Four Lessons We Learned From Online Grocery Sales Trends In 2025

This article was originally published on June 18, 2020. It was updated for publication on January 22, 2026.

Online grocery is no longer an experiment for American households.

Month after month in 2025, online grocery sales held and grew, even as budgets tightened and competition intensified.

Delivery rebounded, ship-to-home accelerated, pickup held steady, and households continued to spread their grocery shopping across digital and physical trips.

All of the sales trends from January to December make one thing clear: For a growing number of consumers, online grocery shopping is now the preferred way to buy groceries, not just a convenient option.

With the benefit of a complete year of data, the story of 2025 comes into focus. Across every reporting date, four lessons stand out that help explain how online grocery reached this point and what it now demands from retailers.

Lesson #1: Online Grocery Is No Longer Conditional

The first and most consequential lesson of 2025 is also the most straightforward: online grocery sales no longer depend on favorable conditions to perform.

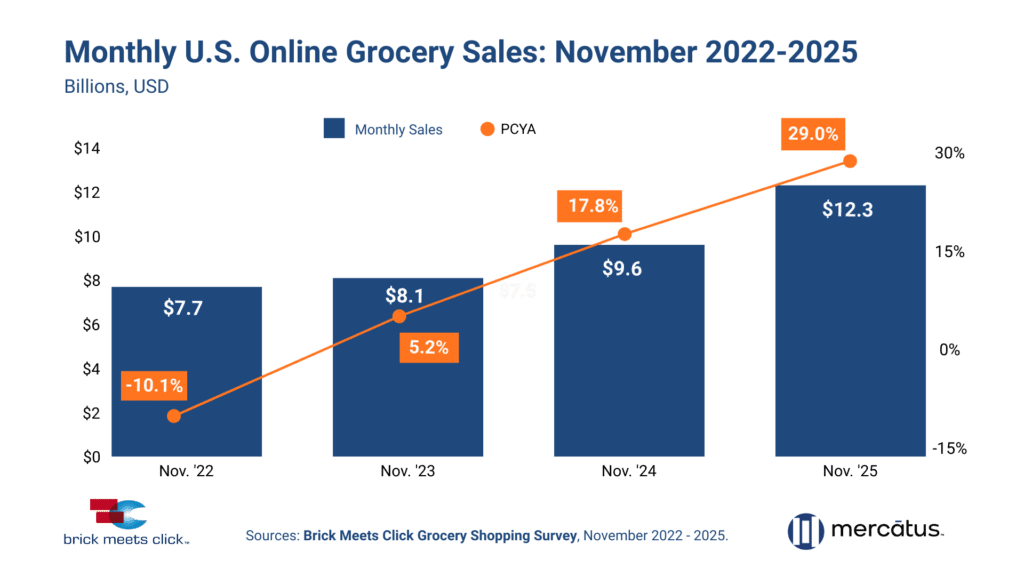

Throughout the year, Brick Meets Click reported steady growth across nearly every reporting date. In November alone, online grocery sales reached $12.3 billion, up 29% year over year, despite SNAP delays, rising food prices, and mounting household pressure.

Earlier in the year, September posted $12.5 billion in sales, while July crossed $10 billion for the first time. Instead of pulling back, households continued to place orders across multiple fulfillment methods in the same month.

That consistency matters more than the peaks themselves. It shows that online grocery shopping has moved beyond situational use.

Shoppers no longer turn to digital only when time is scarce or circumstances are extreme. They rely on it as part of their regular grocery routine, even when budgets tighten and trade-offs become sharper.

For retailers, this marks a shift in responsibility.

Digital grocery can no longer be treated as a side channel that flexes with demand. It is a permanent part of how groceries are bought, and it must be operated with the same discipline as the store itself.

In other words, the question isn’t whether online grocery will show up next month. It’s whether it will show up profitably for your stores.

And that sets the stage for the next lesson.

