Why Grocers Need Relevance, Not More Discounts

SNAP benefits are flowing again, but the stress on household budgets hasn’t eased.

For the 42 million Americans who rely on the program (USDA), the effects of a late or reduced payment don’t fade when the next deposit arrives. It lingers in the rhythm of their grocery trips: smaller baskets, skipped extras, a carefully planned week that still runs short by Thursday.

But the strain isn’t just about SNAP. The delayed benefits hit families hard because they landed on top of everything else pressing their budget. Food prices remain stubbornly high, rent keeps climbing, and utility bills swing upward with every cold snap. When those pressures stack, even routine grocery trips—online or in-store—become exercises in math rather than habit.

Grocers feel this shift almost as quickly as shoppers do.

It’s estimated that SNAP injects roughly $8 billion a month into America’s grocery aisles. When that purchasing power tightens, the ripple is immediate. And it doesn’t bounce back. It settles into new behavior: fewer impulse additions, more trade-downs, a steady drift toward private label, and a growing willingness to shop wherever a dollar goes a little further.

Those changes reshape the strategies of retailers.

When shoppers are making every decision with heightened scrutiny, the old playbook of “cast a wide net and hope something hits” stops working. Broad promotions might bring bodies through the door, but it doesn’t equate to customer loyalty or long-term profitability.

In a moment defined by financial pressure, relevance matters more than reach because customers act on what feels tailored to their reality, not what’s simply available.

That’s what makes meaningful support the differentiator to customers and the challenge to retailers.

A Grocer Caught Between Empathy and Economics

This can play out in several different scenarios, but imagine a midsized regional grocery store that’s been part of a community for decades.

It’s one of those stores that sponsors local baseball teams and shares free bakery samples with kids on Saturday mornings. The staff know their customers by name. They know which families rely on SNAP, who prefers store brand oatmeal, and who buys two gallons of milk every time they stop in.

Data from Numerator suggests that SNAP shoppers would likely represent some of their most loyal customers, averaging 6.6 shopping trips a month compared to 6.1 for non-SNAP shoppers. They would also likely spend more overall: roughly $832 per month, about 20% higher than non-SNAP households.

For some grocers, SNAP isn’t just a segment of shoppers.

It’s up to 65% of their total sales.

NPR via Grocery Dive

But loyalty doesn’t override math.

Lately, those same shoppers are ordering smaller, more deliberate baskets. The store adjusts by rolling out broader promotions. It feels generous. It feels right.

Yet, each blanket discount slices into already thin margins and still fails to improve average order value.

Why Broad Discounts Can’t Fix a Targeted Problem

This limitation isn’t the intent behind the promotions. It’s the design.

Blanket discounts speak to everyone the same way, even though households are facing wildly different pressures. They can boost store or eCommerce traffic, but they also markdown items that would’ve sold anyway and overlook the shoppers who truly need a well-placed nudge.

They’re also relics of a market that no longer behaves the way it once did. There was a time when getting someone into the store almost guaranteed a full cart. That certainty has evaporated.

Numerator research cited by The Wall Street Journal shows the average shopper now visits nearly 21 different retailers a year for groceries, chasing value across banners and channels.

That fluidity changes what a promotion actually accomplishes. A blanket discount might get a shopper in the door or on your app for the one item that’s on sale, but that’s often where the interaction ends. They’ll redeem the offer, then head to another retailer for the next deal that helps them stretch their week.

It’s a transaction, not a relationship.

To create anything lasting, a grocer has to signal that they understand their customers the way a good in-store experience does. The right offer, aimed at the right household at the right moment, shows that you recognize what they rely on and where they’re feeling the pressure.

That kind of relevance doesn’t emerge from intuition or tradition. It comes from customer data, and using it to understand exactly how customers behave and where a small nudge can meaningfully shift their spend.

When engagement aligns with those realities, the impact multiplies. Mercatus research shows that shoppers who interact digitally multiple times per month spend 2.6× more than those who rarely engage.

It’s connection, not volume, that ultimately drives value.

In other words, an avalanche of coupons won’t grow your business. The lift grocers are looking for comes from relevance, from the sense that the retailer understands the customer’s reality and is responding to it.

How DXPro Turns Data into Dollars

This is exactly the point at which DXPro changes the equation for regional grocers.

DXPro provides something broad promotions never can: a clear view of who their customers are and what they need right now.

