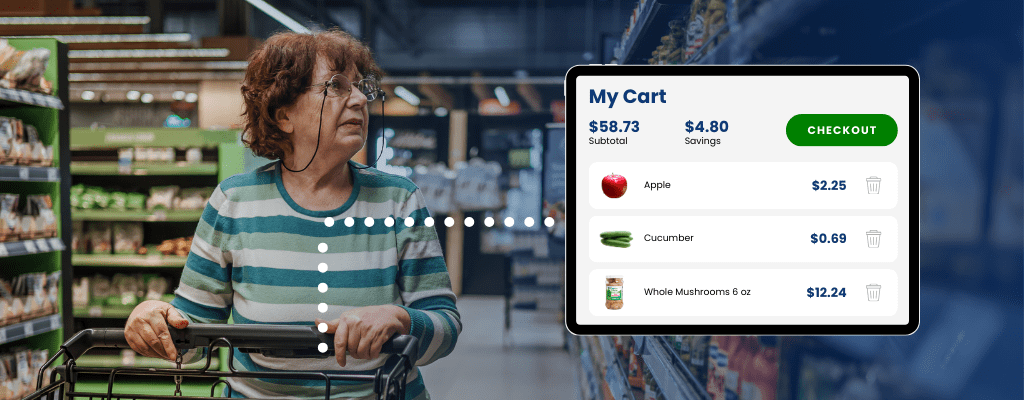

This strategic use of third-party control is well-illustrated in the recent promotion of Instacart’s Caper Cart smart shopping cart. It’s marketed as a tech-forward solution to enhance the in-store shopping experience, offering convenience and efficiency to both consumers and retailers.

While its benefits to grocers are debatable — Mercatus ran a pilot program with a similar idea in 2008 that resulted in neither a discernible ROI for retailers nor better ad recall over shelf markers and floor graphics — the Caper Cart serves as yet another channel for Instacart to collect valuable customer data and sell advertising based on this data.

From our Mercatus Concierge experiment, more than 15 years ago, tracking data was the most valuable aspect of implementing smart carts. The Caper Carts quietly give Instacart a comprehensive view of omnichannel shopping habits, preferences, and behaviors — both online and in-store — further entrenching its position between grocers and their customers.

This data will not only be used to fuel their online platform’s efficiency but also enhance their retail media offerings beyond online to in-store, all while reinforcing their top-of-mind position for consumers — the carts are branded with a large Instacart logo.

Loss of Control Over Customer Experience

Surrendering branding space on grocery carts to a third party may seem minor, but it’s part of the larger issue we identified at the beginning of this article: the cost of ceding control of the crucial grocer-to-consumer connections needed to compete with the big retailers like Walmart.

Instead of enhancing customer relationships, reliance on a third party for digital engagement, order fulfillment, and in-store convenience results in:

- Lack of Personal Touch: The unique brand identity and personal touch that grocers can offer isn’t felt by customers.

- Data Disconnection: Grocers miss out on crucial insights into shopping habits and preferences, limiting their ability to personalize and improve the shopping experience.

- Communication Barriers: Third-party platforms impede direct feedback and the ability to address concerns promptly.

- Customer Loyalty to Platform: The convenience of a third-party platform encourages loyalty to the third party rather than to any individual grocery store.

Not only does a third party’s platform make it harder for grocers to build a dedicated customer base through branding, but the alternative options provided by a third party actually makes cross-shopping easier for consumers.

Challenges in Building Customer Loyalty

Before we talk about cross-shopping specifically, though, let’s examine the importance of customer loyalty.

One of the most interesting findings from last year’s eGrocery Performance Benchmarking report is that many grocery stores faced a decline in sales despite increases in average order value. The true culprit for lower overall sales figures has more to do with customer churn than individual shoppers spending less money.

The report goes on to stress the high cost of customer attrition, revealing that it takes approximately 2.5 to 3.5 new customers to replace the value lost from a single long-term customer. It also identifies five reasons why grocery retailers are seeing declines in active customers:

- Pricing Discrepancies: Customers are deterred by different prices in-store versus online.

- Personalization Gap: The absence of personalized experiences can drive customers to more innovative competitors.

- Customer Engagement: Without compelling engagement, grocers risk losing customers to competitors who offer greater value and recognition.

- Pickup and Delivery Efficiency: Subpar pickup and delivery services can lead customers to prefer retailers with more convenient options.

- Last Mile Execution: Flaws in delivery, such as delays and errors, significantly diminish customer satisfaction and increase churn.

Reliance on a third-party platform affects all these areas, restricting the ability of grocers to enhance or even maintain the relationships that retain customers, drive sales and effectively compete against the bigger retailers who can afford to win customers through lower prices.

