Are Your Stores Ready For The 5 Shifts That Will Define Grocery Shopping In 2026?

For most of grocery history, shopping followed a straight line.

Customers walked the aisles, joined the queue, unloaded the cart, paid, and left.

For grocers, that same line connected service to the customer. Stock the shelves. Staff the lanes. Ring the sale.

Early eCommerce didn’t break that line. It bent it. Shoppers weighed convenience against cost, chose in-store or online, pickup or delivery, and paid either with time or with fees.

The path was still singular. They picked one and followed it through.

But in 2026, grocery shopping looks less like a queue and more like scattered points.

The same household that shops in person at their nearby grocer after work on Thursday will order delivery from Walmart on Monday morning, ship paper towels from Amazon on Tuesday night, then switch to pickup at a supermarket midweek after a late meeting throws off their schedule.

None of this looks orderly. None of it moves in sequence. And none of it rewards strategies built for a single, predictable path.

Shoppers move fluidly between fulfillment methods, spread spending across more, smaller trips, and try new options without committing to any one.

In a market like that, growth doesn’t come from pushing harder on the old line. It comes from building new connections between moments through greater relevance.

This article outlines the five shopper shifts driving that change and identifies the one solution grocers need in 2026 to connect to customers without eroding margin or relying on guesswork.

See The Solution In Action

The 5 Shopper Shifts Set to Shape Grocery in 2026

hat solution is a digital experience platform designed for grocery shopping that no longer moves in a straight line.

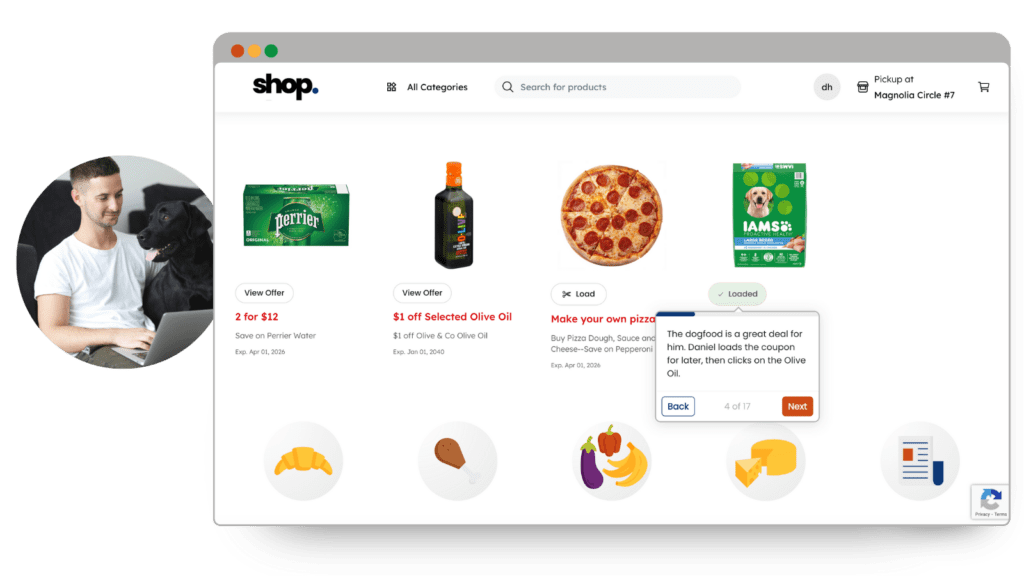

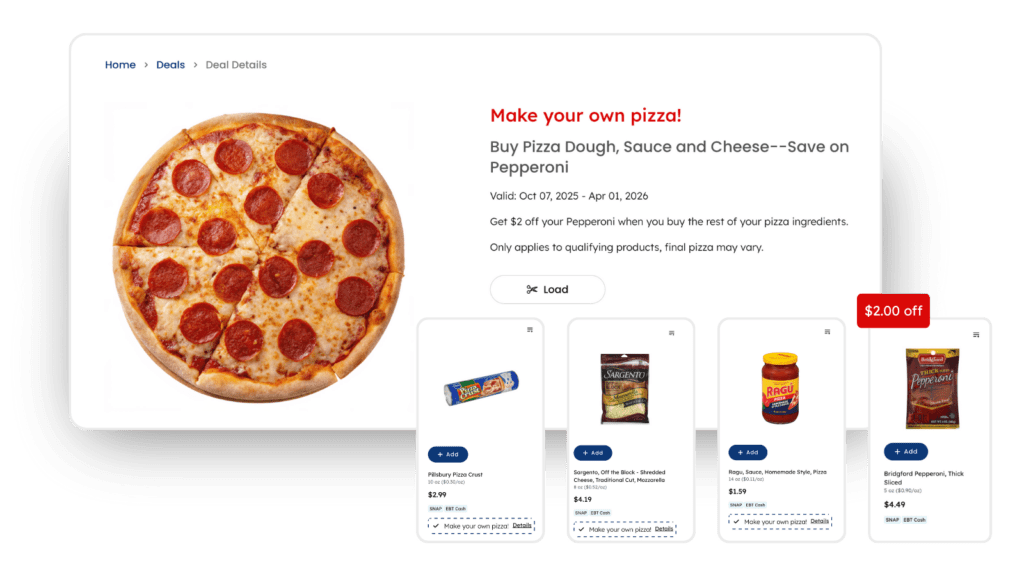

DXPro’s embedded customer data platform makes sense of behavior scattered across trips, channels, and fulfillment methods, turning insight into clear opportunities for relevance.

Using DXPro, retailers can load targeted coupons, relevant product placement, and timely nudges that customers actually notice and use.

The five shifts below show why that capability matters, and how grocery shopping in 2026 demands relevance that works moment by moment.

