US eGrocery Sales Trends with Brick Meets Click – November 2024 Insights

Online Grocery Sales Reach $9.6 Billion in November—an 18% YOY Increase

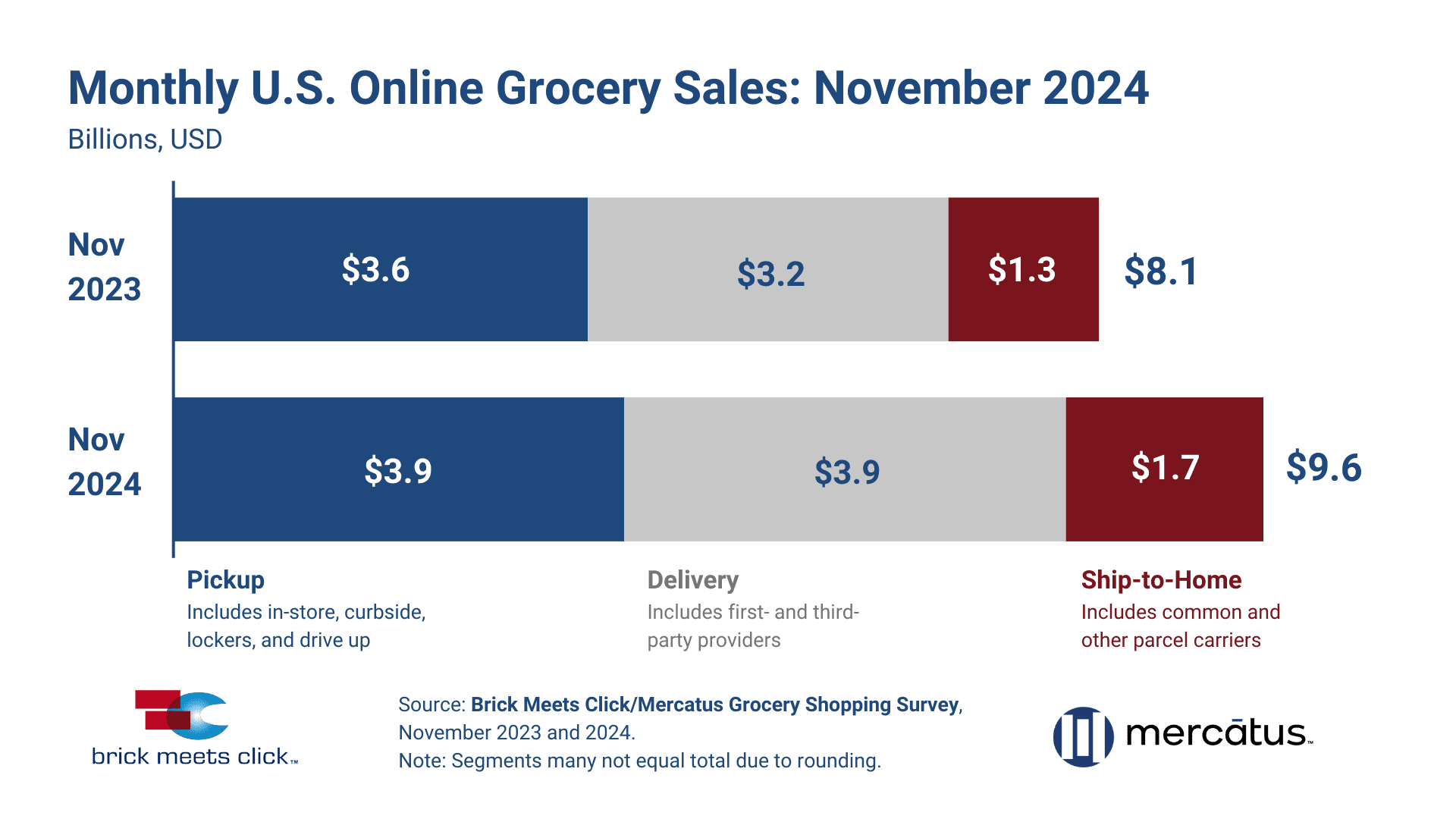

The U.S. eGrocery market continued its upward trajectory in November, posting $9.6 billion in sales—a year-over-year (YOY) increase of 18%.

This growth was fueled by a record-breaking 77.8 million households who bought groceries online this past month. Meanwhile, order frequency rates inched up and overall spending per order remained unchanged versus last year.

