Here’s How Instacart Platform is Doing Grocery Businesses More Harm than Good

In 2020, the pandemic accelerated the shift to digital. Grocery retailers turned to marketplaces like Instacart to fill the gap.

Today, the risks of depending on those marketplaces are becoming clear. Increasing fees, competition for ad revenue, and eroding brand loyalty are a few challenges retailers are facing with Instacart.

Last month, Instacart filed a confidential draft registration statement to the SEC for its long-awaited IPO. A confidential registration allows them to keep their financials away from public scrutiny. Commentators suggest that slowed growth, nervous investors, and a massive devaluation have forced this move. While the company has positioned itself as an innovator in the grocery delivery space, some industry insiders are noting how Instacart’s much anticipated micro-fulfillment centers with Publix are simply dark stores using their existing picking software.

With increasing competition from DoorDash and Uber, there’s sure to be more pressure from shareholders to find new channels for growth. Instacart’s recent pivot to retail enablement underlies concerns over dwindling advertising revenue. While they’ve pledged never to compete with grocers, it’s unclear how much longer leadership will resist that call for change.

With an IPO or acquisition on the horizon, revenue diversification is the name of the game for Instacart. Grocery retailers still need to ask themselves: can we trust Instacart to be a good partner?

The pandemic-fuelled digital transformation has been a turning point for most industries, and online grocery shopping is no different. In fact, experts argue that the sudden, unprecedented rise in consumers’ affinity towards grocery eCommerce was a disruption waiting to happen for quite some time now. Instacart was one of the few businesses to make the most of these tumultuous times and give shoppers exactly what they wanted and grocery retailers exactly what they needed.

Launched in 2012 and popularized in the past few years, Instacart is a grocery delivery and pickup service that allows buyers to shop from leading retailers via its own platform. As grocery retailers increasingly realized that the future will belong to eCommerce and that taking their services online is the only way to stay afloat in this digital era, they turned to Instacart.

Instacart assured them of a promising solution, wherein they could avoid the heavy lifting and still jump on the bandwagon almost immediately. The Instacart marketplace became the go-to choice among grocers as it

- Allowed them to take their inventory and services online without having to build the technical functionality required

- Promised irresistibly narrow delivery windows to shoppers – something retailers would need time, expertise, and operational excellence to build and execute

- Allowed them to take the first step towards going multi-channel, something that would require significant investment to do in-house, which most grocers couldn’t afford to make right away

However, with grocers depending so heavily on Instacart to meet their customers’ online needs, are they doing their business more harm than good? In the next section, we shall dissect the ways in which Instacart is inevitably hurting grocery retailers and eroding profit margins. We will also suggest a course of action that fits the best interests of your grocery business.

11 Reasons Why Instacart Has Been Hurting Grocery Businesses

1. Instacart controls more of the end-to-end customer relationship

Grocery retailers risk losing control over their shopping experience

Needless to say, Instacart offers convenience to grocery shoppers and helps improve the reach of grocery merchants. However, to shop from their favorite grocery retailers, most consumers navigate the Instacart app, select the store and product (in no particular order), and then complete the checkout process in the app.

Many retailers even redirect their website visitors to Instacart to buy from them, since they don’t manage their own eCommerce fulfillment operations. This essentially boils down to grocers willingly handing over their customer journeys to a third party.

On the marketplace, Instacart has complete control over the buyer experience. For grocers, this means you have little or no control over how your own customers experience that shopping journey. Any and all modifications that Instacart decides to make to the customer experience – including the quality of delivery – will impact consumers’ perception of the retailer’s brand.

In a nutshell, grocers’ lack of control over their shopping experiences could negatively impact buyers’ affinity towards their brand.

