US eGrocery Sales Trends with Brick Meets Click – September 2024 Insights

Aggressive Delivery Discounts Fuel 27% YOY Increase in September’s US eGrocery Sales

A 27% year-over-year (YOY) jump in sales would normally evoke the kind of eye-popping reaction you’d see in a cartoon.

However, this month’s Brick Meets Click/Mercatus Grocery Shopper Survey uncovers the story behind this surge—and it’s what’s driving the growth that makes all the difference.

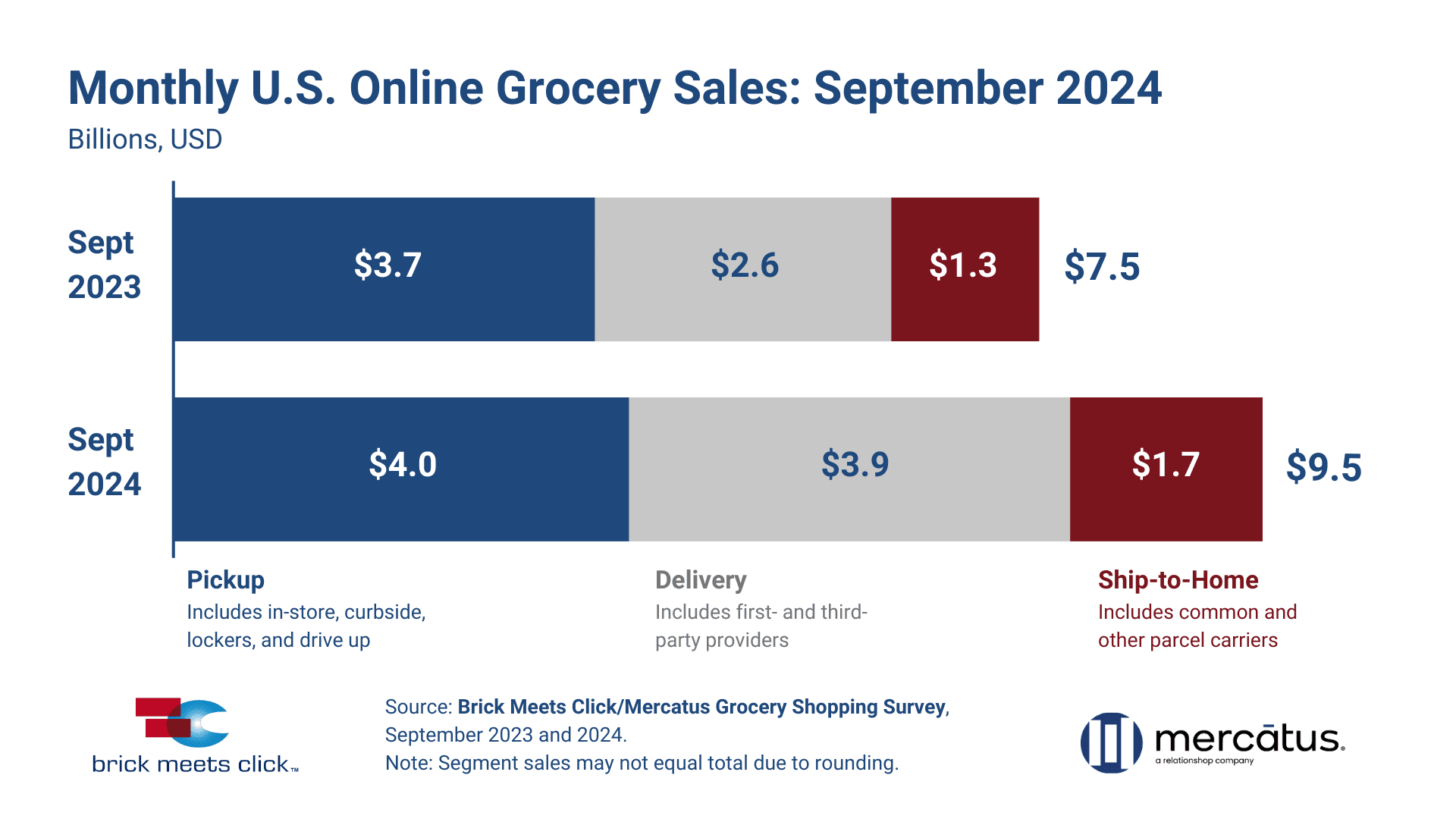

According to the latest data, September 2024’s eGrocery sales reached $9.5 billion. This increase from $7.5 billion in September 2023 can largely be attributed to another major spike in delivery sales, as major players like Walmart continued with aggressive promotions tied to their delivery subscription plans.

