US eGrocery Shopper Profiles Report with Brick Meets Click – 2024

How to Retain High-value Customers and Engage Price-sensitive Shoppers

Walmart isn’t just for budget-conscious shoppers anymore.

The big retailer is making major inroads with affluent households as well, and grocers must respond.

The 2024 US eGrocery Shopper Profiles Report from Brick Meets Click highlights a surprising and concerning trend for grocery retailers: During the first half of 2024, Walmart has seen a 50% increase in sales and 40% surge in average order value (AOV) from households earning $200K or more.

Meanwhile supermarkets have experienced a drop in AOV from this same affluent group, alongside a 20% decline in sales from lower-income households.

Why are higher-income shoppers moving to Walmart?

The data in this report answers that question by uncovering key trends in consumer behavior across income groups.

By understanding these findings and leveraging our analysis, grocers can reach and retain the customers who have flocked to Walmart in recent months, by:

- Strengthening personalization efforts by using data to deliver tailored offers and seamless experiences to all customer segments.

- Owning customer relationships by controlling the shopping experience through first-party services.

- Evaluating value propositions to focus on what sets grocers apart, such as premium private labels, fresh food offerings, and community engagement.

To access the full report, click the link below. Once validated, you’ll receive it free of charge.

➡️ Download the 2024 US eGrocery Shopper Profiles Report

The 5 Most Important Takeaways From The Report

1. Walmart’s Appeal to Affluent Households is Growing

While Walmart’s strength in lower-income households isn’t new, its success with affluent shoppers is a more recent development.

The report shows a sharp rise in purchases from households earning more than $200K—a 50% year-over-year (YOY) increase—fueled by the expansion of Walmart’s eCommerce value proposition.

It’s no longer just about price; it also includes convenience, delivery options, and general merchandise availability.

These features are proving compelling for affluent households, which traditionally preferred regional grocers for their high-quality service and convenience—which leads us to our next takeaway…

2. Grocers Are Losing High-income Customers

As Walmart attracts more affluent customers, the supermarket segment is seeing a decline in AOV from high-income customers. This is a troubling trend for grocers who have relied on this group’s higher spending power.

With their strong in-store service and quality fresh products, regional grocers need to rethink how they can offer value and convenience to earn more from these customers.

To do that, grocers need to first understand shoppers at a more granular level. Segmenting customers by income group and shopping preferences can help grocers craft more targeted strategies and defend against Walmart’s growing appeal to higher-income households.

3. Price Gaps Are Hard to Ignore

While higher-income households have traditionally been driven by convenience over value, Walmart’s growth in this customer segment suggests that the flight to value has extended to more affluent customer segments—especially when it comes to center-aisle products.

Between averaging more than two orders per month and an AOV close to $120, affluent shoppers have quickly become incredibly valuable customers to Walmart’s eGrocery business.

This suggests that wealthier shoppers are starting to make more price comparisons between regional grocers and Walmart, with the larger retailer often coming out significantly less expensive on a per product basis.

4. Delivery is a Game-changer

When this is combined with Walmart’s low-cost delivery option—deep delivery discounts bundled with its Walmart Plus memberships—it results in larger baskets beyond the lower price on the single product that first appealed to the shopper.

Walmart’s overall AOV held steady YOY, but its AOV for eGrocery orders placed by affluent shoppers grew by more than 40% to $119 compared to last year when the average order with this demographic was only $84.

As an added benefit, Walmart’s delivery service allows affluent shoppers to enjoy its lower prices without the need to physically visit the store. This bypasses any concerns they may have about status or image, making it more comfortable for them to shop discreetly. By removing the in-person barrier, Walmart has broadened its appeal to higher-income customers.

And that’s not all.

The retailer has further attracted higher-income households with its enhanced in-home delivery services, allowing shoppers to have groceries delivered directly into their homes or refrigerators. This feature is seen as a significant draw for affluent customers, as it provides added convenience without worries over security.

5. Customer Retention is Important Across All Income Levels

This year’s report isn’t just about affluent customers.

