Your Most Valuable Customers Already Shop with You—Here’s How to Grow Their Value

The pressures facing regional grocers have never been greater.

Margins are narrowing, promotions are costing more than they return, and the biggest players in grocery retail keep pulling customers into their ecosystems with discounts that regionals and independents can’t afford to match.

The instinct might be to look outward for growth. But when grocers chase new customers, the campaigns are too broad, the discounts cut too deep, and the trial offers rarely lead to repeat business.

A better approach might be to take a cue from the philosophers.

Great thinkers have long said that answers come from looking within. In this case, however, it’s not about self-reflection. It’s about the customers already in your orbit. More specifically, customers making in-store purchases.

They’re already spending steadily with you, but they haven’t taken the step into your digital channel.

When they do, it has the potential to change everything.

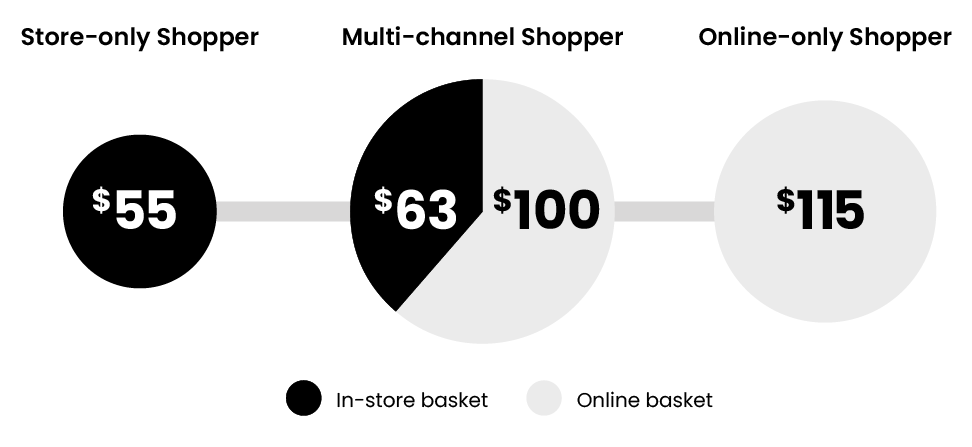

In a recent study with a Mercatus retail partner, we found that multi-channel shoppers averaged $5,300 in annual spend, while store-only shoppers averaged just $3,500.

That’s an enormous lift in annual revenue.

By looking deeper into this potential, we discovered that multi-channel shoppers don’t just replace one channel with another. They keep shopping in-store, make more total trips, and quickly become some of the most profitable customers in your system.

Why Multi-channel Shoppers Matter

Before we go further, we should address the elephant in the checkout lane.

There’s a persistent fear among grocers that digital orders will cannibalize in-store visits. It’s understandable. If a shopper clicks, why would they also come in?

The numbers, however, tell a different story.

Customers who add online shopping to their routine don’t abandon the store. In fact, our case study reveals multi-channel shoppers still average more than 60 in-store trips a year, while layering online orders on top.

Their digital baskets averaged around $100, which is a little smaller than online-only customers at $115. However, these additional in-store orders pushed their total annual spend well past their single-channel peers.

What emerges is not a trade-off but a reinforcement.

In-store and online behaviors complement each other, widening the shopper’s wallet rather than splitting it.

This is what makes multi-channel shoppers so valuable.

They may not be the largest group in your customer base, but they consistently deliver a disproportionate share of your revenue.

How to Grow Your Multi-channel Base

And that brings us back to what we stated at the beginning of this article.

The biggest opportunity grocers have isn’t brand-new customers. It’s with the loyal customers who already buy from you in-store but haven’t yet tried your digital channel.

These are the customers with the most room to grow.

The question, then, is how do you make that shift happen?

The path is straightforward: remove friction, reinforce the behavior, and then build it into a habit.

Step 1: Lower the Barrier

The first hurdle is getting a store-only shopper to try digital.

A free pickup option or a digital-only deal can be enough to prompt that first order. That single trial opens the door to a higher-value pattern of spending.

Step 2: Follow Up

The second hurdle is making sure digital doesn’t replace in-store but complements it.

