US eGrocery Sales Trends with Brick Meets Click – June 2023 Insights

US eGrocery Sales Slip 1.2% YoY in June 2023 to $7.1 Billion

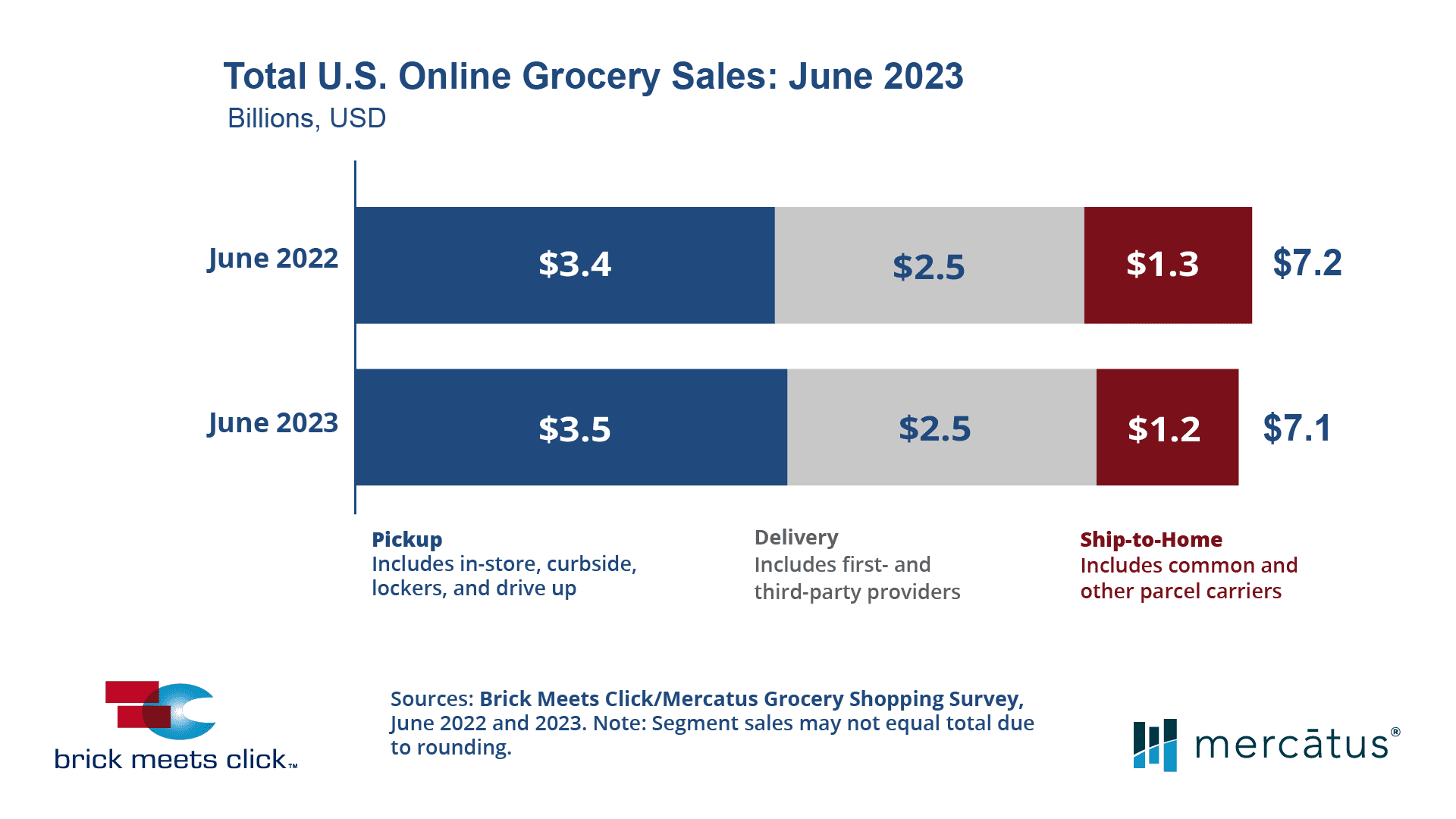

The latest Brick Meets Click/Mercatus Grocery Shopping Survey, conducted on June 29-30, 2023, reports that US eGrocery sales reached $7.1 billion in June, marking a 1.2% decrease year-over-year (YoY).

