US eGrocery Sales Trends with Brick Meets Click – April 2024 Insights

April U.S. eGrocery Sales Reach $8.5 Billion, Up 4.4% Over Previous Year

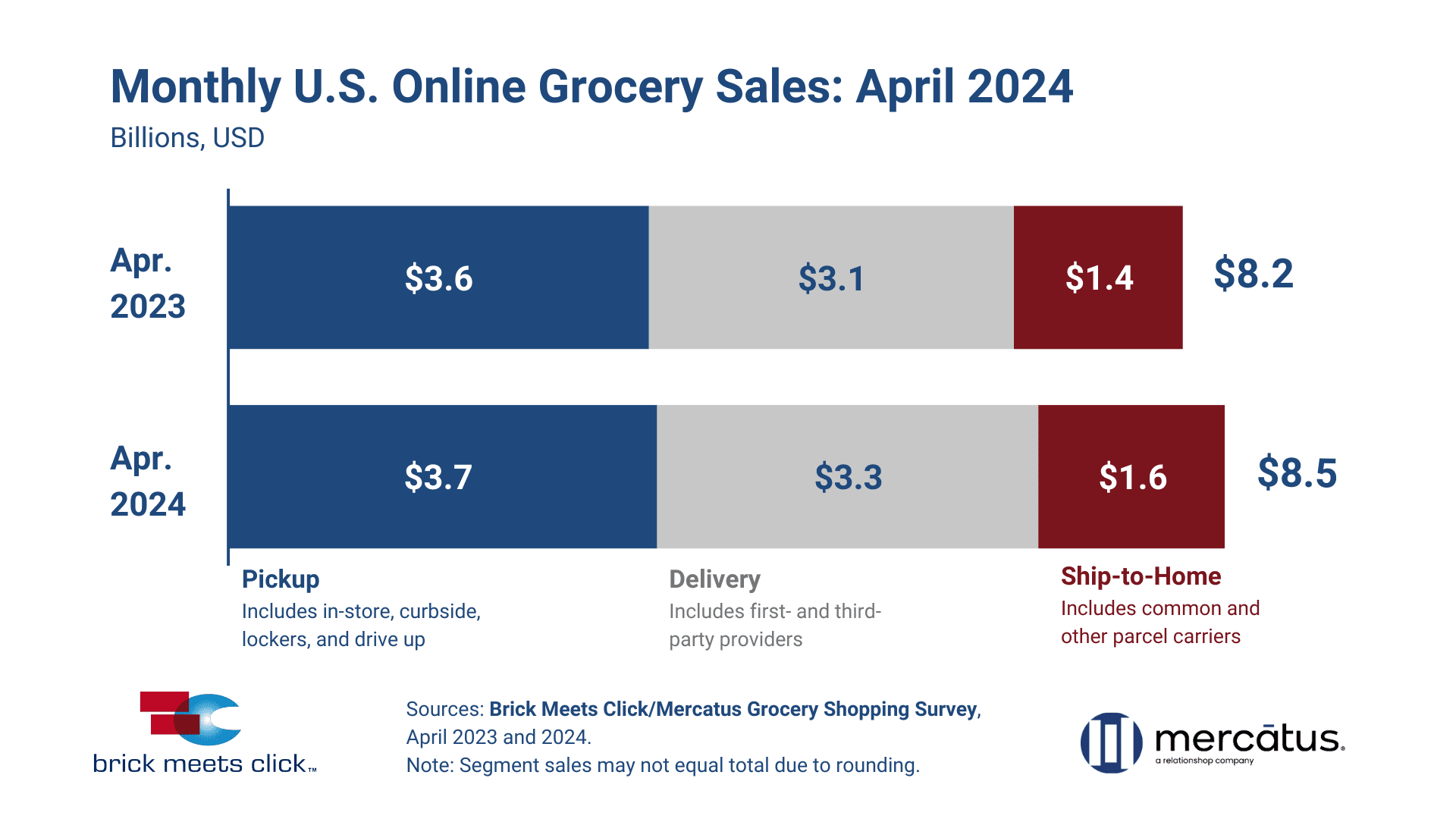

The latest data from the Mercatus/Brick Meets Click Grocery Shopping Survey has just been released, revealing a 4.4% increase in April 2024 eGrocery sales over April 2023.