These discounts have continued to impact online grocery sales numbers since April of this year and have led to YOY eGrocery growth for four successive months. However, the numbers from September are stronger than ever: Delivery sales increased by more than 45% YOY to reach $3.9 billion, with significant growth in monthly active users (MAUs), average order value (AOV), and order frequency.

While these delivery discounts are driving record-breaking sales, they also present a tough challenge for grocers struggling to compete with major players like Walmart. To learn how your business can respond effectively and maintain competitiveness, keep reading for a deeper analysis of this month’s numbers and actionable strategies.

September 2024 US Online Grocery Sales Analysis

Delivery’s Record-Setting Month

While it’s clear that aggressive delivery discounts have been the driving force behind the surge in eGrocery sales, the sheer scale of their impact is still impressive. September 2024 saw delivery hit several new milestones.

- Sales Share Growth: Delivery captured 560 basis points (bps) of sales share year-over-year, marking the fifth time since 2019 that it has accounted for more than 40% of monthly eGrocery sales.

- Record Household Penetration: Delivery also set a new record in household penetration, with almost half of all MAUs placing at least one Delivery order in September 2024, surpassing the record set just the month before.

- Increased Order Frequency: The number of orders per MAU climbed 12.6% year-over-year, reaching an average of 2.60 orders, up from the post-COVID low of 2.31 set in September 2023.

- Higher Customer Spending: Alongside the rise in order frequency, all fulfillment methods experienced growth in AOV. Ship-to-home saw the largest jump (~12% YOY), while Pickup and Delivery expanded by ~8% and ~6%, respectively.

Pickup & Ship-to-home’s Performance

While delivery takes much of the spotlight for this month’s numbers—and deservedly so— it’s important to recognize the performance of the other fulfillment methods.

Both Pickup and Ship-to-home posted notable YOY growth:

- Pickup reported $4 billion in sales in September, a nearly 10% YOY increase. This growth was fueled by a slightly larger MAU base and higher AOVs, which countered a slight decline in order frequency.

- Ship-to-home sales grew by more than 30%, reaching $1.7 billion. This receiving method actually experienced the fastest AOV growth among the three, benefitting from a significant rise in MAUs and order frequency.

The Repeat Intent Gap is Growing

Another clear shift this month can be found in the growing gap in repeat intent between mass merchants and grocery retailers. While grocery’s repeat intent rate held steady compared to last year, mass retailers were able to widen the gap by nearly three times.

One of the main reasons for this is the way Walmart handles its delivery orders through first-party distribution (using its own infrastructure), while regional grocers often rely on third-party providers. This gives Walmart an edge in terms of delivery reliability and speed, making it harder for regional grocers to compete effectively in this area.

10 Key Takeaways from September 2024 eGrocery Sales:

- September eGrocery sales increased 27% YOY, reaching $9.5 billion.

- Delivery grew by more than 45% YOY, reaching $3.9 billion, driven by MAU growth and higher order frequency.

- Pickup sales rose nearly 10% YOY to $4 billion, with MAU and AOV growth offsetting order frequency declines.

- Ship-to-home sales climbed 30% YOY, reaching $1.7 billion, with the fastest AOV growth among fulfillment methods.

- Delivery captured an additional 560 bps of sales share, surpassing 40% of monthly eGrocery sales for the fifth time since 2019.

- Delivery set a record with 47% of MAUs placing at least one order, surpassing the previous month’s record.

- Average order frequency per MAU increased by 12.6% YOY, reaching 2.60 orders.

