US eGrocery Sales Trends with Brick Meets Click – February 2024 Insights

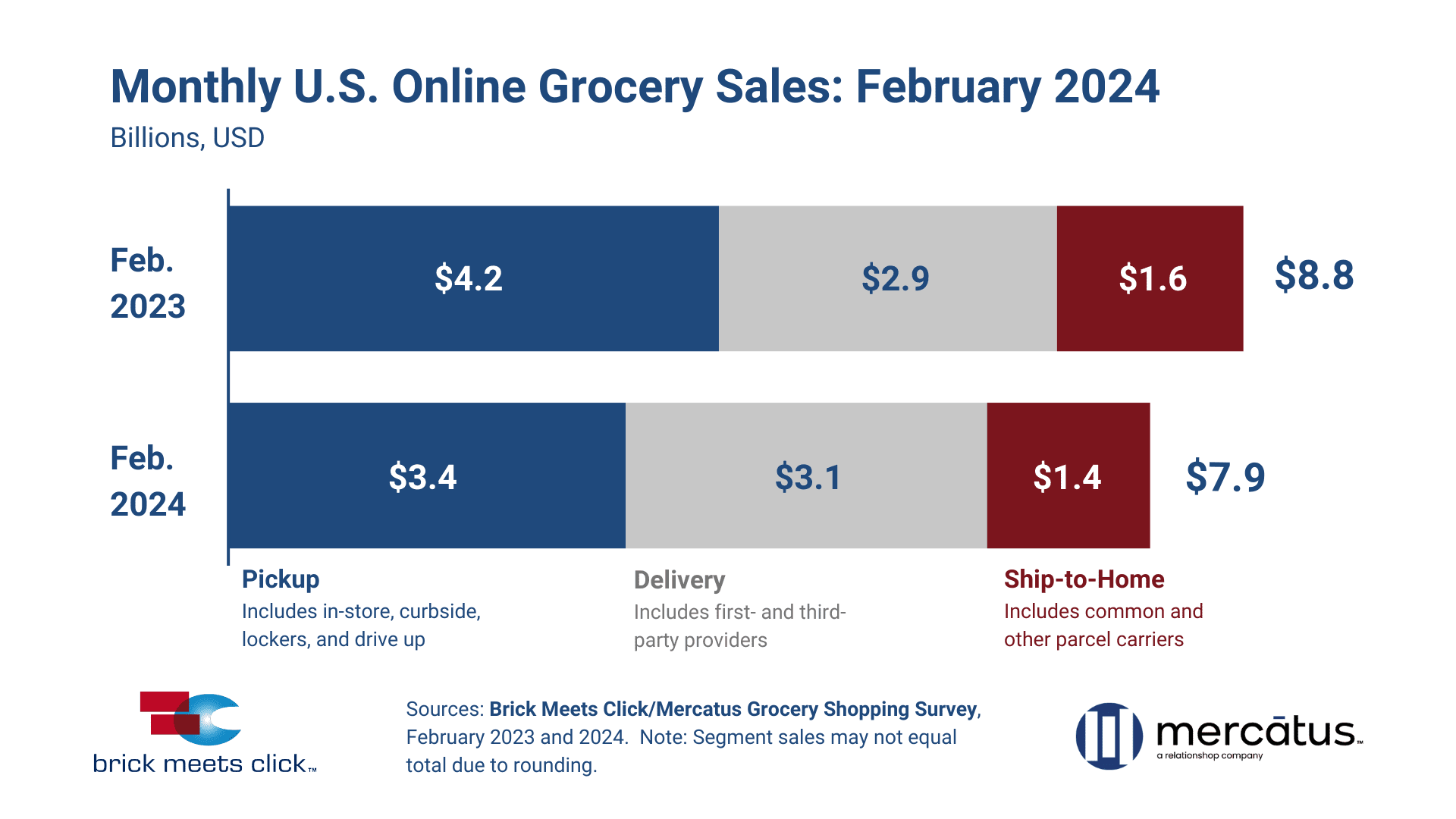

February U.S. eGrocery Sales Total $7.9 Billion, Down 10.5% Over Previous Year

The latest data from the Mercatus/Brick Meets Click February 2024 Grocery Shopping Survey has just been released. As always, there are several takeaways and recommendations to consider based on last month’s sales numbers — including a further emphasis on the importance of providing a truly engaging customer experience.

But before we get into any strategic recommendations, let’s address the overall numbers:

Top-line sales in the U.S. eGrocery market totaled $7.9 billion in February, down 10.5% compared to one year ago. The decline is mostly due to a reduction in average order values (AOV) across all receiving methods and store types — with even Walmart experiencing a slight 2% decline.

Despite all receiving methods falling victim to the AOV downturn, Delivery stood out with a 4.7% increase in sales, aided by a strong rebound in monthly active users (MAUs) versus last year. Meanwhile, Ship-to-Home dropped 15.4% and Pickup fell 12.8%

We’ll identify the primary reason why AOV dropped last month — and take a deeper look into some of the other data from February’s eGrocery sales report — in the analysis below.

February 2024 US Online Grocery Sales

What Caused The 10.5% Decline In YOY Sales?

We already mentioned the impact lower AOV had on total sales in February. The timing of the decline, coinciding with the end of emergency pandemic allocations for SNAP, is not a coincidence.

Ending SNAP has affected overall consumer spending habits through a pronounced pullback among lower-income households. Fewer lower-income households reported using a Pickup or Delivery service during February 2024, as penetration pulled back 70 bps and 460 bps, respectively, compared to last year.