A coupon tied to the next store trip or a replenishment reminder helps maintain cadence across both channels. The data shows this dual behavior actually increases in-store spend by 15%, rather than eroding it.

Step 3: Create Habit

Then, the final hurdle is turning sporadic behavior into habit.

Over time, the rhythm of store → online → store becomes second nature.

That’s where the real payoff comes in.

Multi-channel shoppers in the study spent about $1,800 more per year than store-only shoppers. For a mid-sized to larger regional grocer with 500,000 in-store customers, converting just 1% of them would add nearly $9 million in annual revenue.

From here, every percentage point of conversion steadily compounds into a larger share of profitable sales.

From Strategy to Execution

While millions in additional revenue sounds great, we still haven’t answered the question we initially posed: How do you actually make that shift happen?

Most grocers don’t struggle with the idea of opening up new channels for their customers to shop. They struggle with execution.

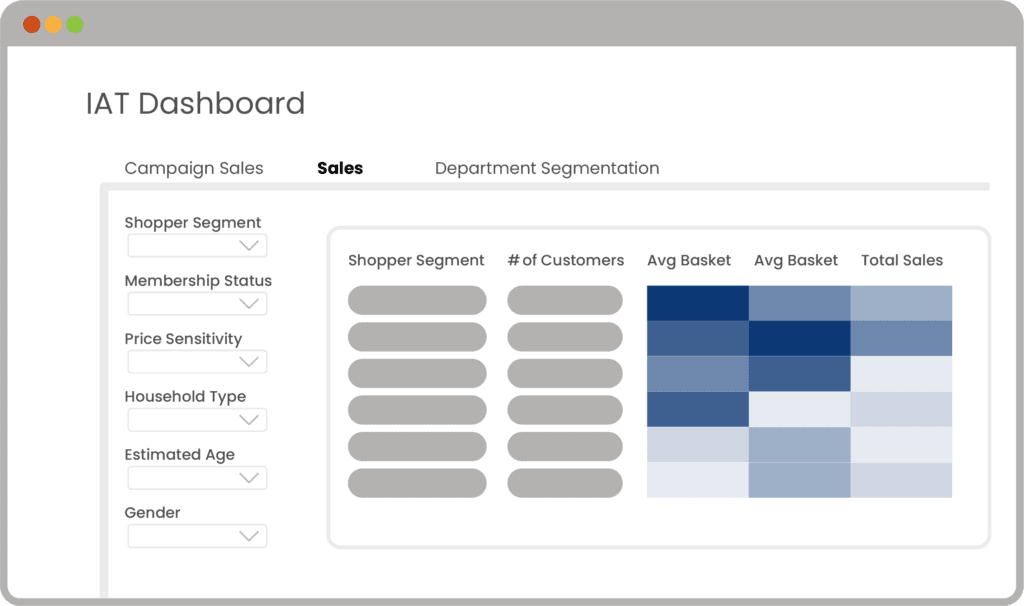

That’s simply because their customer data sits in too many places—POS, loyalty, eCommerce, mobile apps, third-party marketplaces—and it rarely connects.

By the time data is stitched together to spot a store-only shopper ready to convert, the moment has passed. (And more often than not, that customer has already been tempted away by a competitor.)

Manual campaigns aren’t the fix. They’re too slow, too scattershot, and too hard to measure.

What grocers need is a way to see the right customers at the right time, and act before it’s too late.

Turn Missed Moments into Timely Action

That’s where DXPro comes in.

The new digital experience platform from Mercatus unifies all your customer data—POS, loyalty, eCommerce, and app activity— within an embedded CDP and uses it to engage customers on a whole new level.

That means you don’t just know who your store-only shoppers are. You know which ones are most likely to try digital, which ones are slipping, and which ones are showing signs of higher-value behavior.

From there, DXPro does what no manual campaign can: It triggers the right engagement in real time.

Earlier, we mapped out the three steps to grow your multi-channel base: lower the barrier, follow up, and create habit.

