How to Optimize Your Omnichannel Grocery Strategy

This article was originally published on November 11, 2022 with the title, “Latest Research Findings Show How Omnichannel Grocery Shopping Behavior Has Evolved.” It was updated on September 16, 2024.

Consumer behavior can seem like a constantly moving target — especially for grocery retailers.

Over the last five years, the pandemic, supply chain issues, inflation, rising food prices, and uncertain economic conditions have tossed and turned shopping patterns, compelling grocers to continually adapt their strategies to meet customer needs and preferences.

But finally, the market is stabilizing.

Analysis from the 2024 Brick Meets Click U.S. eGrocery 5-Year Sales Forecast suggests that the explosive growth of online grocery sales during the pandemic has recently steadied, maintaining a secure segment of the overall market.As we move further toward a return to “normal,” we find that much of the research from the peak of eGrocery sales in 2022 provides insights and recommendations that remain relevant today. Specifically, the consumer expectations identified and advice to grocers provided in Volume 1 and Volume 2 of the 2022 Omnichannel Shopper Behavior Report continue to offer valuable guidance for the current grocery market.

While grocery retailers are more aware of the importance of integrating eCommerce offerings into their overall value proposition now, questions still remain about optimizing omnichannel grocery strategies to enhance profitability — in terms of both increased revenue and reduced operational expenses.

Here’s what we’ve learned about implementing that type of successful omnichannel grocery strategy — from both past research and today’s data.

Grocery Retailers Need to Balance Value and Convenience

We identified it then. And it remains true today. Consumer behavior is driven by value and convenience.

Customers need value due to lingering economic issues, but they’ve grown accustomed to the convenience of buying their groceries online.

Price Sensitivity

With the increasing market share being taken by mass merchants like Walmart, grocers are well aware of the impact price sensitivity can make. But what might not be so top of mind is that the drive for value extends beyond per product pricing.

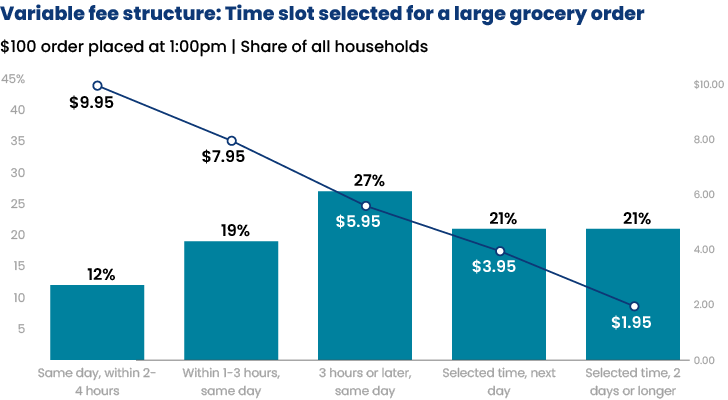

Customers remain highly sensitive to additional costs such as delivery fees. The original omnichannel grocery shopper report from a couple of years ago identified the difference between grocery stores that offered fixed delivery fees versus retailers who offered variable fees.

If it was a fixed delivery fee, consumers showed a preference for faster, same-day delivery (one to three hours). For variable fees dependent on timing, customers chose next-day delivery for a reduced fee.

This demonstrates how minimizing explicit costs can significantly influence customer behavior.

The same impact can be seen more recently with Walmart and Instacart’s promotional efforts tied to their membership plans. By offering reduced delivery fees as a perk for signing up, both big players were able to attract many new members — so much so that overall eGrocery sales were affected by more delivery users, orders, and sales.

Convenience Across Age Groups

In terms of convenience, the original research confirms that all age groups prioritize it in their shopping, whether from physical stores or if they shop online. However, it also shows how younger demographics are particularly inclined towards it — a data point that’s consistently confirmed in monthly eGrocery sales data.

The Grocer’s Takeaway

Offering flexible fees around delivery and pickup options caters to these drivers and will enhance overall customer satisfaction.

In July’s episode of US eGrocery Sales Trends, Brick Meets Click partner David Bishop recommended grocers focus on offering services that Walmart and Instacart don’t provide or emphasize less to combat the promotional offers mentioned above.

While the big players boost delivery with these promotions, this opens opportunities for grocers to enhance their pickup services, which remain the most popular eGrocery method.

Although Walmart often doesn’t charge for pickup, many regional grocers do. This can be turned into an advantage by offering subscription plans that waive pickup fees or provide expedited service. This creates a unique value proposition and contributes to overall customer retention.

Grocers should always remember that the majority of customers prefer pickup. It offers convenience, control, and a lower cost. By enhancing its value, grocers can attract a broader customer base, including price-sensitive households that prefer in-store shopping experiences to avoid the fees associated with online shopping.

Demographic Differences: Online & In-Store

In the original omnichannel grocery research, we examined additional demographic breakdowns in the data collection, including both age groups and household incomes. Behaviors from diverse demographic segments of grocery consumers — with their different preferences and choices — remain very similar to today’s consumers.

Customer Loyalty & Subscription Programs

In 2022, the 30-44 age group and households with incomes over $200K showed the highest inclination towards signing up for grocery loyalty or subscription programs.

This is in-line with today’s estimates which identify that same age group as the MVP of online grocery customers. Meanwhile, higher-income households continue to comprise a large portion of loyalty and subscription programs, which has grown further with the increased personalization technology of the last few years.