2. Retailer brands are not a priority for Instacart shoppers

It is nearly impossible for grocery retailers to build loyalty via Instacart

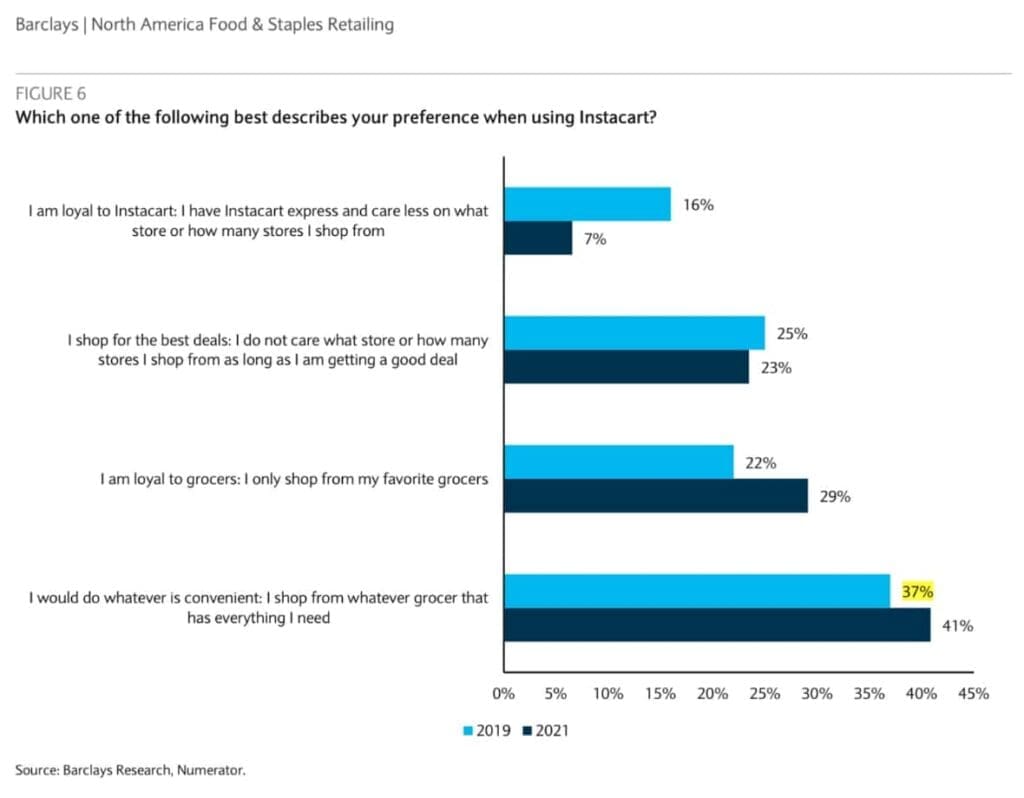

As per Barclays Research report titled Dissecting Instacart’s Hangover that surveyed over 1000 Instacart customers in September 2021, 37% of the respondents said that they would continue to use Instacart with a different retailer in case the one that they usually buy from is no longer available. This number was even higher in 2019 (43%).

If these numbers are anything to go by, they clearly indicate that it is next to impossible for grocers to build loyalty among their buyers as long as they use Instacart to shop from their stores. This primarily stems from the fact that brand name isn’t really a priority for shoppers when using Instacart and they are happy to switch retailers, but want to continue using the app.

In fact, when asked why they prefer using Instacart, as many as 41% of the respondents said that convenience is the primary criterion for them and they would shop from whichever grocer has everything they need.

In the latest episode of the Digital Grocer, Sylvain Perrier (CEO Mercatus) and Mark Fairhurst (VP Marketing, Mercatus) discuss that coming out of the pandemic, the average consumer happens to be extremely time-starved. Between planning a vacation after almost two years, watching their favorite sports game live, and catching up with friends and family, in-store grocery shopping might take a backseat because of the convenience that online shopping offers.

Nearly 23% of the respondents admitted that they shop for the best deals and do not particularly care about the store they are shopping from. Although the number is rather small, it is worth noting that 7% of them even went on to confirm that they are loyal to Instacart and not any specific retailer.

The bottom line is that as long as grocers are using Instacart as their digital storefront, they cannot possibly build customer loyalty or brand affinity and will have to continue to beat their competition on price point and product availability.

3. Instacart comes between retailers and their customers and could potentially take over retailers’ loyal customer base

Grocery retailers need to compete with Instacart to retain shoppers and their loyalty

Grocery shoppers are drawn to Instacart because of one very obvious reason – the convenience of same-day delivery. For time-starved families, there’s a clear benefit in not having to navigate store aisles with kids in tow. At the same time, Instacart is working hard to be the go-to place for online grocery shopping, at the expense of retailers’ relationships with grocery shoppers. In essence, this puts a lot of pressure on grocery marketers who are responsible for maintaining and growing retailer brand affinity.

Therefore, the Instacart marketplace doesn’t seem to be complementing the retailer’s shopping experience or adding to it, but rather working towards replacing it or more evidently, competing with it. For grocery retailers, this seems to be a double-edged sword – the more heavily they depend on Instacart to offer shoppers more avenues to buy from them, the more competitive advantage they are offering Instacart.

