Grocery Trends for Shopper Behavior One Year into the Pandemic

One year into the pandemic, Brick Meets Click’s ongoing research has uncovered important online grocery trends for shopper behavior.

We recently passed a critical milestone: one year of living with COVID-19. And that means, with the March 2021 edition of the ongoing research by Brick Meets Click sponsored by Mercatus, we now have a year’s worth of online shopping data collected since the first pandemic shelter-in-place orders took effect.

This is providing some key insights into grocery trends for shopper behavior, and the shifts that have occurred since the beginning of the pandemic. How are grocery shopping patterns evolving? Which behaviors are attributable to pandemic-induced panic buying, and which ones represent long-lasting consumer patterns? What can grocers expect from the coming year, and how can they prepare?

Get the highlights, in this discussion between Mark Fairhurst, VP of Marketing at Mercatus, and David Bishop, partner, Brick Meets Click. (Watch the video here.)

March survey highlights

Overall, the March survey suggests online grocery continues to have strong support from shoppers. March 2021 logged $9.3 billion in online grocery sales, a return to the record-high spending levels seen in January of this year following February’s brief decline. And, when compared to March of the previous year, March 2021 sales are up 43%.

While fewer households (69.3 million) ordered groceries online this March compared to last (74.5 million), they placed more orders per month.

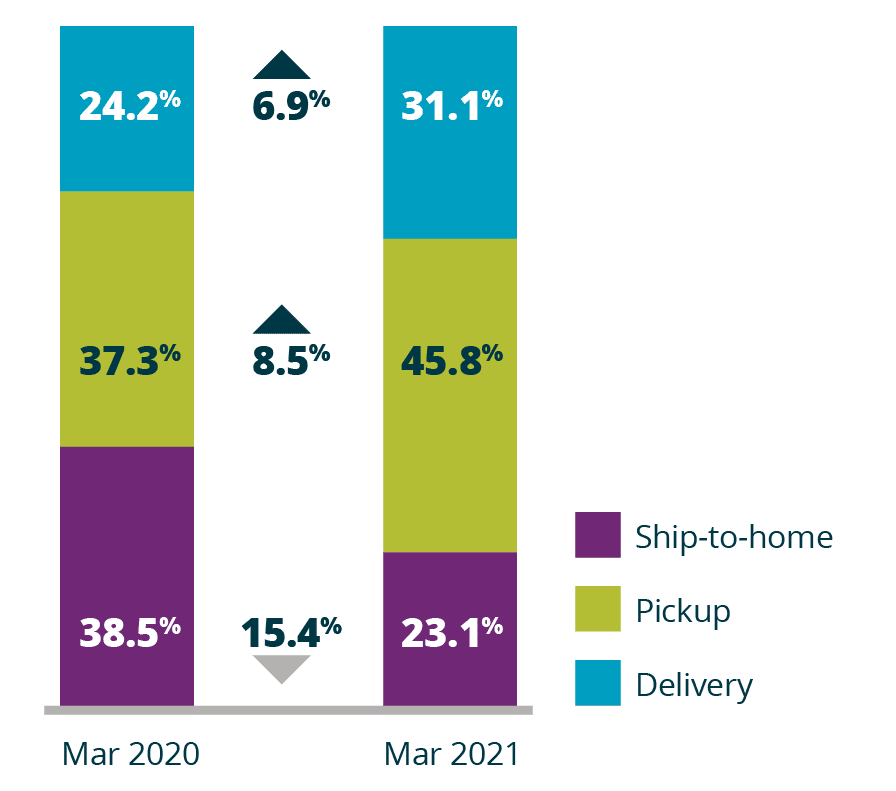

Notably, the 7% drop in monthly active users was entirely attributable to the decline in grocery purchases shipped to home via common or contract carriers. The ship-to-home segment lost 27% of its monthly users over the past year, while the pickup and delivery segments gained 12% and 23%, respectively. Despite the larger bump up for delivery, pickup is the preferred choice in the U.S., claiming nearly 46% of online grocery sales in March 2021, compared to 31% for delivery.

