US eGrocery Sales Trends with Brick Meets Click – 2023

U.S. eGrocery Sales Total $95.8 Billion in 2023

The results from a year of Mercatus/Brick Meets Click Grocery Shopping Survey have been finalized, and there are several important takeaways and recommendations to follow based on the data.

But first, the overall findings:

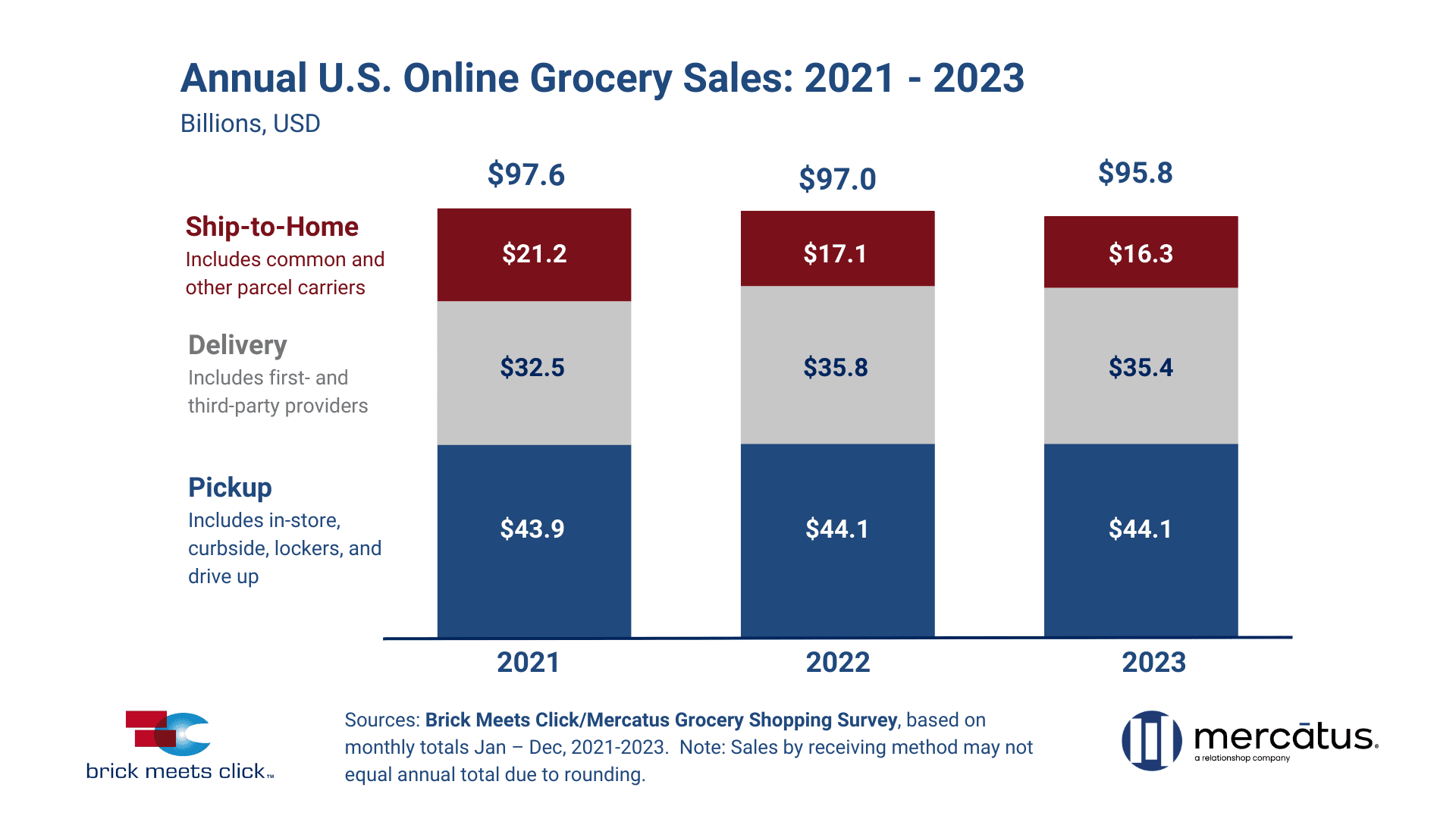

Despite facing economic and competitive pressures, the U.S. eGrocery market closed 2023 with $95.8 billion in sales, marking a slight decline of 1.2% compared to 2022.

Fewer orders from online grocery shoppers is the primary culprit for the small decrease. This only serves to highlight how inflation and price sensitivity have reshaped shopping habits for households across the United States.

With fewer orders being made, all three eGrocery formats posted year-over-year increases in Average Order Value (AOV) in 2023:

- Delivery AOV grew by 3.0%,

- Pickup increased by 2.6%, and

- Ship-to-Home rose 1.7%.

