Retail Grocery Industry Scorecarding: How do you Compare?

Retail grocery industry leaders in digital maturity see consistent growth YoY. A new Incisiv report reveals what your business can learn.

In the world of COVID-19, success in the retail grocery industry depends upon adopting the right technologies and processes to accommodate a new set of customer expectations. But which technologies and processes are the right ones?

To find out, the Incisiv Grocery Digital Maturity Benchmark 2020 report, sponsored by Mercatus, looked at the activities of 90 grocery retailers and food banners with the highest annual revenues in the US, Canada, and Western Europe. This is their most expansive digital maturity survey to date, analyzing nearly twice as many attributes as the 2019 survey.

Investing leads to success

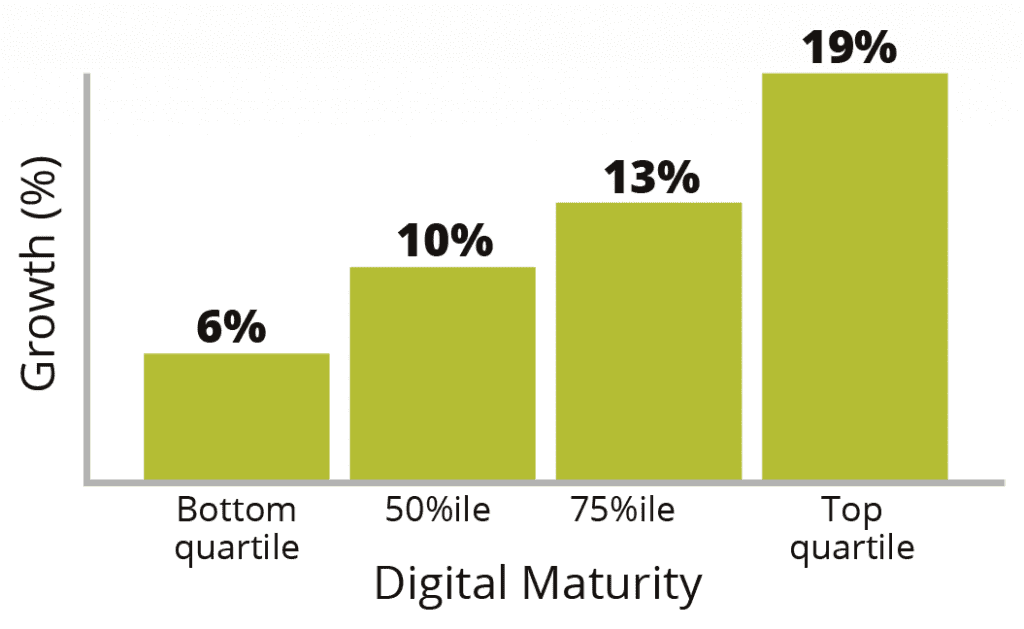

Incisiv observed that the companies that invested early in digital initiatives were benefiting from much stronger growth. And this effect was even more pronounced when the pandemic hit.

In the last year, the most digitally mature grocery chains enjoyed an average of 2.4 times more revenue than less mature grocery retailers.

And, during Q2 2020 when the first wave of the pandemic was in full force, the grocery retailers in the top quartile of digital maturity grew 19%. This is compared to only 6% growth experienced by those in the bottom quartile. It’s also a full 6% above their nearest peers in the second quartile.

So, what can you learn from the successes of these retail grocery industry leaders? Which digital investments are most likely to help you share in financial success and continue to grow over the next five years?

Let’s take a look at some key learnings. Incisiv identified how leading grocery chains have differentiated themselves across four key categories: Research and Discovery; Ease of Ordering; Fulfillment; and Customer Engagement and Service. Here, we’ll look at 4 of the 18 differentiators identified in the report.

Get all the insights!

Read the full Grocery Digital Maturity Benchmark 2020 report now.

Research and Discovery

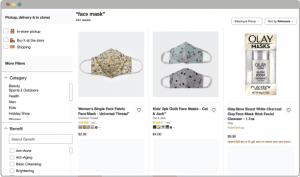

Differentiator: Filters for the availability of different pick-up and delivery options, dietary restrictions, and allergens.

