How Should Grocers Adapt to Changes in Grocery Shopping Behavior? Prioritize Customer Engagement

This article was originally published with the title “New Research Shows How Grocery Shopping Behavior Has Changed” on November 16, 2021. It was updated on February 19, 2025.

Grocery shopping changed in 2024—and then it changed again.

Back in May 2024, a Wall Street Journal article asked if rising prices had ended the era of one-stop grocery shopping. The story included several reports that confirmed what our research with Brick Meets Click had already revealed: U.S. shoppers were visiting multiple retailers for their grocery spending.

This examination of modern consumer behavior and grocery store brand loyalty sparked widespread discussion across the industry—including from us.

Then, a funny thing happened. Concerns over cross-shopping faded as overall eGrocery sales began to climb. Yet, for many grocers, the rising tide wasn’t lifting all boats.

The growth in sales was quickly traced back to initiatives from some of the industry’s biggest players: Walmart, Instacart, and Amazon (among others) were rolling out aggressive discounts on annual memberships, and pairing them with reduced delivery fees.

These efforts attracted more shoppers to eGrocery shopping, and in the process, fundamentally shifted preferences toward the increased convenience of delivery as the fulfillment method of choice.

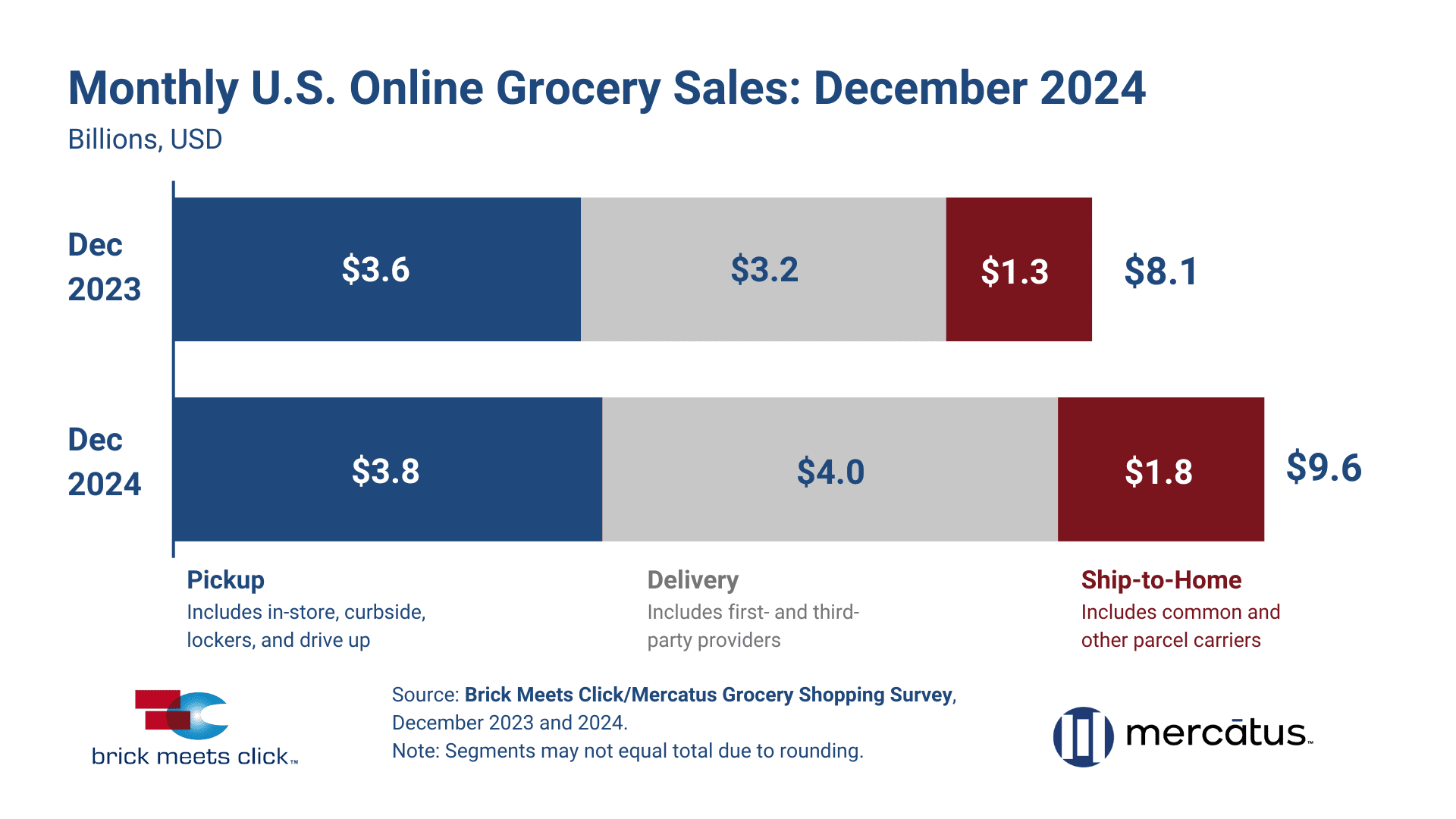

By the beginning of 2025, U.S. eGrocery sales had exceeded $9.5 billion for five consecutive months. Total 2024 eGrocery sales rose 9.1% YOY, with a 17.7% surge in the second half of the year. Delivery sales, in particular, surged 24.6% YOY in December, capturing 41.7% of total online grocery sales and overtaking pickup.

This data doesn’t just represent overall growth in online grocery shopping—it reflects a deeper transformation in grocery shopping behavior.

How Online Grocery Shopping Changed in 2024

Convenience, once a differentiator for retailers, has now become the expectation.

Not only do modern grocery store shoppers not feel tied to their local supermarket, they’re increasingly assuming they’ll get more for less from their grocery shopping experience. They’ve quickly come to expect their grocery shopping—whether in-store or online—to be easy, personalized, and connected to loyalty programs that maximize value and save them time.

This is how modern consumers shop, and it’s how modern grocery stores must adapt if they want to compete.

While the membership discounts from bigger players may have shaped these consumer expectations, it’s regional grocers and independents that are uniquely positioned to meet them.

Grocers already excel at building trust and forming deep connections with their customers. The real challenge is extending that high-touch engagement and personalized service into the digital experience, ensuring that shoppers feel the same level of care and attention no matter how they interact.

With the right tools and the right process, grocery retailers can bring their in-store strengths online, meeting shoppers where they are and creating deeper, lasting connections.

Customer Engagement Gives Modern Consumers What They Want

When we talk about creating “deeper, lasting connections,” we’re talking about customer engagement—a way to build relationships with shoppers that go beyond transactions.

