US eGrocery Sales Trends with Brick Meets Click – November 2023 Insights

November U.S. eGrocery Sales Rise More Than 5% YoY — Reaching $8.1 Billion

The results from the Mercatus/Brick Meets Click November 2023 Grocery Shopping Survey were just released, and as always, it includes several fascinating insights, takeaways and recommendations.

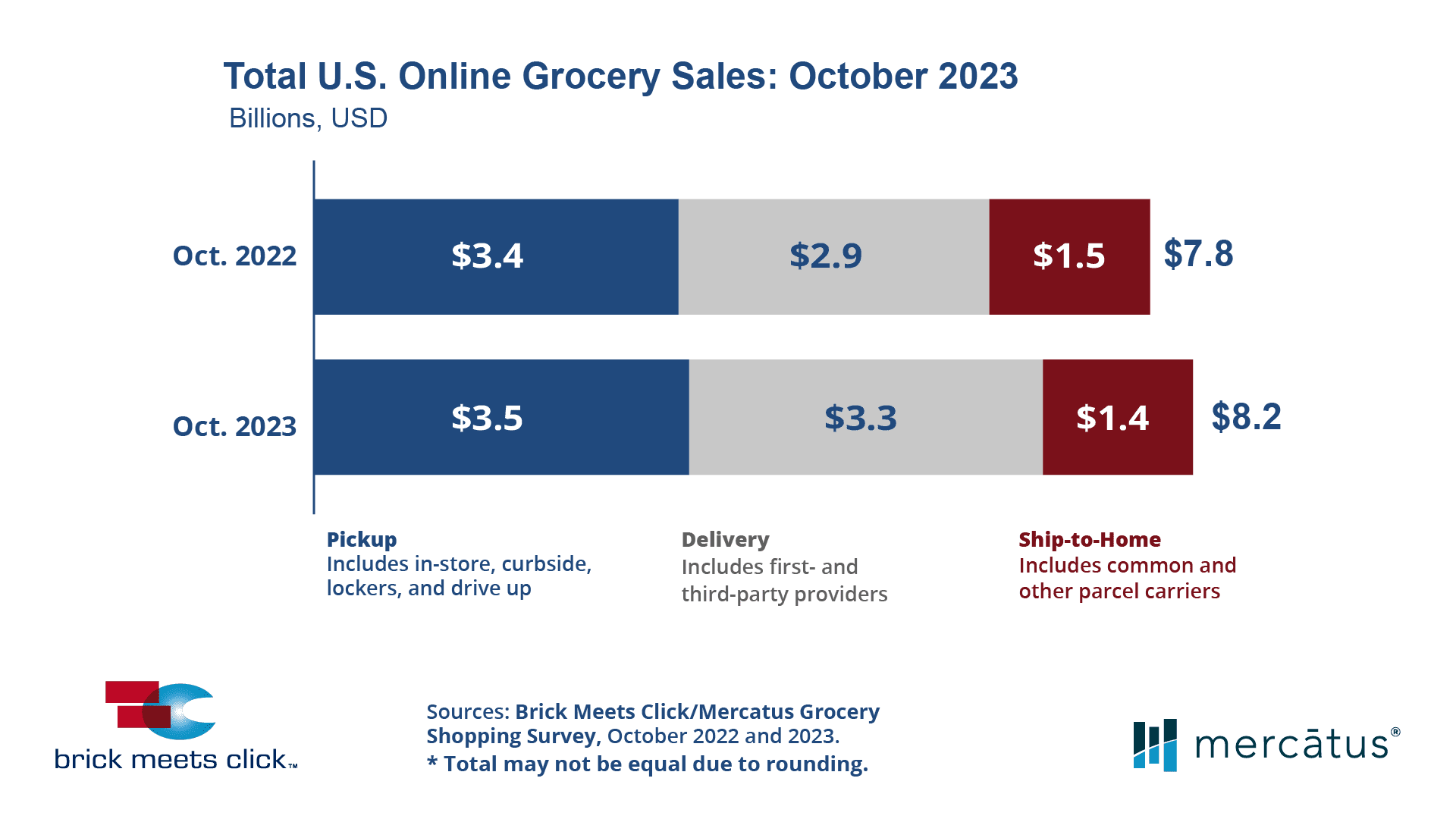

But first, the overall growth numbers:

The U.S. eGrocery market continued its upward trajectory, registering a 5.2% increase over the previous year, closing November with $8.1 billion in sales.

This growth can be attributed to several factors, including the growing preference for Mass retailers and a notable shift in delivery services, but the growth for Mass is especially notable because this month’s numbers show that it has now overtaken Supermarkets as the primary choice for grocery shopping among U.S. households.

In November, 42% of American households turned to mass for most of their grocery needs, including both in-store and online purchases. This is in contrast to fewer than six months ago when Supermarkets were cited as the primary store by 42% of households compared to 39% for Mass.