Digital Maturity Category Leader: Target ranked Number 1 in the Research and Discovery category, offering a search function that includes a filter for in-store pick-up (see below). Out of all retailers assessed, only 6% offer this feature, which really gives Target an advantage.

Takeaway: Research and Discovery is an important category for grocers wishing to improve their digital maturity. If shoppers can’t find what they’re looking for on a website quickly and easily, you risk losing them to the competition. Another benefit to investing in these features is Research and Discovery play a key role in driving in-store purchases as well. As Dave Abbott, CMO of Brookshire’s noted on our recent podcast on lessons across retail verticals—in-store shoppers use retailer sites to research products before purchase.

Ease of Online Ordering

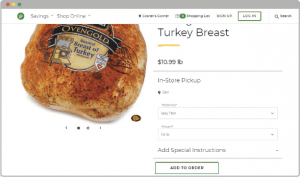

Differentiator: Ability to make requests for product selection (ripeness, expiry, etc.)

Digital Maturity Category Leader: Publix, which was among the top five chains in this category, allows customers to fine-tune their order by specifying the ripeness or size they want the pickers to select. In the screen capture below, you can see how Publix allows deli customers to choose the thickness of meat slices. Less than one-quarter of grocers in the survey can boast this differentiator.

Takeaway: Grocers need to offer the right information at every stage of purchase, from browsing to building the cart to placing the order. When done right, this will drive speed, the urgency of purchase, and product cross-sell. The Publix example is a good reminder that information is a two-way street. By allowing customers to convey information about their preferences to the grocer, a much higher overall satisfaction level can be achieved.

Fulfillment

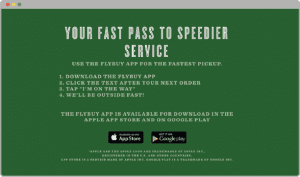

Differentiator: “Arriving for pickup” alerts from the customer to the store.

Digital Maturity Category Leader: Lowes offers location-based functionality that provides speedier curbside pickup by communicating customer location and sending order status and pick-up alerts. The adoption rate for this feature sits at 21%, putting Lowes in the top quartile in this category.

Takeaway: Fulfillment is an area where we saw significant improvements, and rightly so. More than 45% of customers changed their fulfillment preferences due to the pandemic. The industry saw a whopping 370% increase in curbside pick-up in Q2 2020. It’s more important than ever for grocers to succeed at fulfillment. (Learn more about shopper loyalty and how shopping habits are expected to change in the Digital Grocer podcast, Shopper Behavior: The New Reality in Grocery.) Low wait times, timely order status notifications, discounted or waived service fees and contactless transactions are all important differentiators — both during the pandemic and beyond.

Customer Engagement and Service

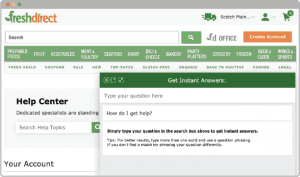

Differentiator: On-demand customer service features, such as live chat and availability on social channels.

Digital Maturity Category Leader: Freshdirect (see below) is one grocer that offers live chat. With a 38% adoption rate, this feature is gaining in popularity but has yet to be adopted by almost two-thirds of grocers.

Takeaway: In times of uncertainty like the current pandemic, customer service and engagement build a foundation of trust. Only one-third of shoppers in our report expressed satisfaction with the ease of contacting customer service. Improvements in this area play an important role in customer retention, both short- and long-term. With features such as live chat, grocers can address shopper queries quickly, which can also reduce cart abandonment rates. A good experience during bad times leads to customer advocacy and loyalty in the future.

The ultimate takeaway

Making the digital investments that differentiate your brand has never been more vital. Here, we’ve explored just 4 of the 18 differentiators that set retail grocery industry leaders apart. Discover the other investments that can help your digital grocery program become a leader. Download our free report, Grocery Digital Maturity Benchmark, 2020.

Looking for more retail grocery industry insights? You might also like:

Newsroom

Newsroom