US eGrocery Sales Trends with Brick Meets Click – August 2023 Insights

August U.S. eGrocery Sales Surge by 8.7%, Reaching a New High of $9.3 Billion

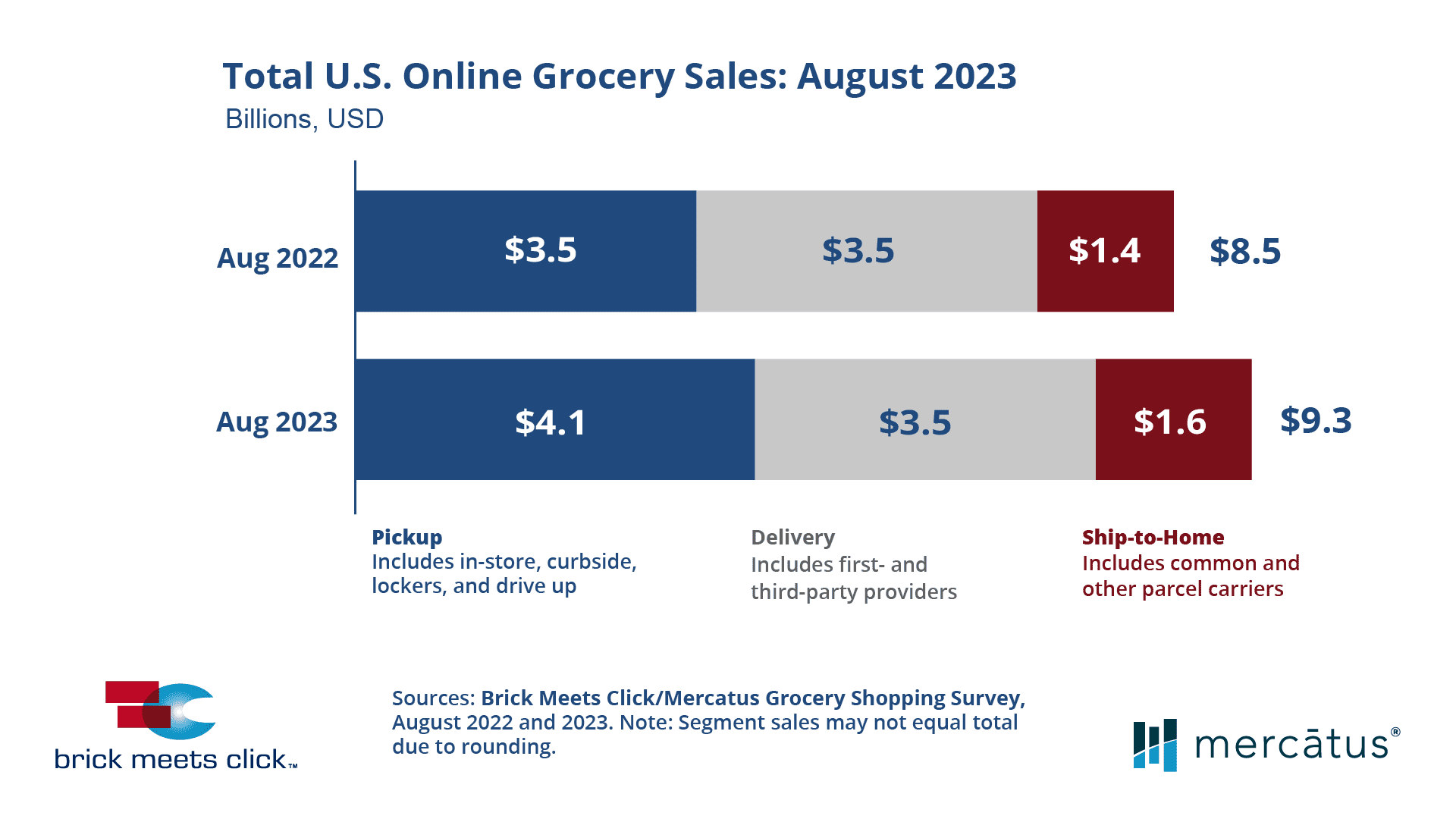

The data from the August 30-31, 2023 Shopping Survey has landed. The U.S. eGrocery market reached sales of $9.3 billion, representing an 8.7% growth year-over-year (YoY). The surge in sales was largely credited to the Pickup and Ship-to-Home segments, as Delivery saw a reduction in order volume. The month also witnessed Mass retailers consistently outperforming Supermarkets.

