US eGrocery Sales Trends with Brick Meets Click – April 2023 Insights

U.S. eGrocery Sales Increased 1% YoY in April 2023 to $8.2 Billion

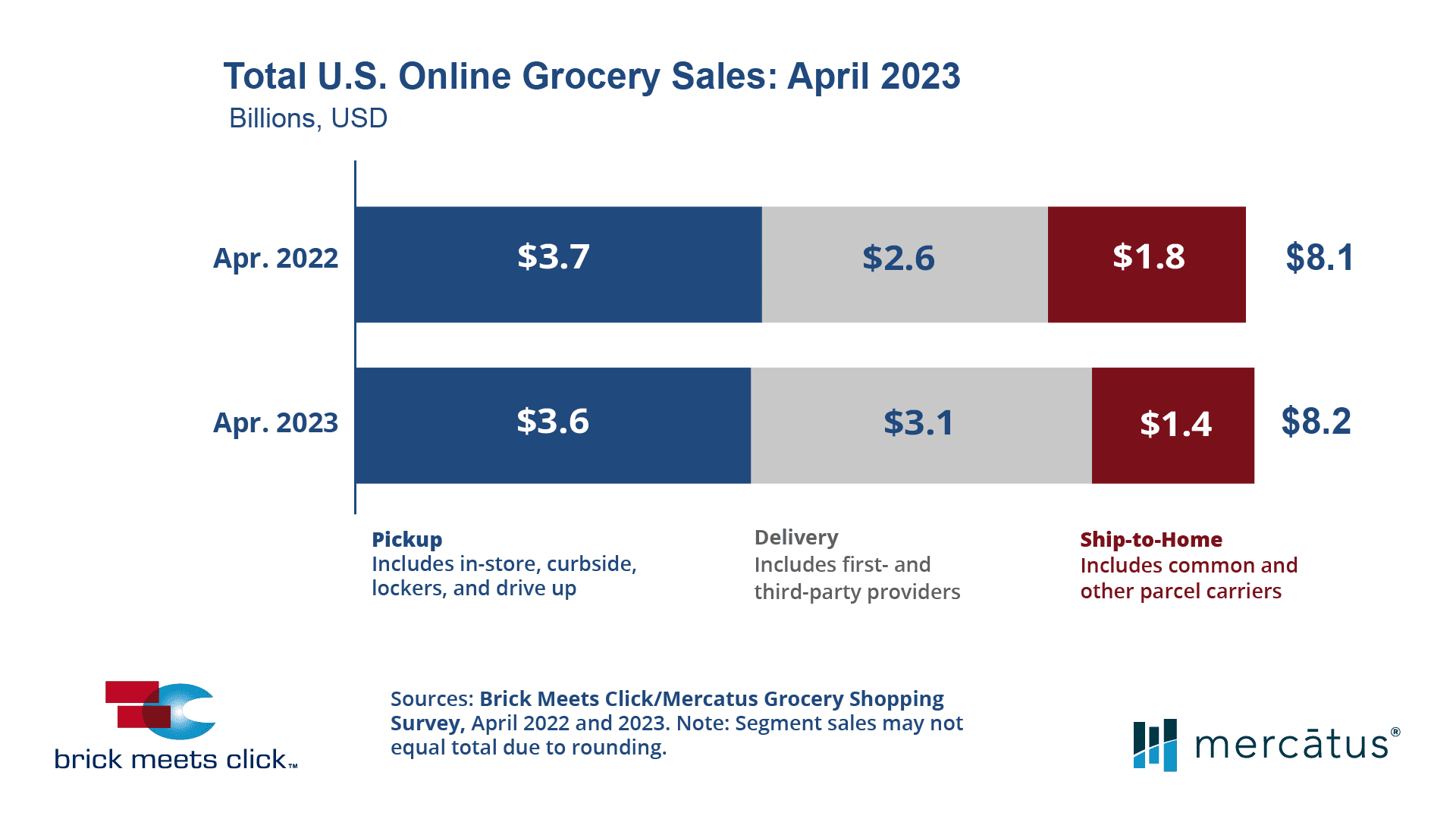

The latest Brick Meets Click/Mercatus Grocery Shopping Survey conducted on April 28-29, 2023, reveals that US eGrocery sales in April reached $8.2 billion, marking a 0.9% increase year-over-year (YoY). However, this aggregate figure masks drastically different performances of the three main segments: Delivery, Pickup, and Ship-to-Home.

April 2023 US Online Grocery Sales

Delivery sales experienced a significant surge, up 20% YoY, buoyed by a rebound in Monthly Active Users (MAUs) and a higher Average Order Value (AOV). The 11% growth in Delivery’s MAU base over the past year and a 5% increase in the AOV seems to underscore the broader trend of consumers turning to delivery services for their grocery needs.

