US eGrocery Sales Trends with Brick Meets Click – April 2025 Insights

Online Grocery Sales Reach $9.8 Billion in April—a 15% YOY Increase

For the ninth consecutive month, U.S. online grocery sales have surpassed $9.5 billion. In April, sales reached $9.8 billion, marking a 15% year-over-year increase.

Once again, discounted delivery fees tied to membership and subscription programs are fueling this growth. But the impact goes beyond immediate sales.

These initiatives are reshaping grocery shopper perception.

What was once the domain of curbside pickup—convenience, control, and cost-effectiveness—has now been largely claimed by delivery. Thanks to aggressive discounting and improved delivery tracking, the value equation has shifted in the minds of shoppers.

How should grocers respond?

As delivery continues to absorb the key advantages once associated with pickup, grocers must stay informed and aligned with shifting consumer expectations—adapting how they market, price, and communicate value to stay competitive.

This is what makes the insights shared in the monthly U.S. eGrocery Sales Reports so important. Get this information delivered straight to your inbox every month by joining the Mercatus Grocery Retailer Distribution List today.

5 Key Takeaways from April 2025 US eGrocery Sales

Here are the biggest headlines from this month’s report:

- Total U.S. eGrocery sales reached $9.8 billion in April, up 15% YoY.

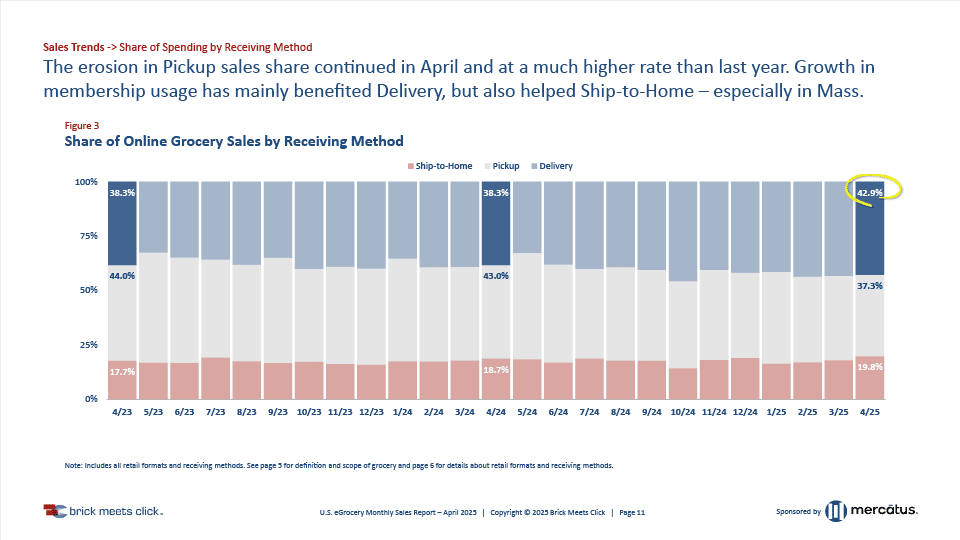

- Delivery accounted for nearly 75% of the year-over-year gains with 43% of all online grocery sales.

- Pickup holds a 37% share, down from the 43% it held last April.

- Ship-to-Home now represents almost 20% of eGrocery sales, up from the 18.7% it posted at this time last year.

- 71% of online grocery shoppers said they’d use the same service within the next 30 days—the highest repeat intent rate since COVID.

Three Questions Grocers Are Asking Right Now

As delivery expands—not just in volume but in perceived value—grocers need to examine their current customer acquisition and retention strategies.

Here are three critical questions based on this month’s numbers that grocers will be asking right now:

1. Should We Abandon Our Investment in Pickup Services?

It may seem counterintuitive with consumer preference shifting to delivery, but now is the time to double down on pickup. While delivery is continuing to fuel eGrocery growth, pickup remains the most viable fulfillment option for regional grocers.

It offers greater control, better margins, and proximity advantages. The challenge is making pickup compelling enough to match consumer expectations even as reduced fees and better tech removes the barriers that traditionally stopped customers from using delivery.

