Advice to Grocers Who Want to Compete with Mass Retailers in 2024

If grocery shoppers had a mascot in 2023, it would have been the chameleon.

The creature perfectly symbolizes a year of shifting consumer behavior and the grocery industry’s response.

Faced with inflation, increasing food prices, and a consistently inconsistent economic outlook, the entire grocery industry found itself catering to shoppers who were insistent on affordability and value without compromising on the convenience to which they had grown accustomed.

This shift in consumer mindset led to significant changes in long-established shopping habits, including:

- An increased emphasis on cost-saving measures;

- A tendency towards less frequent, but more substantial orders;

- Cross-shopping hit record highs; and

- Retaining customers became more important than ever.

But most notably, the year saw a dramatic surge in the market share of Mass Retailers, signaling a significant shift in consumer preference and loyalty.

The grocery trends of the last year are not passing fads; they’re indicative of a deeper change in consumer psyche, one that will require regional grocers and independents to rethink their approach in the coming 12 months. As part of that process, it’s important to look back, identify the major trends and discover ways to turn last year’s challenges into this year’s opportunities.

We begin our look back at the biggest grocery trends of 2023 with the biggest trend of all: the increasing dominance of Mass Retailers.

Why Mass Retailers Surpassed Supermarkets in Grocery Sales

In Nov. 2023, research from Brick Meets Click and Mercatus revealed 42% of American households turned to Mass Retailers for the majority of their grocery shopping needs. That number meant that mass merchants surpassed Supermarkets as the primary retailers of choice during the month, whether online or in-store. Only six months earlier, it was Supermarkets with a 42% share of the market, and big retailers with 39%.

How did this happen?

As the cost of living surged, consumers increasingly turned to mass retailers for their grocery needs. This shift was driven by the need to stretch household budgets further, making the cost-effectiveness of mass retailers more appealing than ever.

Large retailers like Walmart were only too happy to use these market conditions to lean into their inherent advantages:

- Economies of Scale: Lower purchasing costs due to bulk buying allows them to offer products at lower prices.

- Extensive Product Range: They also offer a wide variety of products, from groceries to general merchandise, catering to diverse consumer needs in one location.

- Strong Supply Chain and Distribution Networks: With advanced logistics, mass retailers ensure efficient inventory management and timely product delivery.

- Retail Media: Mass retailers utilize retail media networks to generate additional revenue through targeted advertising, enhancing their overall profitability.

- Personalization and Omnichannel Capabilities: They provide a seamless shopping experience across online and offline channels, meeting the modern consumer’s demand for convenience.

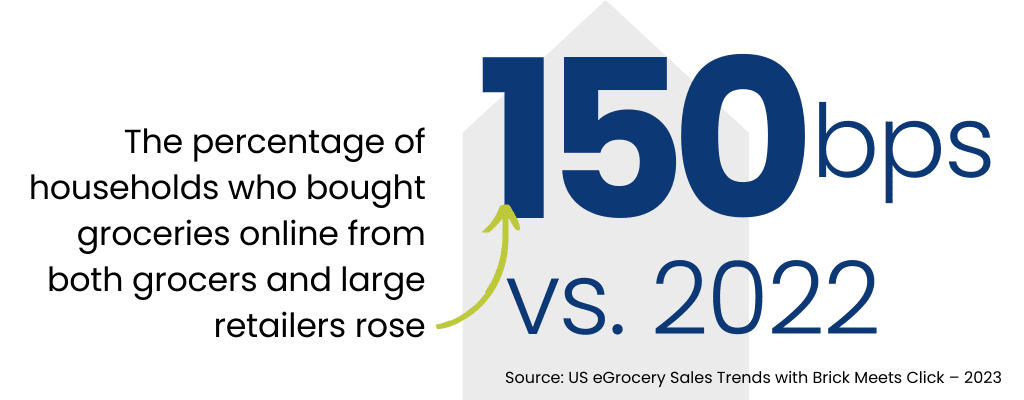

This resulted in Mass Retailers expanding their share of overall eGrocery sales by 460 basis points in 2023, taking 45% of the market share, as cross-shopping between Supermarkets and the big retailers hit record highs.

What Can Regional Grocers and Independents Learn From the Success of Mass Retailers?