In terms of overall sales performance, the largest of the three options, Pickup, grew its market share while Delivery experienced a small dip and Ship-to-Home experienced a second consecutive year of contraction.

2023 US Online Grocery Sales

Pickup Remains Method of Choice for Shoppers

The performance of eGrocery formats fluctuated throughout the year with Delivery finishing strong thanks to third-party providers enhancing their efforts to combine value and convenience to customers. Nonetheless, Pickup remains the method of choice for the majority of eGrocery shopper:

- Pickup grew its share of eGrocery sales by 56 basis points (bps) to 46.0% in 2023, totaling $44.1 billion in sales.

- Delivery experienced a sales decline of 0.9% in 2023 versus the prior year, but gained an additional 11 bps of sales share to end the year with a 37% share of the market.

- Ship-to-Home continued its annual contraction as sales slipped 4.9% on a year-over-year basis, leading to a 66-bps drop in sales share to 17%.

Fewer, But Bigger Orders

2023 witnessed a 6.0% drop in the average number of monthly online grocery orders, continuing a decline that began the previous year.

A notable finding is the increase in shoppers who make only a single eGrocery order per month. This figure rose to 34% in 2023. One-and-done shoppers are likely to place bigger orders, and could be a contributing factor to the 3.0% AOV increase across different receiving methods.

Increased Competition

The overall Monthly Active User (MAU) base for eGrocery expanded by 2.0% compared to 2022, but this was driven primarily by Mass and Hard Discount Retailers.

The past 12 months marked a significant period for both these types of retailers: Mass and Hard DIscount experienced growth in their MAU bases, while Supermarkets saw a decline. Mass retailers, in particular, expanded their share of overall eGrocery sales to 45.0%, thanks in large part to their MAU base, and the strategies they employed to strengthen it.

Cross-Shopping Is On The Rise

The impact of competition on consumer behavior is perhaps best seen in the increase of cross-shopping rates between Grocery and Mass formats. Despite a decline in December, 30% of the MAU base for grocers also shopped for groceries online with large retailers like Walmart in 2023.

Key Takeaways from 2023 eGrocery Sales:

- The U.S. eGrocery market reaches $95.8 billion in 2023. This 1.2% decrease from the previous year highlights a number of contributing factors including economic conditions, price sensitivity, increased competition and shoppers returning to in-store experiences as concerns over COVID-19 are further diminished.

- Mass retailers expanded their share of overall eGrocery sales by 460 bps in 2023, reaching 45% of the market. This was achieved through effective omnichannel strategies that brought a 15% increase in MAUs compared to 2022. The ability of mass retailers to engage customers both online and in-store is proving to be a key differentiator, especially in an economic environment that favors value and convenience.

- The average number of monthly online grocery orders fell by 6.0% in 2023 compared to 2022. However, the Average Order Value (AOV) rose by 3.0% across different receiving methods, indicating fewer, but larger order sizes.

- The Pickup segment grew its share of eGrocery sales, reaching 46.0% in 2023. By growing its market share despite economic challenges, the popularity of Pickup suggests that consumers still want convenience even as they search for value.

- There was a marked increase in cross-shopping between Grocery and Mass formats, reflecting changing consumer behaviors. The percentage of households who bought groceries online from both grocers and large retailers formats rose 150 bps versus 2022. In a single month, 30.0% of the Grocery MAU would cross-shop with a Mass Retailer.

Strategic Recommendations for 2024

Keep Customers Happy

Retailers have to continue to utilize consumer data to personalize offerings and improve service efficiency. Enhancing the customer experience is crucial for maintaining loyalty and combating the cross-shopping between supermarkets and the large retailers.

Combine Value with Convenience

Learn from both the continued success of Pickup and the year-end increase in Delivery — thanks to the increased efforts of third-party providers who combined great deals with convenience. Despite increased pricing sensitivity, consumers are still interested in convenient shopping experiences. To attract and retain them, it’s vital to find ways to balance both in your service offerings.

Leverage Big Retailer Retention Strategies

This is obviously easier said than done, but there’s something to be learned by how mass retailers are increasing their MAU base. Retailers should focus on enhancing their omnichannel strategies to meet consumer needs in both online and in-store settings. Mass retailers have set a precedent to be emulated, successfully integrating their online and physical experiences.

Closing Thoughts

The overall eGrocery numbers for 2023 emphasizes consumer behavior heavily influenced by economic trends and increased competition from big retailers. Despite the small decline in online sales this year, there are clear opportunities for independent and regional grocers to grow through enhancing customer experience, combining value with convenience and employing omnichannel strategies that increase both online and in-store sales.

As we move forward in 2024, understanding these opportunities and adapting to consumer behavior will be crucial for grocers to remain competitive and find the advantages that will see them thrive over the next 12 months and beyond.

As always, thanks for reading.

Stay tuned for next month’s analysis, and for more details on the year in eGrocery sales trends, read the complete press release here.

Newsroom

Newsroom