Four Ways to Turn At-Risk Shoppers into ‘Super Users’

Your best chance to grow grocery sales isn’t a new ad campaign or a deeper discount.

It’s found in the shoppers already in your database.

By engaging the right customers, top regional grocers are earning millions in incremental revenue without increasing ad spend.

The latest U.S. eGrocery Sales Report highlights why grocers see greater returns by deepening engagement with existing customers rather than chasing new ones.

Last month saw a record number of active users buying groceries online—up nearly 11% from a year ago.

But that growth didn’t come from new shoppers. It came from infrequent and lapsing customers returning after two or three months away.

July’s report also highlights the importance of “super users.”

These are shoppers who place four or more online orders over three months. This prized segment now accounts for more than half of all active online grocery shoppers, spending 50% more than other segments, shopping more frequently, and staying loyal longer.

This aligns with our own research that shows how digitally engaged customers who log in four or more times a month make 2.5x more trips and spend 2.6x more per person than lightly engaged shoppers who log in once a month or less.

It also points to a key growth strategy for grocers based on catching infrequent and lapsing shoppers early and turning them into loyal super users.

The problem is most grocers can’t see these segments clearly enough to act because their customer data sits in silos, unstructured and underutilized.

Every trip, every purchase, every clipped coupon, every online order is a signal telling you how to keep shoppers coming back.

But those signals only work if you can collect them, connect them, and act on them in time.

The Cost of Letting Data Idle

Imagine two separate retailers who handle their customer data differently.

One grocer activates their data and grows their business while the other watches as their numbers slide.

If your current data system is closer to A than B, you can’t afford to wait and see what happens any longer. You need to start putting your customer data to better use.

Grocers using DXPro, the new digital experience platfrom from Mercatus, have already seen what’s possible when customer data is put to work.

Its embedded Customer Data Platform has been used by one leading grocer to re-engage 65% of at-risk customers, deliver a 90% retention rate among those returning, and earn $2 million in incremental sales over just six months.

Activate Your Customer Data with Standardized Engagement Programs

The bridge between customer data and those kinds of outcomes are standardized engagement programs.

These programs—shared below—provide ready-made strategies for identifying the right customers, segmenting them based on their actual behavior, and sending timely, relevant offers that get them to shop more often and spend more when they do.

Instead of scrambling to design one-off campaigns every time you see a dip in trips, these are proven, repeatable strategies targeted to your most important segments.

1. Lapsing Shopper Program

Who They Are

High-value loyal shoppers who have gone inactive for 60–120 days. These are customers who’ve skipped expected purchases, drifting out of their normal cadence, but still remain familiar with your brand.

Data to Watch

- Last purchase date (60–120 days)

- Historical trip frequency and basket composition

- Missed expected purchases in recent months

- Categories purchased most often

Ideas for Engagement

Start with a simple basket discount to lower the barrier to return, like $5 off a $25 purchase.

Then, add high-convenience touches like one-click reorders, saved shopping lists, or reminders for staples they’ve purchased before.

Proof it Works

As we mentioned earlier, Mercatus worked with one retailer on a win-back-and-retain campaign that re-engaged 65% of targeted shoppers in just two weeks. Of those who redeemed an offer, 90% kept shopping for months and their baskets grew by 40%.

Big Takeaway

Lapsing shoppers aren’t lost—yet. But they’re waiting for the right nudge to return. Provide it to them and keep giving them a reason to shop with you. They’ll soon become the super users that every grocer wants.

2. Top Shopper Program

Who They Are

Your highest-value segment. These are shoppers with consistently high engagement and spend, typically in the Gold/Silver loyalty tiers. They’re stable or growing, but need ongoing recognition and reinforcement to maintain their behavior.

Data to Watch

- 12-month patterns: frequency, spend, basket size, category diversity

- 3-month loyalty tier stability

- Days between orders

- Engagement sessions

Ideas for Engagement

Monthly basket discounts or deep discounts on signature items reinforce value and encourage repeat trips. Pair these with personalized replenishment reminders timed to their shopping cycle.

Proof It Works

Earlier, we mentioned how our own research confirmed that super users drive a disproportionately large share of grocery sales.

These findings are based on a retailer who wanted to see if there was a connection between engagement sessions and overall spend.

Shoppers who logged in four or more times per month weren’t just more active, they were far more valuable than less engaged cohorts. These “digitally engaged” shoppers took 2.5× more trips and spent 2.6× more per person than those logging in once a month or less.

The impact shows up in dollars: moving from 2–6 sessions to 25+ sessions raised revenue per household from $639 to $1,547. On top of that, engaged shoppers grew basket size by 8%, adding margin without relying on deeper discounts.

And the path upward is clear.

By nudging customers to log in just one more time a month, retailers can convince customers to shop more often, spend more per trip, and remain a customer longer.

Big Takeaway

Your top shoppers don’t just magically appear and stick around. They’re nurtured and maintained through regular engagement that reaches them on a personal level.

3. At-risk Shopper Program

Who They Are

Loyal, high-value shoppers whose engagement is slipping. This segment are often steady spenders—like midlife, family-based professionals—whose trip frequency or basket size is trending downward.

Data to Watch

- Negative trends in trips or basket size over a 3-month window

- Declining offer redemption rates

- Decreased session frequency in apps or on site

- Drop-off in category purchases they used to buy regularly

Ideas for Engagement

A baseline basket discount can be used to drive immediate conversion, but it should be supported by category-specific offers in departments they favor.