Despite an increase in households buying groceries online in June 2023, the average number of orders declined, resulting in a slight dip in sales. Moreover, a mixed performance in the average order value (AOV) across the segments added to this downward trend.

June 2023 US Online Grocery Sales

The number of monthly active users (MAUs) for online grocery increased by slightly more than 1% in June, and the overall average order value (AOV) saw a 3% YoY increase. However, these slight improvements were unable to compensate for the 5% decrease in the average number of orders placed during the month.

Looking at the performance of the three eGrocery segments – Pickup, Delivery, and Ship-to-Home – the trends vary.

- Pickup sales grew by 3.2% YoY, accounting for nearly 49% of total eGrocery sales, a 2% increase from June 2022.

- The Delivery segment experienced a 2.5% YoY decline, dropping its sales share by 50 bps to just under 35%.

- While the Ship-to-Home segment saw a more considerable fall, with a 9.7% YoY decrease, leading to a share of just under 17% in total eGrocery purchases.

The overall repeat intent rate remained stable at 63%, compared to last year, halting the decline observed between March and May 2023. However, the current rate still lags behind the pre-COVID levels by over 10 points, indicating the ongoing challenge grocers are facing with retention.

The online share of total grocery spending decreased by 230 bps to 11.9% YoY. When excluding Ship-to-Home, the combined contribution from Pickup and Delivery was 10%, down 160 bps compared to last year, driven by Delivery’s weaker performance in June.

Customer Loyalty and Market Share

Despite a 1.8% decrease in total eGrocery sales in the first half of 2023 compared to the same period in 2022, Pickup sales saw a 1.3% YoY increase. This growth is mostly attributed to Pickup’s larger share of eGrocery sales, up by 140 bps from last year, capturing 47.1% of total eGrocery sales. By contrast, Delivery sales fell by 2.0%, and Ship-to-Home sales declined by 9.0%. As a result, eGrocery’s contribution to total grocery sales for the first half of 2023 decreased by 100 bps to 12.3% YoY.

Key Findings for June 2023

- Total US online grocery sales for June 2023 dropped by around 1.2% YoY. This decrease is attributed to a continued decline in Ship-to-Home and a slowdown in Delivery, despite an uptick in Pickup sales.

- The number of U.S. households purchasing groceries online in June 2023 grew by more than 1% YoY. However, the frequency of orders declined by over 5% compared to last year.

- The weighted average AOV saw mixed results across the three delivery methods in June YoY. Delivery posted a growth of about 7%, Pickup experienced a slight decrease of 0.4%, and Ship-to-Home reported a fall of about 1%.

- Repeat intent rates for the online grocery shopping remained constant at 63% YoY, reflecting the ongoing challenges in customer retention.

- Weekly Household grocery spending increased 7.4% YoY, while online’s share of grocery spending continued to fall, dropping 230 bps to 11.9%, due mainly to lower order frequency.

Key eGrocery Strategy Recommendations

- Focus on Pickup – As Pickup continues to see growth, retailers should enhance their Pickup services to make them more appealing and convenient.

- Strengthen customer retention – With repeat intent rates remaining stable but still below pre-COVID levels, retailers must focus on customer retention strategies.

- Offer excellent customer experience – Ensuring a smooth and pleasant shopping experience can help retailers retain and grow their customer base in this competitive environment.

In summary, the U.S. eGrocery market experienced a slight dip in June 2023, as an increase in Pickup sales could not offset a decrease in Ship-to-Home and Delivery sales. The challenge now for retailers is to maintain customer retention rates and adjust accordingly to the shifting market dynamics.

Don’t miss the webinar from Mark Fairhurst, Chief Growth Officer at Mercatus, and David Bishop, Partner at Brick Meets Click.

Check out the full June 2023 US eGrocery Sales press release here.

P.S. If you are a Grocery Retailer looking for online grocery insights to help inform your strategy and help to improve business results, sign up for our exclusive distribution list here.

Thank you for reading!

Newsroom

Newsroom