The 2024 U.S. eGrocery 5-Year Sales Forecast with Brick Meets Click

U.S. eGrocery Sales Projected to Reach $120 Billion Annually By End of 2028

The 2024 Brick Meets Click U.S. eGrocery 5-Year Sales Forecast has just been released. This annual report, sponsored by Mercatus, utilizes proprietary data from Brick Meets Click to provide a comprehensive and accurate projection of the eGrocery market, including:

- How total grocery sales are expected to trend;

- A detailed comparison between in-store to online sales; and

- Analysis of eGrocery sales across Delivery, Pickup, and Ship-to-Home receiving methods.

Our analysis of this new report includes several key insights alongside strategic guidance for regional grocers and independents.

But before we get into our evaluation, let’s identify a few of the report’s topline findings:

- Online Grocery Growth: Total eGrocery sales are projected to reach $120 billion annually by the end of 2028. While the overall grocery market is projected to grow at a modest rate of 1.6%, online sales (4.5%) are expected to grow three times faster than in-store (1.3%).

- Importance of Order Frequency: Increasing the frequency of orders is anticipated to be the most important driver for online grocery sales growth through 2028, with expectations that it will contribute 40% of eGrocery’s sales growth over the next five years.

- Pickup’s Growing Appeal: Through to 2028, Pickup is projected to grow faster (+5.4%) than Delivery (+4.4%) or Ship-to-Home (+2.8%).

Continue reading below for further analysis on the 2024 Brick Meets Click U.S. eGrocery 5-Year Sales Forecast — including insights into what’s behind the numbers mentioned above and strategic recommendations based on this important annual report.

5-Year U.S. eGrocery Sales Projection

Grocery Sales Growth Stabilizes with Online Set to Outpace In-Store

Overall U.S. grocery sales, including both in-store and online, will grow at a considerably slower rate through 2028 (+1.6%) than in the five-year period that ended in 2023 (+5.6%).

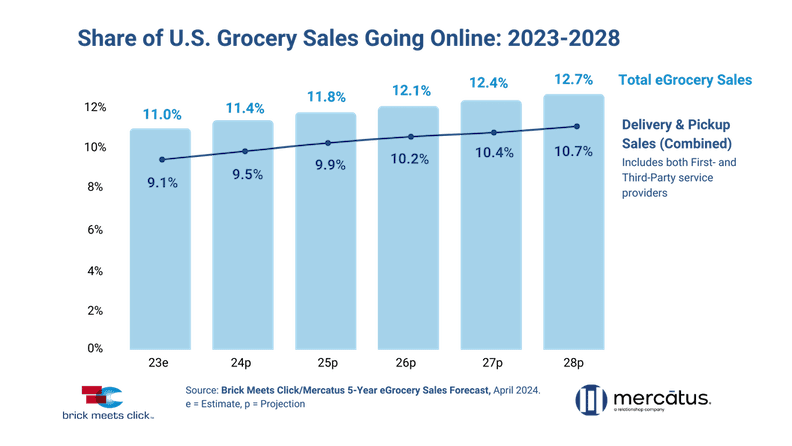

Despite the slower overall growth, total eGrocery sales are expected to reach nearly $120 billion annually by the end of 2028, accounting for 12.7% of all U.S. grocery sales. This growth is projected to be more than three times faster than in-store sales increases (4.5% vs. 1.3%) during that same period.

This suggests that, following the explosive sales increases during the pandemic, eGrocery has secured a large and stabilized segment of the market, marking a fundamental change to how American households purchase and receive their groceries.

The Increasing Threat of Mass Retailers to eGrocery Market Share

The expanded share of the eGrocery market being taken by Mass Retailers, particularly Walmart, increased to 45.4% in 2023, a 620 basis points rise from 2021. This shift is fueled in large part by the value larger retailers are able to offer, as comparable baskets of goods at a Walmart are more than 10% less expensive than at traditional supermarket banners.

As consumer spending remains constrained by current economic uncertainty, the preference for Mass Retailers is forecasted to persist, creating challenges for traditional grocers who must innovate to remain competitive in this new market reality.

But the outlook isn’t entirely gloomy. New technological innovations will allow traditional grocers to leverage enhanced service quality through greater personalization as a means of maintaining market relevance amidst this fierce competition. We’ll highlight some of these tactics in our Strategic Recommendations section.

Pickup is Key to eGrocery Expansion

Pickup services are predicted to see the fastest growth among eGrocery receiving formats, with a projected increase of 5.4% through to 2028.

This method isn’t as saturated as Delivery and aligns more closely with current consumer drivers such as value, convenience and control over shopping experiences. As Pickup becomes increasingly integrated into service offerings for regional grocers, it’s expected to solidify its place as the dominant method of eGrocery.

This underscores the need to effectively enhance and promote Pickup services.

The Role of Order Frequency in eGrocery Growth

The report identifies order frequency as the most important driver of eGrocery’s continued expansion, predicting it will account for 40% of sales growth over the next five years.

The challenge for grocers will be to encourage customers, particularly those making only one order per month, to engage more frequently. This can be addressed through targeted marketing strategies, subscription models, and loyalty programs that reach customers through personalized communications to incentivize regular shopping.

First-Party Platforms to Gain Ground on Third-Party Services

In 2023, Third-Party (3P) sales accounted for more than half of a typical Supermarket’s eGrocery business. However, the increased implementation of First-Party (1P) platforms is expected to capture a larger share over the next five years.

As retailers focus on building volume for their 1P services, it’s anticipated that more informed customers will move away from 3P marketplaces where costs are averaging more than 9% than on 1P alternatives.

