US eGrocery Sales Trends with Brick Meets Click – October 2024 Insights

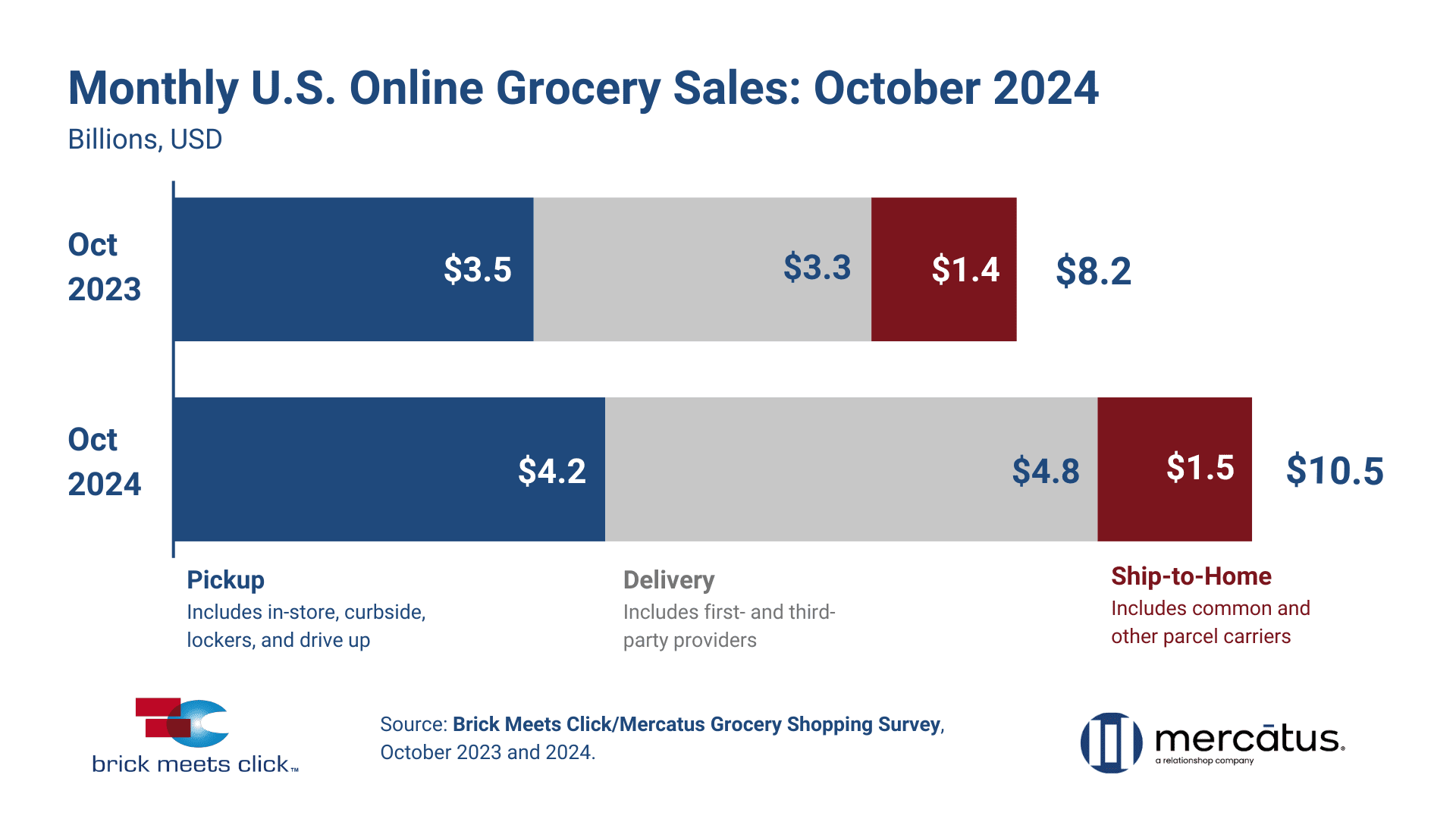

Driven by Delivery, Pickup, and Ship-to-Home, eGrocery Sales Surge to $10.5 Billion in October 2024—a 28% YOY Increase

The trend set by September’s online sales growth has continued into October.

High twenty-percent gains thanks to deep-discount strategies are pushing October’s year-over-year (YOY) eGrocery sales up 28% to $10.5 billion, a number not seen since the peak of ordering activity in the pandemic.

Top retailers like Kroger, Walmart, and Instacart are offering big discounts on annual subscription plans, while newer players like DoorDash and Uber attract users with extended free trials contributing to the 46% year-over-year boost in Delivery sales.