Because lower-income households represent nearly half of Walmart’s MAU base for online grocery orders — but less than 40% for Supermarkets — Walmart experienced a 150 bps drop in penetration compared to a 60 bps drop for Supermarkets among this customer segment.

Did Delivery Defy The Downward Trend?

Despite the drop in AOV, Delivery’s overall sales numbers — up 4.7% YOY — appear to be fueled by an uptick in MAUs. While the increased availability of Delivery through third-party markets is contributing to this number, Delivery’s growth can be mostly attributed to an easier comparison to lower February 2023 numbers.

- Pickup’s overall sales fell 12.8% YOY with a 13% decline in AOV.

- Delivery’s sales grew 4.7%, but witnessed a 7% AOV downturn.

- Ship-to-Home dropped 15.4% in terms of sales, and saw its AOV reduced by 13%.

Repeat Intent Rates Are On The Decline

During February, repeat intent rates for Pickup and Delivery services fell to 56.2%. This is one of the lowest levels reported over the past two years, as an increasing number of second- and third-time customers said they were significantly less likely to use the same service again within the next 30 days.

While the cessation of SNAP can be partly blamed for the decline, it should further emphasize the importance of maintaining customer retention tactics to grocers.

Cross-Shopping Declines

Speaking of the importance of customer retention…

After a few straight months of YOY decline, cross-shopping between Mass and Grocery increased in February. Last month, more than 30% of households that bought groceries online from a Grocery service also did so from a Mass Retailer.

Just as we see with the decline in repeat intent rates, the continued pressure of economic uncertainty is dictating a shift in consumer preferences. Staying aware of these shifts and responding quickly to customer demand is going to be vital for grocers in the coming months.

Key Takeaways from February 2024 eGrocery Sales:

- The U.S. eGrocery market totals $7.9 billion in February 2024. This 10.5% decrease from the previous year, driven by lower AOVs, is a result of households having reduced purchasing power. Yes, the timing can be linked to the end of SNAP payments, but the general state of the economy remains the true culprit.

- The composite Grocery and Mass repeat intent rate for Pickup and Delivery services fall to 56.2%. This 850 basis points decline versus 2023 again signifies how consumers are responding to economic pressures. Cost considerations are becoming increasingly decisive in how and where customers shop online.

- Supermarkets experience a 15% drop in AOV for Pickup and Delivery compared to February 2023. While most retailers and formats experienced lower AOVs versus last year, the decline was felt most significantly by the Supermarket segment.

- All three receiving methods expand their MAU bases. Despite the declines in AOVs and the low repeat intent rate, more customers were ordering more frequently for Pickup, Delivery, and Ship-To-Home in February.

- More than 30% of households cross-shopped in February. This not only represents a 170-bps increase in cross-shopping between Grocery and Mass last month, but also a doubling of the rate compared to pre-COVID times.

Strategic Recommendations

Address The AOV Challenge Through Pricing

With the decline in AOVs causing all sorts of havoc, grocers need to double down on their efforts to increase basket sizes. That means innovative pricing and promotion strategies that, yes, include traditional tactics like bundling and rewards for higher spending thresholds.

However, enhanced pricing strategies can also extend to receiving methods. Larger retailers and third-party delivery programs are finding success through membership plans and threshold offers that significantly reduce the cost of delivery to the consumer. Adopting and adapting this tactic to increase order sizes can appeal to the value-driven approach customers are taking.

The challenge will be in finding the line between competitive and profitable with these offers. Lean into the data and analysis that technology can provide to discover the most effective thresholds.

Enhance The Customer Experience With Greater Control

Another adopt-and-adapt tactic for regional grocers is the focus on customer experience that the big retailers are making. The Targets and Walmarts of the world have invested heavily in customer experience to incentivize repeat purchases.

Last month, we discussed the importance of ensuring every interaction you have with a customer reflects your brand’s values and service standards. Although incredibly important, that doesn’t just refer to the ordering process. It also extends to the distribution component of the customer experience.

By taking greater control of the entire customer journey, grocers can establish a cycle of continuous improvement for the shopping experience they provide. This approach not only ensures your values and standards are implemented, but it also allows you to gather your own detailed data. This data can then be used to drive personalization efforts, significantly enhancing the overall customer experience.

Monitor Your Delivery Service Data

Delivery has performed comparatively well for a few months in a row. However, it’s not entirely clear how much of this is due to third-party providers offering unsustainable discounts, poor performances from one year ago, or an overall shift in consumer preferences.

This past month’s decline in AOV and repeat intent rates would suggest it isn’t the latter. However, it’s worth keeping an eye on how your specific customers are responding in terms of value versus convenience with their receiving methods. This will keep you agile and ready-to-respond to the ongoing shifts in consumer behavior we’ve witnessed throughout this period.

Don’t Lose Sight of Cross-Shopping

Cross-shopping numbers are increasing after a couple encouraging months of decline. For regional grocers and independents, this once again emphasizes the need to develop compelling loyalty programs through personalization. The technology exists to engage customers beyond a traditional transactional relationship — and make them feel as though your store is designed specifically with them in mind.

Closing Thoughts

The main theme from this month’s Mercatus/Brick Meets Click Grocery Shopping Survey is agility. Consumer behavior is continuing to shift in both anticipated and unanticipated directions, based primarily on the current state of the economy and how that’s influencing their purchasing power.

This further reinforces the importance of using technology to leverage data and respond quickly to these changes. Personalization is the most effective way to deliver an optimal experience to each customer in a varied market such as this.

Thanks for reading.

For more details on this month’s eGrocery sales numbers, read the complete press release here. As always, stay tuned for next month’s analysis.

Newsroom

Newsroom