Understanding and learning from the strategies employed by Mass Retailers is crucial. To effectively compete and win customers back, independent and regional grocers can take a page from the Mass Retailer playbook and capitalize on their own unique strengths while adopting other strategies:

- Leverage Local Community Ties: Embrace your role in the community by offering locally sourced produce and creating bundles for local events. This approach not only supports local suppliers, but also resonates with customers who value community-focused shopping that Mass can’t provide.

- Make It Easier: Prioritize a seamless shopping experience for your customers with an end-to-end eCommerce platform that runs your digital storefronts, fulfills orders for pickup and delivery, personalized rewards and loyalty offers, and ultimately leads you toward achieving omnichannel profitability.

- Optimize Omnichannel Presence: It’s worth emphasizing an omnichannel strategy because this approach is one area that the Mass Retailers have really used to their benefit. The right platform can help you develop a cohesive omnichannel strategy that enhances your online and in-store engagement strategies to meet evolving consumer needs.

The Critical Role of Customer Retention in Online Grocery Shopping

Of course, it doesn’t end there. Competing with the big retailers isn’t as easy as a one, two, three checklist. It’s going to take further analysis of last year’s trends, and using that insight to adopt new strategies.

One major trend identified in the eGrocery Performance Benchmarking 2023 report, from Brick Meets Click and Mercatus, is that many grocery stores faced a decline in sales despite increases in average order value. The true culprit for lower sales wasn’t customers spending less money. It was actually customer churn: previously active customers suddenly going elsewhere for their groceries.

This is further emphasized by the findings of the year-end eGrocery sales numbers that found 30% of Supermarket shoppers would cross-shop with a Mass Retailer in the same month.

The 2023 Performance Benchmarking report went on to stress the high cost of customer attrition, revealing that it takes approximately 2.5 to 3.5 new customers to replace the value lost from a single long-term customer. This statistic underscores the incredible importance of keeping existing customers engaged.

In addition to Mass Retailers drawing customers away from independent and regional grocers, the report identified several reasons why grocery retailers are seeing declines in active customers:

- Pricing Discrepancies: Customers are driven away by noticeable price differences, especially when they find better deals with competitors, necessitating pricing strategy optimization for regional grocers.

- Technology and Personalization Gap: A lack of advanced technology and personalized shopping experiences can lead to customer loss, as competitors offering more tailored services attract these customers.

- Inadequate Customer Engagement and Loyalty Programs: Successful grocers need effective engagement strategies and loyalty programs. Otherwise, they risk losing customers to competitors who provide more value and recognition.

- Suboptimal Pickup and Delivery Options: Inefficient pickup and delivery services can frustrate customers, leading them to choose retailers who offer better convenience in these areas.

- The Last Mile Experience: Poor execution in the delivery phase, including delays and inaccurate orders, significantly impacts customer satisfaction, contributing to higher attrition rates.

What Can Independent and Regional Grocers Learn From the Churn of Grocery Shoppers?

To address these reasons and effectively retain customers, regional and independent grocers can employ several straightforward tactics:

- Align Pricing with Market Expectations: Regularly analyze and adjust online pricing strategies to remain competitive.

- Strengthen Customer Engagement and Loyalty Initiatives: Develop robust loyalty programs and engage customers through targeted marketing campaigns.

- Improve Pickup and Delivery Services: Ensure these services are efficient, flexible, and customer-centric.

- Focus on the Last Mile: Enhance the final phase of the eGrocery experience by ensuring timely deliveries, accurate order fulfillment, and offering better substitutions for out-of-stock items.

- Enhance Technology Use for Personalization: Invest in technology that offers personalized shopping experiences and utilizes customer data effectively.

Retail Media Grows as a Viable Option for Grocery Retailers

We end the previous section by highlighting the importance of investing in technology, but it’s important to recognize that understanding the benefits of investing in technology and being able to afford that investment are often two very different things.

That’s why the next trend from 2023 was such a breath of fresh air for the grocery industry.

In the search to offset costs associated with increased technological integrations and boost profits, the $45 billion retail media industry grew as a winning option for grocery retailers of all sizes.

How does it work?

Retailers connect with consumer packaged goods companies and other grocery brands interested in paying for advertising space on the retailer’s app and website.

