US eGrocery Sales Trends with Brick Meets Click – January 2025 Insights

Online Grocery Sales Reach $10 Billion in January—a 16.6% YOY Increase

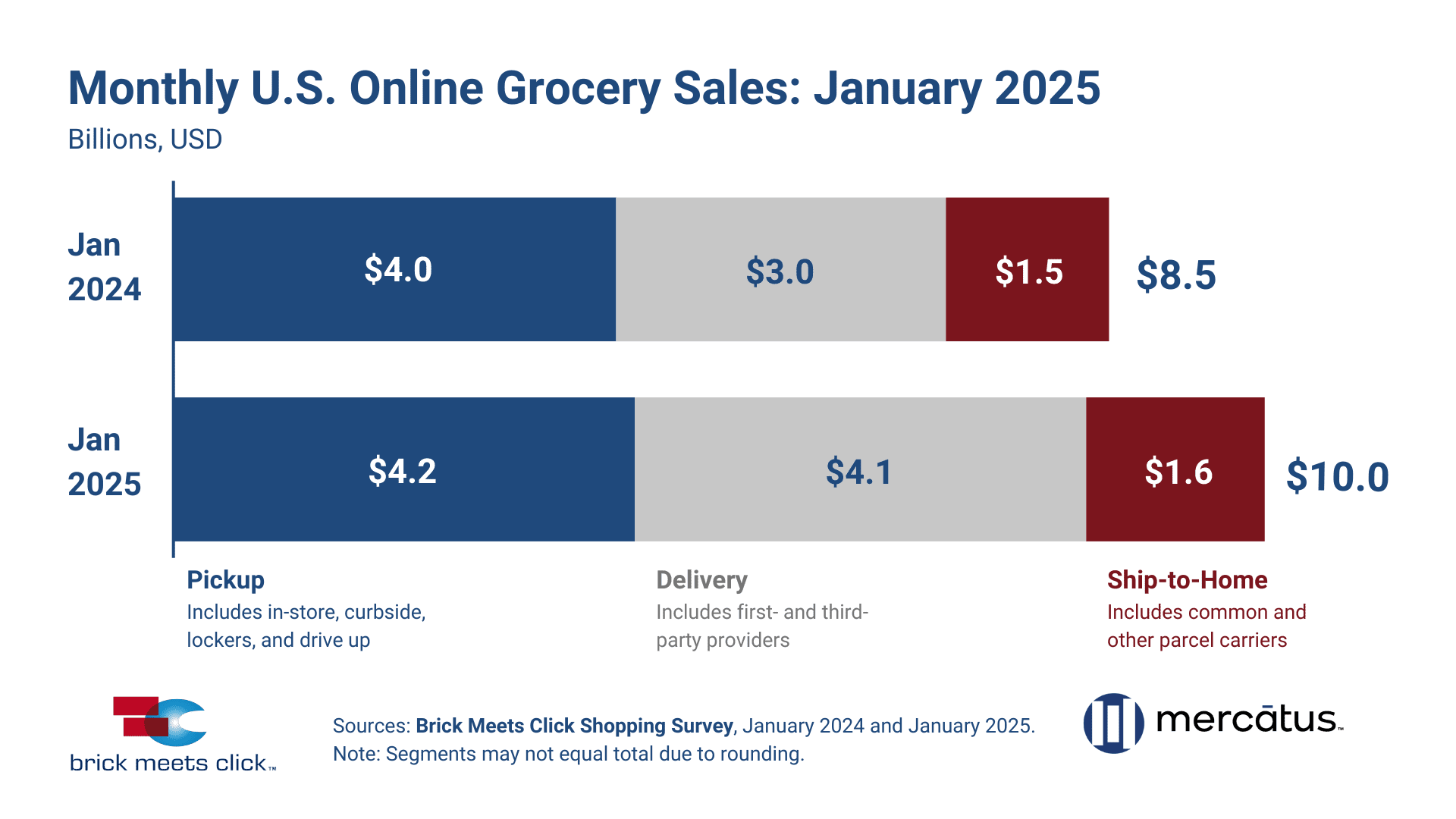

For six consecutive months, U.S. online grocery sales have exceeded $9.5 billion. In January, sales hit $10 billion, a 16.6% increase over last year, according to the latest Brick Meets Click/Mercatus US eGrocery Sales Report.

Once again, major retailers are using membership discounts and lower delivery fees to reshape customer expectations, driving higher spending and repeat orders.

With delivery continuing to gain momentum, are you positioned to retain customers and protect your market share?

To stay competitive, grocers rely on insights grounded in the latest sales data—insights that reveal where the market is headed, how fulfillment trends are evolving, and which strategies are driving customer retention and growth.

Get this exclusive data alongside expert insights delivered straight to your inbox. Sign up today for our Grocery Retailer Distribution List to receive the latest research and key industry updates—all completely free.

➡️ Join Today

Key Takeaways from January 2025 US eGrocery Sales

Here’s what you need to know from this month’s report:

- The U.S. online grocery market reached $10 billion in sales in January 2025, a 16.6% YOY increase.

- Delivery surged 37% YOY to $4.1 billion, now capturing 41% of all eGrocery sales.

- Pickup sales increased 4% YOY to $4.2 billion, now representing 42% of the market.

- Ship-to-Home grew 9% YOY to $1.6 billion, but its market share declined to 16%.

- Walmart continues to leverage its Walmart+ membership and subscription incentives to drive sales frequency, customer retention, and market share.

But it’s not all about Walmart’s dominance.

There’s a positive sign for grocers in this month’s numbers as well: The grocery segment saw a 600 bps YOY increase in repeat intent, narrowing the gap with mass retailers.

While larger retailers still lead in delivery adoption, this shift highlights a growing opportunity for grocers to strengthen retention through increased engagement.

Three Ways to Capitalize on Repeat Intent Growth

With repeat intent rising among grocery customers—most notably for pickup—now is the time for grocers to reinforce engagement and build lasting loyalty.

Here’s how to do it:

1. Leverage Personalization to Drive Engagement

Walmart is using data to push upsells like express delivery and in-home service. Grocers need to collect and use their own customer data to offer tailored promotions, personalized product recommendations, and incentives for repeat orders. This is how occasional shoppers become loyal customers.

2. Reduce Fulfillment Friction

Customers expect seamless, convenient, and cost-effective service—and they’re getting it from mass retailers. Grocers can close the convenience gap by offering more precise pickup time slots, improving delivery tracking, and ensuring a smooth collection process. At the same time, reducing or bundling fees through memberships can help make pricing more predictable and appealing.

3. Streamline Operations for Greater Reliability

Order accuracy and service quality remain critical to repeat business. Grocers must minimize substitutions, improve fulfillment efficiency, and provide real-time updates to ensure customers receive exactly what they expect. Fast and responsive customer service connects to the personalization efforts mentioned above, reinforcing trust in your grocery business and long-term loyalty.

Closing Thoughts

This month’s data is a call to action for grocers to focus on engagement and loyalty.

As membership-driven promotions mature and eGrocery expansion stabilizes, customer acquisition is only going to become more challenging. The real growth opportunity for grocers lies in retention.

By adopting strategies that enhance personalization, convenience, and service quality, grocers can continue closing the loyalty gap and strengthen their position against Walmart and other mass retailers.

Thank you for reading. If you have any questions about this month’s data or analysis, please don’t hesitate to book some time with us to discuss.

This is just a snapshot of this month’s numbers. For all of the data and insights from the Brick Meets Click/Mercatus January 2025 Grocery Shopper Survey, click here to access the full report.

Newsroom

Newsroom