eGrocery Trends with Brick Meets Click – January 2021 Insights

Online Grocery Services Shoppers are using

According to the January 2021 Brick Meets Click/Mercatus Grocery Shopping Survey, the month’s record high total online sales were driven the growth monthly active users (up 16%) and are tempered by flat average number of orders per month and a 10% drop in average order value across all three types of fulfillment (ship-to-home, delivery and pickup).

4 Ways Online Shoppers are impacting eGrocery in January 2021

Growing the Base for Grocery Delivery and Pickup

The increase in total online sales for January 2020 was driven largely by a 16% increase in the number of households buying online (A). Among the total household monthly active users –

- 78% engaged with either a delivery or pickup service – up from 64% in November.

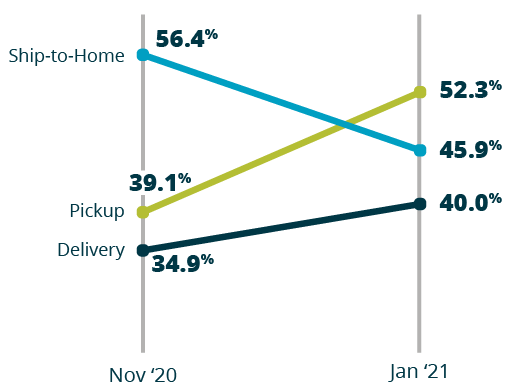

- 46% used a ship-to-home service – down from 56% in November. (B)

A. The 16% increase is the 60.1 HHs to 69.7 million HH

B. Both Pickup and Delivery methods reach their highest usage levels while ship-to-home dropped to 46% (it’s lowest to date) down from 56% in Nov.

Shifting Orders Towards Delivery and Pickup

While the average number of total online grocery orders placed by monthly active users for January 2021 remained at 2.8, essentially flat versus November 2020, the order mix changed as the delivery and pickup segments collectively.

- Gained eight percentage points of order share for Jan vs Nov.

- Accounted for 66% of all online orders completed during January 2021 up from 57.5% in Nov ’20.

The Pickup segment gained six percentage points for Jan vs Nov.

Decrease in Average Order Value

The average order value decreased nearly 11% in January 2021 versus November 2020 when analyzing the aggregated spend rates across all three segments (pickup, delivery, and ship-to-home).

Decrease in Customer Satisfaction

January’s ratings for intent to make a repeat purchase in the next month were down across all retail formats and segments.

- The overall satisfaction metric dropped to 56% in January, down more than 32 percentage points from the record high ratings level in November 2020; the pickup segment had the greatest decline (35 points) during the period. (from the Press Release).

- January’s drop in repeat intent scores can be partially explained by shifts in the customer mix, but retail conditions are causing a decrease in satisfaction levels among even the more experienced customer cohort; intent-to-repeat for this group dropped by almost 18 points in January compared to November 2020.

“While throwing more labor at the issue isn’t ideal, this, along with improving assembling productivities via enhanced pick and pack practices, is vital to remaining competitive in the near term and not inadvertently giving your customer a reason to shop elsewhere. Even though many grocers remain capacity constrained – especially with pickup – others are growing market share as they staff up or expand pickup to a larger store base,” explains David.

-David Bishop, partner, Brick Meets Click.

For a more extensive summary of the January 2021 research insights is available from Brick Meets Click via subscription to the eGrocery Insights Program. To purchase a single-month or three-month subscription, please visit brickmeetclick.com.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

Newsroom

Newsroom