US eGrocery Sales Trends with Brick Meets Click – October 2023 Insights

October U.S. eGrocery Sales Rise by 5% YoY, Reaching $8.2 Billion

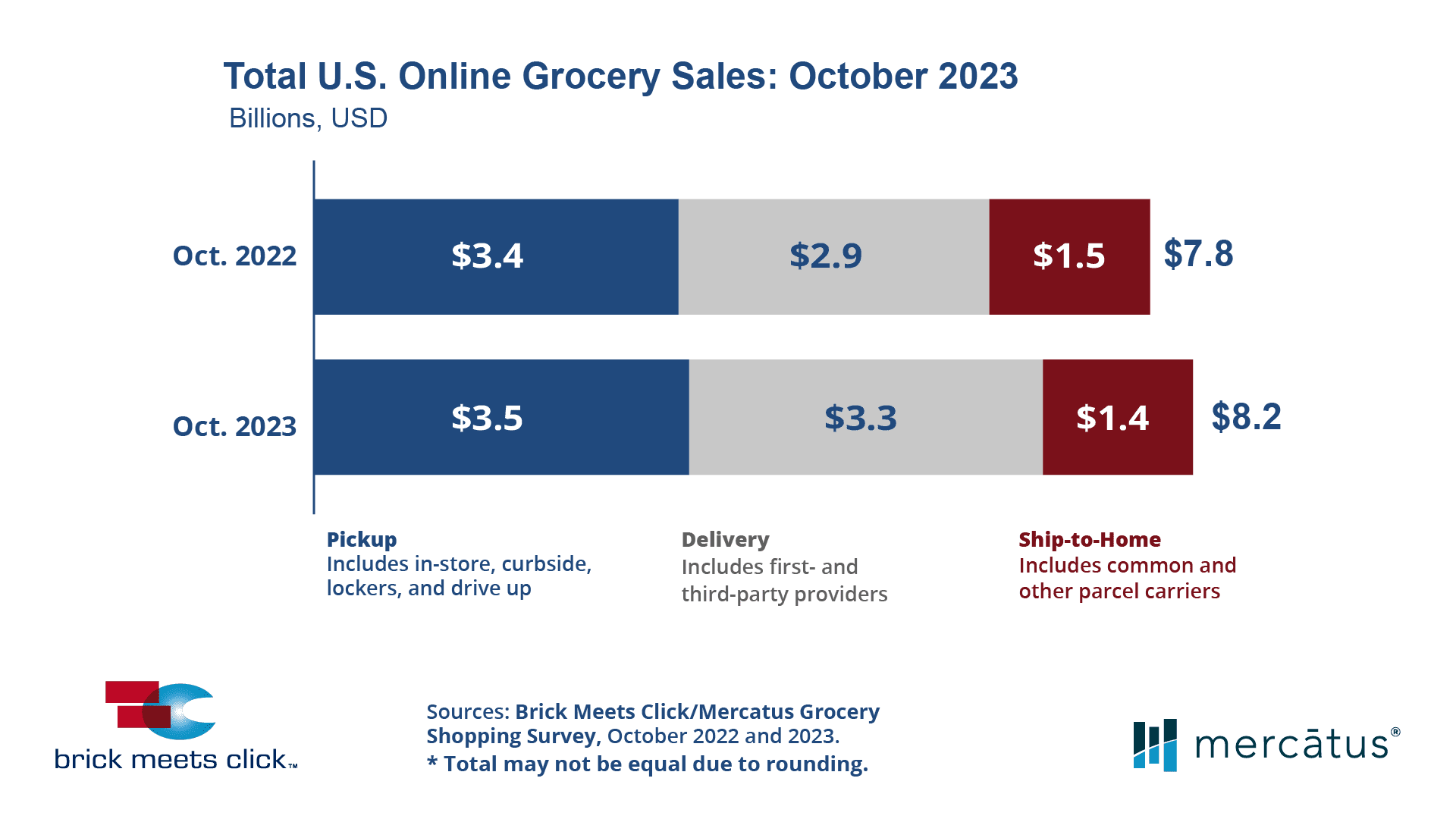

The Mercatus/Brick Meets Click October 2023 Grocery Shopping Survey data is in. The U.S. eGrocery market continued its upward trajectory, registering a 5% increase over last year and closing October with $8.2 billion in sales.