By displaying these ads, retailers can monetize a significant portion of their digital traffic. This includes leveraging sponsored product placements on grocery items, digital offers, and other advertising formats that attract brands looking to reach specific consumer segments.

It’s a win-win situation because effective retail media strategies also enhance the shopping experience of customers by showing relevant ads and offers, increasing the likelihood of purchases and improving customer satisfaction.

This has traditionally been the domain of mass retailers, but with new software emerging — like the product sampling solution directly integrated with the Mercatus Digital Commerce Platform — regional grocers can more easily manage their retail media strategies.

How Can Independent and Regional Grocers Implement an Effective Retail Media Strategy?

In September of last year, our very own Peter Nakamura, Product Marketing Manager, and Rob LaGrave, Digital Ad Operations Manager, offered five recommendations on implementing an effective retail media strategy.

- Evaluate eCommerce Traffic and Order Data: Success in retail media begins with thoroughly understanding your eCommerce traffic and order data, including the specifics of different page types and the average value of online orders.

- Choose the Right Retail Media Solution: Select a retail media network that aligns with your brand coverage, ad types, budget, and operational capabilities, especially considering the effort required from your team.

- Capitalize on Both Web and Mobile Traffic: Ensure your retail media strategy covers both web and mobile app environments to maximize advertising reach, tapping into the significant portion of eCommerce orders that come through mobile.

- Develop In-House Expertise: Grow your in-house retail media expertise to engage directly with brands and manage ad placements through your CMS, offering advertising opportunities that align with omnichannel marketing strategies.

- Monitor Key Metrics: Continuously track key performance metrics like advertised products, ad fulfillment rates, click-through rates, conversion rates, and ROAS to gauge consumer interaction and the effectiveness of your retail media strategy.

The Steady Strength of Pickup Services in the Grocery Industry

At the beginning of this article, we highlighted the changing approach of consumers this past year as they responded to uncertain market conditions by seeking more value in their online grocery shopping. However, there was one constant amidst all this flux: consumers preference for pickup services.

The performance of eGrocery formats fluctuated throughout the year, but Pickup — just as it has over the past few years — was again the method of choice for the majority of online grocery shoppers, growing its share of eGrocery sales by 56 basis points, totalling $44.1 billion in sales and taking 46% of the market versus Delivery and Ship-to-Home options.

The continued success of Pickup represents an especially insightful perspective into consumer preferences. They want the convenience of online shopping, but they need the value provided by Pickup, which typically lower fees than Delivery.

This is further emphasized by the end-of-year rise of Delivery, which increased drastically over the last two months of the year due to third-party providers enhancing their efforts to combine value and convenience to customers with significantly lower delivery fees.

What Can Independent and Regional Grocers Learn From the Continued Success of Pickup?

These two bits of consumer data suggest that there's room for independent and regional grocery retailers to win market share back from Mass Retailers not just by enhancing Delivery options, but by finding new and innovative ways to combine convenience with value.

The ongoing appeal of Pickup proves that despite increased pricing sensitivity, consumers are still interested in convenient online grocery shopping experiences. To attract and retain them, it’s vital to find ways to balance both in your service offerings.

- Streamlined Online and In-Store Shopping: Once again we come back to the importance of developing an efficient, user-friendly online shopping platform that seamlessly integrates with the in-store experience. This could include a mobile app with features like shopping lists, easy reordering of previous purchases, and real-time inventory updates. Enhancing the in-store experience with self-checkout options and well-organized store layouts can also add to the convenience.

- Personalized Promotions: Use customer data to offer personalized deals and promotions. This approach not only adds value for the customer but also makes the shopping experience more relevant and convenient. Loyalty programs can be a great tool for this, offering rewards and discounts based on shopping history.

- Bulk Buying and Bundled Deals: Offer bulk buying options and bundled deals for commonly purchased items. This approach can save customers money (value), reduce the frequency of their shopping trips (convenience), and play into another trend we witnessed in 2023 with the number of monthly orders decreasing while the average order value increased.

- Technology for Efficiency: Utilize technology to streamline operations, reduce waiting times, and improve the accuracy of orders. This includes investing in an end-to-end eCommerce platform that delivers inventory management systems, predictive analytics for stock levels, and easy-to-use online ordering systems.

