US eGrocery Sales Trends with Brick Meets Click – May 2025 Insights

Online Grocery Sales Hit $8.7 Billion in May—A 27% YOY Increase

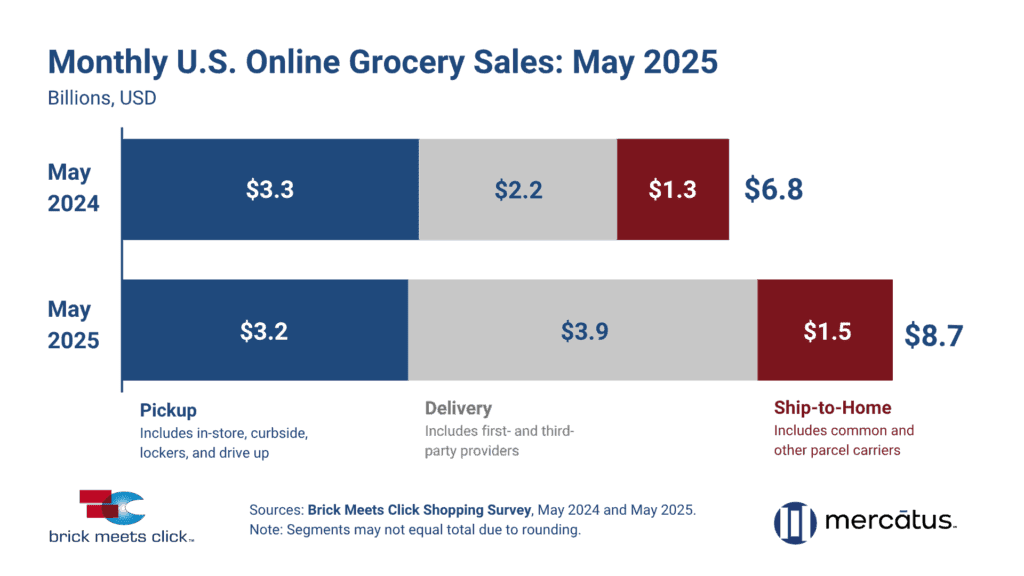

Online grocery demand surged in May, with sales reaching $8.7 billion.

While this represents a robust 27% year-over-year increase, it also marks the first time since August 2024 that monthly online grocery sales dipped below $9.5 billion.

This seasonal drop was actually milder than expected thanks to delivery’s extraordinary momentum, which continues to reshape our expectations surrounding eGrocery sales.

Delivery sales jumped by more than 70% YOY to nearly $4 billion in May, capturing a remarkable 45.4% of the overall eGrocery market.

As low-fee delivery becomes the new baseline expectation for grocery shoppers, regional grocers face an enormous retention challenge: How can you keep customers loyal in a delivery-first market?

We’ll get to that below, but first…

5 Key Takeaways from May 2025 US eGrocery Sales

- Total U.S. eGrocery sales reach $8.7 billion, up 27% YoY.

- Delivery sales increase to $3.9 billion, up 70% YOY, with share rising to 45.4%.

- Pickup sales drop to $3.2 billion, down 3.6% YOY, share fell to 37.2%.

- Ship-to-home sales rise to $1.5 billion, up 20.7% YOY, but market share dips to 17.5%.

- Cross-shopping between grocers and mass retailers reaches 33.7%.

How Regional Grocers Can Compete in a Delivery-driven Market

The rise of delivery—powered by subscriptions, convenience, and aggressive discounting—is reshaping how today’s consumers shop for groceries online.

To retain these customers, regional grocers need a focused strategy built around five key priorities:

1. Launch a Membership Program

With approximately 90% of Walmart’s delivery orders tied to Walmart+, membership plans have become the modern-day customer loyalty cards.

Subscriptions drive higher order frequency, AOV, and retention, and create opportunities to bundle services—like waiving pickup fees—to boost value perception.

2. Modernize Pickup

While delivery continues to get all the attention, pickup still offers key advantages: proximity, freshness, and better margins.

Rather than pulling back, grocers should focus on modernizing the service:

- Add prepared foods to curbside

- Tie pickup to membership perks

- Improve mobile UX for faster, easier use

3. Own the First-party Experience

Relying on third-party marketplaces means losing customer data and risking loyalty.

A unified first-party platform—especially via a branded app—enables better targeting, personalization, and long-term engagement for you and you alone.

4. Rethink Third-party Exposure

Third-party platforms offer reach, but they also increase the risk of margin erosion and cross-shopping.

Grocers don’t have to abandon them entirely, but you should ensure these partnerships support your brand, and don’t weaken it.

5. Double Down on Retention

It takes 2.5 to 3.5 new customers to replace the value of one lost.

Retention should be measured and reinforced through consistent value, fast issue resolution, and trust-building actions. Walmart does an excellent job of this through real-time stock updates and offering free delivery for any missed or unavailable items.

Watch metrics like repeat intent, order frequency, and subscription renewals to track the effectiveness of your retention strategies.

Closing Thoughts

The data from May 2025 tells a compelling story about just how far delivery has come.

Not only has it continued to grow over the last several months, but it’s also redefined what customers expect from an online grocery shopping experience.

That puts a lot of pressure on regional grocers who can’t match the delivery discounts of mass retailers.

But it’s not an insurmountable challenge.

Grocers will have to adapt—both operationally and strategically—by building customer loyalty through memberships, enhancing pickup, and taking back ownership of the customer experience.

For all the data behind these recommendations, click here to access the Brick Meets Click/Mercatus US eGrocery Sales Report for May 2025.

Newsroom

Newsroom