As competition heats up, grocers without a strong subscription model may feel the strain. In October, nearly 40% of eGrocery households shopped across both Grocery and Mass formats—a five-point increase from last year—indicating that customers are more open than ever to exploring their options.

David Bishop, Partner at Brick Meets Click, explained, “Delivery is riding its next growth curve, fueled not simply by subscriptions or membership offers but by promotional tactics that encourage annual commitments.”

This report highlights October’s record-breaking eGrocery sales and the rising competition in the market. Do you know how your regional grocery business can compete?

Dive into this month’s report for actionable insights and strategies to keep your regional grocery business competitive moving into the holidays and the new year.

October 2024 US Online Grocery Sales Analysis

Delivery’s Momentum Pushes October Performance

It’s undeniable that hefty delivery discounts have played a pivotal role in boosting eGrocery sales, with October 2024 setting even more impressive milestones. This month’s data highlights just how impactful these promotions have been, pushing delivery to new record highs across key metrics.

- MAU Expansion: Delivery’s Monthly Active User (MAU) base expanded by 16% YOY, with growth primarily seen in households aged 30-60.

- Higher Order Frequency: The surge in Delivery’s user base led to a 24% increase in order volume compared to October 2023, significantly widening Delivery’s lead over Pickup in large metro areas.

- Increased Average Order Value (AOV): Delivery’s AOV rose by over 15% YOY, fueled by a growing share of high-frequency users who tend to spend more on each order.

- Promotional Impact: Ongoing deep-discount strategies—such as discounts on annual subscriptions from Walmart, Kroger, and Instacart—played a key role in expanding Delivery’s reach and maintaining strong growth momentum in user activity.

Pickup and Ship-to-Home’s Performance

Pickup and Ship-to-Home continue to be areas of growth in the industry and more importantly, an area of opportunity for regional grocers.

Here is Pickup and Ship-to-Home YOY growth from October:

- Pickup sales rose to $4.2 billion, up nearly 20% YOY, driven by a 6% increase in order volume and boosted AOV (+13%). Growth stemmed mainly from higher order frequency rather than new users, with gains in some age groups offset by a decline among 45-60-year-olds.

- Ship-to-Home sales experienced a more moderate growth at 6% YOY to $1.5 billion, with AOV up 12%, driven by Amazon’s 16% order size increase. MAUs rose 3%, especially among younger and older shoppers, though overall order volume declined 5% as users placed fewer orders.

Highlight: Per-household Purchase Trends

The U.S. eGrocery market saw a substantial rise in spending per household, driven by increases in average order values (AOV) across all delivery methods.

Delivery, in particular, achieved notable growth, with a 15% boost in AOV due to a combination of frequent use and rising spending habits among loyal customers. Pickup followed closely, with an almost 13% increase in AOV, while ship-to-home posted a nearly 12% jump, largely supported by Amazon’s strong performance in this category. These gains reflect consumers’ increasing reliance on online grocery services and highlight the effectiveness of deep-discount strategies and subscription offers in driving higher-value purchases.

10 Key Takeaways from October 2024 eGrocery Sales:

- October eGrocery sales increased by 28% YOY reaching a record $10.5 billion.

- Delivery Growth: Delivery sales jumped 46% YOY to $4.8 billion, driven by a 16% rise in MAUs and a 24% increase in order frequency.

- Pickup Expansion: Pickup sales grew nearly 20% YOY, reaching $4.2 billion, with stable MAUs and a boost in AOV.

- Ship-to-home Gains: Ship-to-home rose 6% YOY to $1.5 billion, supported by demand among young and older shoppers, despite a dip in middle-aged households.

- Market Share Shift: Delivery expanded its share lead over Pickup in large metro areas, capturing more MAU activity.

- Increased Order Frequency: Delivery orders per user climbed 24% YOY, reflecting higher engagement and repeat orders.

- AOV Growth Across Methods: Average order value rose for all fulfillment methods, with delivery up 15%, pickup up 13%, and ship-to-home up nearly 12%.

- Rising Cross-Shopping: 40% of eGrocery households ordered from both grocery and mass, up 5 percentage points YOY.

- Repeat Intent Gap Widens: Mass retailers strengthened repeat intent scores in both delivery and pickup, widening their lead over grocery.

- Subscription-driven Retention: Aggressive subscription discounts (up to 80%) from major players like Walmart and Instacart bolstered customer loyalty, favoring long-term retention over free trials.

These takeaways highlight a competitive landscape where targeted discounts, subscriptions, and cross-shopping trends are shaping the eGrocery market’s growth trajectory.

Strategic Recommendations for Grocers

Offer the Best of Both Worlds

Integrating online and in-store promotions creates a seamless, loyalty-boosting experience that helps regional grocers truly stand out.