- AOVs grew across the board, with Ship-to-home up 12%, and Pickup and Delivery increasing 8% and 6%, respectively.

- Mass retailers tripled the gap in repeat intent compared to grocery, showing stronger customer retention through their first-party delivery.

- Nearly one in three households cross-shopped between grocery and mass, up 470 bps YOY.

Strategic Recommendations for Grocers

Get Personal with Your Customers

Regional grocers have a unique opportunity to fill the personalization gap that mass retailers like Walmart often leave open.

While larger players focus on broad-scale delivery, they tend to overlook localized customer preferences and personalized service. To capitalize on this, regional grocers can enhance their customer experience by offering tailored promotions and services based on first-party data.

Using customer insights to create personalized offers—such as rewards for frequent shoppers or customized discounts for those who buy specific categories—can drive loyalty and strengthen relationships. By emphasizing personal connections and local community engagement, regional grocers can craft a shopping experience that resonates with their customers on a deeper level.

This is a competitive advantage that large retailers can’t easily replicate, allowing grocers to foster long-term relationships and build loyalty that is more sustainable than term-limited delivery discounts.

Keep Calm and Communicate On

The sales data from September shows how important customer experience is to customer retention. Maintaining customer trust is crucial, especially when issues like order cancellations can negatively impact customer loyalty.

Regional grocers can differentiate themselves and contribute to their reputation for personalized service by ensuring clear and empathetic communication whenever there is a service disruption, such as a delayed or canceled order.

When problems arise, offering proactive solutions—like quickly rescheduling deliveries or offering compensation for the inconvenience—can turn a negative experience into a positive one. By addressing issues directly with personalized communication, regional grocers can retain existing customers and win back those who may have had a poor experience.

This customer-focused approach not only prevents churn but also creates loyal advocates who value the personal touch that regional grocers can provide.

Communicate Savings More Effectively

Building on this communicative approach, it’s equally important for regional grocers to clearly communicate the value they offer, especially when it comes to savings.

With 47% of MAUs placing an online grocery delivery order in September, the value-focused promotions from big players are clearly effective. While regional grocers may not be able to match these discounts dollar for dollar, they can still leverage a powerful strategy: transparent communication about savings.

By clearly highlighting the value they offer—whether through price rollbacks, waived fees on pickup, or loyalty perks—regional grocers can appeal to customers’ desire to save.

Make sure every discount or offer is communicated effectively to ensure customers know they’re getting a deal. This not only helps build trust but also turns value-conscious shoppers into loyal, long-term customers.

Pick Up the Pace on Pickup

While large retailers dominate delivery services, pickup remains an underutilized growth area for regional grocers. Grocery retailers can enhance the appeal of pickup by focusing on two key factors: convenience and speed.

Offering subscription plans that prioritize expedited pickup times and curbside convenience will attract customers who want the immediacy of in-store shopping, but prefer the convenience of online ordering. Grocers can also highlight the customer control and lower cost-to-serve of pickup compared to delivery, positioning it as the smarter, more economical choice for value-conscious shoppers. For customers who want to save time and avoid fees, creating special promotions that offer free or discounted pickup services can further incentivize usage.

But beyond communication, the most important factor in the success of an optimized pickup service will be providing a frictionless, fast, and economical experience. This is how regional grocers can stand out—and remain profitable—in a market where convenience is king.

Closing Thoughts

While it may seem obvious to point out that this month’s report highlights the impact of delivery discounts, this isn’t just a routine observation—it’s a call to action for grocers.

The aggressive promotions by big players like Walmart are reshaping the market, and grocers need to respond. Just as those retailers are playing into their strengths with massive discounts, regional grocers must lean into theirs.

By focusing on personalized service, enhancing pickup options, and leveraging local knowledge, grocers can differentiate themselves in ways that larger chains can’t easily replicate. This strategic focus on strengths will help grocers build loyalty and stay competitive among consumers driven by value and convenience.

As always, thank you for reading. If you have any questions related to this month’s report, please don’t hesitate to reach out. For more insights from the Brick Meets Click/Mercatus September 2024 Grocery Shopper Survey, you can access the full report here.

Newsroom

Newsroom