This growth, despite an unchanged monthly active user (MAU) base, was driven by higher average order values (AOVs), particularly in the Delivery segment.

The Mass market segment remained a significant contributor accounting for over 45% of all eGrocery sales.

October 2023 US Online Grocery Sales

Delivery Leads the Charge

October saw a diverse performance across various eGrocery formats:

- Delivery services experienced a notable uptick, expanding their sales share to 40%. This growth was fueled by a substantial increase in AOVs and stronger volume from Mass retailers.

- Pickup, while still popular, saw a slight contraction in its market share, landing at 42.7%. Despite this, Pickup continued to attract new users, expanding its MAU base by 6%.

- Ship-to-Home faced a decline, both in terms of order volume and sales share, which dropped to 17.3%.

The data reflects a nuanced consumer base that values both convenience and cost-effectiveness, with Delivery emerging as a strong contender this month.

Mass Retailers Continued Growth

Mass retailers, particularly Walmart, continued to capitalize on the eGrocery market. The Mass segment accounted for over 45% of all eGrocery sales and saw a dramatic 29% growth in its MAU base year-over-year.

This ‘flight-to-value’ shopping behavior is a clear response to the current financial conditions, as households increasingly turn to Mass retailers for their online grocery needs.

Cross-Shopping Hits Record High

In a notable shift, the cross-shopping rate between Grocery and Mass sectors reached an all-time high. Over 34% of Grocery’s MAU base also engaged with Mass online shopping services in October, signaling a significant change in consumer shopping habits and preferences.

The Dynamics of Customer Loyalty

The composite repeat rate for Pickup and Delivery improved significantly, with Mass leading the way. Mass outperformed Grocery in terms of year-over-year gains in repeat rates, particularly in Delivery orders, suggesting a stronger customer loyalty towards Mass retailers.

Key Takeaways from October 2023 eGrocery Sales:

- The US online grocery market experienced a 5% year-over-year growth, reaching $8.2 billion. This increase was primarily driven by higher Average Order Values (AOVs), particularly in the Delivery segment, which compensated for the overall slowdown in order volume.

- Compared to last year, the total number of eGrocery orders decreased by about 3%. This decline was mainly due to a reduction in Ship-to-Home orders and a slight drop in Pickup orders. Contrarily, Delivery orders saw growth, significantly supported by increased volume from Mass retailers.

- Delivery’s share of sales grew by 260 basis points to 40%, while Pickup’s share decreased by 130 basis points to 42.7%, and Ship-to-Home’s share reduced by 140 basis points to 17.3%.

- The total number of households (HHs) receiving online grocery orders remained relatively stable compared to the previous year. However, Pickup and Delivery formats showed better performance than Ship-to-Home, with Pickup expanding its MAU base by 6% and Delivery by 2%, while Ship-to-Home saw a 6% contraction.

- The average number of orders per MAU was 2.47, an increase from September’s post-COVID low of 2.31 but a 3% decrease from the previous year.

- The overall AOV for eGrocery rose nearly 9% year-over-year. Within this, Delivery’s AOV increased by 10%, Pickup’s by 6%, and Ship-to-Home’s by 5%.

- October 2023 set a record for cross-shopping, with over 34% of Grocery’s MAU base also purchasing online from Mass retailers. This represented a substantial 680 basis point increase compared to last year.

Strategic Recommendations for October 2023

Emphasize Value and Convenience

Focus on balancing cost-efficiency with convenience, particularly in Delivery and Pickup services, to cater to the evolving needs of online shoppers.

Tap into the Older Demographic

Tailor services, offerings, and promotions to appeal to the over 60 years-old market segment.

Strengthen Customer Connections

Enhance the online shopping experience to foster customer loyalty, especially to compete against the Mass retail segment.

Consider Cross-Shopping

Explore strategies to leverage the increasing trend of consumers shopping across both Grocery and Mass.

Closing Thoughts

October 2023 highlighted the steady growth and shifting trends in the U.S. eGrocery market. As we experience more changes in order volumes, MAU bases, and spending patterns, the key to success lies in understanding these trends and responding accordingly. Retailers who adapt their strategy to these changes, focusing on value, convenience, and targeted demographic engagement, are likely to see improvements.

Thanks for reading!

Stay tuned for next month’s insights, and for the full details, read the complete press release here.

Newsroom

Newsroom