US eGrocery Sales Trends with Brick Meets Click – June 2025 Insights

Online Grocery Sales Reach $9.8 Billion in June—Up 28% Over Last Year

After a seasonal dip in May—the only month since August 2024 below $9.5 billion—U.S. eGrocery sales rebounded strongly, hitting $9.8 billion in June, up 28% year-over-year.

While this growth continues to be primarily driven by delivery—fueled by aggressive membership discounts that essentially make it free—pickup and ship-to-home also saw remarkable increases of more than 25% each.

This broad-based growth shows just how dramatically shopper expectations are changing.

Consumers are no longer loyal to a single channel, trip type, or brand experience

They’re moving fluidly between pickup, delivery, and in-store based on convenience, value, and need.

For regional grocers, that means the path to customer retention isn’t about offering every option at any cost. It’s about understanding which of your customers are using which services, as well as when and why.

The only way to compete effectively in this environment is by leveraging customer data—especially first-party data—to identify behavior patterns, anticipate needs, and build smarter, more relevant shopping experiences.

Walmart’s Strategic Advantage Is First-Party Data Ownership

For regional grocers, this raises a critical question: Are you truly using your customer data to keep pace with changing shopper expectations and turn that insight into lasting loyalty?

To appreciate the urgency of this question, consider how Walmart is gaining market share.

The big retailer has increased the profitability of its eGrocery operations—and driven much of the growth in delivery sales—by strategically shifting to direct ownership of its digital relationships with customers.

It’s currently capturing nearly 95% of online grocery orders via first-party channels.

This deliberate shift to first-party data gives Walmart deeper insight into individual shopper behaviors, allowing targeted, personalized promotions to engage customers and strengthen loyalty.

As a result, they’re continuing to draw customers away from grocers, with more than one in four regular supermarket customers also ordering groceries from Walmart last month.

Why Grocers Struggle to Leverage Customer Data Effectively

In contrast, regional grocers are failing to capitalize on first-party data, due to three main challenges:

1. Assumptions about existing customer knowledge

Many grocers understandably believe they already deeply understand their customers, given years of face-to-face interactions.

Yet the reality is customer habits and expectations—especially around digital and fulfillment—shift dramatically and quickly, leaving many grocers behind.

Fewer customers are sticking with one fulfillment method and more are jumping between all three in a given month.

2. Disconnected legacy systems

Fragmented legacy technologies—POS, loyalty programs, payment processing, and fulfillment—result in disconnected silos.

This makes accessing unified customer insights challenging and creates friction in the shopping experience.

3. Over-reliance on third-party marketplaces

Third-party platforms offer convenience and immediate access to a large market, but there’s no such thing as a free lunch.

Reliance on these platforms cost grocers immensely in terms of control over customer experience, retail media opportunities, and most importantly, valuable first-party data.

Without this, effective personalization and strategic insights are nearly impossible.

How Regional Grocers Can Close The Data Gap

That’s why Mercatus developed DXPro.

