US eGrocery Sales Trends with Brick Meets Click – August 2025 Insights

Online Grocery Sales Surpass $11 Billion in August

U.S. online grocery sales climbed to $11.2 billion in August 2025.

The 13.5% YOY growth in topline sales is consistent with increases across the entire range of standard online grocery KPIs, including monthly active users (+1.25%), average number of orders (+5.8%), and average order value (+6.6%).

But the big takeaway from this month’s eGrocery sales report can be found in the fulfillment numbers.

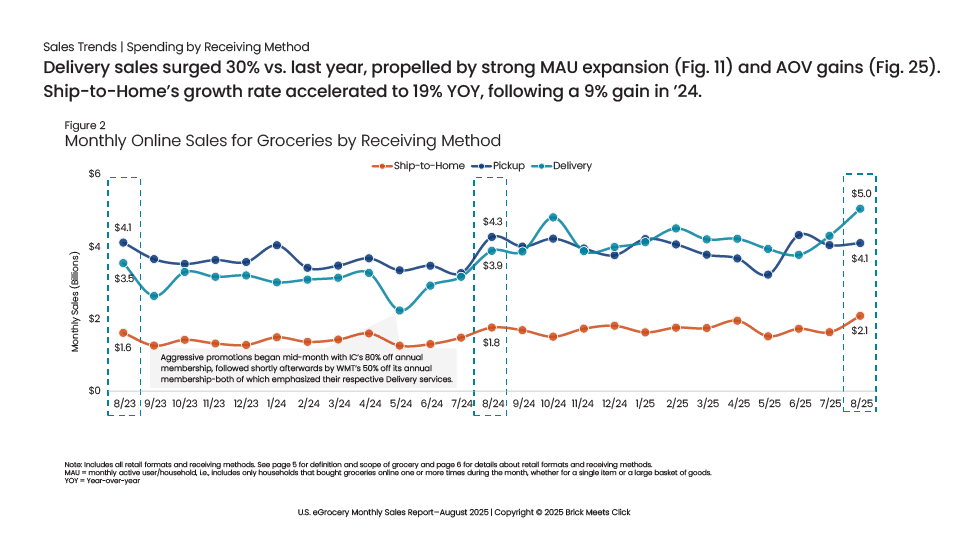

Delivery surged 30% year-over-year to hit $5.0 billion in sales, now accounting for 45% of total eGrocery spend. Ship-to-home grew 19% YOY to reach $2.1 billion, while pickup slipped slightly, down from $4.3 billion last year to $4.1 billion, representing 36.5% of sales.

In just one year, delivery has gained nearly six share points of the market. This shift, alongside ship-to-home’s recent growth, highlights how speed and convenience are rewriting the rules of online grocery.

Big Players with Big Initiatives

Amazon is steadily collapsing the distinction between ship-to-home and delivery with the expansion of its same-day fresh food delivery service.

Meanwhile, Walmart is monetizing speed outright, with half of its delivery orders now arriving in under three hours and many customers—already signed up for the Walmart+ membership program—are happily paying extra for the privilege.

Together, these moves are resetting the bar for what shoppers expect and what grocery retailers will have to compete against.

The Margin Risk for Grocers

This raises the obvious question: How can regional grocers keep pace with these rising expectations?

Competing head-to-head on speed risks a margin-draining race that grocers simply aren’t going to win. Every dollar spent chasing faster fulfillment is a dollar not invested in building long-term loyalty.

The true competition isn’t delivering groceries the fastest. It’s finding profitability in the cost structure of eGrocery services and retaining more customers through the benefits these services provide.

Differentiate to Deepen Relationships

Instead of trying to out-Amazon Amazon and out-Walmart Walmart, lean into what makes you distinct.

Prepared meals, health and wellness options, and perimeter department offerings are just a few of the areas where regionals can deliver differentiated value that mass retailers and eCommerce marketplaces can’t easily replicate.

But to engage customers with these advantages, grocers must leverage the data they’ve collected—through point-of-sale, loyalty programs, and digital behavior—to provide meaningful personalized recommendations, discounts, and interactions.

Most regional grocers, however, still struggle with fragmented systems or reliance on third parties that strip away the valuable insight they need.

Without a unified view of the customer, it’s nearly impossible to deliver the kind of engagement that competes with the speedy initiatives of these enormous retailers.

DXPro Makes Profitability Possible

That’s the gap our new digital experience platform was built to close.

By consolidating POS, loyalty, payment, and fulfillment data into a single, unified platform, DXPro gives grocers the insight—and control—to leverage differentiators in a meaningful way.

Every action a shopper takes—every search, every cart, every order—is collected and consolidated within your ecosystem.

From there, DXPro makes it possible to:

Identify Profitable Target Audiences

DXPro’s embedded CDP surfaces behavioral patterns so you know who’s about to churn and who’s primed for a bigger basket.

Segment and Personalize at Scale

With standardized engagement programs, DXPro allows you to move beyond generic offers with proven campaigns tuned to purchase history that allow you to promote your differentiators.

Automate Timely Engagement

Whether by email, SMS, or in-app, DXPro ensures promotions and recommendations land at the moment they’ll matter most.

Manage Orders Efficiently

Behind the scenes, DXPro allows you to streamline center-aisle, fresh, and specialty orders with real-time tracking and intelligent slotting that ensures accuracy, speed, and customer satisfaction.

Offer Flexible Fulfillment Options

DXPro provides you with the flexibility to support pickup, delivery, and in-store handoff without overextending your team or budget through scalable fulfillment integrations.

Compete Where It Counts

Ultimately, DXPro allows you to avoid subsidizing speed at the expense of your bottom line.

This is how regional grocers turn their biggest natural advantages into a digital strategy that drives loyalty and profitability.

August’s report makes the stakes clear: The speed and convenience being offered by the biggest retailers in the world are reshaping consumer expectations.

And that’s okay. Let them set their pace. Your opportunity lies elsewhere.

Focus on what you can control: driving long-term profitability by owning the customer relationship.

With DXPro, you don’t need Walmart’s budget or Amazon’s scale to compete. You just need to put your data to work.

That’s how you build deeper relationships, stronger margins, and a loyal, high-value customer base.

Download the August 2025 Brick Meets Click / Mercatus US eGrocery Sales Report to find all the data behind these recommendations.

Newsroom

Newsroom