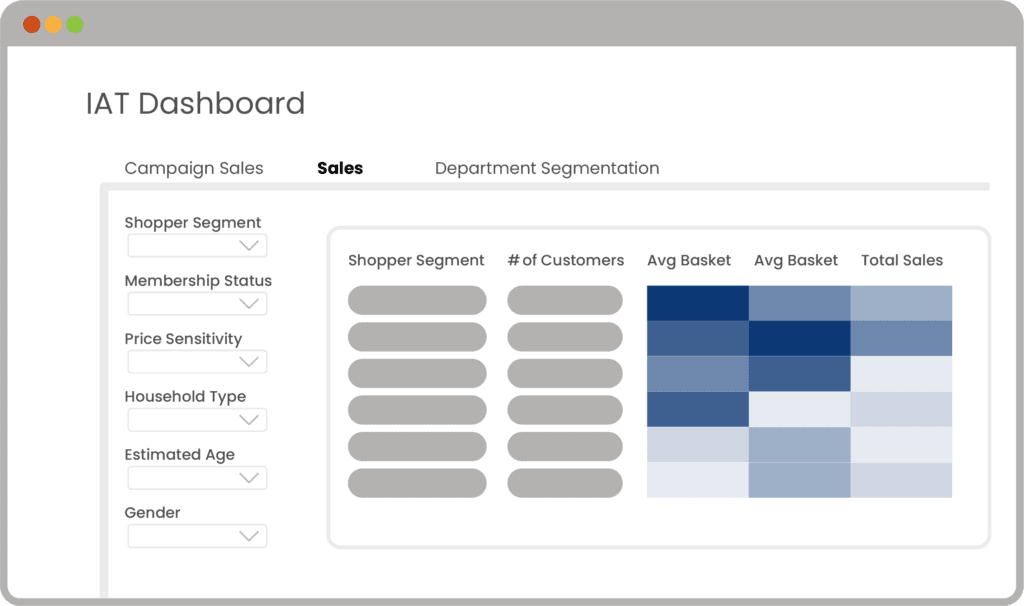

Built specifically for grocery, it unifies customer data across POS, loyalty, eCommerce, and engagement into a single, dynamic profile instead of leaving it scattered across separate systems.

With that unified intelligence, the picture sharpens. Grocers can finally see the patterns that blanket promotions blur: who’s visiting less often, whose baskets are shrinking, who’s drifting toward competitors, and which offers will actually resonate with households.

And DXPro doesn’t stop at understanding. It uses that insight to segment shoppers into prebuilt standardized engagement programs that automatically deliver timely, personalized engagement to the shoppers most likely to respond.

The effect is the opposite of mass promotion and blanket discounts.

Instead of discounting everything, DXPro helps you automatically deliver the right offer to the right household at the right moment, maximizing the impact of a discount while protecting margin.

It’s the best of both worlds: engagement that feels specific and relevant to customers; a path to profitable and long-term growth for grocers.

Proof That Personalization Pays Off

The most compelling evidence of what we’re describing above comes from retailers already using DXPro.

One regional grocer used the platform to re-engage 65% of at-risk customers within two weeks.

Ninety percent of those shoppers remained active for months, and their average basket size increased 40%, translating into more than $2 million in protected sales over six months.

That’s the impact of engagement grounded in real customer behavior, not broad assumptions.

What happens when grocers use DXPro?

65%

of targeted shoppers return within two weeks

90%

of redeemers continue to shop for months afterwards

40%

increase in average basket size for redeemers

$ 2M

in protected revenue over 6 months

A slide toward smaller baskets, fewer impulse additions, more trade-downs, and a willingness to shop wherever a dollar goes a little further is reversible. But to save millions like the retailer above, grocers have to provide meaningful engagement before the shopper drifts too far.

When that happens, shoppers feel understood, they stay longer, shop more often, and buy more when they do.

Connection isn’t a soft metric. It’s a business outcome that DXPro provides to grow baskets, increase loyalty, and customer lifetime value.

It’s Time to Decide

SNAP payments may be flowing again, but the underlying financial pressure hasn’t eased and the behavioral shifts it created aren’t going away.

Families are making more careful decisions and grocers are absorbing the impact.

DXPro is built for this exact moment.

It gives grocers the intelligence and precision needed to engage shoppers meaningfully without sacrificing margin. It transforms every interaction from a guess into a measurable opportunity and turns a customer-first philosophy into something actionable and automatic, not just aspirational.

Here’s what acting on that belief looks like:

1. Reach out to the Mercatus team

We’ll talk about your goals, your challenges, and how your shoppers are behaving today.

2. See DXPro in action

We’ll show you how easy DXPro’s modular design can be integrated into your operations.

3. Implement a solution that derives more value from shoppers

We’ll help you help your customers stretch their budgets further, and strengthens your business in the process

Because giving customers deeper relevance isn’t just good marketing. It’s how grocers grow in moments of constraint.

American households are changing their grocery shopping budgets week to week. Grocers now have a way to adapt just as quickly.

The squeeze may not be over, but the guesswork can be.

Reach out to our sales team today to see what DXPro can do for you.

Newsroom

Newsroom