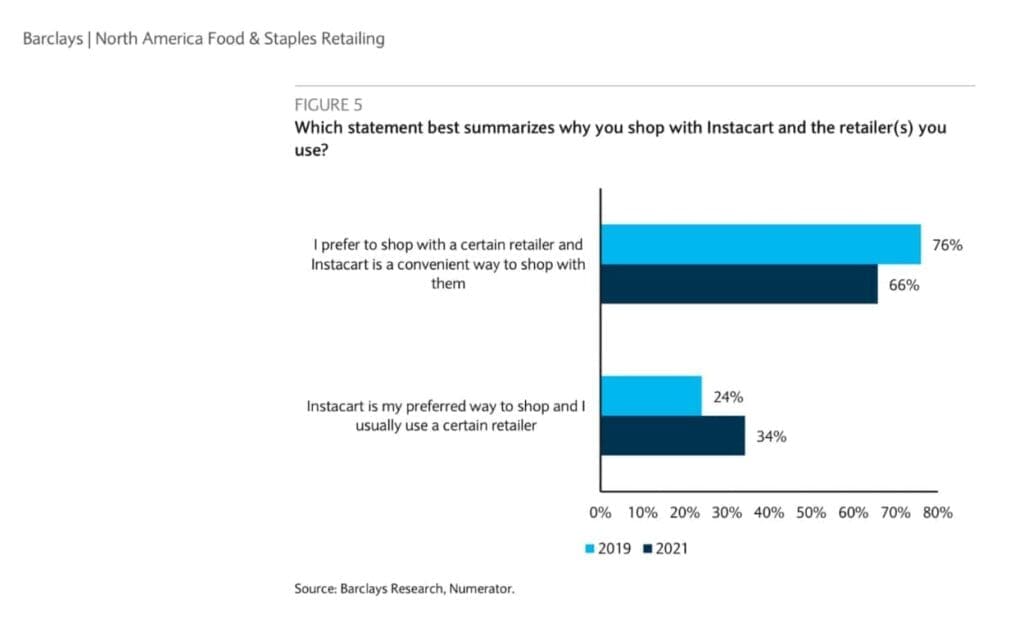

As per the Barclays research conducted in 2021, 34% of the respondents prefer to shop for groceries via Instacart because of its user-friendly platform, robust technology, and the fact that they can choose among multiple retailers. This number is up from 24% in 2019 and goes on to indicate that Instacart is clearly competing with retailers by offering convenience under their brand experience. As a result, partnering with Instacart translates into retailers handing over control of their customer experience, subsequently their loyalty, to a nimbler competitor.

Retailers’ dependence on Instacart exposes them to the risk of being disrupted by a company that is better able to meet the needs of customers. This could potentially mean that Instacart might soon take over retailers’ loyal customer base if it decides to build its own inventory.

Moreover, since Instacart has access to valuable data and insights around shoppers’ purchase history and preferences on the platform, they have an edge over retailers in terms of competing for CPG trade dollars, as they can make more informed, data-backed targeting decisions. Leading us to our next concern…

4. Instacart has ownership of valuable customer data

Grocery retailers do not have any visibility into their own shoppers’ buying behavior

It’s 2022 and we’re living in the digital era, where data drives key decisions. In such a landscape where customer data is the most valuable asset a business has, not having any visibility into it can prove to be a huge disadvantage.

Instacart has complete control over the customer data that it collects via the platform, which can be used to draw insights around customer purchase history and shopping behavior, and identify trends and patterns to better target marketing efforts. They can use this information not only to improve their services but also to redirect shoppers to other retailers (read: competitors).

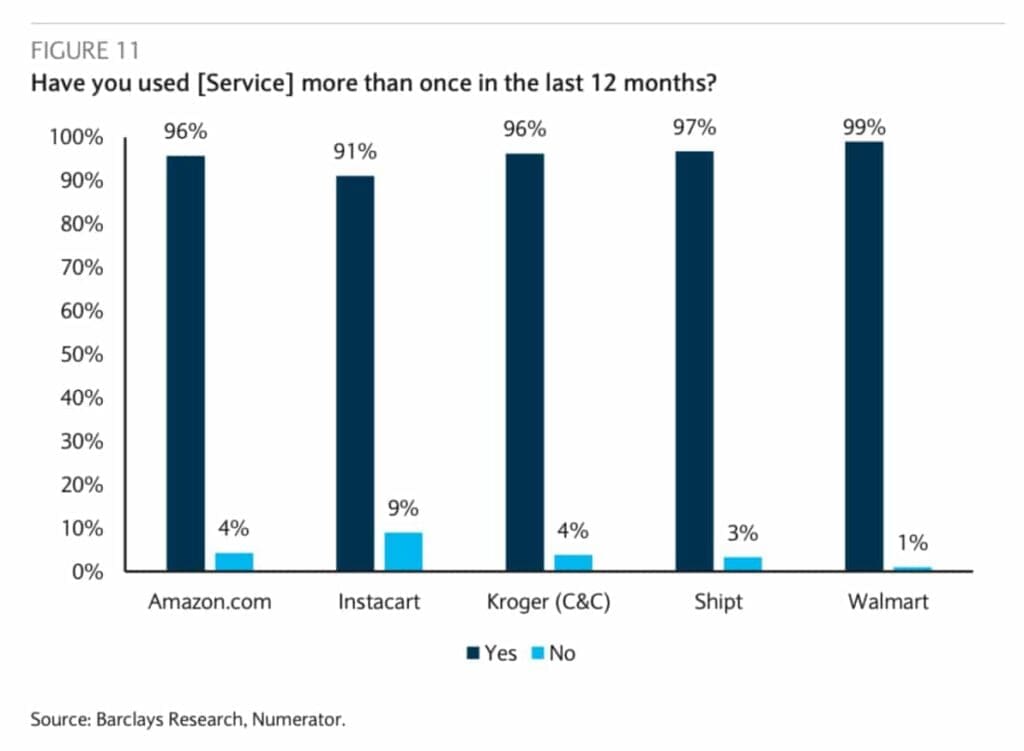

In fact, Barclays Research Numerator suggests that 91% of the respondents used Instacart’s services more than once in the past 12 months. Not only does this indicate shoppers’ affinity towards the platform, but also the fact that Instacart has access to billions of data points from millions of users, comparable to the likes of Amazon, Walmart, and Kroger. These data points are a source of rich insights into shopper behavior and preferences that can be used by Instacart to retarget buyers and get them to spend more on the platform.