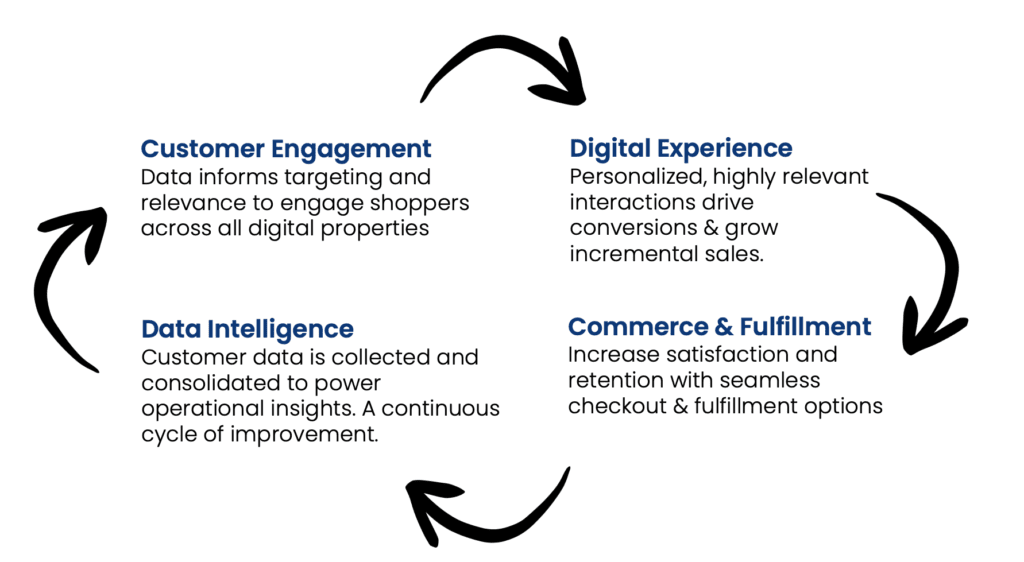

DXPro is an integrated digital experience platform designed specifically to give grocery retailers the tools to overcome these barriers and fully capitalize on the power of first-party customer data.

It consolidates your existing systems—POS, loyalty programs, payments, and fulfillment—into one unified platform, providing full visibility and control over your first-party customer data.

Here’s exactly how DXPro helps grocers leverage customer data effectively to compete in today’s fast-changing market:

1. Reduce dependence on third-party marketplaces

DXPro is designed so that your data, your customer insights, and your engagement strategy don’t get siphoned off by third-party marketplaces.

Every action a customer takes—every clip, every cart, every reorder—feeds back into your ecosystem to enable personalized offers, smarter fulfillment, and ultimately, long-term profitability.

2. Understand and respond to shifting fulfillment preferences

DXPro’s embedded Customer Data Platform (CDP) consolidates all of the first-party shopping data that you own.

This provides clear insights into behaviors, order preferences, and fulfillment trends, so you can segment quickly and extend personalized offers strategically.

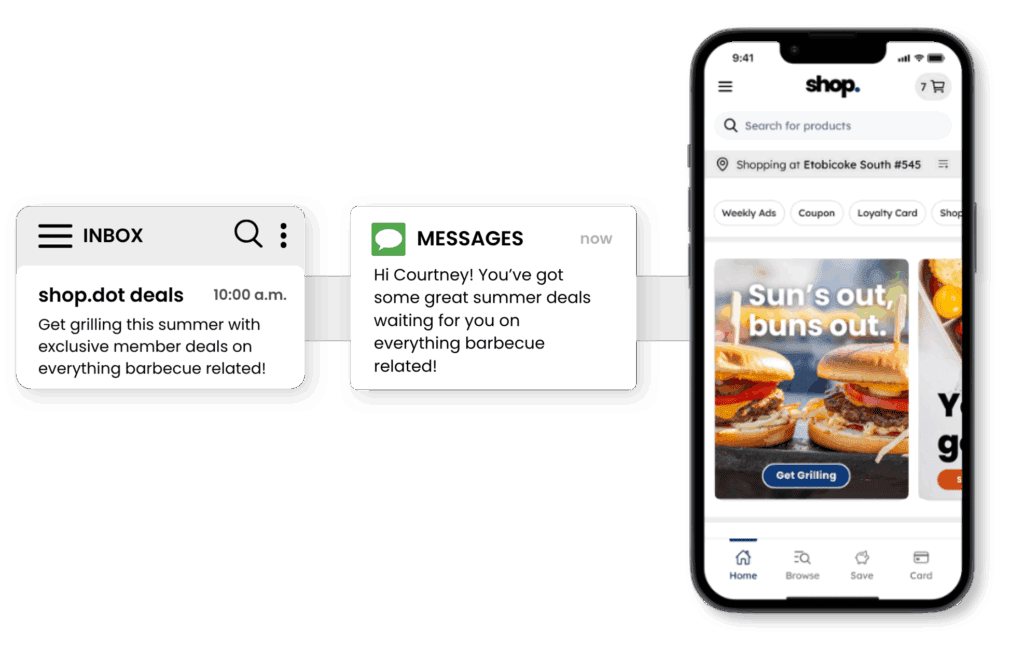

3. Deliver personalized promotions that build real loyalty

These offers are then delivered automatically across multiple channels.