August 2023 US Online Grocery Sales

Pickup Continues to Lead the Way

Pckup dominated the month, attributing to a significant portion of the year-over-year online grocery sales growth. This underscores the need for regional grocers to further invest in and refine their pickup services to ensure that they align with the 45% of consumers who prefer this method.

Analyzing eGrocery Sales Distribution in August

The distribution of eGrocery sales for August showcased some interesting dynamics:

- Pickup maintained its dominance, securing a 45% share of eGrocery sales, reflecting its continued consumer appeal.

- Ship-to-Home, bolstered by Amazon’s pure-play segments, wrapped up the month with an almost 18% sales share, marking its presence in the market.

- Delivery, however, experienced a setback, ending the month with 38% of eGrocery sales, shedding 360 basis points YoY.

The trends reveal a consumer base that’s not solely after the ease of online shopping but is also eyeing an important mix of convenience and cost-effectiveness. The rise in Pickup and Ship-to-Home orders underscores this shift in consumer sentiment.

Performance Disparity Between Mass and Supermarket Continues

The chasm between Mass and Supermarket persisted in their performance metrics:

- Mass witnessed a nearly 20% leap in its monthly active user (MAU) base in August, while Supermarkets saw a decline of more than 10%.

- Order frequency presented a mixed picture, with Mass registering a slight increase and Supermarkets experiencing a decline.

- Average order values (AOV) for both formats were comparable, suggesting a common ground in terms of consumer spending patterns.

The robust growth in Mass’s customer base can be attributed to its expansive product range and the perceived value it offers. In contrast, the modest decline in Grocery’s MAUs may imply that higher cost localized offerings might be losing their appeal amid the current market dynamics.

The Evolving Landscape of Customer Preferences

The August findings revealed a noteworthy trend: a significant increase in cross-shopping rates between Grocery and Mass, indicating a clear shift in consumer behavior since pre-COVID times.

Sylvain Perrier, president and CEO of Mercatus, commented on the increasing challenges of retaining online customer loyalty. “Online customer loyalty is becoming harder to secure. It’s imperative for grocers to curate seamless experiences that ensure repeated visits, especially from first-time users,” he commented. Offering tailored recommendations based on user history and preferences can amplify connections with customers, making transactions more than just a mere exchange of goods.

Key Takeaways from the August 2023 Shopping Survey:

- Online grocery sales in the U.S. grew 8.7% YoY to $9.3 billion for August 2023.

- Delivery lost 3.6% sales share YoY to end August with 38% of total eGrocery sales. Pickup captured more than three-quarters of the share lost by Delivery and finished with 45% of eGrocery sales while Ship-to-Home claimed the remainder, ending with almost 18%.

- The total number of U.S. HHs who bought groceries online increased nearly 5% versus last year, as Ship-to-Home expanded by over 9% and Pickup increased by nearly 6%, while Delivery was up less than 1%.

- The average number of orders per MAU inched up 20 bps to 2.65 versus a year ago, Pickup posted the highest gain of 6% for average order value (AOV), followed by Delivery, up 4%, and Ship-to-Home, up 3%, compared to a year ago.

- Cross-shopping rates between Grocery and Mass continued to climb, increasing 490 basis points versus last year to finish the month at 34%. This is the highest level of cross-shopping to date and more than twice that of pre-COVID levels recorded in August 2019.

- Weekly HH grocery spending jumped 14.9% to $231 in August, while online’s share of grocery spending dipped 20 bps versus last year to 13.9% due to a pullback in Large Metro areas.

Key eGrocery Strategy Recommendations for August 2023:

Balance the Service Delivery

Continue to focus on blending convenience with cost, keeping in mind the growing preference for Pickup and Ship-to-Home services.

Engage & Retain

Offer a seamless and enhanced online shopping experience to ensure customer loyalty and encourage repeat purchases.

Customize & Personalize

Use shopping history and preferences to offer tailored recommendations, fostering a stronger bond with shoppers.’

Expand Horizons

With cross-shopping rates on the rise, consider collaborations or strategies to tap into this behavior.

Closing Thoughts

August 2023 showcased the dynamic nature of the US eGrocery market, with online sales hitting $9.3 billion. As consumer preferences evolve and the market matures, adaptability is the key to sustained success. Balancing cost with convenience can pave the way for more robust sales outcomes.

Thanks for reading and we will see you next month.

Newsroom

Newsroom