For retailers, not having any access to data about shoppers’ purchase behavior on their online store equals losing out on all those valuable insights that they could have been leveraging to tailor their promotions and marketing efforts. They, thus, have to shoot in the dark when dedicatedly targeting eCommerce shoppers. Even for traditional retailers to reclaim a fraction of data points that are being gathered by Instacart will help them better inform their eCommerce decisions.

5. Instacart promotes vendor lock-in and handcuffs retailers to their eCommerce roadmap

Grocers on the losing end of the tech divide

America’s leading toy, clothing, and baby product retailer, Toys “R” Us realized that it needed to foray into eCommerce to stay relevant in the year 2000. To be able to quickly jump on the bandwagon, Toys “R” Us decided to outsource its eCommerce operations to Amazon, in an arrangement wherein the tech behemoth was responsible for processing and fulfilling all the orders received via toysrus.com and babiesrus.com. While this decision made sense at the time as it allowed the toy retailer to diversify its offerings and quickly pivot its operations as per the changing times, it came at a huge cost that only became evident with time.

When it was finally time to end its partnership with Amazon, Toys “R” Us found itself in the middle of a colossal conundrum. Once it regained control of its eCommerce operations, the retailer struggled with managing it and staying ahead of its competitors simply because it lacked the expertise that was needed to thrive in the digital battleground. In 2017, Toys “R” Us filed for bankruptcy likely due to a rapid rise in debt and increased competition from Walmart and Amazon themselves.

Grocers’ increasing dependence on Instacart to manage their eCommerce operations is strikingly similar to how Toys “R” Us relied on Amazon a couple of decades ago. And if history is any indication, this unhealthy dependence poses a serious risk. National retailers such as Walmart and Kroger already have the first-mover advantage as they have built their own platforms that are competing with Instacart in terms of the convenience they offer.

Regional grocers are better off turning to the handful of eCommerce providers that specialize in grocery and take the time to evaluate which provider best suits the retailer’s marketing and merchandising objectives and goals. More importantly, they should ask which provider has the technical expertise and knowledge to enable retailers to have maximum control over the online shopping experience.

6. The platform erodes grocery retailers’ profit margins

Grocery retailers end up hurting their bottom line in the long run

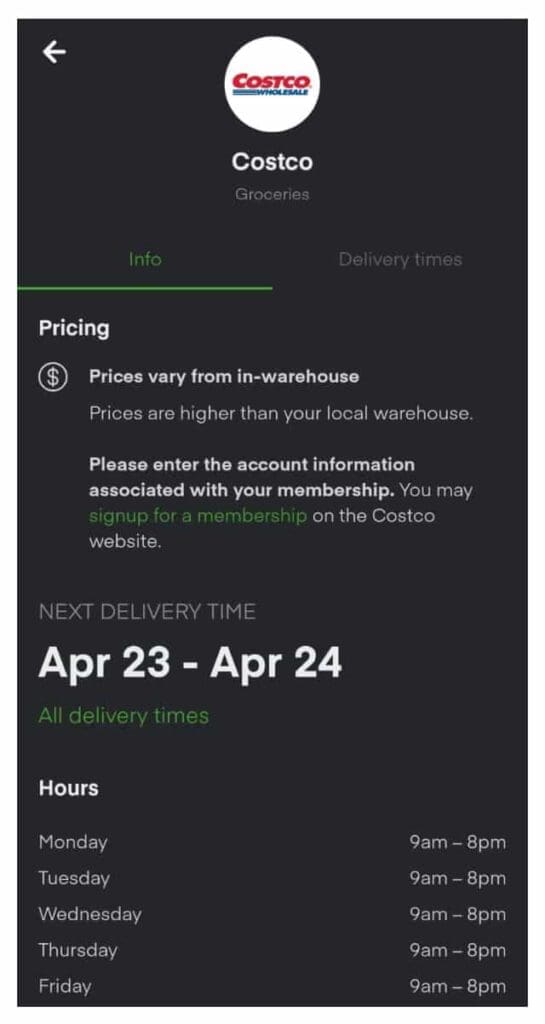

As per the Instacart model, there are two ways for retailers to partner with the platform. To utilize its services, retailers are supposed to pay a direct fee to Instacart, which is a percentage markup on every basket value. Either that or shoppers are directly charged a markup on the in-store retail prices of products.