The surge in monthly active users (MAUs) represents the second-highest YOY growth rate since 2021, breaking the previous record set in April 2020. With the majority of these shoppers favoring a single fulfillment method, delivery and pickup dominated the market— accounting for more than 80% of total sales.

Curious about what’s driving these trends and how your business can stay ahead in this seemingly ever-shifting market? Keep reading for a deeper dive into this month’s numbers and actionable strategies to help you strengthen your position.

November 2024 US Online Grocery Sales Analysis

Pickup Sales Increase As Delivery Continues Growth

While dramatic increases in delivery sales continue to drive overall growth in eGrocery—thanks to big players promoting their subscription services with deep discounts and reduced delivery fees—pickup also saw an 8.8% YOY increase, reaching nearly $4 billion in sales this past month.

Meanwhile, ship-to-home continued to reclaim lost share after bottoming out in 2022, as sales jumped to $1.7 billion in November, ending the month with 18.1% of online sales.

But if you’re talking in terms of growth, delivery takes the crown. With a whopping 22% increase in sales YOY, delivery surged to $3.9 billion in November, coming within striking distance of pickup as the preferred fulfillment method.

More MAUs Than Ever Before

November set a record with 77.8 million monthly active users (MAUs), a 15% YOY increase and the highest since April 2020.

This surge was driven by aggressive delivery promotions, but also holiday demand and growing consumer comfort with eGrocery.

For grocers, this rising customer base presents a challenge and an opportunity:

The challenge: It’s the promotions of eGrocery’s biggest players that are driving this increase and benefitting from it.

The opportunity: More and more customers are trying eGrocery services and growing accustomed to its convenience. To stay competitive, grocers must ensure they deliver the seamless digital experience shoppers now expect.

Customer Loyalty is on the Rise

Customer satisfaction saw a significant boost in November, with the overall repeat intent rate climbing to 65.2%—its highest level in four years.

Most notably, more than 80% of shoppers who placed four or more orders within the last three months expressed strong intentions of reusing the same service, compared to less than 30% among first-time users.

Programs like Walmart+ and other subscription-based services incentivize repeat orders by offering benefits such as discounted delivery and expedited service. These perks create a compelling reason in the minds of customers to maximize the value of their membership, thereby increasing order frequency and loyalty.

Given the high repeat intent rate, it will be especially interesting to see how current subscribers behave when their subscription plans come up for renewal. Is this solely a value play or will they have grown fully accustomed to the convenience offered by placing multiple delivery orders in a given month?

Supermarkets vs. Mass Retailers: The Omnichannel Difference

While supermarkets gained ground with their core customers, particularly among those who consider them their primary grocery store, mass retailers maintained their dominance in capturing cross-channel shoppers.

Households that relied on mass retailers as their primary grocery source were 30% more likely to order groceries online from mass than from supermarkets.

In this month’s episode of US Grocery Sales Trends, David Bishop, Partner at Brick Meets Click, shared his own experience ordering from Walmart. Not only was his grocery order significantly less expensive than it would have been had he ordered from a supermarket, his customer experience was enhanced through innovative app features, seamless delivery options, and personalized communication.

Walmart’s ability to offer same-day delivery with dynamic time slot upselling, combined with a user-friendly app interface, is a great example of how larger retailers are redefining convenience for online shoppers and applying in-store customer service principles to customers using digital platforms.

10 Key Takeaways from November 2024 eGrocery Sales

- The U.S. online grocery market reached $9.6 billion in sales in November 2024, an increase of 17.8% YOY.

- Monthly active users (MAUs) surged by 15% YOY, reaching a record 77.8 million households, the highest since April 2020.

- 72% of MAUs used only one fulfillment method, up 400 basis points compared to 2023.

- Delivery sales rose 22% YOY to $3.9 billion, capturing 40.6% of total eGrocery sales.

- Pickup sales increased 8.8% YOY to $3.9 billion, accounting for 41.3% of eGrocery sales, despite a slight decline in order frequency.

- Ship-to-home sales climbed more than 30% YOY to $1.7 billion, regaining share after bottoming out in 2022.

- The overall repeat intent rate for eGrocery services reached 65.2%, the highest in four years.

- More than 80% of MAUs who placed four or more orders in three months indicated a strong likelihood of reusing the same service—compared to less than 30% among first-time users.