There are several factors contributing to this month’s numbers, but we begin our analysis with a deeper look at the top-line sales figure: $8.5 billion in eGrocery sales.

This growth over last year can be seen across all three receiving segments:

- Pickup sales for April 2024 increased by 2.1%.

- Delivery sales climbed 4.3%.

- Ship-to-Home sales posted a 10.2% gain.

While higher Average Order Value (AOV) contributed to Pickup’s and Ship-to-Home’s growth, Delivery’s gains were due to an increase in Monthly Active Users (MAUs). We’ll explain why this occurred and what it means for overall consumer preferences moving forward in our analysis below.

We’ll also look at how different customer demographics are responding to current economic conditions, get into the latest data on cross-shopping, and — as always — connect the results of this month’s report to key recommendations for grocers.

April 2024 US Online Grocery Sales

What’s Behind April’s eGrocery Sales Growth?

Despite the 4.4% increase in online sales growth, the size of the overall eGrocery customer base held steady for April 2024 versus 2023. Instead of more people shopping online for their groceries, the $8.5 billion in eGrocery spending this month is the result of:

- Customers from large and small metro areas increasing their online grocery spending.

- Shoppers aged 30 to 44 reversed a previous decline from last year by increasing their online spending to 20% of their grocery budget.

- Three of the four income groups increasing their online grocery shopping, most notably the under $50K demographic which continues to shift a larger percentage of its grocery spending online (12%).

These three data points illustrate a dynamic market where consumer purchasing patterns are shifting in certain demographics and regions, contributing to overall sales growth among a stable number of users.

Why Are Delivery MAUs Increasing?

As mentioned in the introduction, the 4.4% growth in eGrocery sales over last year can be seen across all three receiving methods. However, the increase in Delivery’s sales were the result of more MAUs, while Pickup and Ship-to-Home benefited from higher AOVs.

There are two reasons for more MAUs choosing Delivery:

- Consumers are taking advantage of introductory offers — typically free for a brief period of time — from third-party providers; and

- Larger retailers, especially Walmart, are increasing their focus — and therefore, investment — on growing their own first-party delivery services.

This, in turn, prompts a couple of questions:

- How many newer customers, attracted by these trial offers, will continue to shop online once their “free” trial offer expires?

- Among those who do continue to shop online, how many will choose the convenience of Delivery over the value of Pickup?

This month’s US eGrocery Sales Trends episode (video at the top of the page) dives into this topic, further comparing Delivery and Pickup from an operational perspective and noting how each method meets consumer needs and preferences in slightly different ways.

Cross-Shopping Up 800 Basis Points Over Last Year

Cross-shopping between Supermarkets and Mass Retailers is continuing to grow, with nearly 34% of customers who purchased groceries online from a Supermarket also placing orders with Mass Retailers like Walmart in April.

While the so-called “flight-to-value” caused by economic conditions remains the largest culprit in consumers visiting multiple retailers for their grocery needs, the improved customer engagement tactics employed by Mass Merchants can’t be ignored as a contributing factor.

Mass Merchants Seeking Advantages Beyond Pricing

The dangerous combination — lower prices, more engaging experiences — mentioned above is also influencing overall sales and customer retention:

- 51% of the overall eGrocery customer base shopped with the big retailers this past month. Meanwhile, Supermarkets were only able to attract 30% of the MAU base for April 2024.

- More than 80% of the U.S. households that use a big retailer as their primary destination for groceries completed one or more eGrocery orders with them in April. Meanwhile, only 54% of households primarily shopping at a Supermarket did the same.

Key Takeaways from March 2024 eGrocery Sales:

- The U.S. eGrocery market reached $8.5 billion in April 2024, representing 4.4% year over year growth.