By offering personalized experiences, delivering value at every interaction, and fostering ongoing loyalty, grocers can adapt to shifting consumer behavior. But achieving this requires grocery retailers to shift their focus as well.

That means moving from a short-term sales mindset to maximizing customer lifetime value (CLV). This is how an effective customer engagement strategy—that prioritizes long-term relationships over one-off transactions— is measured.

Instead of chasing sales by trying to match the low prices or deep discounts offered by big players, this approach drives long-term profitability while giving grocers a sustainable edge in a consumer-driven market.

The Roadmap to Building a Customer Engagement Program that Works

Delivering the kind of customer engagement that boosts CLV and provides a competitive edge requires a clear, actionable strategy.

To achieve this, grocery retailers must take a foundational approach to gathering and utilizing data, managing customer relationships effectively, and ensuring that every customer touchpoint is both personalized and engaging.

Below, we outline the five essential steps grocers need to implement a customer engagement program that drives incremental sales and helps them compete with the biggest players in the industry.

Step 1: Unify First-party (1P) Data for Insights and Engagement

Customers may be willing to take a ticket and wait their turn at the deli counter, but when it comes to their overall grocery shopping experience, they don’t want to feel like just another number.

While going through each of these steps, it’s important to remember that grocery shopping behavior has changed. Modern consumers have higher expectations, meaning that grocers are no longer just competing on price alone; they’re competing to meet elevated demands.

That’s why personalization must be at the heart of any successful engagement program—and personalization begins with customer data.

Grocers already have access to a wealth of information about the purchasing behavior of their customers—from transaction records and loyalty program activity to online browsing behavior and feedback surveys. But too often, this data is siloed across systems, limiting its potential.

To realize the power of personalization, grocers must consolidate all of their data into a single, unified platform. A complete view of each customer’s grocery shopping behavior—including preferences, habits, and needs—allows for highly targeted and meaningful engagement strategies through accurate segmentation.

Without this step, personalization and meaningful engagement are nearly impossible to achieve.

Step 2: Configure a Loyalty Management System

We mention personalization and meaningful engagement specifically because these are the two biggest factors in engaging modern consumers. And these two factors come together in loyalty programs.

At their core, loyalty programs are about rewarding customers for their continued business. But many consumers today expect loyalty programs to provide something more than point tracking or offering occasional discounts.

To drive real engagement and foster stronger relationships, loyalty programs must deliver true customer value at every stage of the grocery shopping journey.

The most effective loyalty programs incorporate the unified customer data from the first step to provide personalization and value-driven interactions that create meaningful, memorable experiences. This means moving beyond generic discounts to deliver communications, benefits, and rewards that feel uniquely tailored to each individual shopper.

