The power of customer convenience: operational factors found to increase usage of grocery eCommerce service by 2.2x

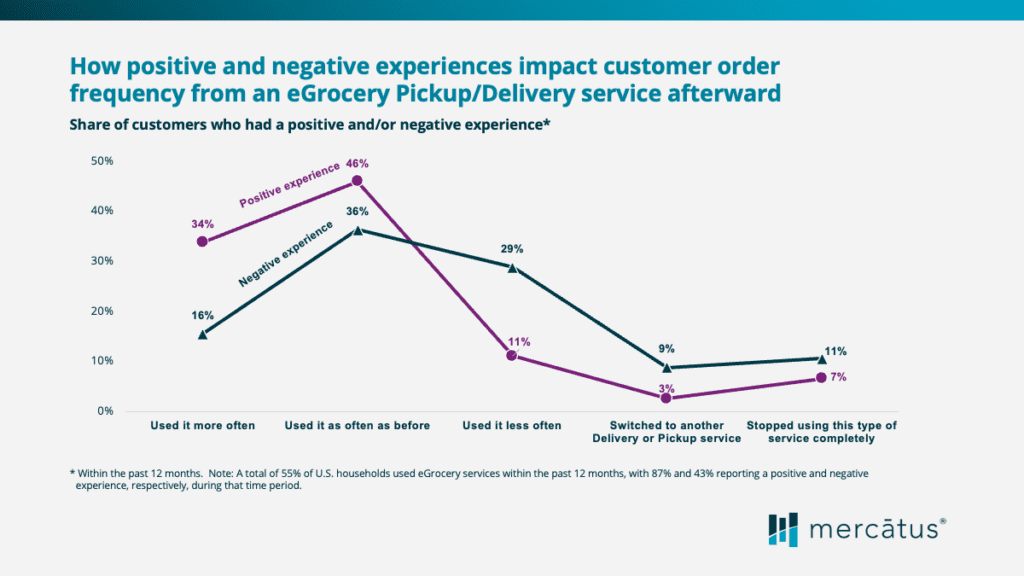

Toronto, Ontario – November 7, 2022 – Customers who had a positive online grocery customer experience were 2.2 times more likely to use that service more often than those who had a negative experience, according to Omnichannel Shopper Behavior Report 2022 Vol 3, from Mercatus, fielded October 6 – 10, 2022. The findings also identify the top factors in a positive experience, key differences between Pickup and Delivery usage and retention, and which types of financial offers motivate trial.

The contrast between the impact of positive and negative experiences is stark. Customers who had a negative experience were 2.6 times more likely to use a service less often than those with a positive experience. These dissatisfied customers were also 3.4 times more likely to switch to another service and 1.6 times more likely to stop using this type of service entirely.

“Grocery retailers who want to grow their online business need to improve the overall customer experience,” said Mark Fairhurst, VP Marketing at Mercatus. “By providing a great experience, the first time and every time, grocery retailers can retain more current customers and fuel positive word-of-mouth advocacy that can attract others to try their online services.”

The top two factors in a positive eGrocery shopping experience were receiving products in good condition, followed closely by getting everything they ordered. This suggests that grocery retailers can improve repeat online purchase frequency by focusing on the operational factors that contribute to positive customer experiences, including issues related to inventory visibility, substitution practices, and how orders are distributed to customers.

“When it comes to a positive eGrocery experience, minimizing out-of-stocks is important but providing products in the condition that customers expect is essential,” said David Bishop, partner at Brick Meets Click. “In other words, having the exact product ordered is good but ensuring that the ice cream is frozen when it arrives is even better. The reward for making improvements in the necessary operational areas can be substantial.”

The Mercatus research also revealed several significant differences between Pickup and Delivery. Nearly half of U.S. households used Pickup during the past 12 months compared to one-third for Delivery; however, Pickup shows greater retention. Two-thirds of Pickup’s annual user base remained active during the past month versus only half for Delivery. Customers were 30% more likely to encounter a poor experience with eGrocery Delivery as opposed to Pickup.

For grocery retailers who want to shift customer demand toward Pickup, the new results suggest a couple of tactics to consider. Excluding health and/or medical issues, financial incentives topped the list of reasons that would motivate a shopper to try a new or different online service.

The top two financial incentives were essentially tied – paying no fee on the first 3 orders and getting $20 off the first order of $75 or more – but the no-fee offer appealed more broadly across all customer segments. For retailers, the no-fee offer is also a win-win since it motivates multiple orders as opposed to a deep discount that’s focused on initial trial and not repeat usage.

“Going forward, online growth will be fueled by the steps grocery retailers take to provide a differentiated customer experience that blends technology, insight, and operational excellence to encourage more frequent repeat purchases,” explained Sylvain Perrier, president and CEO, Mercatus. “Fundamentally, it comes down to knowing who your customers are, understanding what they want, and developing better ways to satisfy those needs.”

This research and related report are Volume 3 in the three-part Omnichannel Shopper Behavior Report series and analyzes what affects the customer experience and how that impacts usage and customer attitudes. Volume 1 examines how customers seek to maximize convenience and minimize costs in grocery Delivery. Volume 2 explores why convenience and costs are driving more customers to grocery Pickup.

For information about how to access the Omnichannel Shopper Behavior research and reports, go to mercatus.com.

About this shopper research

The custom shopper research from Mercatus was conducted by Brick Meets Click via an online survey on October 6 – 10, 2022 with 1,843 U.S. adults, 18 years and older, who participated in the household’s grocery shopping. The sample was weighted to match current population measures related to age and Census region based on the 2020 American Community Survey from the U.S. Census Bureau. The margin of error for the top-line results was +/- 2.3% at the 95% confidence level.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in customer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets, Southeastern Grocers’ Fresco y Más, Harveys Supermarket and Winn-Dixie grocery stores among others.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.