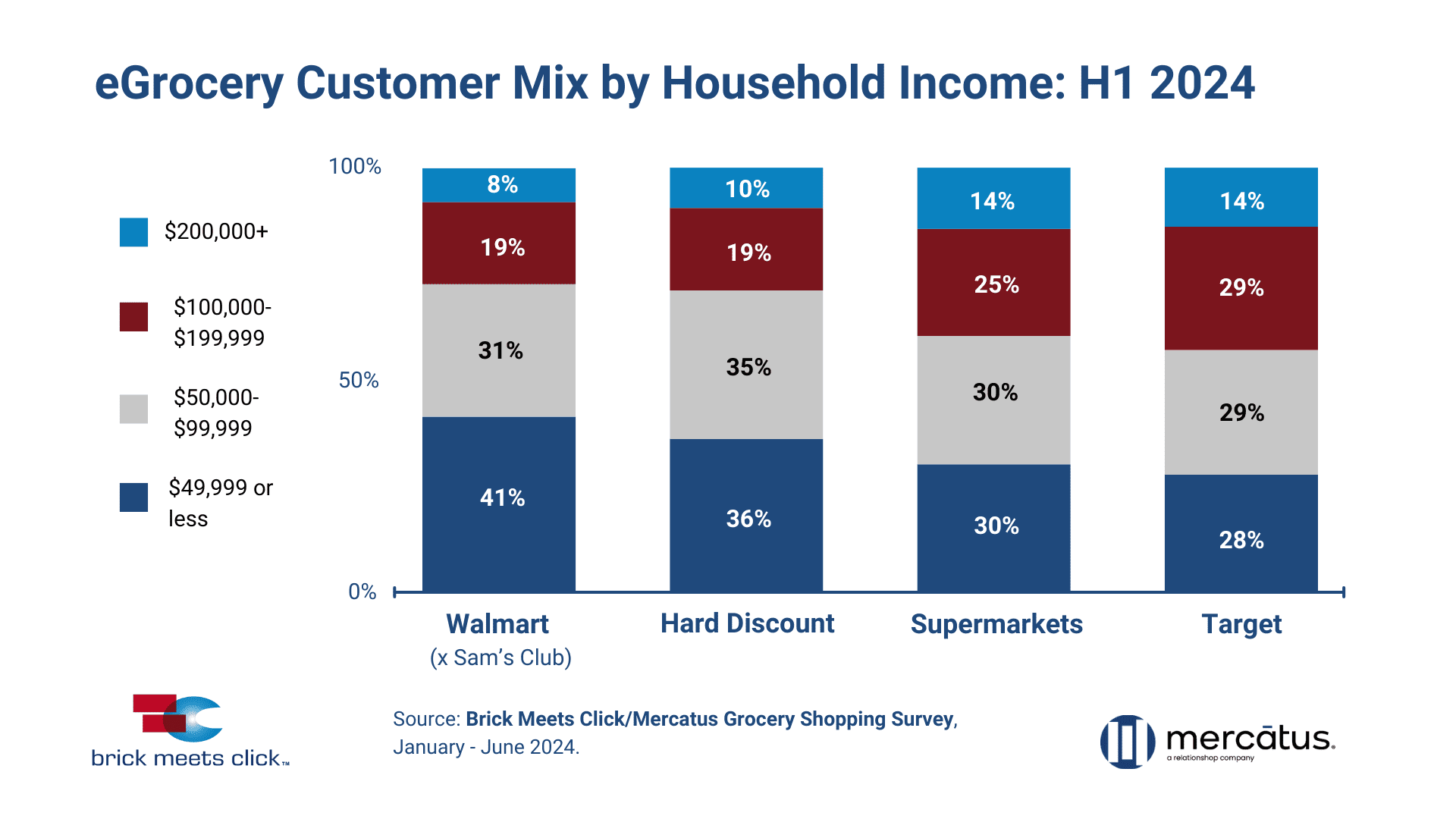

The report also reveals that supermarkets have experienced a 20% drop in sales from lower-income households. At the same time, lower-income households remained Walmart’s core segment, making up 41% of its average monthly active users.

The supermarket segment has traditionally over-indexed on affluent households, with approximately 15% of customers in the $200,000+ group shopping there, while Walmart sees around 8% of this income bracket shopping with them.

That’s all well and good, but grocers need to remember that while affluent households offer 1.5 times higher spending power than lower-income households, they make up a smaller portion of the market compared to the larger, price-sensitive group.

As a result of financial pressure, sales to this larger demographic have pulled back across retailers, with a range of decline from 6% (at Walmart) to 20% (at supermarkets).

