Five Things Grocers Need To Know About The Future Of The Grocery Retail Industry

This article was originally published on April 17, 2018. It was revised on September 9, 2024.

To plan ahead, you have to look ahead.

It sounds simplistic, but whether it’s grocery retail, food retail or any other type of retail, the future is always relevant. Without a clear vision of what lies ahead, plans often lack direction and purpose, making it difficult to achieve meaningful goals or meet challenges.

This is the thinking behind a useful technique in consulting and project management known as “reverse planning.”

Stephen Covey addresses this concept in his famous book, The Seven Habits of Highly Effective People. In Habit #2 – Beginning with the End in Mind, he writes, “To begin with the end in mind means to start with a clear understanding of your destination. It means to know where you’re going so that the steps you take are always in the right direction.”

For grocery executives, this should prompt a simple question: What does the future of grocery retail hold for my grocery business?

The purpose behind the annual Brick Meets Click U.S. eGrocery 5-Year Sales Forecast is to answer this question and provide grocery retailers with the “clear understanding of their destination” that Convey describes.

Sponsored by Mercatus, this report utilizes proprietary data from Brick Meets Click to provide a comprehensive and accurate projection of grocery retail and the eGrocery market. It’s our hope that our analysis of its findings will ensure the steps grocery executives take are always in the right direction.

By the End of 2028, Grocery Stores Will…

To gain a sense of where grocery retailers should focus their strategies today, let’s fast forward to the end of 2028.

What will grocery stores look like? What will grocery shopping look like? What will online shopping look like?

What actions need to be taken now to ensure the projections in this report for the grocery industry either come true or change entirely for traditional grocers?

Further Embrace the Shift to eGrocery

Grocery retail is going to continue to shift toward online ordering.

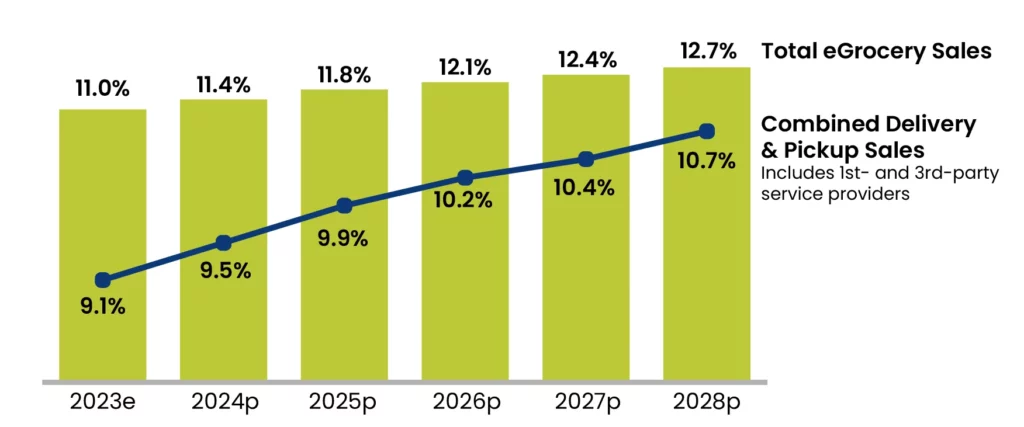

Total eGrocery sales are projected to reach $120 billion annually by the end of 2028, accounting for 12.7% of all U.S. grocery sales. While the overall grocery market is projected to grow at a modest rate of 1.6%, online sales (4.5%) are expected to grow three times faster than in-store (1.3%).

The growing preference for convenience, the increasing comfort with grocery shopping online, and advancements in technology will continue to drive this shift in the way consumers shop at grocery stores over the next five years.

Recommendation for Grocery Retailers

To capitalize on this trend, grocery retailers should continue investing in robust online platforms, improving user interfaces, and ensuring seamless integration between online and in-store shopping experiences.

Emphasizing personalized grocery shopping and leveraging customer data to enhance user experiences will be crucial.

Witness Increased Order Frequency

Increasing order frequency is anticipated to be the most important driver for the online grocery sales growth identified above. In fact, it’s projected to contribute 40% of eGrocery’s sales growth over the next five years.

What’s driving this change to grocery retail?

Enhanced customer loyalty programs, subscription models, and personalized marketing strategies will all combine to drive this increase across grocery retail. With these strategies gaining momentum, consumers will feel valued and see consistent benefits from their regular engagement with grocery stores, and therefore, be more likely to make frequent purchases.

Recommendation for Grocery Retailers

Implement data-driven marketing strategies to create personalized promotions, reminders, and rewards programs. Developing subscription models and store brand loyalty programs that provide regular incentives for frequent purchases from grocery stores will encourage customers to not only shop more often, but shop more often from your grocery business.

Capitalize on Pickup Services

Pickup services are projected to grow at a rate of 5.4% over the next five years, outpacing both Delivery and Ship-to-Home methods.

Consumers appreciate the convenience, control, and cost-effectiveness of Pickup services. The ability to order online and pick up groceries at a convenient time from grocery stores without delivery fees or waiting at home for a delivery meets the consumer drivers of value and convenience.

Recommendation for Grocery Retailers

Expand Pickup locations, streamline the Pickup process to reduce wait times, and offer promotions to encourage customers to use this service.

