How Should Regional Grocers Respond to the Latest Grocery Delivery Trends?

This article was originally published on March 31, 2021. It was updated on August 21, 2024.

A discernible shift in how consumers receive their online grocery orders has occurred over the last few months.

While not quite overtaking pickup as the preferred eGrocery receiving method, the most recent Brick Meets Click/Mercatus Grocery Shopping Surveys reveal an unexpected rise in monthly active users (MAUs), order frequency, and total grocery sales for delivery.

More and more American households are turning to delivery for their online grocery shopping needs.

But why?

An increase in delivery services — typically more expensive than pickup — runs contrary to the flight-to-value many consumers have taken after feeling the financial pinch of inflation, rising food prices, and general economic uncertainty.

How Walmart and Instacart are Influencing Online Grocery Sales

By looking a little bit further into the data, however, we learn that value is playing a major role in this shift.

The increase in delivery numbers can be correlated to Walmart and Instacart offering deep discounts on delivery (50% and 80% off, respectively) for customers signing up for annual membership plans.

This drive to promote membership plans shows that the big players are recognizing customer retention as being crucial to their long-term success.

As with any initiative from a mass merchant or large third-party delivery provider, there are a lot of questions to unpack:

- Are these numbers sustainable?

- Will these offers influence consumer behavior moving forward?

- What can be learned from these discounts and the response from customers?

- How should regional grocers and independents respond?

To learn the answers to these questions — and gain valuable insights into leveraging the latest grocery trends to enhance your own grocery retail operations — keep reading the rest of this article.

Will Delivery Numbers Continue To Rise?

Further analysis into the total grocery sales figures from the last few months suggests that the promotional offers from Walmart and Instacart aren't gaining net new customers as much as they're attracting more purchases from infrequent shoppers and re-engaging lapsed customers.

In other words, the heavy discounts are converting casual users into more committed members — at least in the short-term.

But how many of these customers, recently attracted by the deep discounts, will continue online grocery shopping with Walmart or through Instacart months from now? That depends on how well these big players meet the needs and expectations of their new members.

Do Lower Delivery Costs Create New Expectations for Grocery Shoppers?

The fear for grocers — already feeling the sting of higher cross-shopping figures — is that these discounts will not only steal loyal customers away, but also create an expectation amongst consumers for cheaper delivery service that will further eat into their profitability.

Customer data from the quarterly Market Share Report from Brick Meets Click reveals Supermarket shoppers generally prefer delivery, which is the most expensive option to serve. However, pickup orders in the Supermarket segment have grown significantly as more and more retailers introduce and expand in-store pickup services across their grocery stores.

With a lower cost-to-serve and projections that suggest pickup in store will enhance its stature as the preferred receiving method for grocery orders, grocers want their customers to use curbside pickup.

But as we've identified multiple times before, modern consumers are driven by a combination of value and convenience. While the convenience of grocery orders being dropped off would be considered higher than having to pick them up, there's an element of control — the customer decides when they pick up their groceries — that puts in-store pickup on equal footing. The recent rise in delivery is almost entirely due to the value (deep discounts) being communicated and provided to shoppers.

If grocery retailers are concerned that this is going to create unaffordable expectations, and more demand for cheaper delivery, they should move quickly to communicate and provide increased value on pickup — where profitability is more sustainable.

We'll discuss this further — and identify additional benefits to this strategy — later in the article.

What Else Can Grocers Learn About Online Grocery Shopping From Walmart and Instacart's Promotions?

Before we get into that, we should identify what else can be learned from the way consumers are responding to these discounts.

It's worth mentioning again that, to this point, the membership promotions haven't won over new customers — overall eGrocery users have remained steady over the last few months. Instead, they've attracted commitment from infrequent online grocery shoppers and returned engagement from lapsed customers.

This indicates that infrequent and lapsed customers are willing to give eGrocery another go — just as long as the incentives are right.

Automated Campaigns

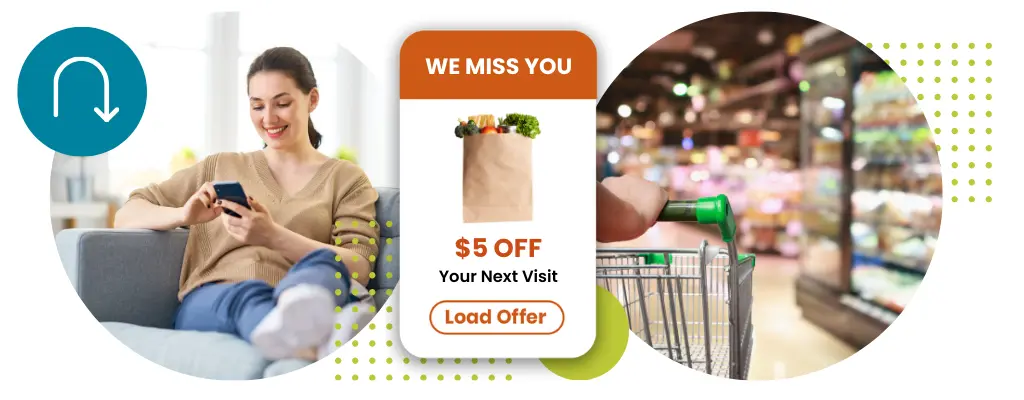

Grocers can take advantage of this information — and do so in a cost-effective manner — by utilizing existing technology to create automated marketing campaigns that entice lapsed customers back.