1. Shoppers rely on online grocery as a default, not a backup

What’s changing

In 2026, online grocery is where shopping begins, not where it ends. Lists are built digitally, with fulfillment decided later based on the moment.

November 2025 proved how entrenched this behavior has become: a month expected to slow under SNAP pressure instead delivered $12.3B in online sales (+29% YoY), with higher order frequency, larger baskets across every method, and nearly half of shoppers using multiple fulfillment options.

That’s not digital as a fallback. It’s digital as the default.

What grocers should do

Treat online as the front door.

Use relevant offers and timely prompts to bring shoppers in, then reinforce that choice immediately with experiences that feel personal, not generic.

What DXPro provides

DXPro’s embedded customer data platform exposes customer behavior across trips, channels, and fulfillment methods, then triggers automated, targeted offers at the moments that matter.

2. Shoppers switch channels and fulfillment methods based on the moment

What’s changing

In 2026, shoppers don’t commit to a single fulfillment method. They fluctuate based on time, cost, and circumstances.

Late 2025 showed how fluid this has become. September delivery and ship-to-home surged as pickup lost share, while November saw pickup rebound alongside delivery and ship-to-home growth. As we mentioned in the previous section, almost half of all online grocery shoppers used multiple fulfillment options in November.

What grocers should do

Stop treating fulfillment methods as separate audiences.

Recognize the same shopper across pickup, delivery, and ship-to-home, and adjust offers and messaging for flexibility as their choices shift.

What DXPro provides

DXPro brings together customer data, digital engagement, and commerce capabilities so grocers can deliver a seamless, personalized experience across delivery, pickup, ship-to-home, and in-store.

DXPro keeps offers and value unified across methods, so relevance follows the shopper, not the fulfillment type.

3. Shoppers pace their spending across more frequent, deliberate trips

What’s changing

In 2026, shoppers aren’t pulling back from online grocery. They’re pacing their spending more deliberately.

By the end of the year, order frequency had increased for 15 straight months. At the same time, average order value became less predictable—up and down across fulfillment methods—signaling that shoppers were actively managing basket size by occasion.

What grocers should do

Respond to changes in cadence, not just changes in spend.

Identify when shoppers shift toward smaller, more frequent baskets and nudge them toward larger spends with targeted value instead of broad discounts.

What DXPro provides

DXPro detects changes in trip frequency and basket size. Those customers are placed into audiences and served automated engagement programs designed to stabilize and grow value over time.

See how you can use DXPro to target high-frequency shoppers with relevant coupons that encourage repeat trips without eroding margin.

4. Shoppers define convenience by speed, not proximity

What’s changing

In 2026, convenience is no longer set by how close the store is. It’s all about by how fast and how predictably an order arrives or can be picked up.

Delivery and ship-to-home gains at the end of 2025 tracked closely with Walmart’s sub-three-hour delivery push and Amazon Fresh’s same-day ship-to-home expansion, resetting expectations for speed without obvious trade-offs.

What grocers should do

Trying to match speed with larger retailers is only going to drain margins. Instead, compete on perceived convenience.

That means anticipating where fees, lead times, or uncertainty will break the experience and use targeted value to keep shoppers moving forward.

What DXPro provides

DXPro connects fulfillment behavior and checkout signals to targeted offers that reduce friction at the moment it matters.

See how DXPro can be used to surface the right coupon or incentive when speed or cost becomes the deciding factor.

5. Shoppers respond when experiences recognize them

What’s changing

In 2026, trial is easy. Commitment is earned.

Throughout 2025, data showed growth driven by the return of lapsing and infrequent shoppers, while “super users” (those shopping four or more times in three months) delivered disproportionate value through higher spend and stronger repeat intent.

What grocers should do

Turn lapsing and infrequent shoppers into “super users.”

Focus less on customer acquisition and more on customer retention by bringing stalled shoppers back into the fold.

Use timely, relevant, and proven engagement to turn return visits into routine behavior.

What DXPro provides

One of the strongest capabilities of DXPro is its ability to identify high-potential segments within returning, lapsing, and threshold shoppers, and automate offers proven to move them toward higher value.

See how easy it is to use DXPro to provide targeted coupons and offers that turn recognition into loyalty and repeat spend.

What Changing Customer Behavior Means For You

Together, these shifts make one thing clear: Straight-line solutions no longer work.

Broad discounts, weekly circulars, and generic loyalty programs assume shoppers move together and pay attention at the same time. In a market defined by fragmented trips and situational decisions, those tools miss more moments than they reach.

The largest retailers already know this.

Walmart and Amazon aren’t just competing on price or speed. They’re raising expectations around relevance, consistency, and immediacy across every interaction.

Trying to match them on speed erodes margin. Trying to match them on price leads to a race you can’t win.

DXPro offers a different path. It helps regional grocers meet modern expectations for relevance by recognizing shoppers across moments, channels, and fulfillment methods without entering a price or speed war.

That’s how to compete in 2026.

How Grocers Can Make 2026 Their Most Successful Year Yet

Grocers don’t need a bigger promotion calendar. You need a platform that turns customer behavior into action, quickly, consistently, and profitably.

DXPro is built to do that by unifying customer data, engagement, commerce, and fulfillment into one system that produces shopper-visible relevance in every interaction.

You’ve seen how easy it can be to respond to customer behavior shifts. The next steps are straightforward:

1. Fully explore the coupons and offers experience so you can see targeting in action.

2. Talk to us about applying the same approach to your own segments, your own margin constraints, your own operational realities.

3. Start making relevance the default across deals, login, and cart, because that’s where 2026 shopping decisions will get made.

In 2026, shoppers are rewarding the retailers that recognize the moment they’re in and help them finish the job. Be that grocer for your customers.

Newsroom

Newsroom