Apart from that, customers are charged delivery and service fees to grocery shop online using Instacart. A critical point raised in the latest episode of Digital Grocer is that this model followed by third-party platforms like Instacart wherein shoppers are required to pay a huge upcharge is not sustainable for grocery retailers and is slowly eroding their profit margins. So, the more retailers decide on targeting shoppers who prioritize rapid delivery, the more they will end up hurting their profit.

7. Instacart has control over its trade dollars and relationships

Grocery retailers lose control over their vendor relationships and dollars

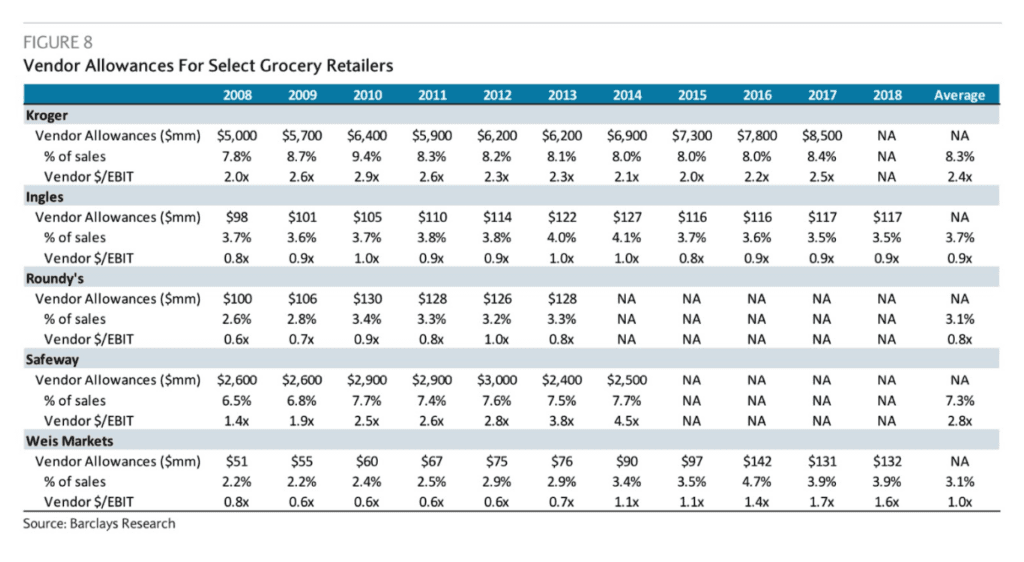

Given the digital advertising and promotion opportunities it provides, Instacart has formed direct relationships with manufacturers. Thus, vendor relationships and dollar opportunities, which make up a significant chunk of retailers’ profits, are being redirected to Instacart – since the platform is benefiting from the massive amount of customer data that is collected on a daily basis.

Below is a screenshot from Barclays’ 2019 research on retailers’ dependence on Instacart, which highlights the vendor allowances for select grocers since 2008. It is clear that vendor dollars make up a significant part of each business’ profitability (Earnings Before Interest and Taxes).

With Instacart’s growing popularity among online grocery shoppers, retailers are losing control over their vendor relationships and dollars, more so because manufacturers are realizing this shift and reallocating their budgets towards the Instacart platform, at the expense of in-store advertising.