Grocery trends for shopper behavior

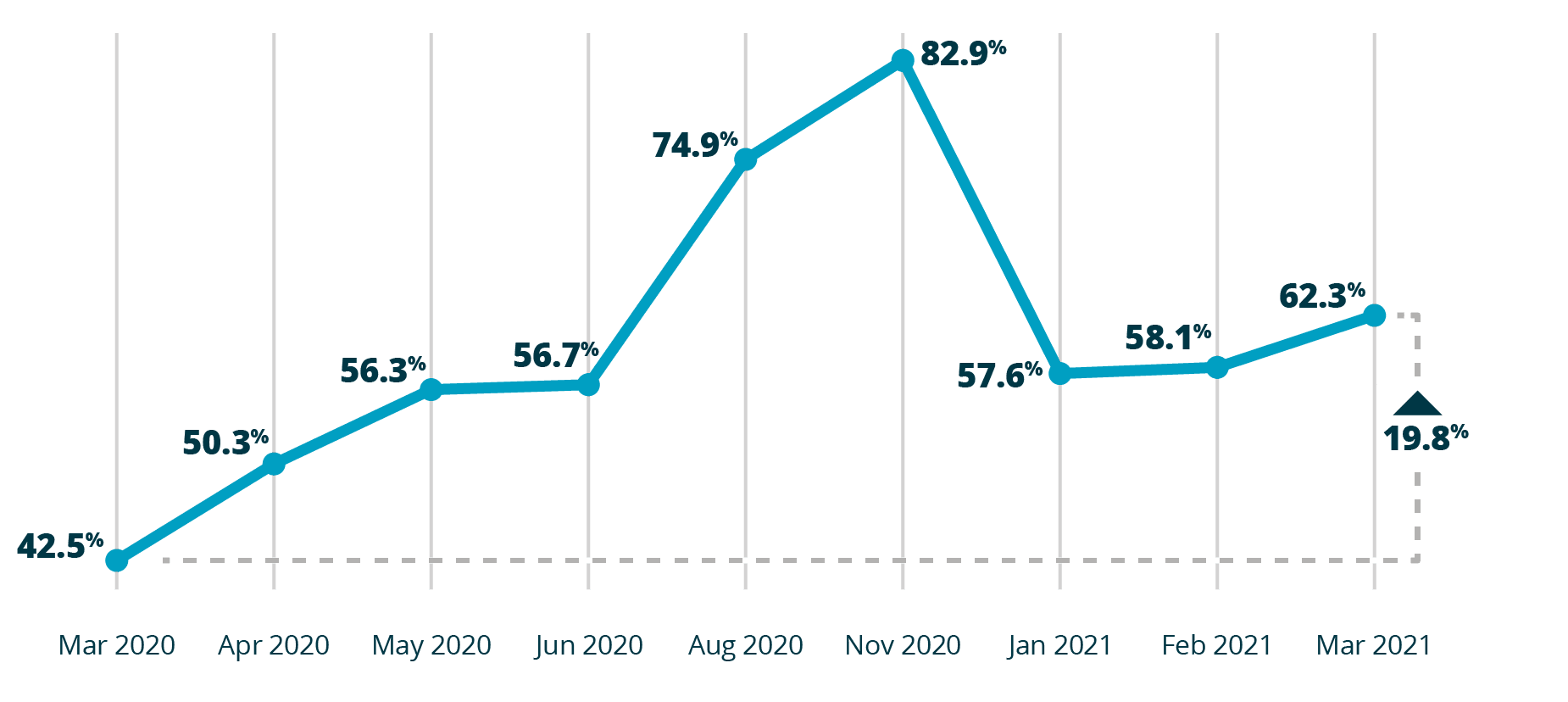

Customer satisfaction levels — as indicated by repeat intent, the measurement of a shopper’s intention to shop again using the same method — are also up from one year ago.

Repeat intent rates jumped to 62.5%, up about 20 points over the previous March. While the jump is a positive thing, it must be kept in mind that March 2020 was a low point from a satisfaction perspective. At the start of the pandemic, regional grocers were dealing with the sudden and unexpected need to ramp up systems and capacity, and customers reacted negatively to issues such as timeslot shortages, inaccurate orders, and product shortages.

The general upward trend in shopper satisfaction and the higher repeat intent ratings seen this March are the result of heavy grocer investments over the course of 2020 to iron out these wrinkles.

David Bishop calls repeat intent an “evaluation of how well retailers’ omnichannel strategies are in essence delivering a more seamless experience.” However, it must be noted that also repeat intent was much higher than at the start of the pandemic, it remains 10 points below the satisfaction level recorded in August 2019, the benchmark of pre-COVID shopping behavior.

The New Normal

With this longer-term collection of insights capturing well over a year’s worth of grocery trends for shopper behavior, we’re getting a sense of how new shopping behaviors are evolving, and some interesting patterns are emerging.

One of those is the notion of “cross-shopping.” Consumers are using a number of different online sources for their grocery shops, just as they have traditionally done in the offline world. For example, we observed that a small but notable portion (14%) of online shoppers used both delivery and pickup in March 2021.