November 2023 US Online Grocery Sales

Consumer Preferences Continue to Evolve

November brought yet another diverse performance across eGrocery formats:

- Delivery services continue to rise, accounting for nearly a third of all eGrocery sales in November by recording an 8.6% sales growth. This is fueled by a substantial rise in its monthly active user (MAU) base and a modest 1.0% increase in average order value (AOV).

- Pickup sees a decrease in its market share, but continues to lead at 38%. Despite an impressive 11.8% increase in AOV, a decline in MAU and lower order frequency are the causes of the decline.

- Ship-to-Home experiences positive growth, with a 7.6% increase in sales. This increase is largely attributed to the performance of Amazon’s pure-play services, contributing to a nearly 3% overall increase in order volume and a 4.5% rise in AOV.

The Mass Effect in eGrocery Sales

Mass retailers continued to expand their influence, with a 14% growth in their MAU base, while Supermarkets saw a contraction of the same magnitude.

Despite similar trends in order frequency and AOV for both Mass and Supermarkets, the former’s delivery and pickup services posted a significant 9.0% increase in AOV, outperforming Supermarkets’ 5.6% rise.

This shift towards Mass retailers, led by giants like Walmart, underscores the dramatic changes in the eGrocery market. With their emphasis on value and convenience, Mass retailers are attracting a larger share of households, especially those feeling the pinch of economic pressures.

Cross-Shopping Dynamics

Though not quite reaching the record highs of October, 33% of Grocery’s MAU base also shopped for groceries online with a Mass retailer.

This, again, highlights how the current economic realities are shaping the behaviors of both households and retailers. But, it’s not all about external forces. Mass retailers are employing a strong omnichannel strategy to win and retain customers.

Pickup and Delivery Options Enhance Consumer Loyalty

There has been a notable shift in consumer loyalty, as indicated by the composite repeat intent rate for Pickup and Delivery improving by 140 basis points compared to the previous year.

This change, in combination with cross-shopping numbers and the increasing influence of Mass retailers, suggests that while customers are exploring various shopping formats, they are also developing stronger preferences and repeat patronage for specific services that meet their needs.

Key Takeaways from November 2023 eGrocery Sales:

- The U.S. eGrocery market reaches $8.1 billion in November 2023. This 5.2% increase from the previous year not only emphasizes households continuing to increase their reliance on online grocery shopping, but also the expanding role of Mass retailers and the performance of delivery services.

- Mass retailers take a 390 basis point lead over Supermarkets, which means that giants like Walmart have surpassed Supermarkets as the primary grocery shopping choice for U.S. households. This shift reflects both the economic pressures facing households, who continue to seek out cost-effective options, and the omnichannel strategy employed by Mass retailers.

- Delivery services experience a substantial 8.6% growth in sales, driven by a significant increase in their monthly active user base. This growth would normally indicate an increasing preference for the convenience of home delivery, but Walmart’s continued expansion of its first-party delivery service along with increased efforts by national grocers and third-party providers also likely contributed.

- A 300 basis point increase in cross-shopping compared to last year indicates that consumers are diversifying their online grocery shopping, utilizing both Mass and Grocery platforms to fulfill their needs.

- Mass retailers have a nearly 19-point lead over Grocery in repeat intent rates, demonstrating their stronger customer engagement strategy. This suggests that Mass retailers are more effectively retaining customers and encouraging repeat purchases compared to traditional Grocery stores.

- An approximately 5% decline in order frequency among their MAU bases was reported for both Mass and Supermarkets.

- Average Order Value is up, however, with Mass AOV increasing by 9.0% across its Delivery and Pickup services, while Supermarkets witnessed a 5.6% YOY rise.

Strategic Recommendations for November 2023

Embrace Omnichannel Engagement

We’ve already mentioned the combination of current economic realities and effective omnichannel strategies. Both of these factors are bolstering the position of Mass retailers. Their ability to engage customers both online and in-store is proving to be a key differentiator in today’s market. Other retailers should take note and enhance their online and in-store engagement strategies to meet evolving consumer needs.

Focus on Value and Convenience

As economic pressures mount, offering value-driven and convenient shopping experiences can attract more customers, especially with Delivery and Pickup services in an ongoing battle for the eGrocery format of choice.

Enhanced Customer Experience

Utilize consumer data to tailor offerings and improve service efficiency. This is vital to fostering customer loyalty and combating the cross-shopping between Supermarkets and Mass retailers.

Closing Thoughts

The November 2023 eGrocery data once again highlights steady growth in the industry, but with significant shifts favoring Mass retailers and delivery services. As we head into the holiday season and into the new year, understanding these trends and adapting strategies to fit the current economic situation facing households will be crucial for retailers.

As always, thanks for reading.

Stay tuned for next month’s insights, and for the full details, read the complete press release here.

Newsroom

Newsroom