Marketing campaigns should highlight the convenience and benefits of Pickup services, making it an attractive option for grocery shoppers.

Still Compete with Mass Merchants

It’s already a challenging environment for many grocery retailers, and that challenge is projected to get bigger in the coming years. The share of the eGrocery market taken by Mass Retailers, particularly Walmart, is expected to grow right through to the end of 2028.

What’s driving this continued sales growth?

Customers want to save money. As mentioned earlier, consumer demand is being heavily influenced by value and convenience. Inflation on food prices and general economic uncertainty are behind the current flight to value that has allowed larger retailers to take an increased share of the eGrocery market.

Why?

When these consumer demands are combined with the low-cost value proposition offered by Mass Retailers — grocery baskets at these retailers cost more than 10% less than those at traditional grocery stores — Walmart, Target, other large chains, and discount stores will continue to attract cost-conscious consumers and drive sales growth for their segment.

Recommendation for Grocery Retailers

Focus on enhancing the customer experience rather than trying to compete on per-product price points. This includes offering targeted savings through personalized service, unique local products, private labels, premium service options, and enhanced online shopping features.

Leveraging technology to provide cost-effective, high-quality service will be key to maintaining market relevance in grocery retail.

Further Develop First-Party Platforms Over Third-Party Reliance

In 2023, third-party (3P) sales accounted for more than half of eGrocery business in typical grocery stores. However, the increased implementation of First-Party (1P) platforms is projected to capture a larger share over the next five years.

As grocery retail focuses on building volume for their 1P services, it’s anticipated that informed customers will move away from 3P marketplaces where costs are averaging more than 9% compared to 1P alternatives directly from grocery stores. The control over the customer experience and direct relationships that 1P platforms offer will also drive this transition.

Recommendation for Grocery Retailers

Invest in and refine first-party eCommerce capabilities. This includes optimizing website and app interfaces, ensuring reliable order fulfillment, and leveraging consumer data for personalized shopping experiences.

By improving the user experience on their own platforms, grocery retailers can better serve their customers, reduce costs, and take advantage of this opportunity for revenue growth.

Influencing the Future Today

As we look ahead to the end of 2028, we see how the grocery retail business is going to change significantly.

The projections listed above all reflect shifts in how consumers shop at grocery stores. These changes in consumer behavior will:

- Drive eGrocery sales growth,

- Boost order frequencies,

- Contribute to the dominance of Pickup services,

- Increase the competition from Mass Retailers, and

- Expedite the transition to first-party platforms.

It’s a lot to take in. But by understanding these trends and strategically planning for them, grocers can position themselves to remain competitive and find success in the increasingly competitive grocery retail industry.

That might mean doing everything possible to take advantage of one of the trends identified; or it could mean enacting strategies in grocery stores today to stop a projection from becoming reality.

This is why we sponsored the Brick Meets Click U.S. eGrocery 5-Year Sales Forecast and it’s why we’ve built our analysis to provide valuable insights and actionable recommendations. By focusing on enhancing customer experiences (in-store experience and online experience), leveraging technology, and adapting to consumer preferences, grocers can find success in the future of grocery retail.

Why Partner with Mercatus?

We believe Mercatus can play an important role in ensuring that success.

What this report makes clear is that the shifts in consumer behavior we’re witnessing today — influenced by the increased cost of living and uncertain economic conditions — will continue to affect grocery shopping — through online channels and in store.

Despite the sales growth we’re witnessing for Mass Merchants, there remain several growth opportunities for regional grocers and independents. Knowing the projections for the future, understanding what’s driving these projections, and taking action on the recommendations based on this analysis will be crucial for these grocers to compete with larger retailers moving forward.

Mercatus is uniquely positioned to help grocers compete in this environment and win back their market share.

Here’s why…

AisleOne

Through our AisleOne personalized customer engagement solution, we put retailers in the driver’s seat. AisleOne collects and consolidates first-party data to give grocers total control over their customer experience, allowing them to provide convenience and value to customers through personalized engagement — all while efficiently managing cost-to-serve.

As an end-to-end personalized engagement solution, AisleOne helps grocers activate, convert, and retain customers, leading to increased monthly active users, higher average order value and improved customer lifetime value.

Retailers have generated impressive sales growth and up to a 14:1 return on their digital engagement investment through AisleOne’s targeted promotions, personalized offers, automated marketing campaigns, and loyalty program activation.

No complex code or development required — just contextualized commerce at scale, ready to transform your go-to-market strategy, and help you win back your market share from the big retailers.

More than any one of our solutions, though, Mercatus serves as a constant source of insights and analysis, helping grocers understand customer needs and market trends, with monthly reports on the eGrocery industry and sponsoring special grocery industry reports like the Brick Meets Click U.S. eGrocery 5-Year Sales Forecast.

And we continue to find new ways to support grocers.

All-In-One eCommerce Platform

In an industry where adapting to change is crucial, Mercatus is a valuable partner for grocers aiming to thrive in the next 12 months, five years, and beyond.

To learn how Mercatus can help your business compete with the largest retailers in the world and win back your market share, schedule a tour of our platform with a grocery eCommerce expert.

Take the first step towards greater sales growth and a more competitive eGrocery future with Mercatus today.

Newsroom

Newsroom