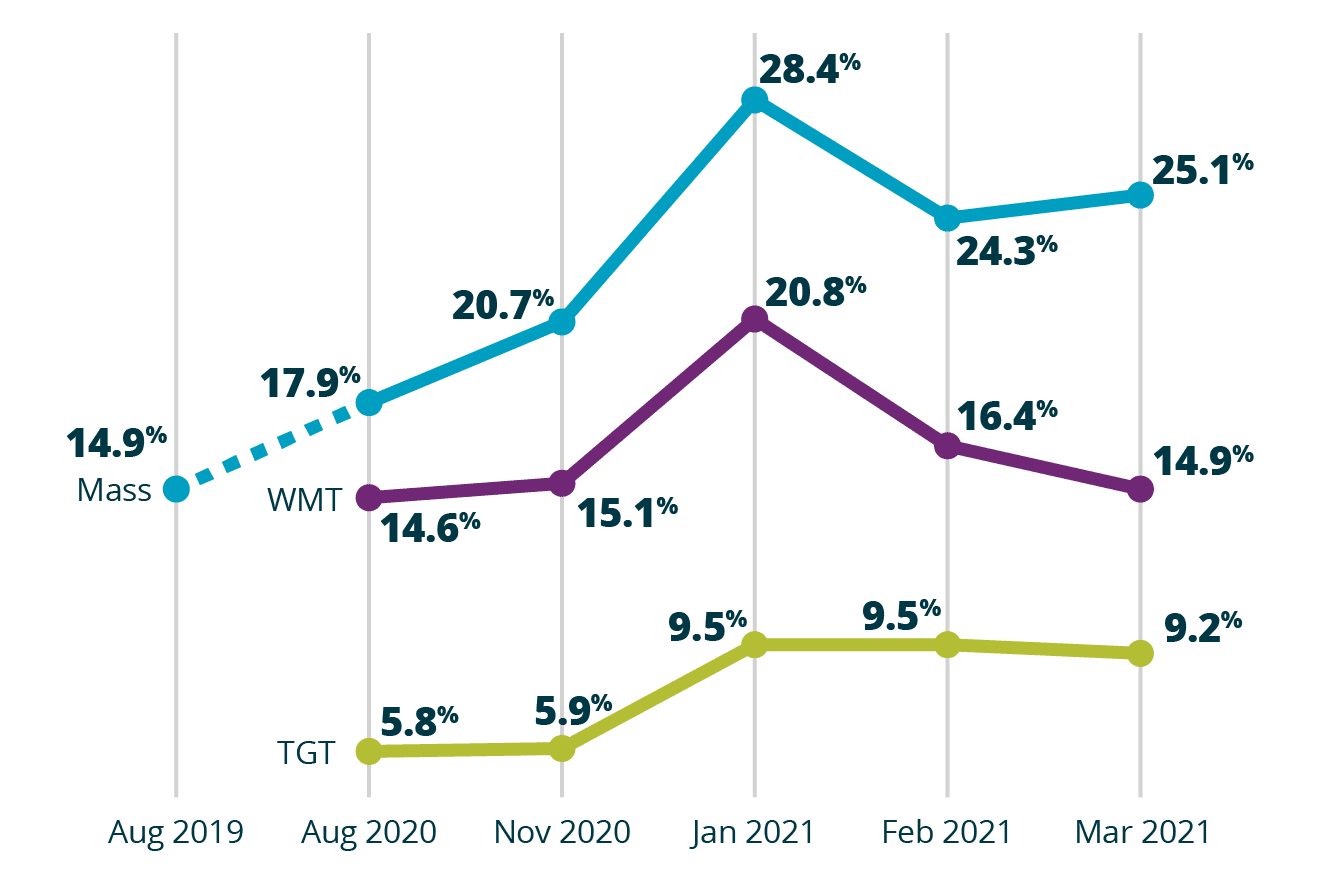

More to the point: one out of every four who shopped online at a supermarket also bought groceries online from a mass merchandiser. This is a noticeable upward trend since pre-pandemic days, and it’s a significant one for regional grocers to bear in mind. That’s because their shoppers are being exposed to the shopping experience offered by a very different category of retailer. Shoppers who experience innovative services and features at mass merchandisers will inevitably hold those experiences up as a point of comparison when they shop at the regional grocer.

Percent of Monthly Active Grocery Users

Managing the Year of Reconciliation

The year ahead will most likely see more fluctuations, with factors such as higher vaccination rates, additional stimulus checks, and pandemic uncertainties at play.

In our March Brick Meets Clicks survey interview, David Bishop characterizes 2020 as the year of acceleration into the shift to digital grocery sales, whereas 2021 is shaping up as the year of reconciliation.

Watch the interview for more research-based insights, and to get David Bishop’s recommendations on the top three things grocers should consider when budgeting for the rest of the year.

Newsroom

Newsroom