8. Instacart aggregates grocery promos and enables cherry-picking

Grocery retailers end up with a competitive disadvantage

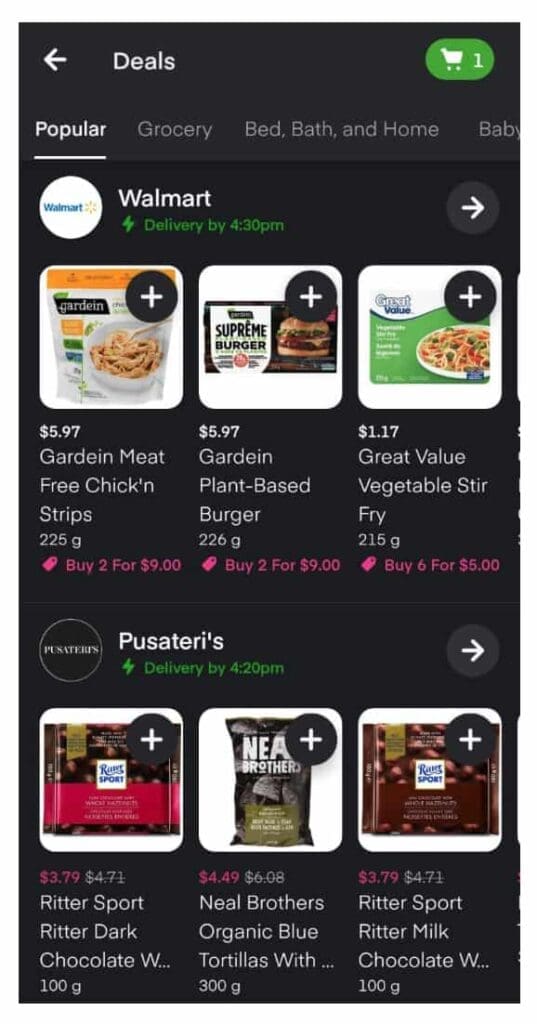

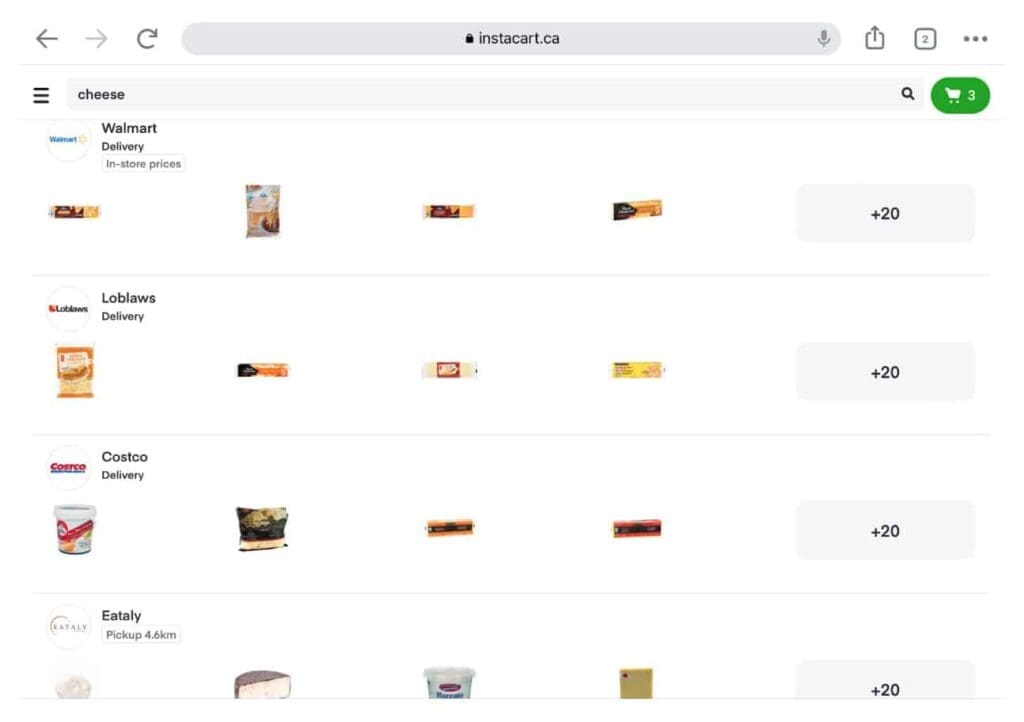

Instacart allows customers to browse products among multiple stores at once, thus encouraging them to comparison shop, which more often than not leads to them choosing the best deal available at the time.

Thus, Instacart essentially ends up pitting grocery retailers against each other in terms of pricing, promotions, and deals, while not really persuading shoppers to build loyalty toward any particular store.