Lesson #2: Fulfillment Is Now a Strategic Lever, Not a Cost Line

If demand held steady in 2025, the way that demand expressed itself changed shape.

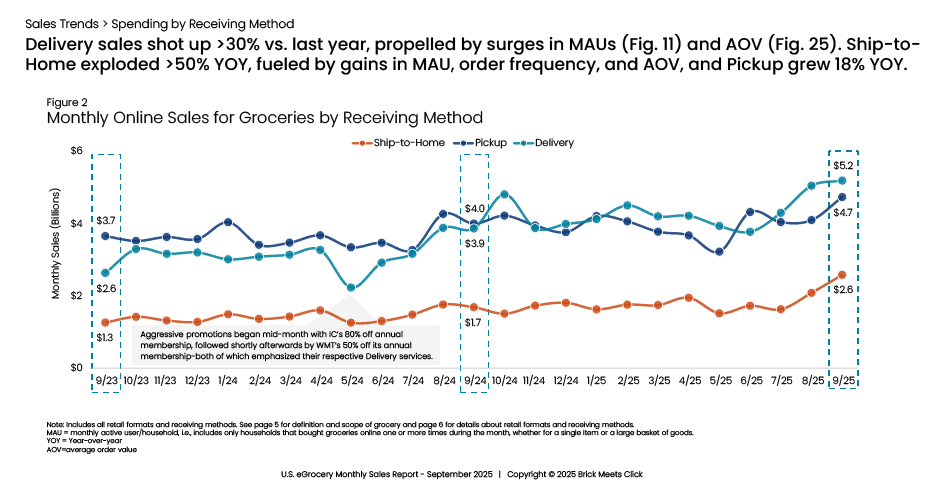

Brick Meets Click’s monthly reports showed a consistent rebalancing across delivery, pickup, and ship to home. Pickup remained essential. Delivery rebounded after softer periods. But the fastest growth came from ship to home, particularly as Amazon expanded same-day food delivery access across more markets.

Notably, certain grocery categories, such as beverages and household essentials, experienced especially strong growth in online sales, highlighting the importance of tracking category-specific performance trends.

In September, when same day initiatives were launched, ship to home sales surged more than 50% year over year. In November, ship to home posted the strongest average order value growth of any fulfillment method—up 12%—outpacing delivery and pickup alike.

This wasn’t just a logistics story. It was a pricing story.

By collapsing the psychological gap between delivery and shipping—without delivery fees or tipping—Amazon’s same-day program offered consumers a lower-cost path to immediacy. Walmart took a similar route, tying speed to its Walmart+ membership program through sub-three-hour delivery windows.

Two strategies. Same result.

Fulfillment stopped being a back-of-house decision. It became a behavioral lever.

That shift changes who carries the responsibility. When fulfillment influences customer choice, grocers can’t simply absorb its costs. They have to manage its outcomes.

That means deciding which behaviors to encourage, which to discourage, and where margin can actually be protected.

Fulfillment is no longer something to optimize quietly behind the scenes. It’s a strategic input that shapes profitability order by order. Competing on speed alone risks a margin-draining race most grocers can’t win. Competing on control—guiding customers toward the right fulfillment option at the right moment—is where leverage now lives.

This is where online grocery economics began to diverge in 2025. The winners weren’t necessarily the fastest. They were the most intentional.

Lesson #3: Growth Got Wider Before It Got Deeper

Growth in online grocery sales didn’t come by getting shoppers to spend more at once. It grew by getting them to order more often.

Brick Meets Click data throughout the year showed monthly active users reaching record levels, driven largely by reactivated and infrequent shoppers returning to online grocery shopping. October alone saw more than 83 million households purchase groceries online, the highest level on record.

At the same time, the underlying pattern of spending became more nuanced.

By the end of the year, order frequency had increased for 15 straight months. Average order value, however, became less predictable. Its month-to-month rise and fall across fulfillment methods signal that shoppers are actively managing basket size by occasion. Larger stock-up orders gave way to smaller, more targeted trips. Convenience didn’t disappear, but it became selective.