Leveraging Technology for Enhanced Customer Experience

Again, we come back to the importance of technology for the grocery industry. However, in 2023, the importance extended beyond combining cost-effectiveness and convenience.

It emerged as the go-to source for delivering the type of enhanced shopping experience necessary to retain customers and compete with bigger retailers and national chains.

This was confirmed by the findings of the 2023 Supermarket Technology Review, conducted by Informa and Supermarket News in partnership with Mercatus. The report, which gathered feedback from grocery retailers and industry professionals, echoed a resounding sentiment: technology is not merely beneficial but fundamental in addressing current challenges and securing the future of the grocery industry.

The only point of unanimous agreement among those surveyed was in acknowledging the pivotal role of technology in meeting the primary business goals of grocery retailers.

We see this again by going over the trends identified above and the strategic recommendations attached to each. Technology is frequently mentioned as a means of providing independent and regional grocers with the tools to compete with Mass Retailers and win customers back.

What Does Technology Provide to Independent and Regional Grocers?

While integral to streamlining the operations of a grocery store, technology is also the best means for independent and regional grocers to match the customer experience offered so effectively by larger retailers — while maintaining manageable costs.

There are three key areas in which increased grocery technology accomplishes this:

- Leveraging Technology for Personalization: Through the use of data analytics and AI, technology allows grocers to personalize shopping experiences by analyzing customer preferences and purchase history. This leads to tailored product recommendations, targeted marketing campaigns, and customized promotions, significantly enhancing customer engagement and satisfaction. Combined with the previously mentioned retail media strategy, this has the potential to boost profits both directly and indirectly.

- Improved Pickup and Delivery Options: Technology enhances pickup and delivery services through the integration of automated systems that streamline the order fulfillment process, reducing errors and speeding up the preparation of pickup and delivery orders. It also enables real-time tracking and efficient route optimization, leading to faster and more reliable deliveries, but more on the importance of Last Mile below.

- Enhancing the Last Mile of the User Experience: Technology plays a crucial role in optimizing the last mile of delivery, ensuring timely and accurate deliveries through advanced logistics software and GPS tracking. This reduces wait times and improves order accuracy, as well as allows for real-time communication with customers, ensuring a smooth and satisfactory end-to-end shopping experience.

Why Partner with Mercatus?

Looking back at 2023, it's clear that the shift in consumer behavior was heavily influenced by the increased cost of living and uncertain economic conditions. This is highlighted by 1.2% decrease (YOY) in the U.S. eGrocery market in 2023 and the increasing share of the market that big retailers amassed with their lower prices.

Despite these challenges, the grocery industry remains ripe with opportunities for growth. Knowing the trends of the last year, understanding why they happened and taking action on the recommendations based on this analysis will be crucial for grocers to compete with Mass Retailers over the next 12 months and beyond.

Mercatus is uniquely positioned to assist grocers in this. We offer an all-encompassing platform that simplifies managing shopper engagement, digital coupons, weekly ads, rewards, and loyalty programs to eCommerce and order fulfillment. More than just a platform, though, Mercatus serves as a constant source of insights and analysis, helping grocers understand customer needs and market trends, with monthly reports on the eGrocery industry. And we continue to find new ways to support grocers.

This next step in our commitment to delivering value to the grocery industry was only recently announced. Relationshop, a provider of digital engagement solutions, has brought Mercatus Technologies and Stor.ai together to form a new company — still called Mercatus — that will use its global reach to help independent and regional grocers compete more effectively against large national chains and mass retailers.

We understand the competitive challenge posed by the increasing market share of mass merchants. This merger is a strategic step to enhance our mutual offerings and satisfy the demands of regional and independent supermarkets worldwide. Our combined capabilities deliver a seamless, personalized digital shopping experience, aimed at attracting customers, boosting online and in-store sales, strengthening customer retention, and enhancing loyalty.

In an industry where adapting to change is crucial, Mercatus stands as a valuable partner for grocers aiming to thrive in the next 12 months and beyond. To learn how Mercatus can help your business compete with the largest retailers in the world and win back your market share, schedule a tour of our platform with a grocery eCommerce expert.

Take the first step towards greater sales growth and a more competitive eGrocery future with Mercatus today.

Newsroom

Newsroom