- Delivery sales increased by 4.3% supported by user growth and stable order values, Pickup sales grew by 2.1% with higher order values despite fewer users, while Ship-to-Home led with a 10.2% increase in sales, mainly from higher average order values.

- The overall eGrocery MAU base remained stable compared to the previous year.

- The share of MAUs using just one delivery method remained above 70%, while those using both Delivery and Pickup represented about 15% of MAUs.

- Mass retailers increased their share of the overall eGrocery customer base to 51%, up by 500 basis points compared to last year. Supermarkets attracted 30% of MAUs, a decrease of 280 basis points from 2023.

- Cross-shopping increased to more than a third of all Supermarket customers also ordering from Mass Retail, up almost 800 basis points.

- 60% of consumers are likely to reuse the same eGrocery service in the next month, a rise of 240 basis points from last year’s repeat intent rate.

- 83% of households that regularly buy groceries from a Mass Retailer completed one or more eGrocery orders with them in April. Meanwhile, only 54% of households primarily shopping at Supermarkets did the same.

Strategic Recommendations

Use Technology To Enhance Customer Experience

Mass Retailers have already leaned into their inherent advantage on pricing to appeal to consumers feeling the pinch of current economic conditions. Now, they’re increasingly investing in their mobile apps and tapping into emerging technologies like machine learning and artificial intelligence to predict, adapt and appeal to consumer preferences.

Grocers need to maintain their customer service advantage to compete, and the most cost-effective means of doing this is through greater investment in technology. By leaning on the right technology partners, regional grocers and independents can offer an enhanced online customer experience that combines with the high-touch, in-store customer service traditionally associated with local grocers.

Just as the big retailers have utilized their existing strengths to improve their market position, it’s time for grocers to invest in their own unique sales propositions — and provide customers with an experience that Mass can’t match.

Create More Engaging Loyalty Programs

In addition to leaning into their own inherent advantages, grocers can take another page out of the big retail playbook by offering loyalty programs that provide real benefits to their customers.

This past month’s data shows how Mass Retailers are improving customer retention through membership programs like Walmart Plus. Grocers can expand their membership and loyalty programs to provide more personalized value to customers.

This type of program requires a holistic customer engagement strategy that begins with a foundational approach to gathering and utilizing data, managing customer relationships, and ensuring that every touchpoint with the customer is personalized and engaging.

Understand That Value Means More Than Lower Product Prices

As each month’s sales figures and cross-shopping numbers confirm, consumers are responding to uncertain economic conditions and inflation by searching for value in their grocery shopping. We typically associate “value” with lower prices, and while that’s certainly part of it, there are other avenues in which grocers can provide value to customers without losing profitability.

For instance, this month’s data shows that larger retailers and third-parties are improving MAU numbers for Delivery through introductory offers that include free trials. This suggests potential for extending pricing strategies to receiving methods.

Adopting and adapting threshold offers that significantly reduce the cost of delivery to the consumer would consolidate orders and increase AOV by appealing to the value-driven approach customers are taking — especially after the free trial periods with the big retailers and third-party providers run out.

Closing Thoughts

The theme of this month’s Brick Meets Click/Mercatus Grocery Shopping Survey is adaptability.

The data from April 2024 emphasizes the importance of identifying consumer preferences and using that knowledge to deliver engaging customer experiences that lead to better retention. The way for grocers to accomplish this is by enhancing digital capabilities and crafting more personalized shopping experiences. This leans into their inherent advantages and provides a level of customer engagement that the big retailers simply can’t match.

Grocery technology is not only a tool for better operational efficiency; it can be used to build the deeper, more resilient customer relationships that grocers have traditionally relied upon to enhance loyalty.

As always, thank you for reading.

For more details on the Mercatus/Brick Meets Click April 2024 Grocery Shopping Survey, read the complete press release here. And stay tuned for next month’s analysis.

Newsroom

Newsroom