Dive deeper into these and other key takeaways by downloading the full report.

5 Recommendations Based on 2024 Shopper Profile Data

1. Strengthen Personalization Efforts

The primary goal of the US eGrocery Shopper Profiles Report is to help grocers gain a deeper understanding of their customers.

But that’s just the beginning.

With today’s technology, grocers can go beyond annual insights to segment customers more precisely, analyze their behaviors in real-time, and activate targeted campaigns that deliver measurable results.

Personalization is essential across all customer segments. For lower-income shoppers, it’s about offering targeted value through promotions and pricing that meet their needs. For affluent customers, it’s about providing extreme convenience through tailored offers, seamless shopping experiences, and smart product substitutions.

Failing to deliver this level of personalization leaves grocers at risk of losing customers to competitors like Walmart, who are excelling in these areas.

That’s why Mercatus has built a personalization engagement solution that helps grocers activate, convert, and retain customers across all profiles and segments. The result is more active users, higher average order value and improved customer lifetime value.

2. Control Your Customer Data

To create the level of personalization described above, grocers need to leverage their customer data—but third-party delivery partners often collect that data for themselves.

Walmart’s first-party delivery is not only attracting affluent households, it’s also providing the big retailer with invaluable customer data to further drive retention strategies focused on this important segment.

Providing your own pickup and delivery services allows grocers to own the customer relationship, personalize the experience, and use data to drive long-term growth and retention.

At Mercatus, we want to put more power in the hands of retailers—not less. That’s why our white label, all-in-one eCommerce platform is developed to help grocers build their brand, foster direct relationships with their customers, and ultimately drive sales without sacrificing anything to a third-party.

3. Evaluate Your Value Proposition

It used to be easy to draw a line between shopper groups: high-income households sought convenience, while lower-income households were driven by price.

But the data from the 2024 US eGrocery Shopper Profiles Report reveals reality to be more complex. It also reveals that grocers need a deeper understanding of what truly motivates different customer segments.

Competing with Walmart on product pricing alone isn’t sustainable. Grocers should instead focus on where they excel: offer premium private labels, personalized delivery options, and exceptional fresh or prepared foods.

By finding alternative ways to create and communicate value, grocers can cater to both affluent and budget-conscious shoppers in ways Walmart can’t.

4. Focus on Convenience and Community, Not Just Price

That’s why it’s crucial for grocers to not only understand their customers but also the competition.

While many attribute Walmart’s growing market share solely to its low prices, the retailer’s success is also rooted in its ability to deliver convenience and service innovations that build customer loyalty.

Regional grocers can’t rely on price competition alone—but they can compete in these other areas. To do so, they need to capitalize on their own strengths and translate those advantages into an improved digital experience.

5. Leverage Your Strength in Fresh and Prepared Foods

While service improvements are important, another area where regional grocers can shine is in their perimeter departments.

Affluent customers, in particular, still prefer regional grocers for the quality, freshness, and locally sourced products they offer—areas where mass retailers like Walmart often fall short. As online shopping for center-aisle products like packaged goods and pantry staples becomes more transactional and price-driven, customers continue to seek out regional stores for fresh produce, bakery goods, deli items, and prepared foods.

To retain high-income customers and drive loyalty, grocers should invest in and emphasize the strengths of their fresh and perimeter categories. By doubling down on fresh products, grocers can maintain a stronghold in categories where they already have a competitive edge and offer value that big-box retailers struggle to match.

The Battle for Customer Loyalty Isn’t Over

The insights from the annual US eGrocery Shopper Profiles Report highlight the increasing challenges grocers face in competing with Walmart. While the retailer’s low prices continue to draw in budget-conscious customers, Walmart is also targeting affluent households—traditionally a stronghold for regional grocers.

Grocers must take action, but action for action’s sake isn’t enough.

A deeper understanding of customer segments is the crucial first step to creating targeted strategies that appeal to both affluent shoppers seeking convenience and value-conscious households looking for savings.

This data is the basis upon which grocers can build lasting customer relationships—across segments and demographics—through personalization, loyalty programs, and greater overall engagement.

To learn how to compete with Walmart for both high-value customers and price-sensitive shoppers, download the full 2024 eGrocery Shopper Profiles Report.

➡️ Download the H1 2024 US eGrocery Shopper Profiles report here

Newsroom

Newsroom