Understanding Online Grocery Shopping Behavior

We talk a lot about “the online shopper” as if they were a single entity or at least an easily identifiable group with homogenous tastes. But who is this mythical person, really? How does the online grocery shopper spend their money?

To get a better handle, we looked at the habits and preferences of nearly 53,000 U.S. grocery shoppers. It turns out that grocery shopping is a complex activity, and even when we narrow the group down to online grocery shoppers, their portrait is far from simplistic.

Survey: online grocery shopping statistics

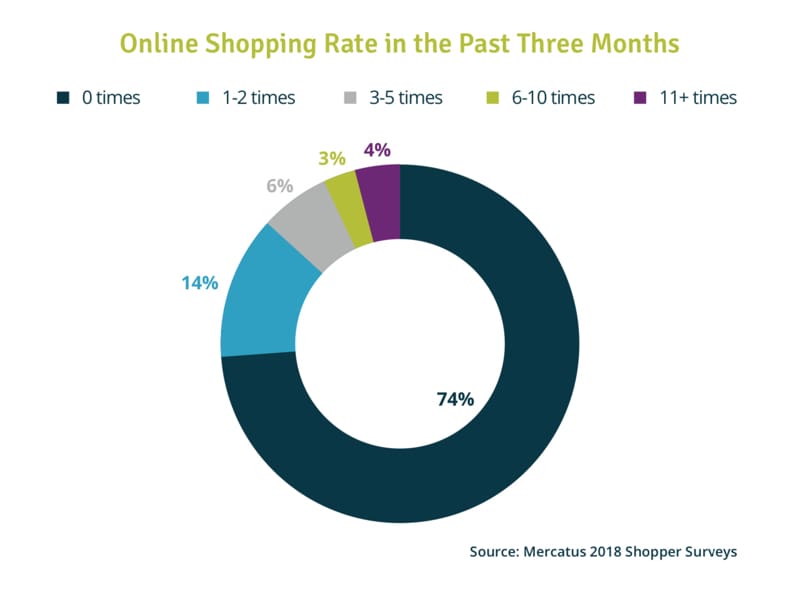

Our survey on online grocery shopping behavior revealed that 26% of shoppers consider themselves to be online grocery shoppers.

When we took a closer look at these shopper profiles, about half were dedicated online grocery shoppers, doing it anywhere from 3 to 11+ times in a three-month period.

The other half had shopped online only once or twice in the previous three months. For this group of online shoppers, their online activities in fact supplement, rather than replace, their visits to the store.

Here’s another interesting finding: when we looked at what people are buying online, shoppers who say they don’t buy groceries online do purchase certain items online that are often purchased in a grocery store. The most popular examples are beauty products (23%), pet supplies (18%), and cleaning and household supplies (11%). They also occasionally purchase canned goods, prepared meals, and other grocery items. There is clearly an opportunity for grocers with these shoppers that may have otherwise been discounted.

In a separate study, we also discovered that customers who made purchases online also purchased more on average. Average basket size went from $30 in-store to $150 online, as shoppers stocked up on bulky items and products with a long shelf-life to supplement their in-store visits.

Growth in online grocery

It’s important to remember that the online grocery shopper is a very new persona. By far the bulk of respondents (45%) have been shopping online for less than one year. And a full 70% have been doing so for fewer than two years.

The primary driver of this trend is curbside pickup (otherwise known as Click and Collect, which increased from 18% of all online grocery sales in 2016 to 48% in 2018.

Based on our national poll, more than one-third of adult shoppers in the U.S. have used curbside pickup and/or delivery options in the past month, and satisfaction with the quality of the picking is high.

Why it’s important to invest in the online shopper

It is unwise to take consumer declarations of themselves as either “online” or “not online” grocery shoppers at face value. Shopping habits are much more complex than merely choosing a single channel and engaging in it exclusively.

Right now, grocery shoppers may make their purchases online, in-store, or — the most common scenario — through both of these channels. But, their preferences are evolving. Developing or enhancing a digital strategy isn’t about simply moving all shoppers to the online shopping channel. It’s about using digital conveniences to enhance every step of the grocery shopping experience.

Online grocery sales are growing by 75% year over year, according to a report by 1010Data. According to the Food Marketing Institute, 70% of U.S. shoppers could be buying groceries online by 2022. Grocers who choose to sit out the eCommerce trend may see their basket size and variety slowly shrink as they lose items to online offerings from the competition.

But for those who step up and offer it well, there is potential for real margin growth. For one grocer we studied, it resulted in a 12% increase in overall weekly shopping revenue and a 6% increase in shopping trips.

Enjoyed this blog post? Then you might like these resources:

Newsroom

Newsroom