That distinction matters.

When growth widens before it deepens, volume increases faster than stability. More households place orders, but not all of them commit in the same way or at the same level. The result is higher activity paired with greater operational complexity.

For grocers, this changes what success looks like.

The challenge is no longer bringing shoppers online. That part is largely solved. The challenge is turning frequent but flexible behavior into durable value. When customers spread spending across smaller baskets and multiple fulfillment methods, profitability depends on guiding that behavior thoughtfully, not simply accommodating it.

Growth without depth strains labor, fulfillment, and margin. Growth that hardens into habit compounds.

The retailers who navigated this phase best in 2025 weren’t focused on maximizing order count alone. They were focused on what happened after the first few trips and how to use that data to earn the next one.

Lesson #4: The Profit Pool Concentrated Around Repeat Customers

By the second half of 2025, the economics of online grocery had become increasingly clear.

Brick Meets Click consistently reported that the most valuable customers—those placing four or more orders within a three-month period—accounted for a disproportionate share of online grocery sales. These “super users” represented nearly 60% of pickup and delivery monthly active users and spent significantly more per order than less frequent shoppers.

Reactivated customers also proved especially valuable when engaged correctly. Once they returned to online grocery shopping, their likelihood of increasing order frequency and basket size rose sharply.

The takeaway was unmistakable.

Profit in online grocery didn’t come from chasing endless new users. It came from recognizing, retaining, and accelerating the customers already in the system.

For grocers, this reframes loyalty from a brand objective into an economic imperative.

When baskets fragment and fulfillment options multiply, profitability depends on knowing which customers matter most, when they’re at risk, and what keeps them coming back. Generic promotions and one-size-fits-all incentives struggle in this environment. Precision matters.

The retailers who will protect their margin best in 2026 will look beyond a reliance on more promotions or deeper discounts. They’re investing in recognition and relevance. They’re using data to reinforce value, consistency, and trust across every trip.

Online grocery didn’t just grow in 2025. It clarified where sustainable value actually lives.

And for grocers looking ahead, that clarity may be the most important lesson of all.

What Online Grocery Shopping Data Demands Of Grocers

What these four lessons point to is not necessarily a change in direction as much as a change in requirements.

Online grocery has stabilized. Fulfillment has become strategic. Growth has shifted toward frequency. Profit has concentrated around repeat customers. None of this is theoretical anymore. It’s visible in the data, month after month.

The challenge for grocers now isn’t deciding whether to invest in digital. It’s deciding how to operate it with enough control to make it sustainable.

That’s where many organizations begin to strain.

Managing this environment requires more than incremental improvements or another point solution layered onto an already complex stack. It requires a unified view of the customer that connects how people shop, what they buy, how often they return, and which fulfillment choices actually protect margin.

This is exactly the gap our digital experience platform was built to close.

What happens when grocers use DXPro?

65%

of targeted shoppers return within two weeks

90%

of redeemers continue to shop for months afterwards

40%

increase in average basket size for redeemers

$ 2M

in protected revenue over 6 months

DXPro brings customer data, engagement, and commerce together in a single platform designed specifically for grocery. It gives grocers the ability to recognize high-value customers, provide fulfillment profitably, and reinforce loyalty across online and in-store trips from one connected system.

Instead of reacting to growth, DXPro helps grocers shape it.

Instead of absorbing fulfillment costs, it helps you manage outcomes.

Instead of relying on generic promotions, it enables relevance at scale based on individual customer behaviors, not wide assumptions.

As online grocery continues to evolve in 2026 and beyond, grocery retailers can’t afford to chase every new tactic and initiative introduced by mass retailers. To compete, they need a foundation to act on what the data is already telling them.

If you’re ready to turn the lessons of 2025 into a more profitable, controlled digital operation, it’s time to see how DXPro unifies data and engagement.

Newsroom

Newsroom