Time sends early in the week: Tuesday/Wednesday campaigns consistently capture peak redemptions.

Proof it Works

A top grocer that works with Mercatus used DXPro to target at-risk customers. Three months after their campaign launched, 90% of re-engaged customers were still shopping with the grocer.

Six months later? The grocer had protected $2 million in incremental sales.

Big Takeaway

A slide into churn is reversible, but to save millions like the retailer above, grocers have to provide meaningful engagement before the shopper drifts too far.

4. Digital Customer Acquisition Program

Who They Are

Store-only regulars who shop often in person, but have never placed an online order. These are highly loyal customers, but they only shop at your physical location. They haven’t yet experienced the convenience or incentives of your digital channel.

Data to Watch

- High in-store spend with no corresponding eCommerce activity

- Categories with strong online potential (bulk, packaged goods)

- Loyal in-store patterns that suggest readiness for multi-channel expansion

Ideas for Engagement

Offer a first-order perk like free pickup or an exclusive digital-only deal to remove the trial barrier. Then, follow every online trip with an in-store coupon to maintain cadence across both channels.

Proof it Works

After analyzing all loyalty-tagged purchases across the physical stores and eCommerce site for one of the retailers working with Mercatus, we found that online and in‑store trips complement, rather than cannibalize, each other.

Customers using both spend ~$1.8K more per year which was about 50% higher than store-only shoppers. They average slightly smaller baskets ($100 vs. $115 for online-only), but place more online orders while still shopping 60+ times in-store each year.

Big Takeaway

Introducing online shopping to in-store customers isn’t about replacing in-person trips. It’s about increasing total wallet share by giving shoppers more ways to buy.

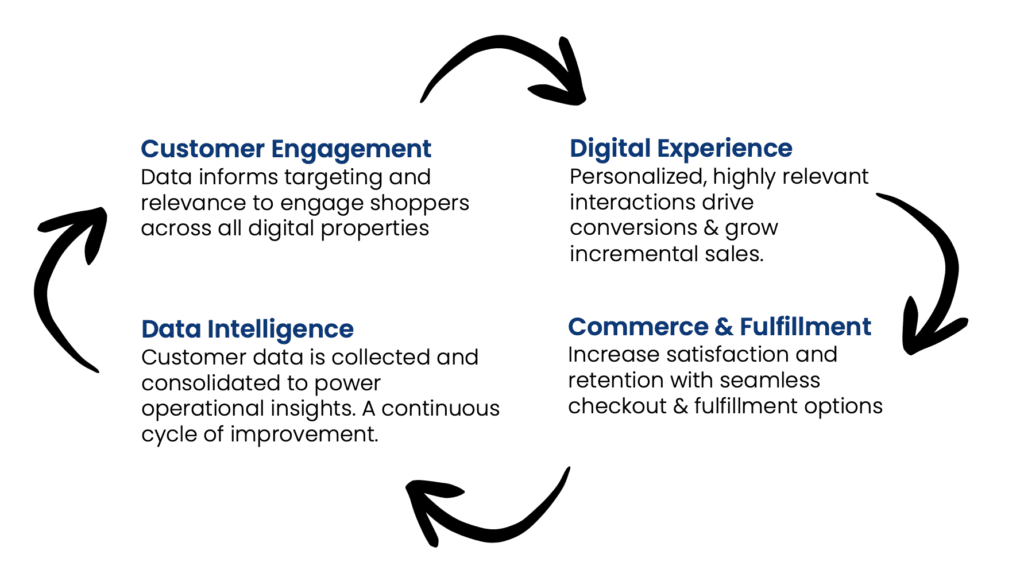

Why All These Programs Work

The standardized programs we’re sharing are successful because they’re built on four fundamentals: precise customer identification, targeted engagement, relevant offers, and continuous measurement.

They work across banners, regions, and shopper demographics because they focus on actual behavior instead of broad assumptions.

But without connected data and automated targeting, these strategies are nearly impossible to implement.

Even if a grocer manually sifted through their customer database to identify specific segments, tracking and analyzing the results of those campaigns would still be an exhausting, time-consuming process.

That makes having the right platform to connect data to engagement to commerce all the more important.

How DXPro Makes It Possible

DXPro is built to handle the entire loop that makes these programs work:

DXPro unifies customer data from every channel—POS, loyalty, eCommerce, and mobile—into a single view. It automatically updates behavioral segments, triggers offers based on real activity, and measures the impact in trips, basket size, and retention.

Here’s what that looks like in action:

We’ve seen the results of what this platform can do already: Better retention, higher margins, more incremental sales.

To make your customer data work for you the way it was intended, here’s what you need to do:

1. Assess your current data setup

Talk to Mercatus about how your customer data is collected today, where it’s siloed, and where you’re seeing drop-off in engagement. We’ll show you what’s possible using DXPro’s embedded CDP.

2. Align on business priorities

Whether your focus is win-back campaigns, basket growth, or expanding your omnichannel base, set clear goals so DXPro can target the highest-impact segments.

3. Activate and measure

Let DXPro build the right segments, launch the right offers, and provide a clear ROI dashboard that ties campaigns directly to revenue.

Standard engagement programs are just the starting point.

Once you’ve implemented these strategies and witnessed the results with DXPro, the platform’s flexibility lets you expand into bespoke strategies that fit your banner, market, and competitive environment—building on the same foundation of proven results store by store and region by region.

Ready to turn your customer data into measurable growth for your grocery business?

Talk to us about DXPro and how you can begin engaging the right shoppers at the right time.

Newsroom

Newsroom