Here are the core components of a loyalty program that truly drives engagement:

Personalized Rewards

Use customer data to craft rewards that resonate with individual grocery shopping behaviors and preferences. Offer discounts on frequently purchased items, exclusive deals on seasonal favorites, or rewards tailored to dietary preferences, such as gluten-free or organic products.

Dynamic Benefits and Tiers

Create tiered reward structures (e.g., silver, gold, platinum) to incentivize deeper loyalty. Offer benefits like free delivery, early access to promotions, or milestone bonuses for increased spending. These tiers encourage shoppers to consolidate more purchases with your grocery store, while keeping them engaged over time.

Omnichannel Engagement

Ensure your loyalty program is accessible and consistent across all channels. Customers should be able to track rewards, redeem benefits, and receive personalized offers whether they shop online, in-store, or through your app. Consistent messaging across email, SMS, and in-app notifications ensures the program stays top of mind for shoppers.

By integrating these dynamic elements, grocers can transform loyalty programs into powerful engines for engagement. These programs shouldn’t just reward shoppers for their loyalty—they need to offer the shopper a real relationship with their grocery store by delivering value in ways that feel personal and relevant.

Step 3: Enhance Marketing Channels

However, an effective engagement program doesn’t just focus on what grocers offer. It also considers how these offerings are delivered.

What we’re talking about here is creating seamless, omnichannel experiences that meet customers wherever they are. To achieve this, grocers must view every touchpoint, every interaction as an opportunity to leave shoppers feeling valued and understood.

While personalization provides the foundation for this, it must be built upon. This is where marketing plays a critical role in reaching modern consumers.

Marketing enables grocers to take the insights gained from the data they’ve collected and deliver meaningful messaging through:

Multi-channel Communication

Consistent messaging across email, SMS, push notifications, and on-site promotions ensures that customers receive the right message at the right time, in the channel they prefer. This keeps grocers top-of-mind and enhances engagement by meeting shoppers where they are.

Dynamic Product Collections

By grouping items into curated collections—such as seasonal meal kits, back-to-school snacks, or holiday essentials—grocers make it easier for shoppers to find what they need while inspiring more purchases. These collections simplify decision-making and encourage larger baskets.

Localized Offers

Grocery store-specific promotions, events, or deals reinforce the grocer’s role as a trusted neighborhood resource. By tailoring offers to local preferences and community needs, grocers can build stronger ties with shoppers while differentiating themselves from mass retailers.

When grocers focus on delivering value at every interaction, they transform the grocery shopping experience from transactional to personal—building trust, loyalty, and repeat visits.

Most consumers want to feel seen and appreciated. By preparing multiple marketing channels by which to reach them, grocers fulfil this desire and give greater access to the tailored experiences that save them time, money, and effort.

Step 4: Employ Programmatic Targeting

But what’s actually being delivered through these marketing channels?

Personalization and value-driven interactions come together through programmatic targeting.

By analyzing consolidated customer data, grocers can uncover actionable insights—patterns, preferences, and opportunities—that enable them to deliver the right message to the right customer at the right time. This precision allows for highly relevant campaigns tailored to specific customer segments, distributed across the multiple marketing channels that have been prepared in the previous step.

Here are some of the ways programmatic targeting can enhance engagement and drive results:

Targeted Recommendations

Use data to suggest products based on past purchases, dietary preferences, or seasonal needs. For example, a customer who buys gluten-free products could receive recommendations for new gluten-free items.

Dynamic Promotions

Offer discounts, deals, and even samples (from consumer packaged goods brands) tailored to individual grocery shopping habits. If a customer regularly buys fresh produce, they might receive a coupon for a discount on organic fruits and vegetables.

Relevant Reminders

Present recommendations and promotions timed to a customer’s purchase cycle. If the shopping behavior data shows a customer buys pet food every three weeks, they can receive a reminder with a discount on their preferred brand a few days before their usual purchase date.

Streamlined Digital Interactions

Personalize digital touchpoints like apps and websites. Features like saved grocery shopping lists, predictive cart suggestions, and reminders for frequently purchased items can make the experience faster and more intuitive.

Programmatic targeting ensures that every marketing message is intentional and relevant, making a significant impact and driving grocery shopping behaviors that contribute to higher CLV.

