US eGrocery Sales Trends with Brick Meets Click – March 2023 Insights

US eGrocery Sales Dip 7.6% YoY in March 2023 to $8 Billion

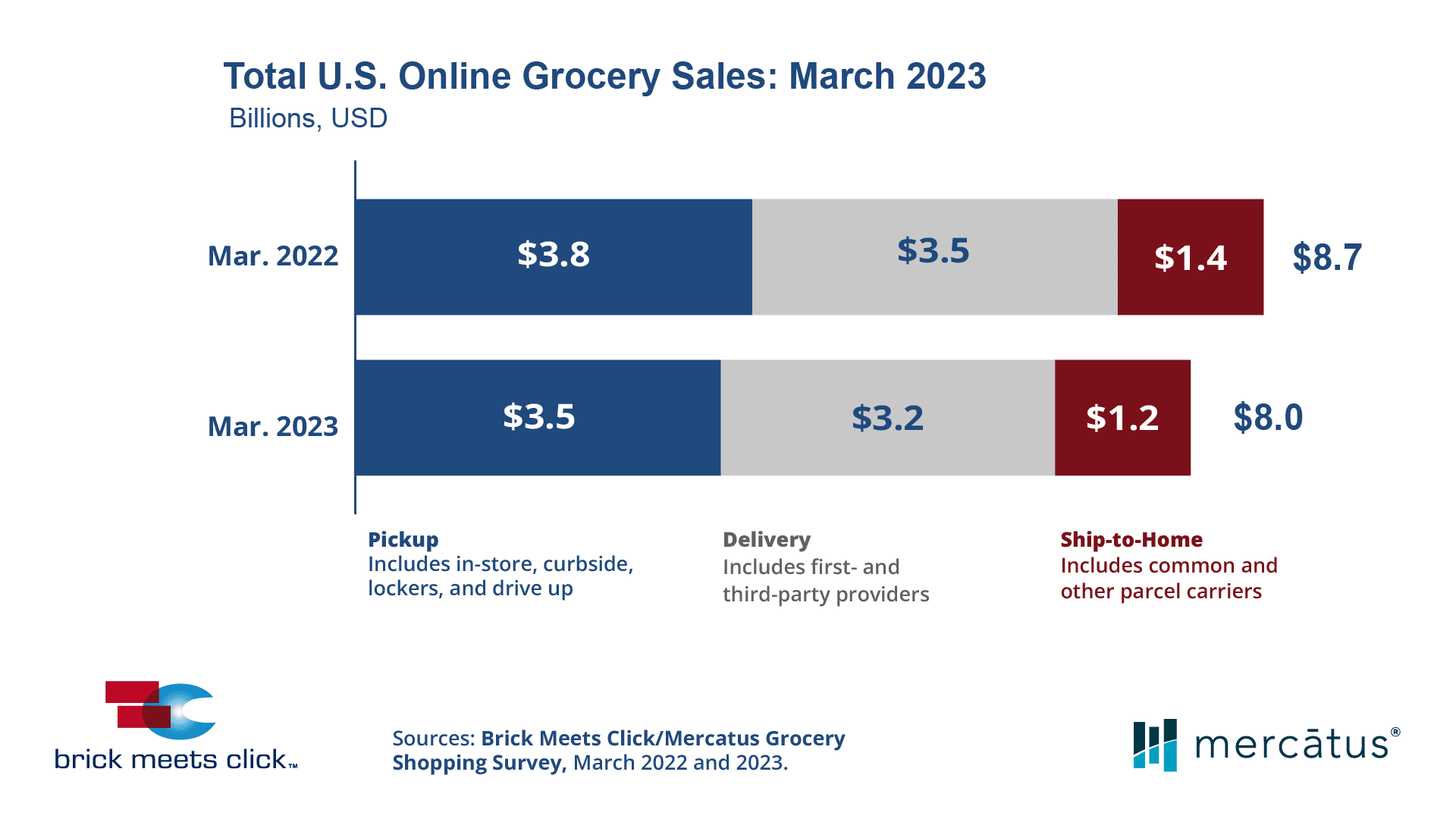

According to the Brick Meets Click/Mercatus Grocery Shopping Survey conducted on March 30-31, 2023, US eGrocery sales in March reached $8.0 billion, marking a 7.6% dip year-over-year (YoY). Core eGrocery segments, such as Delivery and Pickup, also experienced contractions, with sales decreasing by 7.4% and 8.5% respectively. Additionally, Ship-to-Home sales saw a 5.9% decline during the same period.