Here’s how DXPro automates that three-step guide:

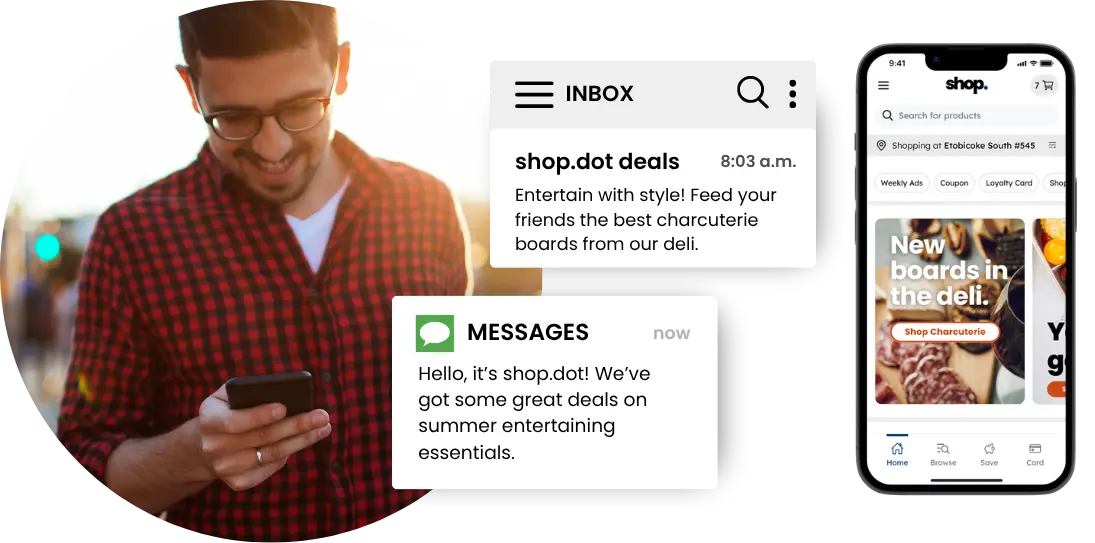

Lower the Barrier

When a store-only loyalist shows signs they’re ready, DXPro delivers the first-order perk that gets them to try digital.

Follow Up

When a shopper completes that first order, DXPro sends the right follow-up—a coupon for their next store trip or a replenishment reminder that keeps both channels active.

Create a Habit

By tracking customer behavior over time, DXPro reinforces the store → online → store rhythm until it becomes second nature.

And it doesn’t stop at one-off campaigns.

DXPro comes with standardized engagement programs already proven to work for Top Shopper, At-Risk, Lapsing, and Lapsed customer segments.

Instead of reinventing the wheel each time, you launch strategies with DXPro that have already delivered results for leading grocers.

The proof is in the outcomes.

One retailer used DXPro to target at-risk shoppers and re-engaged 65% of them in just two weeks. Of those who redeemed, 90% kept shopping for months afterward, their basket sizes grew by 40%, and the retailer protected more than $2 million in sales in just six months.

This is what makes DXPro such an appealing option for grocers. It doesn’t just manage campaigns. It ensures that every offer goes to the right customer, at the right time, with a clear line back to revenue.

It takes the three-step path we outlined earlier and makes it repeatable, measurable, and scalable across banners, markets, and regions.

DXPro Redefines Customer Retention

When we talk about retention in grocery, we usually imagine holding onto customers—keeping them from slipping away, keeping their spend steady.

But that mindset sets the bar too low.

DXPro reframes retention capabilities into something that means more than merely protecting the status quo.

A store-only loyalist doesn’t just need to be held in place. They need to be nudged into digital.

A casual digital shopper doesn’t just need to be prevented from lapsing. They need to be nurtured into repeat behaviors.

With DXPro, retention shifts from “not losing ground” to growing the value of every customer already in your system.

And that’s exactly what grocers need right now. Margins are shrinking. Competition is relentless. Standing still isn’t an option. The only way forward is to increase the value of the customers you already have.

The Next Step

The opportunity is right there in your database. What matters now is acting on it.

DXPro gives you the tools to see the customers ready for more, to move them into higher-value behaviors, and to measure every step of the way.

Mercatus built DXPro to make that shift possible. Book a strategy session today, and we’ll show you how to identify your highest-potential customers, convert them into multi-channel shoppers, and keep them moving up the ladder toward becoming your most valuable customers.

Newsroom

Newsroom