To capitalize on this expected transition, grocers will need to invest in and refine their 1P offerings to better serve their customers.

10 Key Takeaways from the U.S. eGrocery 5-Year Sales Forecast:

- Total eGrocery sales are projected to reach $120 billion annually by the end of 2028.

- eGrocery is expected to account for 12.7% of all grocery sales at the end of this five-year period..

- Overall U.S. grocery sales will grow at a considerably slower rate through 2028 (+1.6%) than in the five-year period that ended in 2023 (+5.6%).

- Online sales are projected to grow more than three times faster than in-store sales (4.5% vs. 1.3%) over the next five years.

- Increased order frequency is expected to contribute approximately 40% of eGrocery’s sales growth through 2028.

- Pickup is projected to remain the dominant eGrocery receiving method, growing at a rate of 5.4% over the next five years. This compares favorably to both Delivery (+4.4%) and Ship-to-Home (+2.8%).

- The online customer base will expand to 55% of the overall market, with a 5-year growth rate of 1.2% to account for more than 74-million American households by the end of 2028.

- Online sales are expected to continue to shift toward Mass Retailers where a similar basket of groceries costs 10% less than a rival Supermarket.

- The share of eGrocery sales for third-party providers will likely decline in the coming years as cost-conscious customers shift their grocery purchases to lower-priced first-party platforms.

- Average order values will increase gradually through the end of 2028 as the customer mix for each eGrocery receiving method shifts to a larger share of returning customers who tend to spend more per order than new ones.

5 Strategic Recommendations

1. Compete with Larger Retailers on Experience Instead of Pricing

According to the report, grocers can expect increased competition with Mass Retailers for their share of the eGrocery market over the next five years.

If anything has been learned from the emergence of the bigger retailers, it’s that competing with the Walmarts of the world on pricing alone isn’t going to work. Their advantage is too significant — more than 10% cheaper on similar baskets from supermarkets.

Instead, regional grocers and independents should focus on what truly matters to their customers and extend their inherently stronger service model into the digital experience. That means increasing personalized service, crafting unique shopping experiences, and offering customer interactions that are truly meaningful.

This can be accomplished through:

- Creating exclusive local product offerings;

- Developing private labels;

- Offering premium service options such as streamlined Pickup or faster Delivery

- Enhancing online shopping features, and

- Curating personalized product recommendations.

No matter the tactic, leveraging technology to make these offerings cost-effective will be vital to winning back your market share from the big retailers.

2. Enhance First-Party Platforms

Just as Mass Retailers have taken advantage of the pronounced flight to value caused by current economic circumstances, the report identifies an opportunity for grocers to do the same by enhancing their first-party platforms in place of reliance on third-party services.

As third-party platforms often introduce a premium on prices, their share of the market is expected to move toward less expensive alternatives. This presents a big opportunity for grocers to invest in first-party eCommerce capabilities that provide consumers with better value.

By improving the user experience on your own platforms, you can control costs more effectively and build direct relationships with customers. This includes optimizing website and app interfaces, ensuring reliability in order fulfillment, and leveraging customer data to personalize shopping experiences.

3. Leverage Data to Increase Order Frequency

Speaking of leveraging customer data, data-driven marketing strategies are going to be crucial to increasing order frequency — the primary driver of eGrocery sales growth identified in the report.

Many grocers have collected large amounts of customer purchase data, but they’re not currently harnessing it to offer tailored promotions, customized reminders, personalized product recommendations or enhancements to rewards programs that encourage more frequent purchases.

This level of personalization is especially important for implementing loyalty programs that reward regular orders and provide incentives for subscription-based models, driving order frequency and deepening customer loyalty.

4. Expand and Promote Pickup Services

Another key takeaway from the U.S. eGrocery 5-Year Sales Forecast is the projected growth in consumer preference for Pickup over Delivery and Ship-to-Home.

Expanding Pickup services is an easy and obvious way to get ahead of the anticipated trend. This could include increasing the number of Pickup locations, streamlining the Pickup process to reduce wait times, offering discounts to initially attract this receiving method, or actively promoting the service option through marketing campaigns that educate customers about its convenience, cost-effectiveness and the control it gives the customer.

5. Be Ready to Adopt and Adapt to Technological Innovations

While autonomous delivery vehicles may not be expected to drastically change the grocery industry within the next five years, improving technological infrastructure to support the emergence of new technologies can prepare grocers for whatever the future holds.

When looking to enhance your tech stack, always consider both short-term gains (Are there immediate cost offsets?) and long-term growth (Will this tech help or hinder scaling my business in the future?).

Closing Thoughts

As we conclude our analysis of the Brick Meets Click eGrocery Sales Forecast, it becomes increasingly evident that while overall growth in the grocery sector might be slowing, the shift towards online shopping — with eGrocery sales projected to reach nearly $120 billion by 2028 — offers substantial opportunities for grocers.

That’s not to suggest there aren’t challenges. But even as Mass Retailers look to their eGrocery market share, major reports like this offer valuable insights and strategies for grocers to better compete.

Staying informed is crucial for success in the next five years. As the industry increasingly depends on leveraging technology to improve customer engagement, increase personalized experiences, and foster more loyalty amongst shoppers, understanding the trajectory of the market is vital. Grocers must be adept in implementing technological solutions that make the most of the latest consumer trends. It’s the only way to stay competitive and capitalize on emerging opportunities.

For more information on the 2024 U.S. eGrocery 5-Year Sales Forecast from Brick Meets Click, sponsored by Mercatus, read the complete press release here.

Newsroom

Newsroom