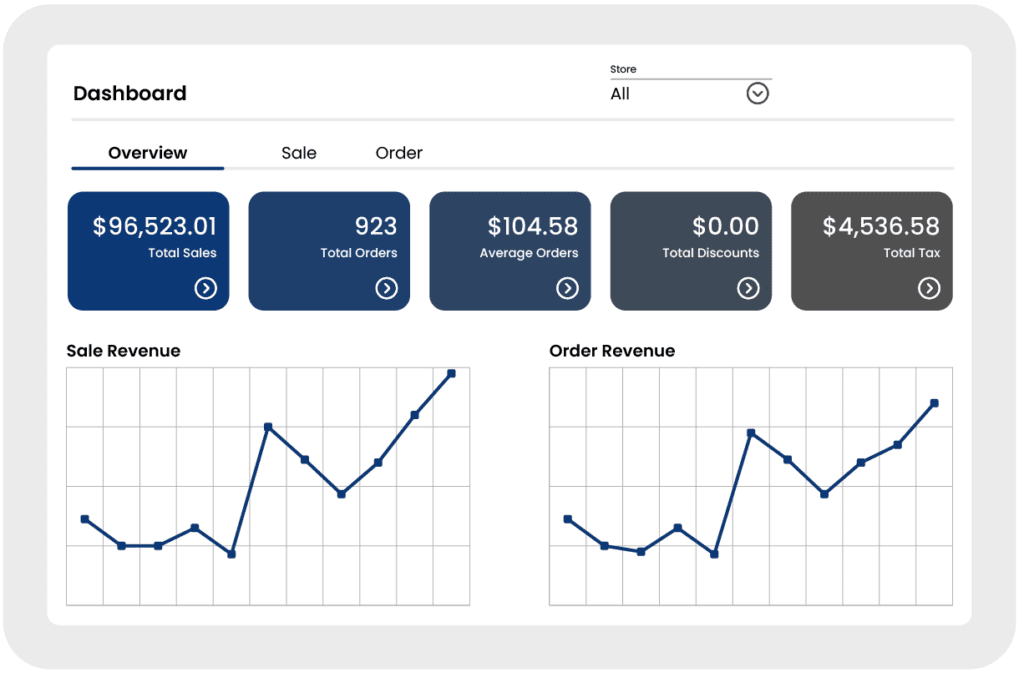

Step 5: Develop a Centralized Hub for CRM and Analytics

By consolidating data, optimizing loyalty programs, enhancing marketing channels, and using programmatic targeting, grocers create a framework for engagement. But to sustain success, these efforts must be tracked, analyzed, and refined.

The final step in creating a successful engagement program is establishing a centralized hub for managing customer relationships and analytics.

A robust CRM and analytics platform ensures that grocers can not only monitor performance but also refine and optimize their strategies over time, creating a self-sustaining cycle of improvement and engagement.

This hub should bring together tools for:

- Monitoring key metrics like retention, engagement, and CLV to measure the effectiveness of your efforts.

- Refining loyalty programs and marketing strategies based on real-time performance data and customer feedback.

- Identifying opportunities to improve engagement across all channels and touchpoints.

Iteration is essential to keeping pace with modern consumer behavior.

Think about it this way: when supermarkets use data to deliver personalized engagement, they encourage customers to buy more through an enhanced shopping experience that makes them feel valued and understood.

This positive experience:

- Builds brand loyalty, encouraging repeat visits.

- Generates more customer data, offering deeper insights into preferences and grocery shopping behavior.

- Enables grocers to create even more relevant recommendations, promotions, and communications.

This cycle of engagement—where every interaction generates data—must be used to fine-tune the segmentation and interactions that deliver increasingly relevant personalization and ultimately creates consistent, valuable interactions that boost CLV.

Redefine Customer Engagement with Mercatus

If there’s one takeaway from this article, it’s that when grocers prioritize customer engagement, they cultivate a loyal customer base that:

- Spends more per visit.

- Returns more often.

- Is far less likely to switch to competitors.

- Drives long-term profitability.

The five steps outlined in this article provide a clear roadmap for implementing a customer engagement program that delivers these outcomes. By unifying data, creating dynamic loyalty programs, and leveraging personalized, value-driven interactions, grocers can deliver the kind of experience modern shoppers expect.

But for many grocery retailers, implementing these strategies can feel daunting. The lack of infrastructure, tools, or resources often makes the idea of enhancing customer engagement seem difficult or costly to execute.

That’s where Mercatus comes in.

Through our personalization and loyalty solutions, we empower grocers to bring these strategies to life in a way that’s both effective and affordable:

- Consolidate first-party data to deliver meaningful personalization,

- Build dynamic loyalty programs that reward customer loyalty and increase CLV,

- Create seamless, omnichannel shopping experiences across digital and in-store channels, and

- Optimize customer journeys with data-driven insights to improve retention and profitability.

In addition to our technology offerings, grocers partnering with Mercatus gain access to the insights and expertise needed to turn customer engagement into a cost-effective, competitive advantage.

If you’re ready to prioritize customer engagement, retain more customers, and boost CLV across your grocery stores, contact Mercatus today to see firsthand how we can drive increased revenue for your business.

Newsroom

Newsroom