US eGrocery Sales Trends with Brick Meets Click – September 2025 Insights

September Online Grocery Sales Reach Record $12.5 Billion

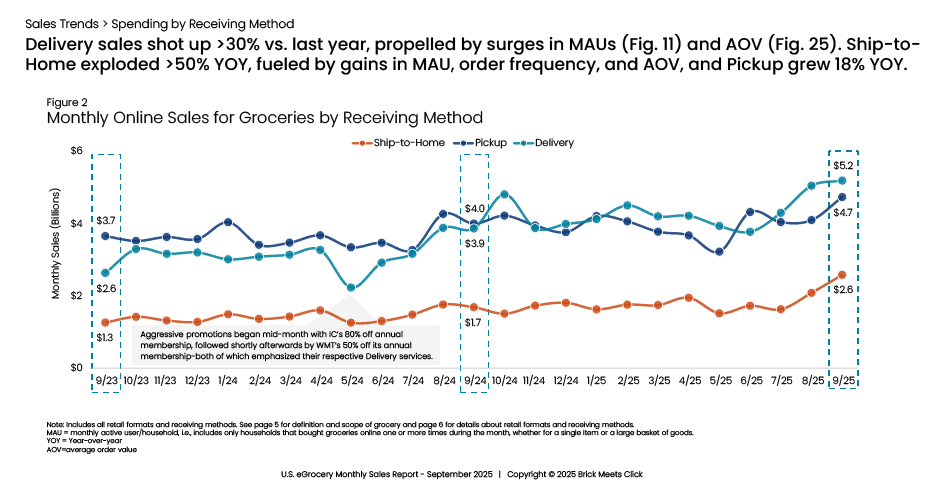

U.S. eGrocery sales surged to $12.5 billion in September 2025. This 31% year-over-year increase marks a new high in monthly performance.

The growth spanned across multiple key performance indicators:

Monthly Active Users (MAUs)

Up 12.9% to 82.9 million American households.

Average Order Value (AOV)

All receiving methods posted YOY gains:

- Ship-to-Home up 11%

- Delivery rises by 8%

- Pickup gains 7%

Order Frequency

Increases across all market types, with Small Metro markets posting a 20% YOY increase.

Share of Total Grocery Spend:

Online spending is up 400 basis points, accounting for 18.9% of total weekly grocery spending per household.

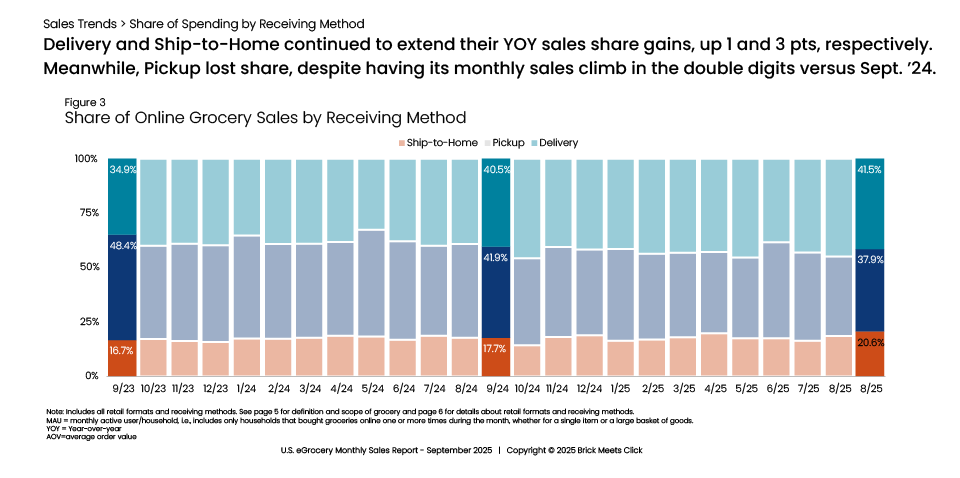

Growth Shifts as Pickup Slips

Despite September’s record-setting numbers, not every fulfillment method shared equally in the sales gains.