By offering loyalty points and discounts redeemable across both digital and physical channels, regional grocers provide the kind of flexibility and convenience that keeps customers coming back. This omnichannel approach, paired with the proximity advantage and a strong focus on locally sourced products, creates a well-rounded shopping experience that meets customer needs and positions regional grocers as a preferred choice.

Digital loyalty programs further enhance this strategy by delivering app-exclusive deals, real-time stock updates, and timely notifications for in-store events or limited-time offers. These features not only encourage customers to visit the store, but also keep your brand top of mind.

Through this unified approach, regional grocers are able to capitalize on their local presence by offering a highly personalized and engaging experience rooted in both convenience and community—qualities that set them apart in a market where large players often rely on scale alone.

Take on the Cross-shopping Gap

October’s report shows a gap in online order averages between mass retailers and general shopping trends, suggesting that customers are fulfilling their needs by shopping across multiple formats like Amazon for ship-to-home or other supermarkets for delivery and pickup.

To capture more of these “gap” orders and enhance customer loyalty, regional grocers can introduce subscription models or rewards specifically designed for frequent shoppers. By offering loyalty bonuses, exclusive savings, or subscription options on fresh, local produce and popular categories, grocers encourage customers to consolidate more of their shopping within one platform.

These incentives should be tailored to reflect local preferences, emphasizing quality, freshness, and the convenience of nearby sources—a combination that big chains may struggle to match.

Understanding customers’ cross-shopping behavior and what drives them to other formats enables regional grocers to create a compelling, loyalty-boosting experience that aligns with both convenience and value. This approach not only increases repeat purchases but also strengthens ties with local shoppers who value the unique benefits of shopping with a regional grocer.

Less Chasing, More Keeping

The October report highlights yet another record-breaking month for eGrocery sales, signaling a pivotal time for grocers. With many markets nearing saturation, it’s becoming more important than ever to focus on keeping current customers happy rather than chasing new ones.

Regional grocers should focus on loyalty-boosting tactics like subscription models and personalized incentives to build a “I’d rather shop here” mindset among regular shoppers. Offering exclusive deals on fresh produce or rewarding frequent orders with unique perks can create a lasting connection that keeps customers coming back.

While big players are driving cross-shopping with heavy discounts, regional grocers can leverage their own customer data to craft unique, personalized experiences. By tapping into individual shopping habits and offering customized rewards, regional grocers can create a familiar, irreplaceable brand connection that makes it harder for shoppers to switch to mass retailers.

Investing in loyalty programs and retention strategies allows regional grocers to grow their share of customer orders, building a level of loyalty that big chains often can’t replicate.

Segment Smarter, Compete Stronger

As the eGrocery market becomes increasingly competitive, knowing who your customers are, and what keeps them coming back, is more impactful than ever for regional grocers looking to stay ahead.

For instance, data from earlier in the summer suggested that many of the lapsed or infrequent shoppers were swayed by enticing discounts—highlighting an opportunity to re-engage these valuable but inconsistent customers. With Walmart seeing a surge in monthly active users (MAUs), it’s clear they’re effectively reaching these groups with tailored incentives.

Regional grocers can leverage a similar approach by identifying and nurturing distinct customer segments.

A prime example of successful segmentation is Sprouts Farmers Market, which has thrived by focusing on customers seeking natural and organic products. Positioned in the premium market, Sprouts stands out not by price but by deeply understanding their customer needs and values.

For regional grocers, adopting a similar strategy—segmenting customers based on specific purchasing behaviors and preferences—can allow for personalized messaging and incentives. This customer-focused approach strengthens loyalty, making it harder for big players to pull these shoppers away, regardless of discounts and scale.

Closing Thoughts

This month’s report highlights the ongoing momentum in eGrocery growth, fueled by aggressive discounts and loyalty promotions from national players. Regional grocers have opportunities to tap into this and make their own impact.

Where large retailers leverage scale, regional grocers can focus on their unique strengths: personalized service, community connections, and tailored shopping experiences that truly resonate. Regional grocers should focus on integrating online and in-store promotions, addressing cross-shopping gaps with tailored rewards, prioritizing retention over new acquisitions, and leveraging customer segmentation for targeted engagement.

This strategic focus on what makes regional grocers unique is about truly leading in areas where big chains can’t easily follow. Building lasting loyalty in this way ensures that customers see more than just convenience—they see a trusted partner in their local grocer.

Thank you for diving into this month’s insights with us. If you have any questions related to this month’s report, please don’t hesitate to reach out. For more insights from the Brick Meets Click/Mercatus October 2024 Grocery Shopper Survey, you can access the full report here.

Newsroom

Newsroom