This issue is perhaps best exemplified by online discussions over “Instacart markup,” where customers share stories of paying more through Instacart than they would have by shopping directly from the store (as revealed by store receipts mistakenly left in delivery bags).

Higher prices, including product markups, on Instacart are often used by grocers to offset the take rate charged by services for enabling the transaction. While this makes financial sense to the retailer, there is often a negative reaction from customers. Without an alternative in place, grocers are left dealing with claims of price gouging from disgruntled shoppers. This is made worse with the additional fees tacked on by Instacart.

In an investigative consumer report from CBC’s Marketplace, Costco and Loblaws both told the news outlet that “Instacart keeps all of the profit from pricing differences, in addition to the delivery and service fees.” The report goes on to say that “while Instacart confirmed that the retailers are responsible for setting the prices, it did not respond to questions about who receives the money from the markups.”

Regardless of who benefits directly from markups, the negative experiences associated with higher prices (as well as missing out on in-store sales and promotions) tarnish the grocer’s reputation and encourage customers to look elsewhere for their next purchase. The same can be said of bad delivery experiences and missing or replaced products in a delivered order — elements that the grocer has no control over.

Making Cross-Shopping Easier for Consumers

Further contributing to customer churn is the cross-shopping trend we mentioned earlier.

Year-end eGrocery sales figures from 2023 reveal Mass Merchants like Walmart expanded their take of overall eGrocery sales by 460 basis points, totalling 45% of the market. One of the key contributors to this increase was the record highs of cross-shopping between Supermarkets and the big retailers: On average, 30% of Supermarket shoppers will cross-shop with a Mass Merchant in a given month.

This is an enormous challenge for regional grocers and independents that’s exacerbated rather than alleviated by a reliance on third parties:

- Aggregated Retailers: Third-party platforms allow for easy comparison across multiple stores, encouraging customers to switch based on deals rather than loyalty.

- Lack of Differentiation: The standardized shopping experience blurs the unique identities of individual retailers, promoting cross-shopping.

- Price Sensitivity: The price transparency across multiple stores leads customers to prioritize cost over retailer loyalty, with the option to mix and match their purchases.

- Promotions and Deals: Advertised promotions across various stores incentivize customers to shop based on discounts, not retailer preference.

- Consumer Data Utilization: Shopping data can be used to promote competing retailers’ deals, directly encouraging customers to cross-shop within the platform’s ecosystem.

When multiple retailers are aggregated within a single platform, competition is based on margins rather than service or quality. This is especially damaging for grocers in our current economic climate which has caused a massive flight to value for consumers, a key factor in the rise of Mass Merchants.

And even if grocers wanted to appeal to consumers on a service or convenience basis, Instacart has severely limited this opportunity through its recently announced partnership with UberEats. Instacart will begin rolling out a new “Restaurants” tab on its platform. All powered by UberEats, this will allow app users to place orders with nearby restaurants and track deliveries from Uber couriers.

This increases competition for high-convenience and high-margin grocery items like meal kits, ready-to-go foods, and prepared meals that have traditionally been lucrative for grocers. The third-party platform is taking the two biggest consumer drivers — value and convenience — and decreasing the opportunity/increasing the competition for grocers to appeal to either.

Third-Party Partners Dominate Data by Design

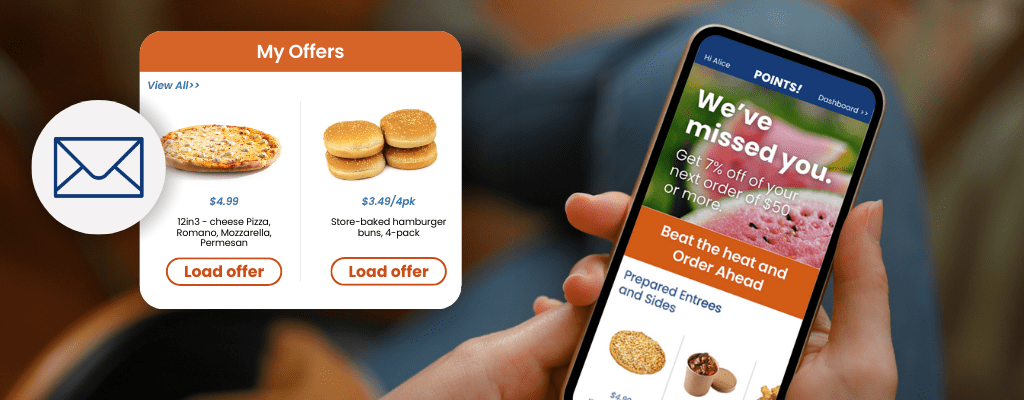

One of the only proven ways for grocers to find success against the pronounced flight to value described above has been by utilizing customer data to enhance online engagement and offer personalized shopping experiences. This approach involves targeted marketing messaging on a grocer’s platform, tailored to reflect the customer’s previous orders and preferences.