What to do:

- Expand product availability for pickup—especially in fresh and prepared foods.

- Streamline the pickup experience to make it just as convenient as in-store shopping.

- Resist over-investing in delivery subsidies that could undermine your unique selling point.

2. Are We Spending Too Much on the Wrong Promotions?

Grocers continue to pour budget into trial-focused discounts that drive one-time orders but fail to convert customers into repeat buyers.

The result? High acquisition costs and low retention.

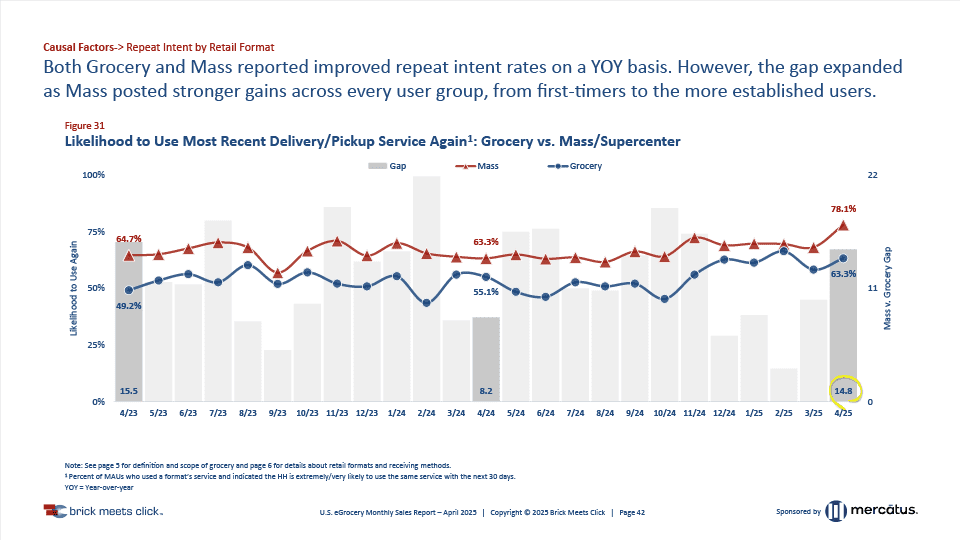

Meanwhile, mass retailers are enjoying the highest repeat intent rate since COVID across every customer type.

Walmart is achieving this by building long-term customer value through deeply discounted annual subscriptions. This strategy doesn’t just retain loyal customers. It also attracts new ones by offering clear, ongoing value through convenience, savings, and reliability.

What to do:

- Shift focus from one-off discounting to experience-driven retention.

- Offer personalized loyalty programs that provide real value.

- Go beyond single transactions to build relationships with customers.

3. Are We Making It Easy Enough for Customers to Choose Us Online?

Many regional grocers continue to rely on third-party marketplaces because shoppers simply aren’t aware of or engaged with their first-party digital options.

Meanwhile, retail leaders like Walmart are reaping the benefits of connecting in-store and online shopping into one seamless, branded experience.

When customers can easily browse, buy, and benefit through a single branded experience, retention goes up, acquisition costs go down, and loyalty becomes much easier to maintain.

What to do:

- Invest in a unified platform that connects in-store and online shopping.

- Promote your digital services off-site through streaming, social, and local advertising.

- Use your app to educate and convert in-store shoppers by highlighting the convenience and benefits of your online platform.

Closing Thoughts

After nine straight months of elevated eGrocery sales, one thing is clear: Reduced delivery fees tied to membership programs have redefined what shoppers see as the most valuable, convenient, and cost-effective way to buy groceries online.

It’s also clear that grocers need to be measured in their response to this new reality.

Now is not the time to try to match delivery subsidies. But it is the time to study what’s working and examine how leading retailers are using memberships, fulfillment strategy, and digital engagement to drive growth.

For more data from the Brick Meets Click/Mercatus April 2025 Grocery Shopper Survey, click here to access the full report.

Newsroom

Newsroom