Pickup, the backbone of eGrocery fulfillment, slipped once again in both share and sales as shoppers shifted toward faster, more flexible options.

Delivery continued its rise, growing by more than 30% YOY. Once again, we can tie a sizeable chunk of this growth to Walmart’s monetization of speedy service. Half of its delivery orders now arrive in less than three hours and many customers—already signed up for the Walmart+ membership program—are happily paying extra for the privilege.

Meanwhile, ship-to-home climbed more than 50%, presumably powered in large part by Amazon’s aggressive rollout of its same-day Fresh delivery.

Together, these channels now represent nearly two-thirds of online grocery sales.

This shift carries serious implications for regional grocers.

Pickup has traditionally been a grocer’s best fulfillment friend. It’s cost-effective, operationally efficient, and built on the proximity of their stores to the neighborhoods their customers live in.

That closeness once defined convenience and gave grocers a clear differentiator.

But that definition is being rewritten.

Convenience is no longer about location. With Walmart and Amazon’s latest initiatives, it’s about immediacy.

Competing Through Retention and Reactivation

Instead of trying to match the infrastructure of mass retailers, regional grocers can compete in this changing market by knowing their customers better.

That means turning first-party data into actionable intelligence. This is how grocers can identify and act on which customers are most valuable, when they’re at risk, and what keeps them loyal.

A year ago, the question was whether shoppers would renew their discounted membership programs with Walmart, Instacart, and others once promotions expired.

Now, as we enter the last quarter of 2025, that question has evolved to be about both reactivation and retention.

How can grocers keep the customers already in their ecosystem engaged and spending as bigger players push convenience and loyalty to new extremes?

The shift outlined above has changed the question.

For regional grocers, differentiation still starts with what they do best—fresh, local, and high-quality prepared foods—but sustaining that advantage online requires that they unify and activate their customer data at scale.

This need is exactly what inspired Mercatus to include an embedded Customer Data Platform (CDP) into DXPro, our new digital experience platform.

Make Customer Data Your Advantage

DXPro unifies customer intelligence, personalized engagement, and commerce into one connected system designed to help grocers grow profitably in a market now defined by immediacy.

Here’s how DXPro helps regional grocers compete and win:

1. Activate the Data You Already Own

DXPro’s embedded CDP unifies customer data from POS, loyalty, and eCommerce systems, turning siloed information into a single, actionable view.

This clarity helps grocery retailers identify high-value segments and target reactivation opportunities.

2. Deliver Personalized Engagement That Builds Loyalty

With this identification and targeting in place, grocers can engage their customers more effectively.

DXPro automates personalized offers across email, app, and SMS, all based on real purchase data and browsing behavior.

3. Grow Wallet Share With Unified Commerce

This level of personalized engagement drives more baskets. That’s why DXPro includes a commerce engine that delivers a seamless experience across every touchpoint while giving grocers full control over how and where they capture revenue.

4. Protect Margins With Smarter Fulfillment

As order volumes rise from streamlined personalized engagement and streamlined commerce, profitability will depend on efficiency.

DXPro makes fulfillment profitable with intelligent slotting, smart substitutions, and real-time order tracking, reducing labor costs while improving accuracy. The result is faster, more reliable service that strengthens customer satisfaction without cutting into margin.

5. Automate Reactivation & Retention With Proven Grocery Algorithms

Every interaction from initial engagement to fulfillment creates new data that’s captured by DXPro to keep the cycle going.

Through its built-in engagement programs—Top Shopper, At-Risk, Lapsing, and Lapsed—DXPro automatically identifies and engages the customers most likely to become more valuable to the retailer.

These proven algorithms turn retention and reactivation into an automated system for sustaining engagement and driving repeat business across multiple stores and regions.

The Bottom Line

Regional grocers might not be able to compete with Walmart and Amazon in terms of infrastructure. But they can compete on intelligence.

By using DXPro to activate first-party data, personalize engagement, and optimize every order, grocers can build the loyalty, efficiency, and profitability they need to compete in even the fastest of markets.

Download the September 2025 Brick Meets Click / Mercatus US eGrocery Sales Report to find all the data behind these insights.

Newsroom

Newsroom