However, the intermediary role of third-party partners provides a significant disadvantage for grocers in this area. The valuable insights into shopping habits and preferences, which grocers could leverage for themselves, are instead captured by platforms like Instacart or the new Amazon delivery service, resulting in several key advantages for the third party:

- Increased Personalization: Third parties leverage one store’s customer data to tailor shopping experiences and recommendations across all its partnerships.

- Targeted Advertising: Third parties capitalize on customer insights to sell targeted ad spaces to brands, simultaneously enhancing user experience and boosting its own advertising revenues.

- Market Insights: Insights into customer behavior enable third parties to fine-tune offerings and strategies to align with current market trends.

- Leverage CPG Partnerships: The comprehensive customer insights bolster the retail media advertising position of the third party, allowing for more favorable partnerships.

The challenge is compounded by the fact that the data gleaned from a single store’s sales isn’t used exclusively for the benefit of that specific store. Instead, the data is amalgamated across all of the third party’s retail partners, using these insights to strengthen its platform and market position, rather than empowering individual grocers.

This model is a brilliant strategy for platforms like Instacart and now Amazon, but it limits the potential for grocers to utilize their own data to drive loyalty and sales, essentially reducing their ability to reclaim their market share from Mass Retailers.

Retail Media Opportunities: What Grocers Are Missing

This brings us back to a couple of examples we provided earlier with the Caper Cart program and Instacart’s increasing focus on digital advertising, including its recent collaboration with Google and even more recently announced partnership with NBC Universal.

Instacart now uses the vast data it’s collected on consumer behavior from its retail partnerships to offer targeted advertising opportunities to CPG brands with:

- Its own mobile and browser-based platforms;

- Online, through Google Shopping ads;

- In-store, through its Caper Carts; and most recently

- On the Peacock streaming platform through its partnership with NBC Universal.

It’s an incredibly attractive situation for CPG brands. Not only does the data that Instacart’s collected ensure the ads are targeted to high-intent audiences, the data the company maintains is also used to measure the impact of the ad campaigns. The CPG brands can leverage ad exposure and purchase data from Instacart to ensure an optimized ad spend.

While the Caper Cart program does offer retailers a share of the advertising money collected by Instacart, alongside all these other examples, it’s still a third party benefiting more from the data it collects than the retail partners whose data is being harvested. According to Forbes, U.S. ad spend for retail media reached $48 billion in 2023. The same report suggests that figure will reach $82 billion by 2025. As competition for advertising dollars increases among all the bigger players, it’s essential for regional grocers and independents to find their footing in this potentially lucrative market.

Instead of ceding control of their customer data to third parties, grocers need to gain more control over CPG partnerships. The additional revenue stream that retail media opportunities provide would offset the technological costs associated with integrating their own platforms — all while allowing retailers to reclaim control over the other critical elements outlined in this article.

How Can Grocers Take Control of Their eCommerce Strategy?

This represents one of the biggest differences between third parties and Mercatus. Instead of wresting control from its partners, Mercatus empowers grocers to take greater control.

Our white label unified commerce platform is developed to help grocers build their brand, foster direct relationships with their customers, and ultimately drive sales without sacrificing autonomy to a third-party intermediary. Every solution and eCommerce feature we create at Mercatus is designed with the retailer’s immediate and long-term needs front-of-mind.

That means that in today’s grocery market, where the flight-to-value has provided larger retailers with an advantage, we help regional grocers and independents compete through:

- Direct Customer Connection: Our white label platform ensures your brand is consistently represented and communicated across all channels.

- Improved Customer Experience: Instead of inconsistent fulfillment and product markups diminishing the customer experience, the Mercatus platform integrates with your choice of last-mile delivery partners and lets you control the cost-to-serve.

- Enhanced Personalization and Customer Loyalty: Mercatus offers a personalization solution in the form of the all-new AisleOne that transforms customer data into a personalized shopping experience for your customers.

- Additional Revenue Streams: Mercatus Digital Advertising connects you to the growing retail media industry, ensuring ads meet your brand standards, engage your customers and increase sales online. We also further boost your retail media revenue with a product sampling solution that can be directly integrated with the Mercatus Digital Commerce Platform.

Digital retail should be an opportunity for growth, not a concession to third-party platforms. Facing the significant challenge of market share dominance by Mass Retailers is difficult enough already. Grocers need to assert more control, not relinquish it.

To explore how Mercatus can empower you to reclaim control of customer relationships and take back your market share, reach out to us today for a strategy session. Our team of grocery experts is here to help.

Newsroom

Newsroom