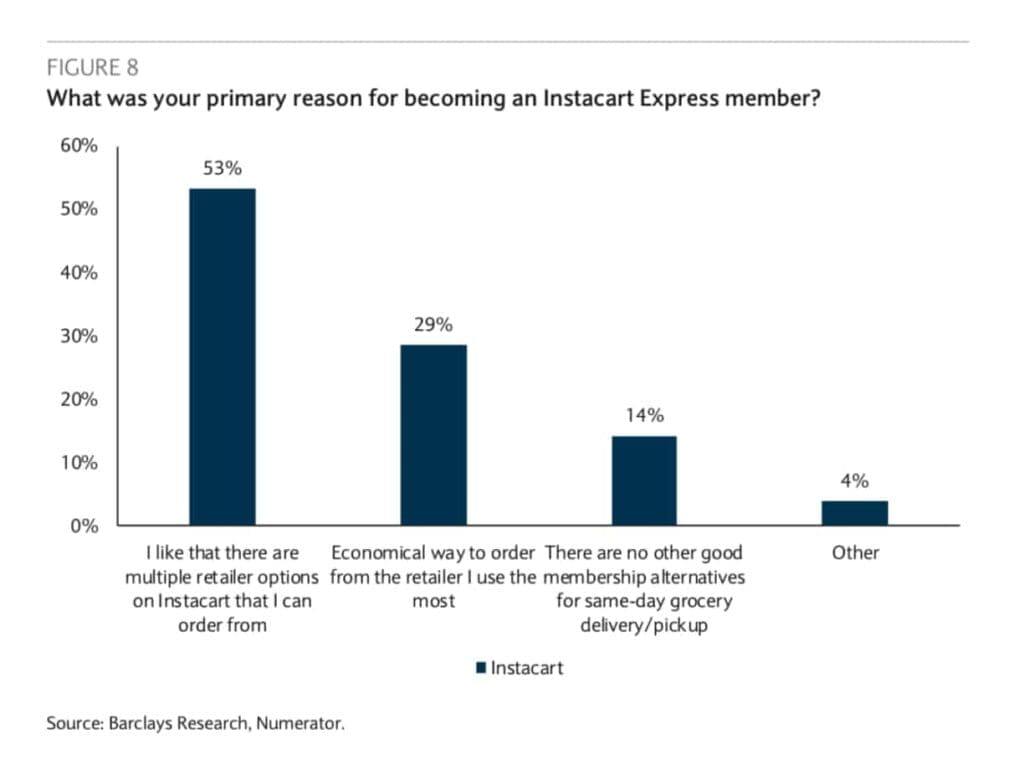

As per Barclays Research, shoppers’ primary reason for choosing Instacart Express membership is that the platform offers products from multiple retailers that they can choose and order from. For grocers, this isn’t a great sign because, in an effort to go omnichannel, they end up having to constantly compete to get their products noticed.

Moreover, this gives Instacart significant bargaining power when it comes to negotiating pricing with retailers, given the massive amount of competition that they are a part of and the extensive array of choices that shoppers are subjected to.