Pickup Preferences

While cost-saving remains a universal motivator for all omnichannel grocery shoppers, younger consumers often choose pickup for its shorter wait times rather than reduced fees. This aligns with the general preference for pickup which includes the often overlooked “control” factor.

While we emphasized value and convenience as the two largest consumer drivers, control, which does contribute to convenience, also remains a massive motivating factor for today's omnichannel shoppers.

The Grocer's Takeaway

These insights can guide targeted marketing efforts and the structuring of loyalty programs to attract and retain two of the most valuable customer segments.

Tailoring loyalty programs to meet the specific needs of the 30-44 year old demographic and higher-income households will have an impact on customer retention. Meanwhile, allowing customers to exert greater control with pickup options can be very appealing to a particular segment of American grocery shoppers.

Overall, these two insights suggest that understanding your customer’s needs and preferences is key to eCommerce success. In the time since the original omnichannel grocery shopper report, the importance of collecting and consolidating first-party data has emerged as an integral strategy for retailers.

This information can be used by machine learning to offer predictive personalization that further increases the experience of customers — for single-channel patrons (digital-only customers or in-store-only grocery customers) and omnichannel shoppers alike.

Pickup is a Grocer's Best Friend

Fulfillment has always been an integral component of the online shopping journey. That's why our initial research took such an in-depth look at how orders get into the hands of shoppers.

Our key takeaway from the 2022 survey aligns with much of what we've examined so far in this article.

Cost, Convenience & Control

Grocery shoppers who buy online in the US choose pickup as their preferred fulfillment method as it allows them to save on explicit additional charges (associated with delivery), while enjoying the convenience of a local pickup location (provided by a regional grocer) and the control that comes from selecting their desired time slot.

While the recent increase in delivery can be correlated to the promotional offers we mentioned earlier, pickup remains the preferred receiving method for customers shopping at grocery stores online. According to the 2024 Brick Meets Click U.S. eGrocery 5-Year Sales Forecast, pickup is only expected to grow its market share in the years to come.

The Grocer's Takeaway

Making the right investments to ensure a quality pickup experience for your customers remains vital for grocers.

In addition to all the reasoning above, pickup is also the least expensive fulfillment option from an operational perspective. It also fits perfectly with a unique service offering that grocers provide: multiple, nearby locations for consumers to gather their groceries.

By emphasizing their pickup services, grocers highlight an area of fulfillment that larger retailers can’t match.

Physical Stores and Digital Tools: The Present and Future is Mobile

Another fascinating and incredibly important finding from our previous omnichannel grocery research was that shoppers increasingly used a retailer’s mobile app to check in during order pickup and also to share their location so that their items can be handed off in good time.

If anything, this trend has only increased in the years since this research was conducted.

Modern grocery shoppers are continuing to embrace technology, especially mobile — in answer to the drivers we identified earlier: value (exclusive discounts for buying groceries online) and convenience (same day pickup or delivery).

The Grocer's Takeaway

If it wasn't already the case, a fully omnichannel grocery experience that offers the ability to shop at the store location, online — and by mobile app — is now essential.

Grocers must invest in an online grocery shopping platform that offers a seamless experience, from ordering to fulfillment. Ensuring that the mobile app reflects the in-store experience will further drive customer engagement and satisfaction, while ensuring your brand resonates in the customer's mind while grocery shopping on any one of multiple channels.

What Does Seamless Omnichannel Grocery Shopping Look Like?

What we're talking about above is essentially a holistic approach to the customer experience that synergizes both online and in-store experiences.

This involves:

Synchronized Loyalty Programs and Offers

Loyalty programs and offers should be seamlessly integrated across both online and in-store channels. Customers should have access to the same benefits, regardless of how they choose to shop.

Unified Product Catalogs

Ensure that product availability is consistent across all channels. A unified product catalog prevents discrepancies and enhances the experience of customers.

Online markups can be a beneficial method for reducing the cost to serve online orders, but remember to be transparent. Maintaining customer trust is vital.

Maximizing Convenience with Pickup and Delivery Options

Offering flexible pickup and delivery options, including a range of fees, encourages customers to engage with all available services. True omnichannel success lies in providing customers the choice to shop across all channels seamlessly.

Consistent Marketing Messages

Maintain consistent marketing messages across all channels.

Synchronize loyalty programs, offers, and promotions to ensure customers receive a cohesive brand experience no matter the channel through which they’re shopping.

Enabling Fluid Movement Between Online and Offline Shopping

Grocers must enable customers to move fluidly between online and offline shopping, enjoying a cohesive brand experience that leverages the strengths of each platform.

Mercatus Can Help You Optimize Your Omnichannel Grocery Strategy

The Mercatus all-in-one eCommerce platform is built to ensure that the convenience of digital shopping complements the tactile and immediate nature of shopping at a brick-and-mortar store.

It empowers grocers to provide their customers with a seamless omnichannel experience. That means total control over the entire customer journey, including order fulfillment and last-mile delivery. This solution gives you the power to implement the most effective strategies — whether its no-fee pickup or delivery threshold offers — aligned to your specific customers.

And that's not all.

With our AisleOne personalization solution, you can use your first-party data to offer the deep personalization necessary to attract and retain individual customers based on their specific behavior. It further empowers retailers to meet customers where they are, ensuring the right offer is delivered with the right message at the right time.

To learn more about the omnichannel capabilities Mercatus provides grocery retailers through its entire suite of solutions, reach out to our sales team today.

Newsroom

Newsroom