- Supermarkets increased their share of online orders from primary-store shoppers by nearly 7 percentage points YOY, reaching 56%.

- Households relying on mass retailers as their primary grocery source were 30% more likely to order online from mass retailers than from supermarkets.

Strategic Recommendations for Grocers

Double Down on Pickup Services

Pickup is the ideal fulfillment option for grocers because it offers:

- Lower Cost-to-Serve: Pickup avoids costly last-mile logistics, making it a more budget-friendly option for grocers.

- Higher Customer Control: Customers appreciate predictable time slots and the convenience of managing their pickups.

- Nearby Locations: Regional grocers can capitalize on their local presence to offer convenient pickup options.

- In-Store Visits: Pickup encourages customers to visit the store, even briefly, creating opportunities to promote, upsell, and increase communications.

- Strengthened Customer Relationships: In-person interactions during pickups enhance loyalty and satisfaction.

And while delivery has gotten much of the attention in recent months due to its YOY growth, pickup remains the preferred fulfillment option in eGrocery. It accounted for 41.3% of total sales in November.

This should prompt regional grocers to work on enhancing their pickup services by:

- Offering faster pickup windows and minimizing wait times.

- Promoting the cost-effectiveness of pickup over delivery, as it often has fewer if any fees.

- Highlighting pickup’s convenience through targeted marketing campaigns, emphasizing control over the shopping experience.

Including a frictionless, reliable, and affordable pickup service as part of a subscription plan can help regional grocers compete and differentiate themselves from mass retailers.

Build Loyalty Through Personalized Experiences

Three data points from November’s eGrocery sales combine to tell a clear story: customer satisfaction is at a four-year high, repeat intent rates are climbing, and households relying on mass retailers are 30% more likely to order groceries online from mass than supermarkets.

Larger retailers are finding enormous success in their omnichannel shopping strategies by seamlessly integrating in-store and online experiences. To compete, grocers must prioritize long-term customer relationships by delivering personalization and communicating continued convenience across in-store and online shopping.

Here’s how grocers can do that:

- Control Fulfillment and Acquire Customer Data: Wean customers off of third-party fulfillment and promote first–party services to improve customer experience and gain actionable insights into customer behavior.

- Unify and Leverage First-Party Data: Bring all your customer data together to segment customers and identify unique behaviors that can be used to enhance engagement strategies.

- Deliver Timely, Personalized Offers: Use your unified data to craft targeted discounts, recommendations, and bundles—aligned with purchase cycles.

- Iterate and Optimize: Continuously refine offers and strategies based on performance to maintain relevance with each individual customer.

- Focus on Customer Lifetime Value: Build strategies that prioritize engagement and foster long-term loyalty over quick sales wins.

By embracing these steps, grocers can bring the personalized touch of in-store shopping to the digital space, reducing customer churn and building sustainable loyalty.

Optimize Operations to Better Serve Customers

Walmart’s ability to integrate digital tools with seamless execution is one reason why it’s been so successful in driving omnichannel sales.

Earlier, we referred to David Bishop’s experience ordering through Walmart, where he not only highlighted the cost savings, but also the convenience, reliability, and communication behind their service.

Competing effectively with mass retailers means prioritizing customer retention through seamless, engaging digital experiences like this. A big part of that is service reliability.

Inconsistent order fulfillment—like substitutions, out-of-stocks, or late orders—risks losing frequent users, who are the foundation of repeat intent. By improving inventory management and ensuring accurate, timely fulfillment, regional grocers can establish trust and create habit-forming experiences for loyal customers.

Addressing potential reliability gaps is how regional grocers can turn one-time users into repeat customers, developing long-term loyalty and higher customer lifetime value.

Closing Thoughts

While big players like Walmart continue to shape the market with aggressive subscription promotions and seamless omnichannel experiences, regional grocers have opportunities to carve out their own competitive advantages in these two areas.

By focusing on personalized service, improving reliability, and leveraging their unique local strengths, grocers can better retain their customers and develop a longer-term relationship with them. It’s this strategic focus on long-term loyalty and leveraging the trust they’ve built in their communities that will help regional grocers retain market share against the efforts of the big players.

As always, thank you for reading this month’s data and analysis. If you have any questions, please don’t hesitate to reach out.

For more insights from the Brick Meets Click/Mercatus November 2024 Grocery Shopper Survey, you can access the full report here.

Newsroom

Newsroom