9. High substitution rates lead to poor shopper experience on Instacart

Poor shopping experiences are often associated with grocery retailers

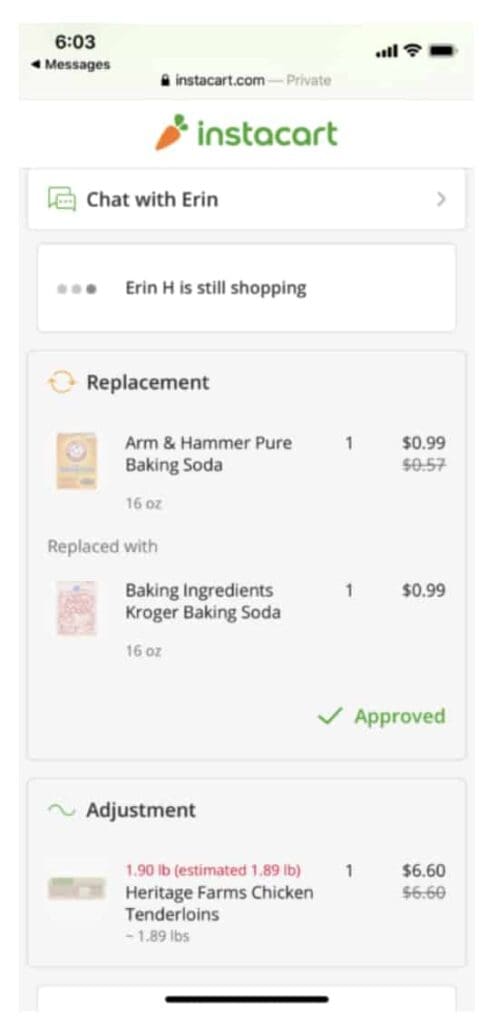

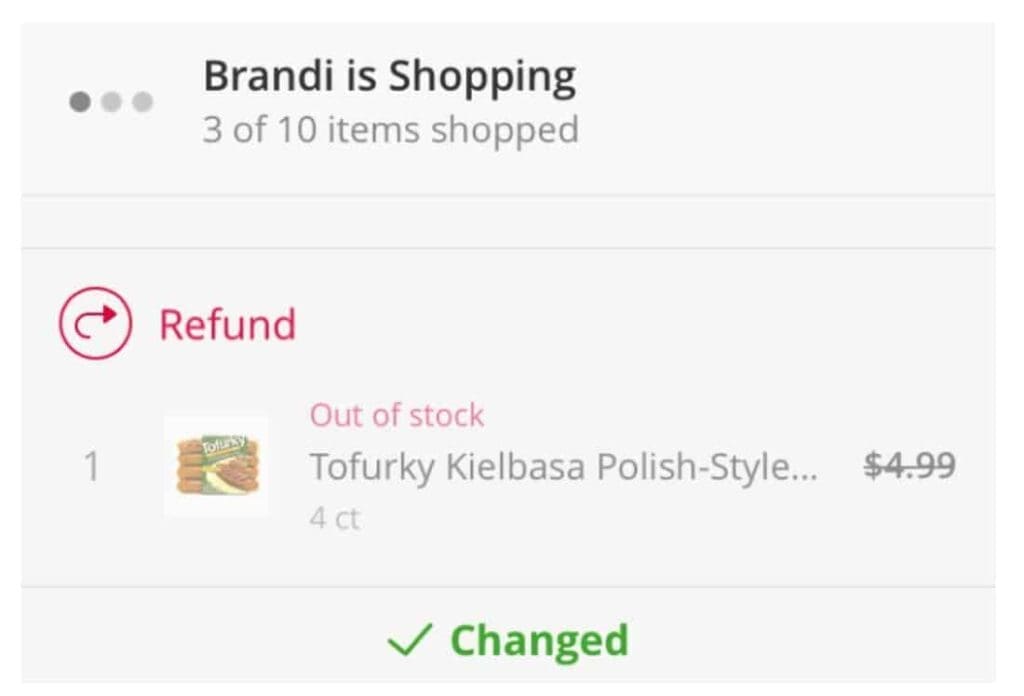

Stockouts and substitutions are very common on the Instacart marketplace due to ordered products not being available at the time the Instacart shopper reaches the store. This ends up frustrating customers who’ve paid service and delivery fees and probably a markup to receive their groceries at home.

Here’s a snapshot of a customer’s tweet that accurately represents the frustration most shoppers have due to the disappointingly high stockout rate:

Moreover, such poor experiences that shoppers have with the Instacart platform are more often than not associated with the retailer as it is assumed that they are to be blamed for a high stockout and substitution rate. Needless to say, such experiences add up to negatively impact retailers’ reputation and credibility among their online shoppers, and make it harder for them to improve their customer satisfaction rate.

10. Shoppers relate a positive shopping experience to Instacart

Retailers rarely receive shoppers’ loyalty for the positive experiences they have

If customers have a great time grocery shopping on the platform and find exactly what they came looking for, they are most likely to associate the positive experience with Instacart and its customer service. The retailer does not receive any recognition or credibility from its online shoppers for the positive experiences they have on Instacart.

Here’s a look at some tweets from happy customers that are loyal to Instacart:

Therefore, by partnering with Instacart, grocery retailers end up bearing the brunt of buyers’ frustration due to an unpleasant shopping experience, while not receiving any loyalty points for a positive one. As a result, it becomes even harder for brands to build meaningful and long-lasting connections with their online customers.

11. Instacart marketplace exclusivity is not healthy for retailers

Relying only on the Instacart marketplace limits retailers’ reach, profits, and control over customer relationships

Instacart is not bad for the ecosystem or should be avoided completely. It’s causing retailers more harm than good because they are relying on it exclusively to build their online presence. A pathway that is neither healthy nor sustainable in the long term.

If retailers take a more strategic, diversified, and multi-channel approach to building customer relationships with their own digital properties as the cornerstone of their online presence, they can get the best of both worlds.

Truth be told, exclusive dependence on Instacart is limiting retailers’ reach, profits, and control over customer relationships. That said, by diversifying their options and prioritizing their own website and app shopping journeys, retailers can reclaim their lost margins, flexibility, and most importantly, customer loyalty.

Over to You

The bottom line remains that while Instacart continues to offer a large degree of convenience to grocery retailers, the concerns it raises are too significant to ignore. And while each retail chain must evaluate the pros and cons for itself, we believe that losing control over operations, customer data, profit margins, buyer experience, and shopper loyalty is too high a price to pay for the benefits the platform promises.

However, this isn’t just a slow and painful race to the bottom. In the last episode of Digital Grocer, Sylvain and Mark dissect recent trends that are negatively impacting retailers’ faith in grocery eCommerce. The sub $100 basket size that had migrated to eCommerce due to the pandemic, has now migrated back to in-store. With that shift, regional grocers are becoming inclined towards pausing their eCommerce investments to focus on control. However, national chains and industry giants will continue to push omnichannel, which is exactly where the growth potential lies – combining in-store and online experiences.

With budget-conscious consumers naturally gravitating towards lower-cost online services, grocers need to find ways to offer these services profitably and remain competitive. Grocers can take advantage of more efficient pick-and-pack practices. Retailers can also use tiered pricing models and variable fee structures to offset the cost of service while still providing a compelling omnichannel experience to customers.

At Mercatus, our aim has always been to empower grocery retailers to gain back control of their digital experiences, strengthen their customer relationships, drive shopper loyalty, and increase profit margins. Mercatus is an enterprise-grade SaaS platform that allows grocers to manage their end-to-end omnichannel customer journeys – right from engagement to fulfillment, and beyond.

The Mercatus platform is designed to equip grocers to accelerate their growth, continually evolve as per the changing consumer needs, and steadily improve their market share. With more than 50 integration partners, grocers have the freedom to work with one of their choices, and more importantly – under their terms.

Our highly experienced team works alongside grocers to offer competent advice and deliver customer-centric and agile solutions that allow them to have complete control and visibility into their operations, shopper data, and multi-channel experiences.

As a grocer, if you are looking to better manage your digital customer journeys, we’d encourage you to experience the Mercatus platform in action by requesting a demo with one of our experts. Learn how you can seamlessly recreate the in-store shopping experience, experiment with innovative digital engagement solutions, and monitor your stores via intuitive tracking and reporting with the powerful Mercatus platform.

Newsroom

Newsroom