On the other hand, Pickup sales witnessed a mild decline of 3% YoY, mainly due to reduced order frequency and lower AOV, offset somewhat by modest growth in its MAU base. The decline in Pickup sales may indicate shifting consumer preferences and possible operational challenges faced by retailers in this segment.

By contrast, Ship-to-Home sales took a significant hit, plunging 19% YoY. This decline seems to have resulted from a deterioration across all key shopping metrics, including a continued contraction of its MAU base and double-digit drops in AOV and order frequency among active users. The drop in Ship-to-Home sales may reflect changes in purchasing patterns, possibly driven by a desire for immediate access to groceries or concerns about shipping costs and times.

April 2023 saw a marked downturn in ‘repeat intent’ scores, a metric indicating the likelihood of a customer using the same service within the next 30 days. The overall repeat intent score dropped by 5.3% compared to last year, landing at under 58%. This decline was largely driven by a substantial decrease from the most-frequent customers. Additionally, the repeat intent rate for Grocery experienced a sharper decline compared to Mass, leading to the largest gap recorded to date between the two formats. These trends may signal challenges related to customer retention and loyalty within the online grocery market.

The online share of total grocery spending dipped slightly in April, falling 20 basis points to 12.1% YoY. However, excluding Ship-to-Home, the combined contribution from Pickup and Delivery increased by 40 basis points YoY, reaching 10.0%, owing to Delivery’s strong performance for the month.

Sylvain Perrier, President and CEO of Mercatus, shared his insights on these trends, “As customers vote with their wallets, the widening gap in repeat intent between Mass and Grocery should serve as a red flag for grocers to reassess all facets of the customer experience. With customer expectations continuously evolving based on past experiences, it’s crucial for grocers to continuously refine various aspects of their operations, whether that means providing a more personalized shopping experience, reducing out-of-stock incidents, or decreasing wait times.”

The survey further investigated current shopping behaviors, asking respondents where they primarily bought groceries during the past month. Of those households indicating Mass, a significant 69% reported online grocery activity in April 2023, compared to 54% of those specifying Grocery (excluding Hard Discount). This implies a continued trend towards online shopping, with Mass channels leading the way.

Interestingly, when it came to where households bought groceries online, 73% of those who primarily shopped with Mass also ordered online from a Mass service. In comparison, only 52% of those identifying Grocery as their primary store also ordered from a Grocery service. These findings may suggest that success in the online space goes beyond merely competing online, hinting at the importance of brand loyalty and the benefits of omnichannel strategies.

Key Findings for April 2023

- Total online grocery sales for April 2023 rose by approximately 1% YoY, with a strong performance in Delivery offset by a slight decline in Pickup and a significant decrease in Ship-to-Home.

- Weekly household spending on groceries increased by 7% YoY in April 2023, while online’s share of grocery spending fell marginally by 20 basis points as households spent more on in-store shopping.

- The number of US households that bought groceries online in April 2023 grew by nearly 6% YoY, largely due to an increase in the Delivery MAU base and a slight expansion in Pickup’s base.

- The average number of orders completed by MAUs decreased by over 5% YoY, influenced by lower demand in Medium and Small metro markets and decreased demand for Ship-to-Home.

- The weighted average AOV across all three methods climbed just over 1% in April YoY, with only Delivery posting a gain of nearly 5% while Pickup was down by approximately 1%, and Ship-to-Home fell by nearly 10%.

- The overall likelihood that MAUs will reorder from a specific Pickup/Delivery service again within the next 30 days fell by 530 basis points in April 2023 compared to the previous year.

eGrocery Strategy Recommendations for April 2023

- Focus on customer experience: Grocers should prioritize improving all aspects of the customer experience, including personalization, stock availability, and wait times.

- Monitor and address customer behaviors: Understanding and addressing the changing behaviors of online shoppers, particularly regarding repeat intent rates, can help grocers stay competitive.

- Diversify service offerings: Grocers can cater to diverse customer needs by offering a range of options across Pickup, Delivery, and Ship-to-Home services.

As the eGrocery landscape continues to evolve rapidly, it’s crucial to stay informed about the changing trends and patterns of online shoppers. To that end, we recommend checking out our most recent report: eGrocery Insights – May 2023: Profiling the Online Shopper, Purchase Patterns in the U.S.

Drawing from extensive survey data collected monthly throughout 2021 and 2022, with responses from over 42,000 shoppers, this comprehensive study offers insights into the shifting patterns of household penetration, spending, and order frequency for eGrocery orders.

Thank you for reading this edition of the US eGrocery Sales Insights from Brick Meets Click/Mercatus. We hope that the insights provided help you to differentiate your grocery brand and drive greater success with your online grocery programs.

Access the full US eGrocery Sales April 2023 press release here.

Newsroom

Newsroom