It starts with the collection and consolidation of first-party data. Machine Learning and algorithms can use this data to allow grocery retailers to deploy specific engagement strategies and individualized offers based on key customer behaviors and segments — including high spenders, new accounts, churning, and, of course, lapsed.

It's all about providing a better customer experience that engages online shoppers on an individual basis.

This is an efficient, cost-effective way for grocers to target the same type of customers Walmart is winning over, without risking profitability through unaffordable delivery discounts. Instead, they can lean on tech to deliver personalization at scale.

Encouraging Repeat Purchases

There's an argument to be made that the contextualized commerce described above is actually more effective than a discount — even large ones like Walmart is putting out.

While the continued effectiveness of these promotions depends on whether or not Walmart and Instacart are able meet the needs and expectations of their new members, the deep personalization provided by contextualized commerce provides a level of customer experience that ensures greater customer loyalty.

It's proven to encourage repeat purchases by timing messages to align with customer behavior and purchase cycles. This approach helps maintain customer engagement and drives consistent grocery sales growth.

How Should Grocery Stores Respond to The Latest Online Shopping Trend?

Beyond being a motivation to increase their tech investment, the most recent online grocery sales data should also prompt grocers to re-examine their own promotional offers.

We've already discussed the obvious benefits of pushing customers toward curbside pickup over delivery services — it's less costly to fulfill. But that's only half the story.

Provide Value Where It Isn’t Already Available

A common strategy with delivery fees is to reduce them based on threshold spends. For example, if the consumer's cart reaches $65, that's $5 off their same day delivery fee.

While there's certainly merits to this tactic — many supermarket chains swear by it — there could be a more cost-effective way to compete with the value offers of the big players.

Instead of competing directly, grocery retailers should identify and promote services that Walmart and Instacart don’t offer or are less motivated to provide.

Offering similar discounts to Walmart on delivery services isn’t very feasible, anyway. The objective for grocers is to increase profitability, not risk it. Instead, grocery retailers should recognize that the success of these promotional offers is due to the communicated and provided value — not an overall preference for delivery.

The big players might be driving the increase in delivery through their promotional offers, but that leaves the door open for grocery retailers to increase their offerings around pickup — which is still the most popular eGrocery receiving method.

Enhance Pickup Services

Many regional grocers still charge a fee for pickup services. While that would typically be identified as a hindrance to online grocery sales, in this case, it's a policy that can be turned into an advantage.

By offering their own subscription plans that promote waived pickup fees and/or expedited service, grocers can demonstrate improved value to customers and create a grocery shopping value proposition that’s not already available from other retailers.

Target Price-Sensitive Customer Segments

By adding an increased sense of value to this aspect of their service offering, grocers can attract a larger customer base.

No-fee pickup promotion has the potential to appeal to more price-sensitive demographics including lower-income households. Already feeling the pinch of higher food prices, these customer segments often stick to in-store shopping — without realizing the potential savings if they buy online — because of the additional fees commonly attached to grocery delivery and curbside pickup.

Consumers Remain Driven By Value and Convenience

If there's one thing to learn from Walmart and Instacart’s promotional strategies, it's that consumers are drawn to services that offer both affordability and ease of use. We see evidence of this month-to-month in the grocery retail industry, even beyond the latest grocery sales trends.

For grocers, this should provide all the motivation necessary to find ways to incorporate value and convenience into their service offerings without compromising profitability.

Each of the tactics and strategies we identified in this article incorporates these two consumer drivers into the customer experience — all based on the latest promotional offerings (and its corresponding impact on the grocery industry) of Walmart and Instacart.

Targeted Personalized Offers

- Utilize technology to create targeted, personalized, and contextualized offers based on shopper profiles and past purchases.

Automated Campaigns to Re-engage Lapsed Customers

- Use first-party data to deploy specific engagement strategies and individualized offers, efficiently delivering personalization at scale.

Offering Subscription Plans for Pickup Services

- Waive pickup fees or provide expedited service to add value and appeal to price-sensitive customers.

Promoting Pickup Services

- Emphasize the value and convenience of pickup, which has a lower cost-to-serve and appeals to customers seeking control over their shopping experience.

Mercatus Provides The Solutions Grocers Need

It's one thing to provide theoretical advice for competing with the latest grocery industry trends, and quite another to have the practical solutions ready for implementation.

At Mercatus, we provide regional grocers and independents with both.

Mercatus offers advanced features, a large array of integrations, and constant innovation, enabling you to build a best-in-class omnichannel experience that meets and exceeds customer expectations.

More specifically, the Mercatus all-in-one eCommerce platform provides grocers with total control over the entire customer journey, including order fulfillment and last-mile delivery. That means you have the power to implement the most effective strategies — whether its no-fee pickup or delivery threshold offers — aligned to your specific customers.

With our AisleOne personalization solution, you can use your first-party data to offer the deep personalization necessary to attract and retain lapsed and infrequent users through automated marketing.

To learn more about the control Mercatus offers grocery retailers, through its suite of solutions, reach out to our sales team today.

Whether it's taking advantage of the latest consumer spending trend or establishing long-lasting loyalty programs that actually work, Mercatus has the solution for you.

Newsroom

Newsroom