In March, cost emerged as the most crucial factor affecting customer shopping behavior, with its importance rising by 3% (300 basis points) compared to the previous year, surpassing convenience. This shift underscores the growing emphasis on cost-saving measures among consumers, as households prioritize budget management amid economic uncertainties.

Moreover, 44% of households utilizing Pickup or Delivery services from grocery or mass retailers cited the desire to avoid paying more than necessary as the primary reason for choosing a specific online grocery service..

Households with different income levels exhibit distinct preferences when choosing between Pickup and Delivery services for their online grocery shopping. According to David Bishop, Partner at Brick Meets Click, households earning below $50,000 annually were 34% more likely to choose Pickup, while those making over $200,000 per year were twice as likely to opt for Delivery.

This pattern suggests that lower-income households prioritize cost savings, opting for Pickup services due to their lower cost compared to Delivery services. As cost remains a crucial factor in customer shopping behavior, retailers should consider offering a range of affordable and convenient options to cater to the diverse needs of their customer base.

The ongoing elimination of emergency SNAP benefits is another factor that has likely had a greater effect on Pickup sales compared to Delivery sales. Over 75% of SNAP households lost the additional $95 per month in pandemic-related support for grocery purchases in the previous month. This loss of financial assistance has further amplified the financial pressures faced by lower-income households, potentially contributing to the decline in Pickup sales as these households seek alternative ways to manage their grocery budgets.

In March, both Grocery and Mass order frequencies experienced a decrease, with Grocery witnessing a more significant change of 10% among its monthly active users (MAUs) compared to Mass’s 2% dip. This suggests that grocery customers may have become more cost-conscious in the previous month. Despite the decrease in order frequencies, Mass shoppers still consider cost the primary factor in selecting an online grocery service.

The ongoing pressure on households to stretch their budgets has led to an increased propensity for Grocery’s monthly active users (MAUs) to also purchase groceries online from Mass retailers. In March 2023, the cross-shopping rate stood at 28%, a mere 90 basis points (bps) lower than the previous year. This indicates that consumers are seeking cost-effective options to optimize their grocery spending.

Interestingly, while the cross-shop rate for Walmart remained essentially unchanged, Target experienced a decrease of 280 bps compared to March 2022. This suggests that Grocery MAUs are increasingly favoring Walmart over Target as a more cost-effective choice for their online grocery shopping needs.

Repeat intent scores, which indicate the likelihood of customers using the same service within the next 30 days, experienced a downward trend in March, reaching 61% – a 2.9% (bps) dip year-over-year (YoY). This change suggests waning customer loyalty and potentially increased competition within the online grocery market.

First-time customers witnessed a more significant decline of 600 bps, indicating a challenge for retailers to retain new users. More frequent customers (those completing four or more orders within the past three months) experienced a smaller drop of 220 bps, reflecting a higher level of loyalty among this segment.

In March, the online share of total grocery spending experienced a decrease of 160 basis points (bps), reaching 12.7% compared to the previous year. This decline indicates a shift in customer preferences or market dynamics, which could be attributed to factors such as increased cost-consciousness among consumers or changes in shopping behaviors.

When excluding Ship-to-Home, the adjusted contribution from Pickup and Delivery dropped by 130 bps, finishing at 10.6% for the month. The decline in the online share of grocery spending highlights the importance for retailers to continue adapting their strategies, focusing on enhancing customer experience and providing competitive pricing to maintain and grow their market share in an evolving landscape.

Sylvain Perrier, president and CEO of Mercatus, has emphasized the importance of customer engagement for conventional grocers. In light of the decline in online grocery sales and the growing emphasis on cost-consciousness among consumers, Perrier advises grocers to focus on providing a great customer experience underpinned by convenience. Retailers can boost customer loyalty and revenue by providing a positive shopping experience and leveraging satisfied customers’ recommendations.

The key eGrocery strategy recommendations from this months report include:

- Focus on cost-effective solutions. By offering a range of affordable options, retailers can cater to the diverse needs of their customer base, particularly those who prioritize cost savings.

- Enhance customer experience. Retailers may focus on providing a seamless, convenient, and positive shopping experience that encourages customer loyalty and repeat purchases.

- Leverage satisfied customers. By capitalizing on positive word-of-mouth, retailers can attract new users to their online platforms, potentially expanding their market share.

Thank you for reading this edition of the US eGrocery Sales Insights from Brick Meets Click/Mercatus. Read the full press release here.

Explore the key insights from the 5 Year Grocery Forecast, to learn more about the predicted shifts in the grocery market.

Newsroom

Newsroom