DXPro automates engagement via email, SMS, in-app messages—all triggered by real-time customer behaviors and purchasing patterns.

Customers receive promotions precisely aligned to their needs, increasing basket sizes and repeat visits.

4. Create seamless shopping experiences

Engaging across multiple channels is only meaningful when the underlying experience is unified.

DXPro uses customer data from both in-store and online interactions to connect every touchpoint into one consistent, frictionless experience.

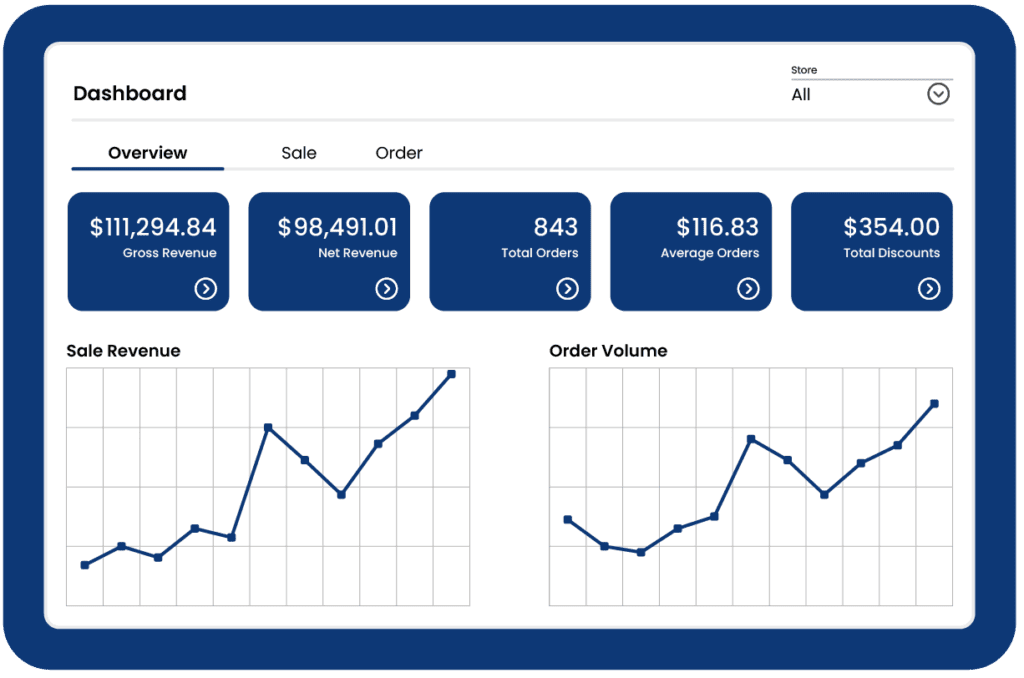

5. Make smarter, data-driven investment decisions

DXPro’s built-in analytics and ROI reporting tools enable you to replicate successful campaigns across multiple segments and regions.

Measure success clearly, so you can optimize spend, confidently scale, and identify new growth opportunities.

Make Customer Data Your Strategic Advantage

This month’s sales trends—and Walmart’s continued gains—highlight what’s working in today’s market: Retailers that control their customer data are better positioned to adapt, personalize, and grow.

With DXPro, regional grocers can move beyond disconnected tools and third-party reliance toward a fully integrated, data-backed strategy that strengthens loyalty and improves performance.

The result?

Smarter engagement, stronger margins, and the ability to scale what’s working without needing a Walmart-sized budget.

Download the Brick Meets Click / Mercatus US eGrocery Sales Report for June 2025 to explore the data behind these insights.

Newsroom

Newsroom